The Ministry of Industry and Trade of the Russian Federation has clarified the list of expensive cars that are subject to increased rates of transport tax (“luxury tax”) in 2021. The new list was compiled at the end of August, it is shorter than that published in March of this year.

The list still consists of cars costing more than 3 million rubles, but now it contains not 1,126 models (as it was originally), but 1,040. Well, the list has fewer models of the brands Audi (-10), Mercedes-Benz (-25) , Bentley (-8), Jaguar (-5), Land Rover (-5) and others. Moreover, some brands added some models to the list, others dropped out, and others moved to a different tax category. The Federal Tax Service notified its territorial divisions of the updated list at the end of August.

Features of tax coefficients

The main criteria influencing the tax rate:

- The cost of a light car (cars with a price of 3-20 million rubles fall into this group).

- Year of production of the vehicle.

These provisions are considered interrelated; they are directly proportional to the % tax rate: if the car is of high value, the tax payment will be collected for a long time with a coefficient higher than for other vehicles.

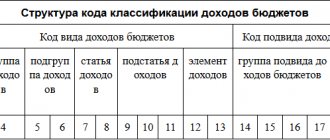

Table of increasing coefficients:

| Vehicle price, rub. | Vehicle age, years | Coefficient value |

| 03.05.2017 | Up to 1 | 1.5 |

| 03.05.2017 | Up to 2 | 1.3 |

| 03.05.2017 | 02.03.2017 | 1.1 |

| 05.10.2017 | Up to 5 | 2 |

| 01.10.2015 | To 10 | 3 |

| Over 15 | Up to 20 | 3 |

For example, if you own a car worth more than 10 million rubles, you will have to pay the tax amount for it for 5 years; the calculation takes into account the coefficient value - 2. Therefore, it is 2 times higher than the same payment for a car of the same power, but not included in the group expensive vehicles.

For very expensive vehicles, the increased tax rate is valid for 10-20 years. These coefficient values are valid in the situation of purchasing a used car; in the scheme for calculating the tax amount, it will be necessary to take into account the date of its release.

Procedure for paying tax by individuals

For individuals, tax amounts are calculated by specialists from the Federal Tax Service, guided by the data provided to them by organizations registering vehicles. Individual car owners are required to transfer the tax to the budget using a receipt sent by the tax authorities no later than December 1 of the year following the year for which the tax was calculated.

Note! When purchasing an expensive car, you do not need to specifically notify the tax authorities (neither an individual nor a legal entity), but the legal entity will be required to apply an increasing coefficient when independently determining the tax, including for advance amounts.

Tax calculation

To correctly calculate the tax payment, you should use a certain formula:

L * R * K = N,

Where:

- L – number of horsepower of the vehicle;

- R – regional transport tax rate;

- K – value of the increased coefficient;

- N – final tax amount.

For example, you can calculate transport taxation for a BMW 535dxDrive with an engine power of 313 hp. Taking into account the option of economic security, engine power, type of fuel - the tax amount will be at least 47 thousand rubles, but this car falls into the price group of 3-5 million rubles, for which an increasing coefficient must be applied - 1.5%. Therefore, the final tax amount will be about 70.5 thousand rubles.

But, for example, for the BMW X5 M, the tax rate will be higher than that of the previous vehicle, although these cars belong to the same price group, but they have a different engine power rating: BMW X5 M - 575 hp, so the basic tax will not be less than 86 thousand rubles, and with an increased coefficient value - 130 thousand rubles.

Another example is an analysis of the payment plan:

- We own an expensive vehicle – a BMW X6, its price is over 4.5 million rubles;

- Scheme for calculating the amount of transport tax for the first year - regular taxation is used, the result is multiplied by an increased coefficient value of 1.5;

- For the second year, the tax payment is reduced by 0.2, in other words, the final figure is multiplied by 1.3;

- For the third year – by 1.1;

- Further, the calculation takes place without increased coefficients.

Vehicle assessment

How can you determine whether your car belongs to a certain price category? Where can I get data on the cost of a vehicle?

Due to inflation, changes in exchange rates, various economic and political factors, a car purchased at a certain time, for example, next year may cost differently. For example, due to the fall in the ruble exchange rate, a car purchased last year for one sum of money may cost differently today.

Article 362 of the Tax Code of the Russian Federation explains that when calculating the tax, it is necessary to take not the price of a specific vehicle, but the cost of a similar car of the same age. For example, a person bought a car in 2013 for 60 thousand. (2 million rubles), and in 2015 this car can cost up to 3.6 million rubles, thereby falling into the group of expensive vehicles. To avoid confusion, the Ministry of Industry and Trade annually publishes on its official website a list of vehicles classified as “luxury objects”.

Here are some of them:

- Mercedes;

- Cadillac;

- Jaguar;

- Hyundai Equus;

- Range Rover Sport/Discovery/Vogue/Evoque;

- Volkswagen Touareg/Multivan/Phaeton;

- Nissan Patrol/GT-R;

- Rolls-Royce;

- Aston Martin;

- BMW;

- Lexus;

- Audi;

- Lamborghini;

- Bugatti;

- Ferrari.

The full table of vehicles, the owners of which must pay tax with an increased coefficient, is published on the official website of the Ministry of Industry and Trade. This list may change annually, so it is important to monitor updates to this table of expensive vehicles.

The Ministry of Industry and Trade of the Russian Federation is making changes to it - adding new brands of vehicles. This happens due to an increase in pricing policy and inflation. According to statistical data, the first table in 2014 consisted of 100 cars, then in 2015 their number increased to 425 vehicles, in 2021 708 cars were already subject to taxation, in 2021 there were over 900 of them.

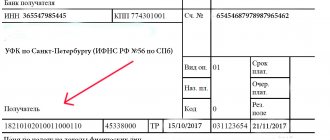

Tax payment

How can I pay this fee?

All regions have their own deadline for paying transport tax, usually the last date is November 1 - before this date, the tax payment for the previous period must be made. The owner of a vehicle can find out his tax debt on the websites of the tax service, bailiffs, and State Services. A legal entity pays the tax amount for a vehicle for 2021 by making an advance payment no later than the last date of the month following the reporting period.

You can pay the tax amount in different ways:

- Online banking (financial organizations, banking institutions).

- Via electronic payment (Yandex.Money, QIWI).

- By mail.

- Through payment terminals, banking institutions, etc.

If tax payments are not made, then penalties will be applied to the owner of the vehicle - a fine in the amount of 20% of the debt, a daily penalty.

Procedure for paying tax by legal entities

Organizations that own cars must calculate the tax amount themselves. They need to make advance tax payments quarterly in the amount of ¼ of the tax amount. At the end of the year, the balance of the tax amount is paid, and a tax return is drawn up, which is submitted to the Federal Tax Service no later than February 1 of the year following the tax period.

Tax and advances are paid at the location of the car within the time limits approved by local legislation. If a multiplying factor is applied to a car, the procedure for transferring tax does not change.

Tax exemption options

There are various ways to avoid paying this fee. First of all, you need to check the annual lists of cars that are subject to tax interest - the cost of the vehicle is reduced, therefore, the need for payments can be avoided.

In addition, categories of people have been defined - they are exempt from paying taxes regardless of the price of their vehicle or its age:

- WWII veterans.

- Citizens of the Russian Federation who are considered parents of many children.

- Representatives of the population who took part in the hostilities.

- Disabled people.

- People who have the title of Hero of the Russian Federation/USSR.

There are other options for evading this tax - this bill contains some points for this:

- No tax is charged for a car that is on the wanted list - after a person reports a stolen vehicle to certain authorities, while he is being searched, the tax may not be paid;

- This fee is not charged to disabled people; in addition, cars designed to transport people with physical disabilities require proof of this;

- Another option is to register the car with a company taking part in the preparations for the 2021 FIFA World Cup.

Is it possible not to pay tax?

It is in the interests of any vehicle owner to increase income and reduce costs. The latter can be achieved by reducing the tax burden. For those who are not rich, this option is the most optimal. After all, luxury cars can be purchased before a person knows that an additional tax will apply to this purchase.

The first option is to negotiate with car dealers. The fact is that they are the ones who dictate the final price of the car and make money from it too. If you ask them for a discount or a reduction in the cost of the car, you can stay within the established limits. For example, car dealers will probably be able to sell a car at a price of 3 million rubles for 2,999,999 rubles.

It seems that the difference is not big. But it is precisely this that makes up the salary of employees of automobile cents, and it also determines whether the buyer will pay luxury tax or save his savings. You shouldn’t count on big discounts, but you can count on seasonal price reductions. In this case, each party to the transaction pursues its own interests: the buyer wants to save money and avoid the fate of a luxury tax payer, and the seller wants to sell the product and attract customers.

There is an alternative, which, by the way, is offered by the state itself. It is enough to have the appropriate status, and then no additional amount will be paid. Benefits are available to WWII veterans, parents of many children, disabled people, heroes of Russia and the USSR, and combatants. Thus, you can avoid the luxury tax, but you should do this specifically only if you have a strong desire to have a specific car.

Possible tax changes in 2021

At the beginning of 2021, taxes and excise taxes will be increased in the Russian Federation, and gasoline prices will rise. Consequently, the cost of maintaining and servicing the machine will increase. How will transport taxation change? Should car owners prepare for something bad?

The existing transport tax will remain a mandatory payment for vehicle owners. The regularity of contributions is monitored by regional authorities. There are no plans to increase tax coefficients, and the list of citizens subject to this tax will not change.

You should not count on the complete abolition of transport taxation, since it brings more than 146 billion rubles to the treasury. Payment terms will change:

- For legal entities - payment of the fee before February 1, 2021, with simultaneous payment of an advance payment for the next reporting period;

- For individuals – payment of tax before December 1 (previously before October 1).

The calculation scheme has not changed. The fixed tax amount for a vehicle is also calculated - 3 factors are taken into account:

- Machine engine power;

- Year of production of the vehicle;

- Duration of its operation.

The value of the coefficient for each region is individual; transport taxation of the population of Moscow, for example, will differ from other cities of the Russian Federation.

Ministry of Industry and Trade: list of cars 2021

“Luxury tax” in 2021 must be paid for cars listed in the list compiled by the Ministry of Industry and Trade (published on February 28, 2018). This list is approved annually before March 1 of the corresponding year, and is published on the department’s website. The list allows you to determine which price category the car brand belongs to, and the real cost of its acquisition is not taken into account.

Thus, the amount of luxury tax (cars) in 2021 depends on the following factors: whether the car is on the list of the Ministry of Industry and Trade (its average cost) and “age”. Increased tax rates for expensive cars should be applied to both legal entities and individuals.