Payment

A special assessment of working conditions is provided by law for each workplace by the employer (Article 212 of the Labor Code

From time to time, an accountant is faced with the task of filling out statistical reports. This part of his job

The rules for calculating average earnings are the same for all payments, with the exception of sick leave and

Purchasing items in accounting may look different depending on the method of transfer of ownership

Home / Family law / Benefits and benefits Back Published: 07/20/2018 Reading time:

Entrepreneurs using the simplified tax system are lucky - according to their regime, they only need to submit a tax return

07/01/2019 0 277 4 min. Paying taxes is an obligation that applies to every employed person.

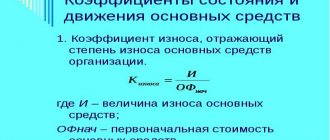

When accounting for the condition of fixed assets, various depreciation methods are used, which have a common

How did the BCC change in 2018-2019 and were there any changes to the BCC according to

Termination of an employment contract by agreement of the parties is the preferred method of ending an employment relationship.