Payment

Why did the minimum wage increase from November 1, 2018? The minimum wage in Moscow is tied to the subsistence level

It is important not only for the employees themselves, but also for the company to improve their qualifications and professionalism.

Registration of a citizen as an individual entrepreneur (IP) is the easiest way to open your own

Updated: January 1, 2021, at 11:35 PSN is subject to changes and modifications by legislators,

Is it time to hire your first employee? It is important to do everything within the allotted time frame, complete the documents correctly,

List of persons entitled to receive money Employing organization by virtue of accounting legislation

Last changes: January 2021 According to the tax code, the tax must go to the budget on the day

How to reflect in the program the reimbursement of expenses to an employee made from personal funds for the needs of the organization,

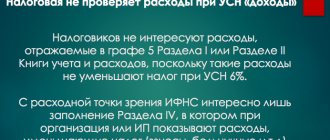

As you know, individual entrepreneurs using the simplified tax system have the right to choose the object of taxation “income” or “income minus expenses”.

Quite often, industrial organizations open retail stores or stalls to sell their own products. This