Composition and deadlines for submitting reports to the Pension Fund from 2021

Organizations and individual entrepreneurs that have employees or have entered into civil law contracts with individuals have been submitting the following reporting forms to the Pension Fund since 2021: (click to expand)

- Monthly “Information about insured persons” in the SZV-M form - until the 15th day of the month following the reporting month. Read also the article: → “Responsibility and fines for late submission of SZV-M.”

- Once a year “Information on the insurance experience of insured persons” in the form SZV-STAZH - until March 1 of the year following the reporting year.

- Quarterly Register of insured persons by the amount of additional insurance contributions for funded pension and the amount of employer contributions (co-financing) - until the 20th day of the month following the reporting quarter.

As a general rule, if the reporting deadline falls on a weekend or holiday, the reporting deadline will be the first business day following the weekend or holiday.

Responsibility for failure to submit SZV-TD

The Code of Administrative Offenses of the Russian Federation and other legal acts provide for responsibility for:

- failure to provide a reporting form;

- late delivery;

- distortion of information, unreliability of information contained in the report.

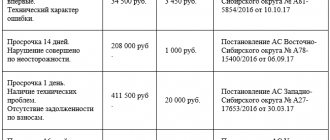

The table below shows the types of violations and responsibility for their commission.

| Offense | Punishment | NPA |

| Late provision of information about employment, dismissal | Fine for an official - 300-500 rubles for each employee for whom a report was not submitted on time | Art. 15.33.2 Code of Administrative Offenses of the Russian Federation |

| Late provision, incompleteness, unreliability of the information provided in other cases |

| Art. 17 of the Law of 01.04.1996 No. 27-FZ, Art. 15.33.2 Code of Administrative Offenses of the Russian Federation |

| Violation of labor laws |

| Part 1 art. 5.27 Code of Administrative Offenses of the Russian Federation |

| Repeated violation of labor laws |

| Part 2 art. 5.27 Code of Administrative Offenses of the Russian Federation |

| Providing a paper report for organizations with 25 or more people | Fine for organization: 1,000 rubles. | Art. 17 of the Law of 04/01/1996 No. 27-FZ |

Officials of the State Labor Inspectorate are authorized to make decisions on bringing to justice in accordance with the Code of Administrative Offenses of the Russian Federation in the event that the Pension Fund of the Russian Federation transmits to them information about the facts of committing offenses.

Penalty for late submission of reports to the Pension Fund of Russia

The fines are established by Article 17 of the Federal Law of April 1, 1996 N 27-FZ (as amended on December 28, 2016) “On individual (personalized) registration in the compulsory pension insurance system” and are:

- for late submission of information on forms SZV-M, SZV-STAZH, register of insured persons, a fine of 500 rubles. for each insured person.

- for failure to provide information or the register in electronic format, the fine is 1,000 rubles.

Reporting must be submitted electronically if the number of insured persons is 25 or more people.

The procedure for applying a Pension Fund fine in case of late submission of reports:

- If a violation is detected, an employee of the territorial body of the Pension Fund draws up a report. The act must be signed by an authorized employee of the Pension Fund of Russia and the policyholder (representative of the policyholder). If the policyholder (the policyholder's representative) refuses to sign the act, a note about this is made in the act.

- The certificate must be delivered to the policyholder within 5 days in one of the following ways:

- personally against signature

- by registered mail (the date of receipt will be considered the 6th day from the date of dispatch)

- in electronic form via telecommunications channels (TCS).

In case of disagreement with the act, the policyholder must submit reasoned objections within 15 days, attaching documents confirming his point of view.

- The act and objections to it are considered by the head (deputy head) of the territorial body of the Pension Fund of the Russian Federation within 10 days after the deadline for submitting objections to the act. The review period may be extended, but not more than 1 month.

- The act is usually reviewed in the presence of the policyholder (representative of the policyholder), who is notified in advance of the time and place of consideration of the act. If the policyholder (the policyholder's representative) fails to appear, the act can only be reviewed by the leadership of the territorial body of the Pension Fund of the Russian Federation.

- Based on the results of the review, a decision is made either to hold the policyholder liable for an offense or to refuse to hold the insurer liable.

- The decision on the act is communicated to the policyholder in one of the ways listed above in paragraph 2.

- The decision comes into force after 10 days from the date of delivery.

- In case of disagreement with the decision, the policyholder may appeal with objections to the higher authority of the Pension Fund of the Russian Federation within 3 months from the day on which he learned (or could have learned) about the violation of his rights.

- The policyholder is sent a requirement to pay penalties within 10 days from the date the decision comes into force. Read also the article: → “Features of verification and control when paying insurance premiums in 2021.”

- The deadline for paying the fine is 10 calendar days from the date of receipt of the request.

- In case of non-payment of penalties (incomplete payment), their collection is carried out in court.

- The statute of limitations for bringing to justice for this offense is 3 years.

What does the Federal Tax Service fine for?

Existing legislation provides for several types of violations in the preparation and submission of the DAM, for which financial punishment is provided:

- violation of filing deadlines;

- incorrect indication of personal data of the insured persons;

- incorrect calculations of insurance premiums.

For reports not submitted on time

Based on Article 119 of the Tax Code of the Russian Federation, the fine for late delivery of the DAM in 2020 is 5% of the amount of contributions not paid on time for each full or partial month of delay. There is an upper limit limiting the amount of sanctions - 30% of the specified amount. The lower limit is 1,000 rubles. If all contributions are transferred on time, the violator will get off with a fine of 1,000 rubles.

In addition, Article 15.5 of the Code of Administrative Offenses of the Russian Federation provides for a fine of 300 to 500 rubles for officials.

IMPORTANT!

Failure to submit a zero report will result in a fine of 1,000 rubles.

For errors in calculations and personal data

If the company has made the calculations correctly, but is in no hurry to make deductions, penalties are provided for this case. If the insurer grossly violated the calculations - underestimated the calculation base - then Article 120 of the Tax Code of the Russian Federation provides for material punishment in the amount of 20% of the amount of unpaid deductions, but not less than 40,000 rubles.

If the report contains inaccurate personal data of employees, such reporting is considered not submitted. To prevent this from happening, carefully fill out the fields F.I.O., SNILS and INN.

IMPORTANT!

It is possible not to pay a fine for violating the 2021 DAM deadlines, but to do this, all errors must be corrected in time. After receiving the report, tax officials conduct an audit. If errors are not detected in time, the policyholder is sent a corresponding notification. If the report was submitted electronically, the violator is given 5 days from the date of receipt of the notification to correct the errors. If the document was submitted on paper, then 10 days are allotted from the date of sending the notification.

Documentation of the offense

All of the above documents are drawn up in accordance with the forms approved by the Pension Fund of the Russian Federation in Resolution of the Pension Fund of the Russian Federation dated November 23, 2016 No. 1058p and which came into force on May 21, 2021.

So, this resolution, for example, approved: (click to expand)

- form of the act on the detected offense;

- form of decision to hold the insured liable;

- form of decision to refuse to hold the insured liable;

- Form for requesting payment of a fine for violating the deadlines for submitting reports to the Pension Fund.

How will the Pension Fund collect fines under the new rules?

The procedure for punishing employers will not change - for violations they will still fine and issue demands. It’s just that the amount with which the Pension Fund will accept a claim must now be no less than 3,000 rubles. This means that for 1,000 rubles. won't go to court. But the punishment will not disappear, but will “hang” on the company until it violates something else. When the fund accumulates 3 thousand rubles, it will immediately file a claim.

Example

The company was late in sending the SZV-M and received a fine of 1.5 thousand. This amount is not enough to recover it in court. The Pension Fund is waiting. The next quarter, the accountant provided incorrect information and was fined another 500 rubles. To file a claim, you only need to save 1,000 rubles. After a couple of months, the company again forgets about the report and receives a penalty of 1.5 thousand. The total fine is 3,500 rubles. Now the fund can go to court; it has 6 months to prepare a claim.

The statute of limitations for collection is 3 years. During these years (from the date of the first punishment), the pension fund will accumulate fines of enterprises to the required amount. And if during this time the company does not violate anything else, then the Pension Fund of Russia will still demand recovery, but will first wait 36 months in case something else appears or the director pays off the debt himself. Simply put, this 1,000 rubles. you will still have to pay, not now in 3 years.

Knowing that the Pension Fund of Russia is accumulating fines, the director can estimate the beginning of legal disputes and get ahead of the fund by transferring the debt himself. You have 3 years for this. Let's say the company received two demands totaling 2,800 rubles. Realizing that the next fine will lead to court, the director will pay one of them. This way he will reduce the “sanction accumulations” and delay filing a claim.

Source:

Personnel blog

Heading:

Reporting to the Pension Fund

reporting to the Pension Fund fine SZV-M

- Nina Loginova, legal consultant

Sign up 9880

12350 ₽

–20%

How is the fine calculated?

It is not difficult to calculate the amount of the penalty for failure to report SZV-M. To do this, it is enough to multiply the amount of 500 rubles by the number of employees filled out in the form. The resulting result from the arithmetic operation will be the amount of the fine issued to the offending institution.

The calculation procedure is the same:

- If there is no report at the reporting time.

- If there is a delay in submitting the SZV-M form.

- If mistakes are made (here a dispute may arise regarding the number of employees who must be taken into account when multiplied by 500 rubles).

Below is a table of the compliance of penalties depending on the number of employees.

How to avoid fines

Do not leave submitting reports until the last minute, so that if an error is discovered, there is time to correct it.

We remind you that the SZV-M form must be submitted monthly before the 15th day after the reporting month, and the SZV-experience form must be submitted once a year before March 1 based on the results of the past year. When an employee retires during the year, the SZV-experience additionally needs to be issued only for him and sent to the Pension Fund of the Russian Federation within 3 working days from the date of receipt of the application for accrual of the pension.

If a notification of an error was received from the Pension Fund to SZV-stazh or SZV-M, send the corrections within five working days.

If you are going to submit information to the Pension Fund electronically for the first time, draw up an agreement on electronic document management with the Pension Fund in advance. Without this agreement, you will not be able to submit an electronic report.

In order to formalize the agreement, you need to visit the Pension Fund branch once. This takes time, so if you catch yourself at the last moment, you will not have time to report on time, and will earn a Pension Fund fine for late submission of the report.

Online accounting “My Business” will help you fill out reports correctly and submit them on time. Together with the electronic wizard, you will go through all the stages step by step, and the system will generate a report for you on an up-to-date form, filled out in accordance with all the rules.

In order to send electronic reports to the Pension Fund directly from your personal account, simply upload a scan of the agreement to the service, enter its number and date. We will issue an electronic signature for you free of charge. After this, you will be able to send documents to the Pension Fund without leaving your workplace, and delivery protocols will be sent to your personal account, and you will be able to make corrections in a timely manner, if necessary.

Who reports

All insurers - legal entities and entrepreneurs with employees - are required to submit calculations for insurance premiums, SZV-M, SZV-STAZH and SZV-TD.

IMPORTANT!

Tax authorities often issue a fine for failure to submit RSV-1 in 2021 to the Federal Tax Service, even if the company did not conduct business during the reporting period and no payments were made to individuals. To avoid punishment, submit zero calculations.

Read more: >How to correctly fill out a zero calculation for insurance premiums

Submit RSV in electronic or paper form. If the company has more than 10 employees, the form is sent electronically; if there are fewer than 10 employees, the report is allowed to be prepared and submitted on paper.

As for reports to the Pension Fund, they are prepared in electronic format if the employer has 25 or more employees.

Read more: >Reporting SZV-M: step-by-step instructions for filling

When does the Pension Fund go to court for a fine?

The recently adopted Federal Law No. 237-FZ of July 20, 2021 established that the Pension Fund has the right to go to court to collect sanctions from policyholders only if the total amount of financial sanctions to be collected exceeds 3,000 rubles.

The Pension Fund's deadline is six months from the date of excess.

If, within three years from the date of expiration of the deadline for fulfilling the earliest requirement, the fines did not exceed 3,000 rubles, then the Pension Fund has the right to apply to the court for recovery within 6 months from the date of expiration of this three-year period.

Read in the berator “Practical Encyclopedia of an Accountant”

Liability for violations in the field of compulsory pension insurance

Can a fine be collected by force?

In 2021, the Pension Fund could independently write off a fine from the organization’s account if it was accrued to you, but for some reason you ignored this requirement and did not go to court within the required 10 days. In this case, a legal debit was allowed from your account.

This happened before the court settlement of the issue. The law allowed such actions to be taken against organizations that made mistakes. In 2021, these actions were declared unlawful and the Pension Fund of the Russian Federation can no longer write off money from your account without filing a lawsuit and receiving a positive decision. Now only the court can allow money to be transferred from the organization’s current account to the insurance fund.

The procedure for issuing a fine is as follows:

- First, the fund’s employees draw up a report based on the results of the audit;

- The company is sent a notice demanding payment of funds to the fund;

- Further, 10 days (and in exceptional cases more) are given to pay the funds;

- At this time, you can go to court or, using the details of the fine, pay it;

- If your demand is ignored, then the insurance fund has the right to file a claim.

The delay of SZV-M arose due to errors regarding several employees

Form SZV-M is a table that displays a list of insured employees indicating their full name, SNILS and Taxpayer Identification Number. This data must be entered without errors. If even one error is detected, the report will not be accepted by Pension Fund employees.

The employer is obliged to eliminate the identified deficiencies as quickly as possible and resubmit the report. Often the re-submission of the SZV-M is carried out late and in this case the Pension Fund of Russia inspector imposes a financial penalty.

Sometimes, under such circumstances, a dispute arises about the amount of the fine. The Pension Fund inspector calculates the amount of the fine based on the number of employees of the institution, but the policyholder does not agree with this, believing that the amount of the fine should be calculated based on the number of employees with corrected data.

There is no clear opinion on this issue. There is no specific explanation in the legislation. However, there is judicial practice in solving this problem, although there is also no clear solution among judges:

- Some support the inspectors; as an example, we can refer to the decision of the Far Eastern Region AS No. F03-4421/2017 dated November 21, 2017.

- However, there are also rulings in favor of the employer. For example, - verdict of the AS of the West Siberian region No. A27-22235/2016 dated 08.23.17.

Therefore, when faced with such a situation, the employer needs to achieve his point of view and contact the judicial authorities. Better yet, of course, is to submit the SZV-M report in a timely manner, avoiding false data and errors.

When should errors be corrected without penalty?

Policyholders will be able, without sanctions, to eliminate their errors and discrepancies identified by Pension Fund specialists during a desk audit of submitted reports within 5 working days.

That is, the deadline for policyholders to eliminate inconsistencies and errors is 5 working days from the date of receipt of notification of the error from the Pension Fund of Russia. If the employer meets this deadline and submits a corrected report, then he will avoid a fine.

During the five-day period, financial sanctions will not be applied to them, and on the sixth day, PFR specialists will draw up an Act on the identification of the offense and apply a fine. Next, the PFR authorities will go to court to collect sanctions if the policyholder does not pay or does not pay them in full.

It often happens that a dismissed employee is reinstated in the workplace by a court decision. In this situation, the policyholder can avoid violating the deadline for submitting information if he reports for all periods when the employee was considered dismissed no later than the next reporting period from the date of the judicial act.

Previously on the topic:

Amendments to the law on persuance accounting: when can the Pension Fund of Russia apply to court for a fine?