Payment

Individual entrepreneurs usually choose preferential tax regimes. This allows them to optimize costs and serve

In business activities, the purpose of which is to make a profit, it is necessary to keep records. The income that is taken into account is

Tax Rates VAT is a specific value used to calculate the tax amount. To count

Taxes and contributions Marina Dmitrieva Leading expert - professional accountant Current as of March 7

Personal income tax (NDFL) has its roots in the history of ancient Rus'. Only then

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

Business lawyer > Accounting > Accounting and reporting > Zero 6-NDFL: sample filling

Difficulties often arise with deductions upon dismissal. Here is just one example: an employee was accrued

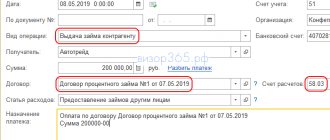

The concepts of “credit” and “loan” Accounting for credits and borrowings in accounting is regulated by PBU 15/2008.

Accounting account 60 “Settlements with suppliers and contractors” is intended to generate data on payments made