If you are serious about getting into trading, you will have to choose which costing method to use. Such a seemingly simple question - how to write off sold goods - can have a serious impact on how your trade will develop. In this material we will look at all methods of cost calculation , evaluate the advantages of each, and also tell you when it is better to use which one.

Please note: it is more convenient to keep records and view analytics in the same program. The MoySklad goods accounting service has built-in reports on turnover, balances, profitability, and movement of goods. They are generated automatically and can be viewed at any time, for example, in a mobile application. No matter where you are: business is always under control. Register and try it now: it's free!

Try MySklad

The law allows three methods of assessment and calculation - by the cost of each unit of goods, by the average cost and by the FIFO method (English: “first in, first out”). Each of them will give different indicators for business profitability, and therefore for tax and management accounting. Let's figure out what the difference is.

At the cost of each unit

As the name implies, this method assumes that the cost of each specific product is taken into account in the calculations. This system is used when trading unique and expensive goods, when accuracy is important. For example, it is suitable for those who will sell cars, art or jewelry. It is logical that when a product is piecemeal, and one cannot easily replace another, exactly the price at which it was delivered is entered into accounting when writing off inventory items. This method also assumes that it is always clear from which specific delivery the goods sold came from.

Cost accounting: economic interpretation

In economics, cost is usually understood as the total cost of a company to produce goods, provide services, or perform work. The costs in question are most often classified as:

- to material ones;

- those related to wages;

- depreciation;

- those related to the sale of goods, services or works.

Each of the noted expense categories can be represented by a large number of items.

Cost as an economic category is classified into 3 types:

- workshop;

- production;

- complete.

The first type of cost includes costs that are associated with the production of goods in a specific workshop (as an independent structural unit of the company).

The production type of cost includes, firstly, workshop costs, and secondly, expenses:

- general economic;

- related to losses from marriage;

- others that are related to the production of goods in the workshop, but are not related to the activities of the workshop.

The full cost includes the production component, as well as expenses that:

- related to the sale of goods;

- relate to administrative;

- are classified as commercial.

Different interpretations of cost in accounting are also reflected in regulations governing the field of accounting.

Let's study them.

Classification of production costs

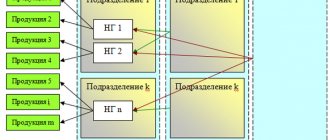

All costs that arise in a manufacturing company can be divided into two groups: direct and indirect (overhead).

A specific list of types of expenses that belong to a particular group is determined by the organization itself and enshrined in its accounting policies. But, as a rule, direct costs include:

- Raw materials and materials.

- Equipment depreciation.

- Workers' wages and insurance premiums accrued on them.

Overhead costs can also be divided into two groups:

- General production.

- General economic (managerial).

The first group relates to the costs of managing the production process, and the second - to the management of the enterprise as a whole.

For example, the salary of a shop manager or foreman is general production costs, and the remuneration of a director or chief accountant is general economic costs.

The concept of cost in accounting legislation

Why does an accountant need to take into account such an indicator as cost in the course of his work? Among the main documents of accounting (as one of the final results of accounting) is the profit and loss statement of the company. In accordance with the requirements reflected in clause 23 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n), it must reflect the cost of goods, services and work.

There is also a mention of cost in other accounting regulations. Thus, in paragraph 5 of PBU 5/01 (order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n) it is stated that the actual cost is the indicator by which inventories are recorded. And in paragraph 59 of the Order of the Ministry of Finance No. 34n dated July 29, 1998 it is stated that finished products should be registered at their cost. But what should the cost be from the point of view of accounting legislation?

First of all, we note that there can be several types of accounting costs. Clause 59 of Order No. 34n of the Ministry of Finance, in particular, mentions the cost:

- actual;

- normative (or planned).

Products, services and work actually supplied to the counterparty (but for which revenue is not recognized) are recorded, in accordance with paragraph 61 of Order No. 34n, in accounting also at cost - actual, standard or planned. Moreover, this cost includes costs reimbursed under the contract and associated with:

- with production;

- implementation.

Clause 9 of PBU 10/99 talks about the need, when calculating financial results, to determine the cost of goods, services and works sold based on expenses for ordinary activities, which:

- reflected in accounting for the current reporting period, as well as previous expenses;

- are reflected in accounting in relation to income in periods that follow the current one, taking into account amendments due to the peculiarities of doing business.

The corresponding expenses for core activities in accordance with clause 8 of PBU 10/99 can be presented:

- material costs;

- labor costs;

- insurance contributions to state funds from salaries;

- depreciation;

- other costs.

In turn, commercial and administrative expenses in accordance with clause 9 of PBU 10/99 can also be reflected in accounting for the current reporting year.

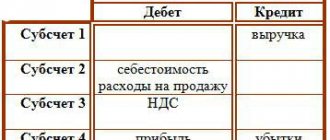

Let us note that the profit and loss statement, which is prepared in accordance with PBU 4/99, is not intended to reflect data on commercial and administrative expenses as part of the cost price.

In addition, the following classification of expenses that form the cost is used in accounting (and reflected in some industry regulations):

- direct (related to a specific type of manufactured product);

- indirect (related to several types of manufactured products).

However, in practice, the division of expenses into direct and indirect is more often used not in accounting, but in tax accounting and is actively used to optimize taxation (Article 318 of the Tax Code of the Russian Federation).

FIFO method. Calculation example

This is the most popular cost calculation method. It uses the queuing principle. It is assumed that the items that were delivered first are written off first. Hence the name FIFO method (English: “first in, first out” - “first in, first out”). However, unless the shelf life is important, it is not necessary to ship goods from an earlier delivery first - this is used as an assumption in the calculations. That is, the cost of goods that are sold first is calculated at the price of the balances from the “oldest” delivery. When the balances are quantitatively exhausted, inventory items are written off at the price of the next delivery, then the next one, and so on.

Example of calculation using the FIFO method

Let’s take our “Stationery” store with ballpoint pens and exactly the same situation as above. We have 370 ballpoint pens for 10 rubles and are supplied in two batches of 500 pens - first for 9 rubles 50 kopecks, then for 9 rubles. 1100 pens sold for 15 rubles. We count the profit.

The first to go will be 370 pens at 10 rubles each - that’s 3,700 rubles. Next, 500 pens cost 9.5 rubles each, which is another 4,750. There are 230 pens left, each priced at 9 rubles, which is 2,070 rubles.

1100 X 15 – (3700 + 4750 + 2070) = 5980 (rub.)

As can be seen from the example of calculation using the FIFO method, the profit indicator in this case is lower than in the example with average cost. Accordingly, income tax will be less.

Cost accounting: main tasks of an accountant

Thus, the concept of cost in the legislation regulating accounting is given in several interpretations. When solving any problems related to cost accounting, the accountant carries out:

- registration of business transactions for expenses that form the cost;

- cost calculation (determining the cost of relevant objects);

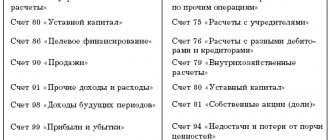

- the use of accounting accounts to reflect transactions on transactions within the framework of accounting for cost objects.

Let's study the features of these areas of work of an accountant in more detail.

How to determine the amount of direct costs attributable to the balance of finished products in the warehouse

In order to assess the balances of finished products in the warehouse at the end of the current month, as prescribed by paragraph 2 of Article 319 of the Tax Code of the Russian Federation, the taxpayer will need data from primary accounting documents on the movement and balances of finished products in the warehouse (in quantitative terms). In addition, he must initially calculate the amount of direct expenses in the current month and the amount of direct expenses attributable to WIP balances. The estimated cost of the balances of finished products in the warehouse is determined as follows: to the amount of direct costs attributable to the balances of finished products in the warehouse at the beginning of the current month, add the amount of direct costs attributable to the production of products in the current month (minus the amount of direct costs attributable to the balance of work in progress ), and the amount of direct costs attributable to products shipped in the current month is deducted. This procedure should be applied by taxpayers engaged in processing raw materials, and those who carry out activities other than processing raw materials and performing work (providing services).