Home / News and changes

Back

Published: 04/03/2019

Reading time: 8 min

1

292

“Luxury tax” is an unofficial name for a tax levy that cannot be found in the Tax Code of the Russian Federation (Tax Code of the Russian Federation).

- What the law says

- What is meant by luxury car tax? Which cars are subject to increased taxation in 2021?

- Calculator

There are special increasing coefficients that are used when calculating transport tax on expensive cars.

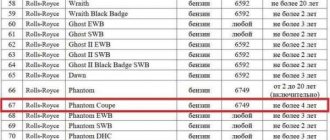

Luxury tax: cars (official list of the Ministry of Industry and Trade of the Russian Federation)

Every year, the Ministry of Industry and Trade updates the list of cars subject to the luxury tax, first introduced in 2014. This year was no exception either. For the period 2020-2021, the list has been supplemented with new vehicles. Moreover, some versions of cars that fall under the luxury tax do not fall under the category of prestigious luxury cars (we are talking about cars in the mass segment).

Let us remind you that the luxury tax for cars in Russia was introduced on January 1, 2014 as part of the so-called “luxury tax” - an increasing coefficient of property tax. This increasing coefficient included not only real estate, but also vehicles (clause 2 of Article 362 of the Tax Code of the Russian Federation). According to this federal law, all vehicles whose cost exceeds 3 million rubles are subject to the luxury tax. In this case, increasing coefficients are applied when calculating transport tax.

When purchasing expensive cars, owners should know a number of nuances in order to accurately understand whether the vehicle is subject to increased transport tax. We at 1Gai.Ru decided to collect answers to all frequently asked questions from luxury car owners related to paying luxury tax.

So, let's remember what a luxury tax for cars is, what is its description and what nuances are worth knowing for those who already own cars worth more than 3 million rubles, and for those who are only going to purchase a car in the future, which, in the opinion of the state , is "luxurious".

Download the list of cars subject to luxury tax:

Download file: List.pdf [251.1 Kb] (downloads: 5145) View online file: List.pdf

Download file: List.doc [112.57 Kb] (downloads: 1538) View online file: List.doc

Why was it introduced?

Firstly , to replenish regional budgets with additional funds;

Secondly , since domestic passenger cars are not subject to the luxury tax, and the list of luxury cars, due to the rise in price of foreign technology, is slowly being replenished with cars that six years ago cost an order of magnitude cheaper and were available to a relatively wide segment of the population, the purpose of introducing an increasing coefficient is also can be considered import substitution;

Thirdly , the application of the above formula that the propertied must pay more money to the treasury

Regulatory documents

In fact, “luxury tax” is a figurative name. No new types of fees were introduced by law. In 2021, after lengthy discussions, Federal Law No. 214-FZ introduced amendments to the Tax Code of the Russian Federation. The changes affected Article 362, which regulates this fee.

The essence of the formal “luxury fee” is the introduction of increasing coefficients when calculating the standard transport tax on some cars.

By law, all expensive cars were divided into price categories, adding age limits to the gradation.

At what price will luxury tax be imposed on cars in 2021?

It is used for cars with an average value under a sales contract of over 3 million rubles. This is the initial cost at which the car model is automatically included in the list of the Ministry of Industry and Trade, while the maximum cost has no restrictions. According to the list, the list in 2020 included passenger cars with an average price of 15 million rubles and above.

The “average cost” of a car, according to the explanation of the Ministry of Industry and Trade, is calculated on the basis of recommended retail prices for basic versions of a particular make, model and year of manufacture. Also, the Ministry of Industry and Trade notes that the calculations do not take into account the actual cost of the passenger vehicle.

The basis will be the recommended retail prices of new cars as of the reporting tax period on July 1 and December 1.

The procedure for calculating the average cost of passenger cars (www.consultant.ru):

“In order to carry out calculations according to formula No. 1, the Ministry of Industry and Trade of the Russian Federation sends annually no later than May 1 to manufacturers and/or authorized persons of the manufacturer a request to provide information on recommended retail prices for each make, model and basic version of cars, taking into account the year of manufacture, whose retail prices exceed 3 million rubles.”

The average cost of a car is determined in the manner approved by Order of the Ministry of Industry and Trade of Russia dated February 28, 2014 No. 316 “On approval of the Procedure for calculating the average cost of passenger cars for the purposes of Chapter 28 of the Tax Code of the Russian Federation.”

What ratios apply for 2021 and 2021?

Increasing transport tax coefficients, according to the Tax Code of the Russian Federation, are as follows:

1.1 - for luxury cars worth 3-5 million and not older than 3 years; 2 - for cars worth 5-10 million and not older than 5 years; 3 - for a car worth 10-15 million rubles and not older than 10 years, as well as more expensive than 15 million and not older than 20 years

IMPORTANT! The exact amount of transport tax, taking into account the increasing coefficient, can only be found out if you have information about the exact cost of the tax base for your car model. In other words, knowing how much your car costs, according to official data, when new.

How to calculate from what cost?

The calculation of the increased tax on a car is carried out using a multiplying factor associated with the year of manufacture and cost of the vehicle, engine power and regional rate. The Tax Code provides several coefficients for calculation.

How much is the size of transport multiplying factors (CI)?

The increasing factor has its own size and applies to cars with the following age and price categories:

- 3 years, from 3 to 5 million rubles: coefficient 1.1;

- 2 years, from 3 to 5 million rubles: coefficient 1.3;

- 1 year, from 3 to 5 million rubles: coefficient 1.5;

- 5 years, from 5 to 10 million rubles: coefficient 2;

- 10 years, from 10 to 15 million rubles: coefficient 3;

- 20 years, over 15 million rubles: coefficient 3.

A car may not fall under this coefficient if the manufacturer deliberately sets the price below 5 million rubles.

How the amount is calculated - procedure and example of how to calculate

When calculating luxury tax on a car, the formula is

N = S×MD×KP×Km/12, where:

- N – tax amount.

- C – regional rate.

- MD – engine power (or NB – tax base).

- KP – increasing coefficient.

- Km – the number of months during which the owner uses the vehicle.

The regional rate is determined in rubles per 1 l/s. Information on rates is presented in the table of transport tax rates for all regions of Russia.

An example of how to count. Citizen K. purchased a car worth 3,750,000 rubles in 2021. The acquisition was made in Moscow. The engine power is 250 l/s, the tax rate is 75 rubles per 1 l/s, the car ownership period is 12 months.

Total: H = 75×250×1.1×12/12 = 20,625 rubles for 12 months.

If the owner has owned the car for an incomplete number of months, the rule for the calculation is that the vehicle must be registered before the 15th day of the month, or deregistered after this date. If the product is registered after the 15th day of the month, or deregistered before this date, this month is not taken into account.

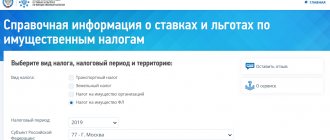

Online calculators

For a faster calculation, it is recommended to use an online calculator. Tax is calculated on such resources as:

- Calculator on the website https://www.nalog.ru/.

- Calculator on the website https://law.drom.ru/calc/.

The calculation results using the calculator always coincide with what is calculated using the tax office formula.

The procedure for calculating transport tax, formulas and examples are given here, and the amount of transport tax by horsepower and by region can be found here.

When and how is it paid?

“Transport tax, regardless of whether the luxury vehicle tax is included in it or not, must be paid by December 1 of the year following the reporting period . If this day falls on a weekend, then the last day of tax payment is postponed to the next working day,” says the Federal Tax Service website.

Thus, the transport tax must be paid before the 1st of December, and if the car is included in the list of the Ministry of Industry and Trade, the luxury tax will be included in the payment automatically.

Application procedure

The tax is paid according to a receipt, which is sent to the car owner from the tax service. The amount indicated on the receipt must be repaid before December 1 of the year in which the payment is due. In addition to the receipt, the taxpayer receives notifications about the need to pay tax 3 times a year.

The payment procedure is as follows:

- Contacting the tax office where the car was registered.

- Making payment according to the receipt (and/or submitting the final declaration).

How to check and pay transport tax is described here.

You can determine the address of the tax office using the form https://service.nalog.ru/addrno.do.

Another payment option is through the portal https://www.gosuslugi.ru/. Here's how the due amount is paid:

- you need to register on the portal and create a personal account;

- then select the “Service Catalog” button in the top panel of the site;

- then go to the “Authorities” tab and press the “Federal Tax Service” button.

On the Federal Tax Service page that appears, you can not only pay transport tax, but also obtain other useful information.

Is it possible to bypass the luxury tax if the car is on the List, but costs less than 3 million rubles?

As we have already mentioned, when calculating whether a car should be subject to an increase factor or not, the term “average cost” is used (calculated based on the recommended retail prices for base versions of a particular make, model and year of manufacture).

In other words, even if you purchased a car at a discount and it cost you less than 3 million rubles, but the model is included in the general register of the Ministry of Industry and Trade, and even if the car was new or no more than 3 years old from the date of production, you will not be able to avoid the increasing factor.

Are there any luxury tax benefits?

Formally there are, but they are of little use, and here's why. Here it is worth turning to tax incentives for transport, established both at the federal and regional levels. In particular, subsidies are regulated by Article 358 of the Tax Code of the Russian Federation.

Namely: citizens who own (part 2 of article 358 “Object of taxation”):

passenger cars specially equipped for use by disabled people, as well as cars with an engine power of up to 100 horsepower (up to 73.55 kW), if the citizen’s disability is confirmed by the relevant authorities;

received (acquired) through social protection authorities in the manner prescribed by law.

As you can see, for this category of people there is no talk of providing benefits for an additional luxury tax due to the low engine power and low budget of these cars.

However, tax benefits for motorists do not end there; in particular, transport tax benefits are also provided for:

veterans and disabled combat veterans; large families; WWII veterans and disabled people; former minor prisoners of concentration camps; heroes of Russia and the USSR; disabled people of groups I and II; one of the guardians of a disabled person since childhood, recognized by the court as incompetent

These categories are exempt from the tax burden on vehicles, and therefore from the increasing coefficient of the “luxury tax”.

But there is a nuance here: transport tax benefits are provided to citizens of the above categories only if the engine power does not exceed 200 hp. With. For example, this procedure applies in the territory of the city of Moscow and is regulated by Part 5 of the Moscow City Law of July 9, 2008 No. 33 “On Transport Tax”:

The benefits established by paragraphs 3-8 and 11-14 of part 1 of this article do not apply to passenger cars with engine power over 200 hp. With. (over 147.1 kW).

And in a number of federal laws for victims of the Chernobyl disaster and other emergencies related to radiation leaks. In these cases, the law also provides for a power limit of up to 200 hp. With.

Who doesn't pay for luxury cars and is it possible to avoid paying tax?

There are no separate benefits for owners of expensive cars. However, you will not have to pay for a car if you are one of the transport tax beneficiaries. For example, if your car is stolen, you have the right not to pay car tax.

In addition, in many parts of the country the following are exempt from paying TN:

- Participants in hostilities;

- Pensioners;

- Disabled people;

- Parents with many children, etc.

So, if you are one of the beneficiaries, you have the right not to pay road tax, regardless of the cost of your car. Complete information on who is entitled to TN benefits in Russia and how to get them is collected here.

An example of calculating transport tax taking into account increasing factors

Option with Federal Tax Service calculator (instructions)

Federal Tax Service calculator: www.nalog.ru

We will calculate the tax with an increasing coefficient on a car presented in the List of the Ministry of Industry and Trade, an Audi A6 Avant with a 3.0-liter V6 TFSI gasoline engine with a power of 245 kW (333 hp).

We enter the initial data into the official tax calculator of the Federal Tax Service: 2019 year of manufacture, ownership for a full year (you can select a report up to 1 month); vehicle type – passenger car, power – 333 hp. With.

Click the “Next” .

Open the tab “If the vehicle costs more than 3 million” and enter the data of the desired model, and calculate.

As you can see, the calculation formula also includes a multiplying factor.

When the multiplying factor is not applied

The increasing factor cannot be applied:

- If the model is not on the list of expensive cars of the Ministry of Industry and Trade for 2021.

Note! According to the clarifications of the Ministry of Finance of the Russian Federation (letter dated June 12, 2017 No. 03-05-04-04/44504), if the description of the car brand in the list is given in a smaller/larger volume than indicated in the traffic police information, an increasing factor is applied.Important! There are other examples in judicial practice. Thus, in one of the cases, the mark on the configuration “OS” (special series) was recognized as a qualifying feature, in the absence of which the increasing coefficient should not be applied - see the resolution of the AS PA dated April 23, 2019 in case No. A65-23739/2018.

- With a greater number of years that have passed since the year of its production, compared to the indication in the column of the List in which this model is listed. The period is calculated starting from the year the expensive car was manufactured until the year the transport tax was calculated (letter from the Ministry of Finance of the Russian Federation dated May 18, 2017 No. 03-05-05-04/30334). Example of applying a 3-year period: if the car is manufactured in 2021, then the increasing factor for 2021 must be accrued.

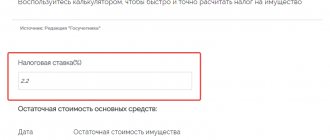

Manual tax calculations taking into account the increasing coefficient

Everything is very simple here.

It is enough to know what transport tax your car is subject to, excluding luxury tax. Next, remember the coefficients and multiply the amount of transport tax by the required one.

For example, we have a Jaguar F-Pace with a 2.0-liter Ingenium turbocharged gasoline engine with a capacity of 300 hp. With. The transport tax will correspond to about 45,000 rubles . We multiply this number by 1.1 and get 49,500 rubles including luxury tax.

The tax for cars of other categories is calculated in the same way, only you need to multiply the coefficient by 2 and 2, respectively. That is, the tax will be 2 or 3 times higher.

Note:

Let us remind you that taxation on cars under three years old in 2021 progressively decreased from the moment of purchase from 1.5 for the first year of operation to 1.1 for models aged from 2 to 3 years .

From 2021, the coefficient has been reduced to 1.1 for all models costing from 3 to 5 million rubles .

And finally. The List published for 2021 now includes 1,298 models plus just over 100 cars. The full list, which includes most foreign automakers, can be found here: minpromtorg.gov.ru.

Who is charged?

Owners of imported vehicles must pay. Payment is considered mandatory if the price of the car exceeds several million rubles.

What expensive cars are subject to HP, what does it depend on?

Taxation depends on the following factors:

- Cost - from 3 to 15 and more million rubles.

- Vehicle age. From one to three years – for vehicles worth up to 5 million, no more than 5 years – up to 10 million, no older than 20 years – costing 15 million rubles and more. You will find the nuances and subtleties of paying transport tax on old cars in Russia here.

- Brand.

- Over 3 million rubles: BMW, Chevrolet, Cadillac, Infiniti, Ford, Lexus, Jaguar, Land Rover, Mercedes Benz, Hyundai, Nissan, Volkswagen, VOLVO, Porsche, Toyota, Audi.

- From 5 to 10 million: Audi, BMW, Jaguar, Aston Martin, Lexus, Mercedes Benz, Bentley, Land Rover, Nissan, Hyundai Genesis, Porsche, Maserati, Chevrolet Corvette.

- From 10 to 15 million: Bentley, Rolls-Royce Ghost, Aston Martin, Ferrari (458 Italia, California, California T, 458 Spider, 458 Speciale), BMW i8, Jaguar, Lamborghini (Gallardo LP 570-4, Gallardo LP 50- 4, Huracan 4 WD Spyder, Huracan 4 WD, Huracan), Land Rover, Maserati (GranCabrio, Quattroporte GTS GranSport, Quattroporte GTS), MersedesBenz, Porsche.

- Over 15 million: luxury cars Lamborghini, Porsche Panamera, Aston Martin, Ferrari, Rolls-Royce, Bugatti (Veyron), Land Rover, MercedesBenz.

- Engine power. If the power is above 200 l/s, the vehicle is subject to tax.

In this case, the payment of tax depends on the time the owner of the car uses it, i.e. from a month and above.

How is the list of elite cars formed?

The register of cars is formed by the Ministry of Industry and Trade using an additional coefficient. The list of cars is updated annually until February 1.

Important! Depending on the configuration, the same car model may or may not be subject to tax.

Cars falling under NR - a new list of the Russian Ministry of Industry and Trade

In the list of the Ministry of Industry and Trade, the following list of cars falls under the luxury tax:

- MercedesBenz;

- BMW;

- Cadillac;

- Ferrari (Ferrari 458 Italia, California, California T, 458 Spider, 458 Speciale);

- Chevrolet;

- Lamborghini (Gallardo LP 570-4, Gallardo LP 50-4, Huracan 4 WD Spyder, Huracan 4 WD, Huracan);

- Infinity;

- Ford;

- Lexus;

- Jaguar;

- Land Rover;

- Hyundai;

- Nissan;

- Volkswagen;

- VOLVO;

- Porsche;

- Toyota;

- Audi;

- Aston Martin;

- Bentley;

- Hyundai Genesis;

- Maserati

- Chevrolet Corvette;

- Rolls-Royce Ghost;

- Aston Martin;

- BMW i8;

- Maserati (GranCabrio, Quattroporte GTS GranSport, Quattroporte GTS);

- Lamborghini;

- Porsche Panamera;

- Ferrari;

- Rolls-Royce;

- Bugatti (Veyron).

For those who want to find out what other cars are subject to this tax, a complete list of vehicles subject to it is available on the website https://minpromtorg.gov.ru/common/upload/files/docs/Perechen_2017_dlya_publikatsii.pdf.

Are there any benefits?

Tax benefits are available to combatants, WWII veterans, parents of many children, disabled people and heroes of the Russian Federation and the USSR. These persons have a discount or are completely exempt from paying tax. The benefit can be used if the vehicle power does not exceed 200 l/s. We told you everything you need to know about the transport tax amnesty here.

When do you no longer need to pay?

The tax is not payable if the service life of the car subject to it has come to an end or the vehicle has been sold to a new owner (what to do if the tax has arrived on a sold car, when you still have to pay, is described here). It is also possible to cancel the payment in the event of an accident in which the car cannot be restored.