Payment

Headings There is a general methodology for calculating the standard of own working capital for work in progress. Depending

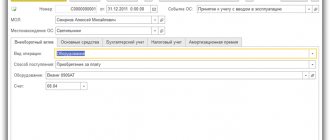

It is not always possible to put purchased equipment into operation immediately. As a rule, it needs

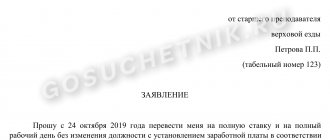

The concept of salary It is represented by the exact and constant amount of the employee’s earnings, which is paid monthly at

Deadlines for October 2021 The tenth month of 2021 usually marks the date of delivery

Home Help Benefits Elderly Russians with official pensioner status can count on various social

How to acquire property Companies and individual entrepreneurs on a simplified basis usually do not have sufficient working capital,

When input VAT can be included in expenses Article 264 of the Tax Code of the Russian Federation regulates these features.

Grounds for a repeat audit A repeat tax audit can be carried out in an organization in two

Starting in 2021, losses incurred in 2007 and later can be carried forward to

When should you draw up an act for writing off low-value items? Any company has something or