The use of electronic sick leave is regulated by the law of May 1, 2021 No. 86-FZ and articles 59 and 78 of the law of November 21, 2011 No. 323-FZ . Electronic sick leave is issued only with the written consent of the insured person.

The electronic certificate of incapacity for work (ELN) is signed with an enhanced qualified electronic signature of the attending physician and medical institution. It has the same legal meaning as a paper sick leave certificate.

Next, we’ll tell you how to work with electronic sick leave in Kontur.Extern.

List of ELN

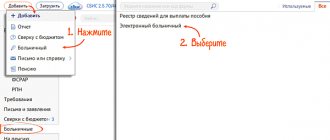

To go to the list of documents, open the main page of Kontur.Extern, then click the “ FSS” and then the “ FSS Benefits” . A list of benefits for the current month will be displayed.

To select a different period, you must click on the “ All documents” :

Search documents

To find the desired document, there is a Search . You can enter your full name and SNILS into the search bar.

If you want to find benefits from a previous period, you must click “ Continue search for....” :

Document statuses

Created and sent files are assigned certain statuses:

- “ Created” – the document is generated, but not sent to the Social Insurance Fund.

- “ Sending error...” – sending did not occur due to detected violations. Re-submission to the FSS is required. You must select the line with the name of the document and click “ Send again” .

- “ ELN not accepted” - during the inspection, violations were identified. You need to correct them and send the file again. To do this, select the desired line in the list of documents and click on it. Then read the violation protocol using the link “ View error log” and click “ Correct errors and resend .

- “ ELN accepted” – the file has been accepted by the Foundation.

Examples of calculations using certificates of incapacity for work in various situations

Source: Journal “Payment in state (municipal) institutions: accounting and taxation”

The magazine's editors have received many questions related to the calculation of benefits based on certificates of incapacity for work. This topic is relevant for any accountant, since almost everyone faces these calculations almost every day. In this regard, in this article we will consider examples of calculations according to the questions of our readers.

Let us recall that the main documents regulating the procedure for calculating and paying benefits for temporary disability and pregnancy and childbirth are the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter - Law No. 255-FZ ) and Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity , approved by the Decree of the Government of the Russian Federation of June 15 .2007 No. 375 (hereinafter referred to as Regulation No. 375 ).