Why did the minimum wage increase on November 1, 2018?

The minimum wage in Moscow is tied to the subsistence level. If the cost of living becomes higher, then from the next month the minimum wage will also increase (clauses 3.1.1, 3.1.2 of the Moscow Government Decree dated December 15, 2015 No. 858-PP). The cost of living in the second quarter of 2021 in Moscow was 18,781 rubles. In this regard, from November 1, 2021, the minimum wage is 18,781 rubles.

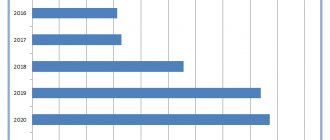

At the federal level, no changes are planned in the procedure for ensuring the minimum wage for the fall of 2021. The next increase in the federal minimum wage will occur on January 1, 2021. “ Minimum wage in Russia from January 1, 2019. ”

What to do due to an increase in the minimum wage

Employers whose employees receive wages less than the minimum wage must increase it to the new established values. To do this, you will have to issue a sample order to increase wages and adjust the staffing table.

You need to understand that the salary may remain the same, since it is not the salary itself that is less than the minimum wage, but the total amount of the salary received by the employee, which includes:

- compensation payments, including allowances and additional payments;

- incentive payments (bonuses);

- reward for work.

Composition of the new minimum wage from November 1, 2018

The new minimum wage from November 1 (18,781 rubles) should already include all types of bonuses and additional payments to employees, except for additional payments:

- for working in harmful and dangerous working conditions

- for overtime work;

- for night work;

- for working on weekends or holidays;

- for combining professions.

It is also important that with the new Moscow minimum wage from November 1, 2018, you need to compare the amount before deduction of personal income tax. That is, if the employee worked the full working time for November. This means that he will receive at least 16,339.47 rubles in his hands. (RUB 18,781 – (RUB 18,781 x 13%).

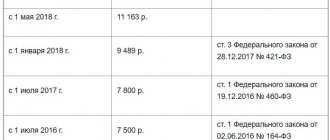

Latest updates in Federal Law No. 82

The most recent update of the federal law on the minimum wage took place in December 2017. The main change affected Federal Law No. Article 1, which regulates the minimum wage.

The text of the regulation states that the State Duma of Russia will establish the maximum permissible level of salary annually. In 2021, its size was 9 thousand 489 rubles. At the beginning of the current reporting period, the new payment system made it possible to increase this figure by 1,791 rubles on average across the country. Moreover, if the volume of payments for a certain quarter becomes less in comparison with the previous period, then the value of the indicator should correspond to the largest figure, i.e. period I.

How to switch to a new minimum wage

Any subject of the Russian Federation (including Moscow) can set its own minimum wage. But it cannot be lower than the minimum wage approved by federal law (Article 133.1 of the Labor Code of the Russian Federation). From May 1, 2021, the federal minimum wage is 11,183 rubles.

If the salary in Moscow to be calculated for November and December 2018 is lower than the minimum wage (18,781 rubles), then the employee must be paid extra. You can set the surcharge in two ways:

- increase salary;

- establish in a local act (for example, a separate order or Regulation on remuneration) an additional payment up to the minimum wage. That is, it should be directly stated that employees are given an additional payment up to the regional minimum wage. Then there will be no need to review salaries or change employment contracts.

An employee whose salary in Moscow is less than the new minimum wage may demand:

- additional payment for the period of validity of the new minimum wage from November 1, 2018;

- compensation for delayed payment from November 1, 2021 (Article 236 of the Labor Code of the Russian Federation).

The minimum wage in Moscow from November 1, 2021 does not affect the amount of benefits. Benefits are calculated based on the federal, not regional minimum wage.

How to increase your salary due to an increase in the minimum wage

If the employee’s salary consists only of salary or tariff rate, the employer must correctly draw up documents to increase the established payments to the minimum wage. To do this, use a sample order to increase salaries for all employees or only those whose salaries do not reach the established minimum.

If the employer includes in the employee’s remuneration, in addition to the salary, other allowances or additional payments, either their amount or the salary (tariff rate) should be increased so that the total amount is at least 11,163 rubles.

To do this, an order should be issued to increase wages in connection with the increase in the minimum wage, which changes the staffing table. Here are instructions on how to do this:

- Issue an order to increase wages.

- Based on this order, make changes to the staffing table (established form T-3).

- Make changes to employment contracts regarding remuneration for labor.

If the payment is less than the new minimum wage

If the Moscow salary for November and December 2021 is lower than the minimum wage, then the employer may be brought to administrative and criminal liability. An individual entrepreneur or director of an organization may be fined in the amount of 1,000 to 5,000 rubles, and an organization – from 30,000 to 50,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Moreover, even an accountant can be held accountable if he calculates wages incorrectly. See “The Federal Tax Service allows you to fine accountants.”

For a repeated violation, you can be fined from 10,000 to 20,000 rubles. or disqualify for a period of one to three years. Fine for individual entrepreneurs for repeated violation: from 10,000 to 20,000 rubles, for a company – from 50,000 to 70,000 rubles. (Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for violations

Provided that the employee carried out labor activities within the monthly norm, the employer is obliged to pay funds no less than the regional minimum or industry indicators. If the applicable legal provisions are violated, the organization may be held liable.

According to the Administrative Code

Penalties in the amount of:

- 10000-15000 rub. for officials;

- 100000-150000 rub. for legal organizations;

- suspension of activities for up to 3 months.

According to the Criminal Code of Russia

Article 145.1 part 2.

Article 145.1 of the Criminal Code of the Russian Federation “Non-payment of wages, pensions, scholarships, benefits and other payments”

How can an employer refuse the new minimum wage?

Any employer has the right to refuse to apply the Moscow minimum wage. To do this, you need to draw up and send a reasoned refusal to the local branch of the Committee on Labor and Employment. The period is 30 calendar days from the date of publication of the tripartite agreement on the regional minimum wage (Article 133.1 of the Labor Code of the Russian Federation).

In this case, the refusal must be motivated, that is, you will need to indicate the reasons why your organization does not want to pay its employees the regional “minimum wage”. As such reasons, we can indicate, for example, “crisis”, “few orders”, “risk of mass layoffs of employees”. In Moscow, the refusal must be sent to the tripartite commission at the address: 121205, Moscow, st. Novy Arbat, 36/9.

An employer who refuses the minimum wage in Moscow on time has the right to adhere to the federal minimum wage. Now it is 11,163 rubles.

However, please note that paragraph 8 of Article 133.1 of the Labor Code of the Russian Federation obliges the employer to attach a set of documents to the refusal, including proposals for the timing of increasing the minimum wage of employees to the amount provided for in the agreement. That is, even a timely refusal does not mean that you will not have to pay the new minimum wage established on November 1, 2018. The employer is simply given the right to delay its introduction.

Also, Article 133.1 of the Labor Code of the Russian Federation gives the Moscow authorities the right to invite representatives of an employer who has refused to adopt the new minimum wage from November 1, 2021, for consultations. That is, abandoning the Moscow minimum wage threatens a collision with administrative resources.

Read also

14.09.2016

Table of minimum wages by region

The table information is taken from the ConsultantPlus Help System.

Minimum wage from October 1, 2021.

A link to information containing the new minimum wage for the current date can be found under the Table.

| The subject of the Russian Federation | Minimum wage, rub. | Base | |

Republic of Adygea (Adygea) | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Altai Republic | 12130 | Regional agreement on the minimum wage in the Altai Republic dated April 24, 2018 | |

| Republic of Bashkortostan | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

The Republic of Buryatia | in an amount equal to the minimum wage (12130), increased by the regional coefficient and a percentage bonus for work experience in areas with special climatic conditions, including in the Far North and equivalent areas | Regional agreement “On the minimum monthly wage in the territory of the Republic of Buryatia” dated March 14, 2018 N 01.08-010-45/18 | |

| The Republic of Dagestan | for employees of non-budgetary organizations - in the amount of the subsistence minimum for the working population of the Republic for the second quarter of the past year | 12130 | Regional agreement “On the minimum wage in the Republic of Dagestan” dated 10/05/2017 |

| The Republic of Ingushetia | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Kabardino-Balkarian Republic | in the amount of the minimum wage:1) for non-profit organizations; 3) for organizations created by public associations of disabled people | 12130 | Regional agreement on the minimum wage in the Kabardino-Balkarian Republic for 2021 - 2022 (Decision of the Kabardino-Balkarian Tripartite Commission on the regulation of social and labor relations dated 07/07/2020 N 1) |

| for the extra-budgetary sphere - in the amount of the subsistence minimum of the working-age population of the Republic for the second quarter of the previous year | 12834 | ||

| Republic of Kalmykia | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Karachay-Cherkess Republic | 12130 | Regional agreement on the minimum wage in the Karachay-Cherkess Republic of October 14, 2019 | |

| Republic of Karelia | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Komi Republic | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Republic of Crimea | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Mari El Republic | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| The Republic of Mordovia | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| The Republic of Sakha (Yakutia) | in an amount not lower than the minimum wage (12130) with the use of compensation payments on top of it for work in the Far North: regional coefficient and percentage bonuses, but not lower than the subsistence level for the working population in the Republic as a whole for the third quarter of the previous year | Republican (regional) agreement on interaction in the field of social and labor relations in the Republic of Sakha (Yakutia) for 2020 - 2022 dated 04/30/2020 | |

| Republic of North Ossetia-Alania | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Republic of Tatarstan (Tatarstan) | for state and municipal institutions of the Republic - in the amount of the minimum wage | 12130 | Agreement on the minimum wage in the Republic of Tatarstan dated December 25, 2019 |

| for employees of the Republic, except for employees of organizations financed from the federal budget, the budget of the Republic and local budgets | 14000 | ||

| Tyva Republic | 12130 excluding regional coefficients and percentage bonuses to wages for work experience in the Far North and equivalent areas | Regional agreement on the minimum wage in the Republic of Tyva from January 1, 2021 | |

| Udmurt republic | 12130 (taking into account the regional coefficient of 13949.5 rubles) | Regional agreement on the minimum wage in the Udmurt Republic dated 02/19/2020 | |

The Republic of Khakassia | in the amount of the minimum wage (12130) with the addition of a regional coefficient and a percentage bonus for work experience in the Republic | Agreement on the minimum wage in the Republic of Khakassia dated 03/05/2019 | |

| Chechen Republic | 12130 | Agreement “On the minimum wage in the Chechen Republic” dated December 26, 2019 | |

| Chuvash Republic - Chuvashia | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Altai region | for agricultural workers (for the period from 01/01/2020 to 12/31/2020), public sector workers, workers participating in public works or temporarily employed under agreements between employers and employment service bodies, employees of enterprises and organizations whose sole founders are all-Russian organizations of disabled people, workers from among citizens with disabilities employed under agreements on the creation or allocation of jobs for the employment of disabled people against the established quota for public organizations of disabled people, as well as for workers employed under a social contract - in the amount of the minimum wage | 12130 | Regional agreement on the minimum wage in the Altai Territory for 2021 - 2021 dated December 17, 2018 |

| for non-budgetary employees (excluding payments for work in areas with special climatic conditions, other compensation, incentives and social payments provided in accordance with current legislation, agreements and collective bargaining agreements) | 13000 | ||

| Transbaikal region | in an amount not lower than the minimum wage (12130) with the use of compensation payments above it for work in special climatic conditions | Tripartite agreement for 2021 - 2021 dated 08/01/2018 N 40-D/SG-2 | |

| Kamchatka Krai | for employees working in organizations located in the region, using regional coefficients and percentage increases in wages | 12130 | Regional agreement “On the minimum wage in the Kamchatka Territory for 2021” dated December 24, 2019 |

| Krasnodar region | for employees working in the territory of the region, with the exception of employees of organizations financed from the federal, regional and municipal budgets - in the amount of the subsistence minimum for the working population per month, excluding compensation, incentives and social payments | 12298 | Regional agreement on the minimum wage in the Krasnodar Territory for 2021 - 2021 (Decision of the Krasnodar Regional Tripartite Commission for the Regulation of Social and Labor Relations dated December 27, 2017 N 7-3) |

| Krasnoyarsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Perm region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Primorsky Krai | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Stavropol region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Khabarovsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Amur region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Arhangelsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Astrakhan region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Belgorod region | 12130 | Tripartite Agreement for 2021 - 2022 dated December 17, 2019 N 43 | |

| Bryansk region | for public sector organizations | 12200 | Regional agreement on the minimum wage in the Bryansk region for 2021 |

| for non-budgetary organizations | 13000 | ||

| Vladimir region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Volgograd region | in the amount of minimum wage:1) for state and municipal institutions of the region; 2) for non-profit organizations; 3) for organizations created by public associations of disabled people; 4) for workers engaged in public and temporary work, the implementation of which is organized within the framework of the implementation of the state program of the region “Development of the labor market and provision of employment in the Volgograd region” | 12130 | Regional agreement on the minimum wage in the Volgograd region dated June 26, 2019 N RS-71/19 |

| for the extra-budgetary sphere - in the amount of 1.3 times the subsistence minimum of the working-age population for the second quarter of the previous year | 14032 <2> | ||

| for employers whose activities relate to the types of economic activities included in the section “Agriculture, forestry, hunting, fishing and fish farming” of OKVED - during the year not less than the minimum wage (12130), and at the end of the calendar year not less than 1.3 times living wage of the working-age population for the second quarter of the previous year | |||

| Vologda Region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Voronezh region | for employees of the extra-budgetary sphere - the size of the monthly tariff rate of category I (minimum official salary) for employees employed in normal working conditions cannot be lower than the minimum wage (12130)) | Tripartite agreement for 2021 - 2022 dated 12/13/2019 | |

| Ivanovo region | 12130 (not lower than the subsistence level of the working-age population for the second quarter of the previous year and the minimum wage) | Regional agreement on the minimum wage in the Ivanovo region for 2021 - 2022 dated 01/23/2020 N 1-s | |

| Irkutsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Kaliningrad region | 13000 | Regional agreement on the minimum wage in the Kaliningrad region dated December 24, 2018 | |

| Kaluga region | in the amount of the subsistence minimum for the working population, but not lower than the minimum wage (12130) | Agreement on the minimum wage in the Kaluga region dated September 10, 2019 | |

| Kemerovo region - Kuzbass | for commercial organizations (except for organizations operating in the field of regulated pricing, for which the main activity is the provision of housing, utilities, transport services (passenger transportation), communications (postal services)) and individual entrepreneurs upon full completion of the monthly working hours - not less than 1.5 times the subsistence level of the working-age population of the region for the second quarter of the previous year, with the regional coefficient applied to it | Kuzbass regional agreement for 2021 - 2021 dated January 17, 2019 N 1 | |

| Kirov region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Kostroma region | in the extra-budgetary sphere, the size of the monthly tariff rate of the 1st category (minimum official salary) of workers employed in normal working conditions, for work that does not require special professional training, knowledge, skills and professional skills and work experience, is not lower than the minimum wage (12130) | Agreement on social partnership in the sphere of labor for 2019-2021 dated 02/08/2019 | |

| Kurgan region | 12130 (taking into account the regional coefficient of 15%, no less than 13949.5 rubles) | Agreement on the amount of the minimum wage in the Kurgan region dated December 26, 2019 N 2/20 | |

| Kursk region | in an amount not lower than the minimum wage (12130) | Agreement for 2021 - 2021 dated 12/17/2018 | |

| Leningrad region | 12800 (in this case, the tariff rate of the 1st category worker (employee), salary (official salary), the employee’s wage rate should not be less than 9940 rubles) | Regional agreement on the minimum wage in the Leningrad region for 2021 dated November 28, 2019 N 15/C-19 | |

| Lipetsk region | for public sector employees - in the amount of the minimum wage | 12130 | Regional agreement on the minimum wage in the Lipetsk region for 2021 - 2021 dated December 27, 2017 |

| for employees of non-budgetary organizations - not less than 1.2 times the subsistence level of the working-age population for the second quarter of the previous year, but not less than the minimum wage (12130) | |||

| Magadan Region | in an amount not lower than the minimum wage (12130), to which a regional coefficient and a percentage bonus for work experience in the Far North are added | Agreement for 2017-2020 dated 05/23/2017 | |

| Moscow region | 15000 | Agreement on the minimum wage in the Moscow region dated October 31, 2019 N 243 | |

| Murmansk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Nizhny Novgorod Region | 12130 | Regional agreement on the minimum wage in the Nizhny Novgorod region for 2021 dated February 13, 2020 N 14-P/27/A-74 | |

| Novgorod region | for employees of organizations financed from regional and local budgets | 12130 <1> | Regional agreement “On the minimum wage in the Novgorod region” dated December 26, 2014 |

| for employees working in the region, except for employees of organizations financed from the federal, regional and local budgets - in the amount of the subsistence level in the region per month | 12378 | ||

| Novosibirsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Omsk region | for employees of non-profit organizations, organizations financed from the regional and local budgets of the region, as well as employees participating in public works organized in accordance with paragraph. 8 pp. 8 clause 1 art. 7.1-1 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” (without taking into account the regional coefficient established for the region) | 12130 | Regional agreement on the minimum wage in the Omsk region dated November 25, 2019 N 93-RS |

| for employees of other employers (without taking into account the regional coefficient established for the region) | 12740 | ||

| Orenburg region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Oryol Region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Penza region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Pskov region | in the amount of minimum wage: 1) for employees of state institutions of the region and state unitary enterprises of the region; 2) employees of municipal institutions and municipal unitary enterprises of municipalities of the region; 3) employees working in the region in socially oriented non-profit organizations; 4) employees working in the region in consumer cooperation organizations; 5) employees working in the region for small businesses; 6) from other employers for employees classified as auxiliary personnel | 12130 | Regional agreement on the minimum wage in the Pskov region dated December 24, 2019 N 304 |

| for other employers for employees belonging to the main personnel - in the amount of the subsistence minimum of the working-age population in the region for the second quarter of the previous year | 12276 | ||

| Rostov region | for employees of non-budgetary organizations, individual entrepreneurs - in an amount not lower than 1.2 minimum wages | 14556 | Rostov regional tripartite (regional) Agreement for 2020 - 2022 dated November 21, 2019 N 13 |

| Ryazan Oblast | for employees of state institutions of the region and municipal institutions of municipal entities of the region - in the amount of the minimum wage | 12130 | Regional agreement on the minimum wage in the Ryazan region for 2021 dated December 25, 2019 N 107-1 |

| for employees working for employers - legal entities (organizations) and individual entrepreneurs, with the exception of organizations financed from the federal budget | 12500 | ||

| Samara Region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Saratov region | for employees working in the region, with the exception of employees of organizations whose activities are financially supported by federal, regional and local budgets | 12615 | Agreement on the minimum wage in the Saratov region dated December 27, 2019 |

| Sakhalin region | 12400 using the regional coefficient and a percentage increase for length of service in accordance with Articles 315 - 317 of the Labor Code of the Russian Federation | Agreement on the minimum wage in the Sakhalin region for 2021 dated 02/10/2020 | |

| Sverdlovsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Smolensk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Tambov Region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Tver region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Tomsk region | 12130 | Regional agreement on the minimum wage in the Tomsk region for 2021 dated December 19, 2019 | |

| Tula region | for employees of state and municipal institutions (organizations) of the region | 12200 | Regional agreement on the minimum wage in the Tula region dated 04/03/2019 |

for non-budgetary workers | 14100 | ||

| Tyumen region | 12200 with the calculation of the regional coefficient and a percentage bonus for work experience in areas with special climatic conditions | Regional agreement on the minimum wage in the Tyumen region dated November 15, 2019 | |

| Ulyanovsk region | for employees of organizations established by the region or municipalities of the region, as well as for employees of small businesses - in the amount of the minimum wage | 12130 | Regional agreement on the minimum wage in the Ulyanovsk region dated October 31, 2019 N 122-DP |

| for employees of extra-budgetary spheres and medium-sized businesses | 14500 | ||

| Chelyabinsk region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Yaroslavl region | 12130 | Regional agreement on the minimum wage in the Yaroslavl region for 2021 - 2021 from December 29, 2017 | |

| Moscow | in the amount of the subsistence minimum of the city’s working population | 20361 | Moscow tripartite agreement for 2019-2021 dated September 19, 2018 |

| Saint Petersburg | 19,000 (in this case, the tariff rate (salary) of a 1st category worker, the salary (official salary) of an employee should not be less than 14,300 rubles) | Regional agreement on the minimum wage in St. Petersburg for 2021 dated December 27, 2019 N 343/19-C | |

| Sevastopol | for employees of public sector organizations | 12130 | Regional agreement on the minimum wage in the city of Sevastopol dated December 25, 2018 |

| for employees of non-budgetary organizations | 12130 | ||

| Jewish Autonomous Region | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Nenets Autonomous Okrug | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Khanty-Mansiysk Autonomous Okrug - Ugra | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

Chukotka Autonomous Okrug | 12130 | Federal Law of June 19, 2000 N 82-FZ | |

| Yamalo-Nenets Autonomous Okrug | in an amount equal to the minimum wage (12130), using the regional coefficient and a percentage increase in wages for work experience in the regions of the Far North and equivalent areas, but not lower than the cost of living of the working population in the Autonomous Okrug for the second quarter of the previous year | Regional tripartite agreement “On the minimum wage in the Yamalo-Nenets Autonomous Okrug” dated December 27, 2017 | |