In addition to the usual forms of organizations, such as LLC or JSC, there are many other commercial and non-profit ones, including various partnerships. Some of the most famous are horticultural and housing. According to the civil code, both of them belong to real estate owners' partnerships (TSN).

In 2021, Federal Law No. 217 was issued; it began to apply (with the exception of one article relating to the use of subsoil) on January 1, 2021. Basically, it is he who determines all aspects of the work of SNT. At the same time, the Civil Code in Articles 123.12-123.14 also establishes several important points:

- Similar to a limited liability company, the limits of liability are established for TSN - the partnership is not liable for the obligations of its members, and they, in turn, are not liable for its obligations.

- The charter of TSN must indicate basic information, including the goals of its activities, the composition of management bodies, voting procedures, as well as information about the name.

Moreover, a large number of questions arose with the latter, because Article 123.12 obliges to include in the name the words “association of real estate owners,” which are naturally absent in previously created organizations. According to the explanations of the Ministry of Economic Development and paragraph 5 of Article 54 of Law 217-FZ, it is not necessary to specifically make changes to the charter, but if the documents change in the future for some other reason, the name will have to be corrected. Previously approved constituent documents can be used if they do not conflict with current legislation.

- The general meeting of SNT members, among other things, decides on the amount of contributions and other mandatory payments.

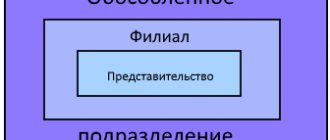

- In addition to the meeting in TSN, there are two more governing bodies: the sole executive body (chairman) and the collegial body (board).

It is imperative that the partnership undergoes regular inspections. For this purpose, an audit commission is elected. An audit company or a professional independent auditor is also involved.

Choosing the SNT taxation system

The volume of supporting documents when maintaining accounting records of partnerships depends on the taxation system chosen by the organization. SNT has the opportunity to choose a general or simplified taxation regime.

| Position | General system | Simplified system |

| Selection order | Assigned by default upon registration | Appointed upon submission of application |

| Accounting | Complete, using all accounts | Limited, using part of accounts |

| Number limits | Not available | Available |

| Tax accounting | Registers for main accounting items are used | A book of income and expenses is used |

| The procedure for accounting for income and expenses | Accrual or cash method | Cash method |

The complexity of document flow with OSNO is much higher. The best option for accounting is to use the simplified tax system, which is allowed according to the main indicators. The transition to a simplified system is subject to compliance with the average number limit. Read the article: → review of the simplified taxation system.

Associations of gardeners: the legal side of the matter

A gardener who owns or uses a garden plot of land has the right to voluntarily join a SNT organized by his neighbors.

Separately, a summer cottage area should be highlighted.

According to the law, a dacha or a country house can be built on a summer cottage; registration is allowed at the address of the building.

As for garden or summer cottage plots, the construction of residential buildings is also allowed within their boundaries, but registration in this case is impossible.

The main document of SNT is the registered charter.

The composition of SNT participants must be at least 3 participants.

I register partnerships according to the same principles and rules by which the registration of any legal entity is carried out.

Accordingly, the charter of the partnership must be drawn up according to the same rules and indicating the same data as the charter of a legal entity.

SNT technology

Must be indicated:

- Name:

- Legal form;

- Address and contact details;

- Volumes of territory number of plots;

- Possible number of members;

- Managment structure;

- Types and procedure for making contributions;

- The range of responsibilities of members and their rights is defined.

Membership in the partnership of gardeners and gardeners is confirmed by a garden, membership book or other document, which must be issued within three months from the moment a citizen is accepted as a member of the partnership's gardeners.

As a member of a gardening partnership, a gardener is obliged to pay membership and other fees specified within the framework of the charter and other local acts regulating the activities of the partnership.

The following types of contributions are distinguished:

- Introductory;

- Membership;

- For specific purposes;

- Share contributions;

- Additional contributions.

The entrance fee, as a rule, is one-time and amounts to a fixed amount.

Membership fees are calculated from the needs of the partnership and can be paid monthly or quarterly.

Targeted contributions are determined based on any specific goals and objectives that gardeners set for themselves.

From this video, you will learn how to obtain a residence permit in SNT.

Share contributions are used to purchase common property and can be not only monetary, but also of a property nature.

Additional contributions are rarely determined by the amount and nature of the contribution.

They are indicated in the local act in case of force majeure.

To make contributions and other funds, the founders of SNT open a current account at a bank branch, print out receipts for members or provide details.

Controls:

- General meeting of members of the partnership;

- Meeting of authorized representatives;

- Chairman of the meeting of members.

Using the simplified tax system in accounting

The limit on the average number of employees in the simplified tax system enterprises should not exceed 100 people. It is not allowed to change the object of taxation of the simplified tax system or the system during the year. In SNT, the most convenient object for accounting is the “income” form. Accounting for expenditure indicators by item is carried out in the transaction log.

When maintaining the simplified tax system, the partnership pays:

- A single tax calculated when conducting commercial activities.

- Insurance premiums accrued to the Pension Fund of the Russian Federation and the Social Insurance Fund for payments made to the manager, accountant, security guards and other employees receiving wages.

- Personal income tax paid by the tax agent.

- Land tax, the amount of which is paid from member contributions.

For taxes paid, SNT submits declarations and calculations to the Federal Tax Service and funds. The balance sheet is presented in a simplified form established for small enterprises. It is mandatory to submit a report on the intended use of the funds received.

When carrying out business activities, separate accounting of income and expenses is necessary. Separate accounting is carried out for funds received and spent on targeted programs and commercial activities.

Tax reporting SNT

The composition of SNT tax reporting is formed based on the applied taxation regime and the availability of taxable objects.

What kind of SNT reporting on OSNO is submitted to the Federal Tax Service in 2021:

- Income tax declaration (the form has changed from the report for 2020, approved by order of the Federal Tax Service dated September 11, 2020 No. ED-7-3/ [email protected] );

- VAT declaration (from the 4th quarter of 2021, an updated form will be used, in accordance with the order of the Federal Tax Service dated August 19, 2020 No. ED-7-3 / [email protected] );

SNT reporting on the simplified tax system:

- a simplified declaration submitted to the Federal Tax Service once a year (for the report for 2021, the previous form is valid, approved by Order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected] , but the adoption of a new form is expected)

A company fills out a VAT return using the simplified tax system only if it acts as a tax agent, for example, when leasing state property.

Regardless of the tax system used, SNTs submit the “Calculation of Insurance Contributions” quarterly (for the DAM for 2021 and beyond, a new form is used, approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/751). The report on the average headcount has been cancelled, starting with the report for 2021; now this information will be indicated in the DAM on the title page.

The obligation to submit land and transport tax declarations has also been canceled - they will not be submitted for 2021 (Law No. 63-FZ dated April 15, 2019). If SNT has land and vehicles on its balance sheet, the amounts payable are calculated by the Federal Tax Service based on data received from Rosreestr and the State Traffic Safety Inspectorate.

SNT is also required to fill out and submit:

- water tax declaration, if the partnership uses water that is subject to licensing (for example, a well is used to collect water),

- property tax declaration, if there are objects taxed at cadastral value.

Accounting for objects of a gardening partnership

SNT document flow is carried out by groups of assets and liabilities.

| Group name | Credentials | Documentation |

| Special-purpose financing | Accounting for income, expenses, registration of relations with third parties | Statements, cash orders, estimates, contracts |

| Partnership property | Accounting for creation, receipts for registration, retrofitting | Acts, cards, contracts, purchase and sale |

| General documents | Accounting for general forms | Orders, estimates, minutes of meetings, accounting policies |

| Cash and banking operations | Accounting for receipts and expenditures of funds | PKO, RKO, cash book, account statements, advance reports |

| SNT employees | Accounting for employment and work records | Employment contracts, accounting journals |

| Wage | Accounting for remuneration payments | Statements, cards |

| commercial activity | Accounting for income received and expenses incurred | Accounting and tax documents |

The responsibilities of the SNT accounting department include tax accounting and reporting for regulatory organizations. The chairman of the SNT may assume responsibility for record keeping. The Federal Tax Service is quite wary of situations where the positions of chairman, accountant and other employees are held on a voluntary basis, without receiving remuneration.

Membership in SNT. Contributions

Only individuals can become members of the partnership (clause 1 of Article 17 of the law) on the basis of an application. As mentioned above, not only owners, but also right holders (for example, tenants) can join SNT. In the application form they must indicate:

- FULL NAME.

- Residence and postal address.

- Email (if available).

- Agreement with the rules of the charter.

You will also need copies of title documents: certificates of ownership, lease agreements, etc. Some applicants may be denied membership for the following reasons:

- a friend was previously expelled due to non-payment of contributions and the debt was not repaid;

- there are no documents confirming the right to the plot;

- the applicant is not the owner or legal holder of the site;

- the requirements for filling out the application have been violated.

Special conditions apply to certain categories of citizens: those who were members of the reorganized organization automatically become members of the SNT if it was created before the entry into force of Law 217-FZ. If the land in horticulture is transferred into perpetual possession or lease, users do not require permission from the state authorities - the owners.

Important! From January 1, 2021, when drilling and using wells common to the entire SNT or several partnerships, a license will be required (see Article 51 of Law 217-FZ).

After the applicant’s candidacy has been reviewed and approved, from the moment such a decision is made, he becomes a member of the partnership and within three months receives a membership book or other supporting document.

The accounting of contributions received depends on the status of owners and users of land plots - their acceptance from SNT members and all others differs. An accountant, cashier, or other person responsible for accepting contributions needs to know in what capacity their payer is acting. In particular, this affects the use of online cash registers and tax accounting.

Contributions

Before the advent of the new federal law, there were three types of contributions, but then entrance fees were excluded from them and only two remained: membership and targeted.

The main ones are membership fees , they provide for current needs: the maintenance of common property and the functioning of the SNT (payment of salaries, provision of security, payment of taxes, landscaping, etc.).

Targeted funds are allocated for the creation or acquisition of common property, payment for registration, cadastral documents and work related to the acquisition of land plots for the partnership, expenses for ensuring activities approved by the decision of the general meeting of the SNT.

The amount of contributions may depend on the area of land or real estate, share of ownership, etc. data. Such conditions are included in the charter. Sanctions for late payment (penalties) are allowed.

According to paragraphs 3 and 6 of Article 14 of Federal Law No. 217-FZ, contributions must be transferred to a current account. In fact, they continue to be paid and accepted in cash - not every gardener is ready to specifically pay a receipt or make a transfer, many of them spend the summer outside the city and do not have the opportunity to go to a bank branch, not everyone even has access to the Internet.

In this case, there is some contradiction between the Civil Code, which allows making payments in any form, and the specialized federal law No. 217-FZ, which establishes special rules for SNT. It is usually believed that the code is the head of everything, but do not forget that it sets out the fundamental rules, and they can be specified in industry documents.

Those. From the point of view of the law, accepting cash payments (contributions) in a partnership is a violation, but so far the Federal Tax Service is not going to fine you for it. If you still want to strictly follow the letter of the law, here are the steps you need to take:

- Make changes to the charter and other documents of SNT regarding the form of making contributions. If the partnership has not gone through the renaming procedure (see above), then add the correct wording “real estate owners’ association” to the name. To adjust the charter, you will either have to bring this issue to the next general meeting or initiate an extraordinary one.

- Register the change in the charter in the Unified State Register of Legal Entities.

- Post information about payment options in all possible ways (in a bank branch, through mobile applications, terminals, etc.) - indicate on the website, distribute leaflets, send SMS, post an advertisement with a link to regulations and the decision adopted by the general meeting on the information board . This way you will achieve maximum coverage of SNT members.

- Print sample receipts (forms) and place them in the public domain with an example of how to fill them out. You can issue several forms of receipts to each comrade for later payment, or print individual receipts and present them at the meeting.

Explain to management that at the moment accepting cash does not threaten sanctions from the tax authorities, but everything can change, and now it is possible to teach people to pay as expected with the least loss; doing this in an emergency will be much more difficult.

Source of income SNT

The receipt of funds for servicing activities is made by membership fees of the participants of the partnership. The amount is determined according to the estimate proposed at the general meeting of members or in the presence of a quorum, the sufficient number of which is determined by the constituent documents. The amount of membership fees is established for a calendar year or other period determined by the partnership. Membership fees are taken into account as targeted income, tax-free.

Receipt of membership fees is carried out according to a cash receipt order. SNT organizations are required to comply with the rules for conducting cash transactions. If the day of receipt of funds at the cash desk coincides with a number of persons, reception can be carried out according to a statement indicating the data of the area, the person and if there is a signature. A PKO (receipt cash order) must be issued for the document and subsequently reflected in the cash book.

Blitz answers to common questions

Let us consider the answers to a number of practical questions regarding the activities of SNT.

Question No. 1. How are the size of membership fees determined and their accounting in the absence of an estimate?

The amount of contributions is established by the general meeting of members and can be accepted without approval of the estimate. To record income and expenses, a transaction journal is kept, which allows you to determine the distribution of amounts among cost accounts.

Question No. 2. How is the fact of payment of fees confirmed if admission is carried out according to a statement?

SNT can take form at a general meeting of members of the partnership. In most associations, membership books are drawn up, where a record of the payment of the contribution is made.

Question No. 3. Are receipts from SNT members to cover payments for electricity and land tax considered income of the partnership?

No, they are not. The amounts are paid as part of membership fees, which must be indicated in the Charter of the partnership.

Question No. 4. How are SNT expenses covered when the need exceeds the income established according to the annual estimate?

The amount of target income of the members of the partnership depends on the established amount adopted by the general meeting of participants. In case of insufficient funds, it will be necessary to assemble a quorum of SNT members and revise the amount of contributions established for the year.

Income Accounts

The working chart of accounts used by the partnership is approved in the appendix to the accounting policy. Receipts are accounted for using account 86 “Targeted financing” and sub-accounts opened for analytical accounting. An account is opened:

- 86/1 to account for the entrance fee funds allocated for documentation.

- 86/2 to account for membership fees used to cover operating expenses.

- 86/3 for accounting for funds allocated for the implementation of target programs, for example, the acquisition of fixed assets.

Let's consider an example with a typical accounting situation in SNT "Uchastok". The general meeting of the partnership members established the need for road construction. The contribution of each person was 1,500 rubles. The target amount is accumulated in account 86/3 for the loan by participants. The following entries are reflected in accounting by person:

Debit 76/5 Credit 86/3 – 1500 rubles – debt accrued in the amount of the target contribution.

Debit 50 Credit 76/5 – 1500 rubles – a cash contribution was made to the target program.

Account 86/3 will be closed after the construction of the SNT “Plot” road. Debt due to counterparties can be determined using account 76/5.

How to find an accountant for SNT or ONT?

offers accountant services for HOAs, SNT, ONT (DNP). Price - from 15,900 ₽/month. This price includes:

- Comprehensive outsourced accounting with error insurance;

- Organizing the receipt of contributions to SNT to a current account;

- HR records management for 2 employees;

- Calculation, optimization, payment of taxes;

- Integration with bank client and 1C;

- Resolution of disputes in government agencies;

- Face-to-face legal consultations;

If you need a specialist who will take care of all the accounting of a holiday village, call or WhatsApp at.

Accounting for partnership expenses

The list of expenses allowed in servicing the activities of SNT must be established in the constituent documents or internal regulations approved by the general meeting of participants. The amount of annual expenses is determined in the estimate. At the end of the year, the chairman submits a report approved at the general meeting.

SNT often uses an accounting journal to maintain operations. The document is necessary for drawing up internal reporting, determining the balance and movement of accounts. Let's look at the features of keeping an accounting journal.

| Position | Characteristic |

| Form used | No. K-1 |

| Procedure for filling out the entry | Chronological |

| Grounds for making an entry | Primary accounting documents |

| Content | Brief description of the operation |

| Procedure for recording amounts | Produced by debit and credit of accounts |

| Removal of residue | At the end of the month and for each account |

The convenience of keeping records in the accounting journal is to obtain accurate indicators that allow you to report on the income and expense parts of the estimate.

Accountant's Directory

Accounting for target financing funds

Contributions of participants must be reflected in accounting separately by their types based on the definitions given in Law No. 66-FZ, as well as their economic content.

To account for accrued and received contributions, it is advisable to open separate sub-accounts to account 86 “Targeted financing”, for example: 86-1 “Entry fees” - to account for funds contributed by members of a horticultural non-profit association for organizational expenses for documentation; 86-2 “Membership fees” - to account for funds periodically contributed by members of a gardening association to pay for the labor of workers who have entered into employment contracts with such an association, and other current expenses of such an association;

86-3 “Targeted contributions” - to account for funds contributed by members of a gardening partnership for the acquisition (creation) of public facilities.

Accounting for shares and additional contributions is organized and maintained in horticultural cooperatives, which differ from horticultural partnerships in that they conduct certain commercial activities (for example, selling grown products). In the event that a gardening partnership receives subsidies, subventions or other types of government assistance, a separate sub-account should be opened to record them.

An additional subaccount “Other sources” can also be opened to account 86 - for example, to reflect settlements with citizens who are not members of the partnership, but use its infrastructure for a fee.

On account 76 “Settlements with various debtors and creditors” it is advisable to take into account the debt of the partnership participants for membership fees. Debt on entry fees is reflected, as a rule, when they are paid, so the use of settlement accounts is not necessary.

However, from the point of view of operational accounting of the debt of the partnership participants in contributions, such accounting can be organized.

Example 1. The general meeting of members of the horticultural non-profit partnership “Pishchevik” established the amount of membership fees - 200 rubles. from one hundred square meters per year, the amount of entrance fees is 1000 rubles. Also, the meeting of members of the partnership decided to collect targeted contributions for the construction of the road in the amount of 600 rubles. from the site.

When reflecting the debt of the participants of the partnership for contributions in the accounting of the gardening partnership, the following entries are made: Debit 76-5 “Settlements with various debtors and creditors”, Credit 86-2 “Membership fees”

— 1200 rub. (200 rub.

Accounting in SNT

x 6 acres) - reflects the debt of the members of the partnership for membership fees; Debit 76-5 “Settlements with various debtors and creditors” Credit 86-3 “Targeted contributions” - 600 rubles. — the debt of the members of the partnership for targeted contributions for the construction of the road is reflected; Debit 50 “Cash” Credit 76-5 “Settlements with various debtors and creditors”

— 1800 rub. - a member of the partnership has paid membership and target contributions to the cash desk.

Example 2. The general meeting of members of the horticultural non-profit partnership “Pishchevik” accepted a new member of the partnership, the amount of entrance fees is 1000 rubles.

When reflecting the debt of the participants of the partnership for contributions in the accounting of the gardening partnership, the following entries are made: Debit 76-5 “Settlements with various debtors and creditors” Credit 86-1 “Admission fees” - 1000 rubles.

— the debt of the members of the partnership for entrance fees is reflected; Debit 50 “Cash” Credit 76-5 “Settlements with various debtors and creditors” - 1000 rubles. - a member of the partnership has paid an entrance fee to the cashier.

The following option for reflecting this operation in accounting is possible: Debit 50 “Cash” Credit 86-1 “Entry fees”

— 1000 rub. — the entrance fee is paid by the member of the gardening association immediately at the time of joining.

Accounting (financial) statements for 2015

Name of the organization Garden Non-Profit Partnership “Garden Society-2” INN 5446012080 Code of the type of economic activity according to the OKVED classifier 70.32.

2 Code according to OKPO 66233556 Form of ownership (according to OKFS) 16 - Private property Organizational and legal form (according to OKOPF) 20701 - Gardening, gardening or dacha non-profit partnerships Report type 0 - socially oriented non-profit organization Unit of measurement 384 - Thousand rubles Composition of reporting Reports for other years

To make reporting easier to read, zero lines are hidden

Print Download the dossier on the Garden Non-Profit Partnership “Garden Society-2”

Report on the intended use of funds

| Indicator name | Line code | For 2015 |

| Balance of funds at the beginning of the reporting year | 6100 | 38 |

| Funds received | ||

| Entry fees | 6210 | |

| Membership fee | 6215 | |

| Targeted contributions | 6220 | 220 |

| Voluntary property contributions and donations | 6230 | |

| Profit from the organization's income-generating activities | 6240 | |

| Others | 6250 | |

| Total funds received | 6200 | 220 |

| Funds used | ||

| Expenses for targeted activities, including: | 6310 | (0) |

| social and charitable assistance | 6311 | (0) |

| holding conferences, meetings, seminars, etc. | 6312 | (0) |

| other events | 6313 | (0) |

| Costs for maintaining the management apparatus, including: | 6320 | (228) |

| expenses related to wages (including accruals) | 6321 | (0) |

| non-wage payments | 6322 | (0) |

| expenses for official travel and business trips | 6323 | (0) |

| maintenance of premises, buildings, vehicles and other property (except for repairs) | 6324 | (0) |

| repair of fixed assets and other property | 6325 | (0) |

| other | 6326 | (0) |

| Acquisition of fixed assets, inventory and other property | 6330 | (0) |

| Others | 6350 | (0) |

| Total funds used | 6300 | (228) |

| Balance of funds at the end of the reporting year | 6400 | 30 |

The information was generated from the open data set “Accounting (financial) statements of enterprises and organizations for 2015” of the Federal State Statistics Service (Rosstat)

Income" with reporting when the number of documents processed per quarter is up to 50 to 7,000 rubles per month with reporting when the number of documents processed per quarter is from 51 to 100 from 7 to 10 thousand.

rubles per month with submission of reports with the number of documents processed per quarter from 101 by agreement depending on the volume of document flow Annual accounting services Preparation and submission of personalized accounting (up to 3 people.

) 4000 rubles per year (+500 rubles/person) Preparation of a 2-personal income tax report (up to 10 people.

employees) 3,000 rubles per year (+500 rubles/person) Establishment and restoration of accounting Restoration of accounting in an organization from 15,000 rubles Formation and processing of primary documents 200/1 document Preparation, submission and protection of reports to the Federal Tax Service, Social Insurance Fund, pension fund and statistical authorities 500/1 hour Development of an enterprise’s accounting policy from RUB 3,000.

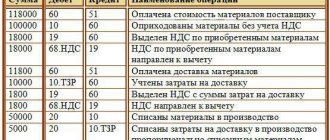

Accounting for utility bills using a practical example

The partnership estimate does not separately reflect utility bills, which must be taken into account. The main type of utility service received by SNT is electricity supplied on the basis of an agreement with a resource supply company. Electricity costs are accounted for on account 26; metered costs are accounted for on account 76/5, broken down by sections or names in correspondence with settlement accounts.

Let's look at examples of transactions when receiving electricity bills and paying them from a service provider.

An invoice was issued to SNT "Ogorodnik" from OJSC "Energosbyt" for June 2021 in the amount of 850 rubles. The chairman of the partnership agreed with the act of receiving energy, which was recorded in the supplier’s copy; the following entries are made:

- Dt 26 Kt60– 850 rubles – the amount of SNT expenses for electricity is accrued according to the act;

- Dt 60 Kt 51 – 850 rubles – payment for the supplied energy has been made;

- Dt 86/2Kt 26 – 850 rubles – costs were covered from targeted revenues.

The debt for the supply of electricity to SNT "Ogorodnik" has been repaid.

The costs of paying utility bills to the service company are covered by the targeted revenues of the participants. The partnership itself does not provide electricity services and proceeds to cover expenses are not income. The responsibilities of the management body of the partnership include collecting funds and transferring them to the company providing the electricity supply service. Accounting in SNT is carried out in strict accordance with the tariffs established for the service.

Participants and management

| Until December 31, 2021 (No. 66-FZ “On dacha non-profit associations of citizens”) | From January 1, 2021 (No. 217-FZ “On gardening partnerships”) | |

| Minimum number of partnership participants | 7 people | 7 people with the possibility of liquidation through the court if the rule is violated |

| Term of board of the chairman of the partnership | 2 years | 5 years |

| Number of board members of the partnership | Established by decision of the General Meeting | At least 3 people, but not more than 5% of the number of participants in the partnership |

| The right to change SNT (ONT) to HOA | No | Yes, by decision of the General Meeting |

Land plots and property of SNT

SNT lands can be used only for their intended purpose for growing crops and erecting buildings. The land is not used for housing construction. The building on the site is not registered as property with the right of registration and has the status of a garden house.

A plot of land cannot be privatized and is provided to a person for rent after joining the partnership. The property is the property of all participants. Persons have at their disposal:

- Public roads located on the territory of SNT.

- Communications intended for the operation of utility networks.

- Areas intended for parking or placement of waste collection containers.

- Common structures, gates, fences.

Accounting for property created with the funds of members of the partnership is carried out in the accounts of fixed assets and construction in progress. The property created with the funds of the participants of the partnership is the property of a legal entity registered in the form of SNT. The right to dispose of property with restrictions on transactions must be approved in the Charter of the partnership.

Members of the partnership have the right to dispose of property on a general basis. In the case of use of SNT property by third parties, an agreement is concluded with them for the right to use for a fee, the amount of which corresponds to the cost established for members.

Objectives of the partnership. Control

Is it possible to own a plot of land without joining the SNT, and why organize it at all? Yes, the law allows not only owners, but also those who use the land on the right of lifelong ownership, lease, etc. not to enter into a partnership. ( ), but at the same time retains for such owners the rights and obligations almost similar to ordinary members of SNT:

- Use of common property.

- Payment of fees.

- Participation in meetings and voting (not on all issues) and others.

Reasons why the creation of an SNT is justified and more convenient for a group of owners (the number of members of the partnership must be at least 7):

- Simplifying the resolution of issues with general communications: electricity, water, gas, etc., solid waste removal, security and other pressing problems. It is easier to conclude contracts and order work on behalf of the organization.

- Protecting the interests of SNT members before third parties, resolving conflict situations whenever possible by voting, and not through legal proceedings. Providing consulting and legal support.

- Defending the interests of SNT before government agencies.

- Assistance in developing sites on the territory of the partnership, organizing land surveying, establishing boundaries, etc.

- Minimization of costs for maintaining common property (water supply, electrical networks, roads, coastal strip, if SNT is located next to a reservoir), more opportunities to improve the territory (for example, build a playground) through joint fees and membership fees.

In order for such a community to work effectively, responsibilities and rights are distributed between three governing bodies, which I have already named above: the general meeting of SNT members, the board and the chairman, and one control body - the audit commission.

Governing body

Next in the hierarchy is the board of the partnership. The chairman is one of the members of the board (at least three and no more than 5% of the number of members of the partnership) and heads it. The timing and frequency of meetings are determined by the charter.

Important! At least half of the board members must be present to make decisions. Regular voting takes place. If the result is 50/50, then the chairman's vote will be decisive.

Makes decisions on holding a general meeting, on current activities, concluding agreements with resource supply organizations, etc. The competence of the board also includes the preparation of reports, including annual ones.

The chairman actually acts as an analogue of a director in a regular organization: he acts on behalf of the partnership without a power of attorney, has the right of first signature, concludes contracts, and hires employees.

Audit committee

The commission must consist of at least three people - members of the partnership. However, they cannot be:

- Chairman.

- Board members.

- Close relatives of the above persons.

The responsibilities of the commission include: checking the legality of transactions concluded by the partnership, implementing decisions of management bodies, auditing activities, identifying violations and preparing proposals for their elimination. The commission is obliged to report all detected inconsistencies and errors to the general meeting.

Elimination of the concept of “dacha partnership”

The first thing worth mentioning is the elimination of the concept of dacha partnership.

Of course, no one will forbid people to call themselves summer residents, but in legal terms this formulation no longer exists. In total, from now on there will be two types of partnerships in Russia:

- gardening (created for the purpose of growing vegetable and fruit crops);

- horticultural (on its territory it is allowed to erect residential buildings and register in them for permanent residence).

According to the new law, only one partnership is allowed to be located on a given territory (for example, if another legal entity appears on a site owned by a gardening partnership, it is subject to cancellation).