Fixed tangible and intangible assets constantly change their residual value. The majority gradually lose it, transferring it to the products produced with their help - through depreciation. But there are also situations when, as a result of modernization or improvement, a particular asset increases in value. In addition, the enterprise renews its material assets, acquiring new ones to replace worn-out ones, and expands their base. One way or another, the value of an enterprise’s main assets is a parameter that is constantly in dynamics, and therefore requires regular analytical and accounting.

It is important that this parameter is in real accordance with the market characteristics of value in order to reflect the true residual value in accounting documents, and not just expressed in certain figures.

In the article we will highlight the essence of the procedure for revaluing the main property assets of an organization, as it occurs in accordance with the latest legislative innovations, and also show how this is done using a specific example.

The essence of revaluation of fixed assets

The property of an enterprise changes its value over time as a result of wear and tear (physical and/or moral). Market processes occur in parallel, changing the price of various assets at different speeds: real estate, equipment, tools, vehicles, etc. The revaluation is carried out precisely in order to bring these data to a single indicator.

The dynamics of the market value of assets is very uneven, it is difficult to assess from the point of view of certain factors, therefore the value of property at any given moment does not reflect its real price in modern market conditions. Hence, significant distortions in various asset parameters are possible:

- cost;

- depreciation charges;

- profitability of funds;

- bases for taxation.

So, revaluation of an organization’s fixed assets is a clarifying measure to bring the residual value of assets to the level of their actual price on the market, that is, establishing the full price that would be needed to restore or renovate them to their original state in modern realities.

FOR EXAMPLE. Two years ago, the company purchased new equipment that cost 50,000 rubles. Over two years, it lost 7 thousand rubles as a result of depreciation. Thus, its residual value according to accounting documents will be 43 thousand rubles. But as a result of certain market processes (the manufacturer released an improved model), the real cost of such equipment of a given level of wear on the market is only 35 thousand rubles. This means that today it can be sold for exactly this amount. It is necessary to carry out a revaluation, as a result of which this equipment will be reflected on the balance sheet at a cost of 35 thousand rubles, which is its real market price, reliable for financial accounting.

About the service

Revaluation of fixed assets (FPE) is a regularly carried out revaluation of fixed assets (FAs) in order to bring their actual value to its real market level.

The uneven dynamics of market prices for individual elements of fixed assets leads to a distorted idea of the real value of existing fixed assets, and, consequently, to a distorted determination of the amount of depreciation charges, the cost of goods or services, profitability, and the tax base. This is especially pronounced during periods when there are high rates of inflation. In practice, the revaluation of fixed assets is often perceived as a purely mechanical accounting procedure. In reality, the revaluation of fixed assets most directly expresses the state policy in the field of investment activity and serves the interests of enterprises and organizations of any form of ownership.

Therefore, the purpose of revaluation of fixed assets is to determine the market value of fixed assets and create prerequisites for normalizing investment processes in the country. During the Soviet period, revaluations of fixed assets were carried out extremely rarely (only a few times over seven decades), usually a year or two after the wholesale price reform. Since the beginning of the 90s. revaluation of fixed assets is carried out systematically (annually) on a larger or smaller scale. Revaluation of fixed assets is carried out as of January 1 of the corresponding year.

The basis for the revaluation of fixed assets is usually the decrees of the Government of the Russian Federation, in pursuance of which the relevant ministries and departments of the Russian Federation (Goskomstat of the Russian Federation, the Ministry of Finance of the Russian Federation, etc.) adopt regulatory documents specifying the procedure for the revaluation of fixed assets, and issue special letters explaining certain issues of revaluation of fixed assets .

Revaluation of fixed assets is carried out in order to bring the book value of the enterprise into line with real prices at the time of valuation for insurance, when lending against the security of your assets. Revaluation of fixed assets and assets has always been a fairly important financial lever in the activities of enterprises.

Every year, the annual report (balance sheet) of an enterprise reflects the value of its property. The initial cost of property over time ceases to reflect the real level of social costs and loses comparability.

Basically, the revaluation of fixed assets is used as a tool to reduce the tax base of an enterprise by reducing property taxes or increasing costs and reducing income taxes. Revaluation of fixed assets may also be required when placing collateral in a bank, investment fund or property insurance, as well as when preparing an enterprise for privatization or purchase and sale.

Currently, commercial enterprises can independently decide whether they need such a revaluation of funds or not. Starting from 2001, fixed assets must be revalued in accordance with the requirements of the new PBU 6/01

Revaluation of fixed assets and funds is carried out by a commercial organization no more than once a year (at the beginning of the reporting year), and a revaluation of a group of similar fixed assets is carried out at current (replacement) cost by indexation or direct recalculation at documented market prices. Thus, PBU 6/01 provides for two ways in which revaluation should be carried out by commercial organizations: indexation and direct recalculation based on documented market prices.

However, if you use the index method, the accountant will certainly have a question: what indices should be used? PBU 6/01 says nothing on this matter. Thus, it is unclear which indices should be used when it is necessary to recalculate the value of fixed assets.

Therefore, analysts at AKTs Department of Professional Appraisal LLC advise revaluing fixed assets using the direct recalculation method at documented market prices. Our specialists, who have experience in revaluing fixed assets since 1997, will help you determine the market price of property, since this is a rather labor-intensive process that requires experience, accounting and economic education.

Is it necessary to revalue funds?

According to clause 15 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, an enterprise has the right, but not the obligation, to revaluate its property. The mandatory nature of this procedure in the Russian Federation was abolished in 1997.

The legislative procedure for the revaluation of property funds is set out in the Tax Code of the Russian Federation in Art. 256 “Depreciable property”, as well as in Art. 257 “The procedure for determining the initial cost of depreciable property.” According to the regulations, the following conditions must be met:

- Having carried out a revaluation once, the company must do this procedure regularly, but not more than once a year (this becomes an obligation);

- the result of the revaluation must be reflected in the documents at the end of the reporting period (before 2011 it was at the beginning);

- objects of revaluation must be owned by the organization;

- the revaluation procedure must be approved in the accounting policy of the organization;

- the beginning of the revaluation process is initiated by an order for the enterprise and the preparation of a list of revalued objects;

- commercial enterprises leave the question of independently conducting revaluation or attracting third-party organizations for this to their own discretion.

How revaluation is shown in financial statements

Let's consider the rules for accounting for revaluation results in the accounting documents of an enterprise.

Balance

| Index | Encoding | 31.12.18 | 31.12.17 | 31.12.16 |

| Non-current fixed assets (asset) | ||||

| Intangible assets | 1110 | |||

| Research and results | 1120 | |||

| Search assets (intangible) | 1130 | |||

| Money | 1140 | |||

| Fixed assets | 1150 | 1340 | 2250 | |

| Reserves and capital (liability) | ||||

| Authorized capital | 1310 | |||

| Own assets | 1320 | |||

| Revaluation of assets | 1340 | 250 | ||

| Additional capital excluding revaluation | 1350 | |||

| Reserves | 1360 | |||

| Uncovered losses (retained earnings) | 1370 | 150 | ||

Reporting financial results

| Indicators | Encoding | For 2021 | For 2021 |

| Other income | 2340 | ||

| Other expenses | 2350 | 150 | |

| For information | |||

| Results of revaluation of funds not included in income (expense) | 2510 | 250 | |

Reporting on changes in capital turnover

The adjustment to account 83 is reflected in the property revaluation indicator of the completed financial reporting form.

If capital is increased:

- Line 3212 - last year;

- Line 3312 is the current period.

If decreased:

- Line 3222 - past;

- Line 3322 is the current one.

The total amounts of revaluation and depreciation are reflected in accounts 91-1 and 91-2.

Profit received by reporting lines:

- 3211 - past period;

- 3311 - current period.

Losses are also entered line by line:

- 3221 - last year;

- 3321 is the current year.

Goals and objectives

In accounting practice, the revaluation of fixed assets of an enterprise is carried out in order to:

- determine the adequate market value of this fixed asset;

- to attract investment partners (for example, for collateral value when lending);

- with prospects for increasing the authorized capital;

- with plans for restructuring;

- to clarify the cost and price of manufactured products (as part of financial analysis);

- to avoid a fall in the market value of assets below the authorized capital (this threatens the liquidation of the company);

- if you need to provide financial statements according to international standards;

- when insuring property (the insurance base is specified);

- the opportunity to reduce property tax (for companies with low profits), since the value of fixed assets on the balance sheet will decrease;

- a decrease in the income tax base (for profitable organizations) as a result of an increase in depreciation charges if the value of fixed assets increases after revaluation.

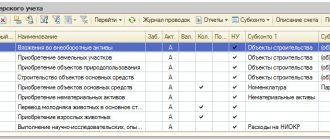

What kind of property can be revalued?

Revaluation of fixed assets can be carried out in relation to:

- working equipment;

- real estate – buildings and structures, including unfinished ones;

- devices, machines, tools;

- computer technology;

- Vehicle;

- various equipment;

- equipment that is just prepared for installation;

- any fixed assets that are currently not operational, but have not been written off from the balance sheet (on conservation, in reserve, being prepared for write-off, etc.).

Documenting

To carry out a revaluation, the manager must issue an official order. The order is formed on the organization’s letterhead. The header of the document contains the contact information of the company: address, phone number, email and website.

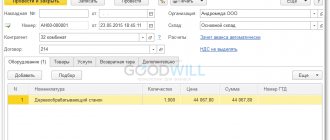

The order must indicate all groups of funds that are planned to be revalued, and those employees who will be appointed responsible for the procedure. In addition, an annex to the order must be drawn up - a list of property assets that are subject to revaluation. The list must indicate not only the name of the fixed asset, but also the date of its acquisition, putting into operation and the date of acceptance for accounting.

The final results of the revaluation of fixed assets must be documented in the following documents:

- The revaluation act, which will be signed by all members of the commission. All primary documents establishing the value of revalued assets must be attached to it.

- Inventory card of the object according to the OS-6 form.

Significance of revaluation of fixed assets

The materiality requirement is set out in clause 44 of the “Methodological guidelines for accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated October 13, 2010 No. 91n. It states that the value of revalued fixed assets reflected on the balance sheet must differ significantly from the original value, otherwise there is no point in carrying out a revaluation. The materiality barrier is conditionally set at 5% (according to the order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n), each organization has the right to independently establish it in its accounting policies, enshrining it in local acts.

FOR EXAMPLE. Brigantina LLC decided to revaluate its fixed assets. According to the balance sheet at the end of the previous reporting year, the cost of fixed assets was 2,000,000 rubles. (let's assume that the OS group is homogeneous). After revaluation, the current (replacement) value of the assets amounted to RUB 2,200,000. The difference is 2,200,000 – 2,000,000 = 200,000 rubles, which is 10% recognized as a significant difference, so these changes should be reflected in the balance sheet.

If the replacement cost was 2,020,000 rubles, then the resulting difference would not be considered significant and the decision on revaluation would not be made.

What is needed for revaluation

Before starting the OS revaluation procedure, you need to carry out a number of preparatory activities, such as:

- Checking the availability of fixed assets subject to revaluation. This stage ends with the preparation of a statement with a list of revalued objects.

- Making a decision on revaluation and documenting it. Issuance of an organization order for all services that will take part in this process. The text of the order should reflect the following features:

- objects subject to revaluation;

- revaluation methodology (method, method of reflection on the balance sheet);

- persons responsible for conducting and processing the revaluation.

- Collection and adoption of the necessary related information:

- information on the level of market prices for similar fixed assets (according to statistical data, information from trade inspections, etc.);

- data on market value from the media and special literary sources;

- information about the cost of products from partners and competitors;

- expert opinions.

Methods of revaluation

The law defines two possible methods for changing the book value of fixed assets:

- indexation – the cost of fixed assets is adjusted based on special statistical deflator indices;

- direct recalculation relative to real market prices is used more often, since currently Rosstat does not regularly publish the statistical indices necessary to apply the first method.

NOTE! If this or that fixed asset has already been revalued, then in the future this procedure requires a recalculation at its replacement cost, taking into account the accrued amount of depreciation during the use of this property.

Groups of homogeneous objects.

Let us explain what is meant by a group of homogeneous fixed assets: this is a group of fixed assets that are similar in terms of their nature and the nature of their use in the activities of the enterprise, for example:

- land;

- building;

- cars and equipment;

- motor vehicles;

- furniture and built-in elements of engineering equipment;

- office equipment.

In a situation where the revaluation of fixed assets was not previously carried out, but in the future the trade organization wants to do this, as it acquires fixed assets, it must create new groups of homogeneous fixed assets (for example, non-residential premises acquired after 2012, vehicles acquired after 2014, etc.) and re-evaluate these groups.

Revaluation results

The result of the revaluation of assets may be an increase or decrease in value compared to the market value. Thus, one of two procedures provided for by law can be carried out on the balance sheet: revaluation or markdown, after which the replacement cost on the balance sheet will be accepted as the original one.

OS revaluation

If the replacement cost turns out to be greater than the residual value, then this fixed asset must be revalued.

The amount by which the value of an asset or group of assets was increased is credited to the company's additional capital. In previous years, the amounts of depreciation charges that constituted a markdown and were included in the balance sheet as “other expenses” should have been equal to the accrued revaluation and included in “other income.”

Balance entries:

- debit 01, credit 83/91.1 – the amount of the initial cost of the fixed asset has been increased;

- debit 83/91.1, credit 02 – the amount of depreciation charges for this fixed asset has been increased.

OS markdown

Produced if, based on the results of indexation or recalculation, the replacement cost is less than the residual value.

This amount is classified as “other expenses”: it reduces the organization’s additional capital, which was formed by revaluing this fixed asset in other periods. The amount by which the excess is obtained constitutes the markdown. It is included in “other expenses”.

Balance transactions:

- debit 83/91.1, credit 01 – the initial cost of the fixed asset has been reduced;

- debit 02, credit 83/91.1 – accrued depreciation of fixed assets has been reduced.

ATTENTION! If, as a result of revaluation, a fixed asset completely loses value and is subject to write-off, its disposal is recorded and reflected as part of “other expenses”. In this case, the amount of its revaluation must be transferred to the organization’s retained earnings.

Example

The revaluation of fixed assets was carried out for the first time in the organization. It was recorded that the initial price of the funds decreased, which was reflected in account 91 in Russian currency - rubles. When re-evaluating the next year, the identified increase in the price of assets exceeded last year's decrease in the price of fixed assets (thanks to the rise in price of property assets). The results will be reflected in accounting entries:

| Debit | Credit | Contents of operation |

| 01 | 91.2 | An increase in the value of funds by an amount corresponding to a decrease in the previous period |

| 91.2 | 02 | Increase in depreciation compared to the previous year |

| 01 | 83 | Reflection of the current year's price increase |

| 83 | 02 | Carrying out residual depreciation |

Impact on tax accounting

From a tax point of view, neither revaluation nor depreciation of fixed assets affects the amount of income or expenses of the organization, since the funds were not actually spent or acquired. Therefore, the income tax on the results of the revaluation will not change. This is reflected in the Tax Code of the Russian Federation and in letters of the Ministry of Finance of Russia dated July 8, 2011 No. 03-03-06/1/412, dated September 8, 2011 No. 03-03-06/1/544.

ATTENTION! The Tax Code provides for changes in the value of fixed assets only in cases clearly defined by law, such as reconstruction, modernization, liquidation, etc. (Part 2 of Article 257 of the Tax Code of the Russian Federation). Revaluation is not included in this list.

However, the revaluation will affect the tax base calculated for paying property taxes.

Therefore, in accounting and tax accounting, the amount of depreciation for a given fixed asset or homogeneous group will be reflected differently. Such a permanent difference causes the appearance of a permanent tax asset (clause 7 of PBU 18/02).

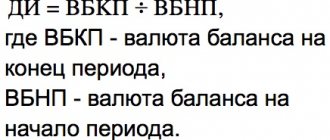

Revaluation factor

This indicator represents the ratio of the real (replacement) cost of the operating system to the original one.

Sometimes the revaluation coefficient is called a deflator index developed by Rosstat to carry out revaluation using the indexation method. As part of this method, the initial cost of fixed assets had to be multiplied by the coefficient established by Rosstat for this group, valid for the required period. These coefficients were regularly published by Rosstat specifically for the needs of revaluation. Rosstat developed them based on the prices of manufacturing companies, and for real estate - on the basis of prices for construction and installation work in various regions.

Today, the indexation method has not been officially canceled, but in fact it has lost force, since Rosstat has stopped publishing the regular dynamics of statistical deflator indices. An enterprise is not prohibited from using indexation during revaluation, but it must establish the index either independently or by contacting Rosstat for a fee. Therefore, in practice, in modern revaluation of fixed assets, the direct recalculation method is almost universally used.

IMPORTANT INFORMATION! Since, from the point of view of the law, there is a choice between the method of indexation and direct recalculation when revaluing fixed assets, it must be reflected in the accounting policies of a particular organization.