Payment

An enterprise can account for goods and materials at accounting prices using account 15. Accounting

Posting a fine for late submission of reports. Interest is paid for each complete or incomplete

Home — Articles General rules Step left, step right—penalty? Clarification for overpayment

Income tax in 2021, current data collected by our accounting company. For that,

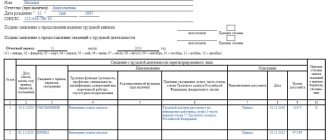

The canceling form SZV-M is used in accounting from April 1, 2021 according to the resolution of the Pension

Employer reporting Oksana Lim Expert in tax and labor relations Current as of February 21, 2020

For what purposes does the SZV-M report serve? First of all, let us remind you what goals the Pension Fund pursues

Writing off accounts receivable allows you to reduce the tax base for the organization’s income tax, but write off

Many multi-storey buildings today are maintained and operated by management companies, which must provide high-quality utilities

Legal regulation Sick leave benefits mean payments made by the employer in favor of a temporarily disabled person