14.09.2020

Accounting for office furniture must be timely and reliable, each operation is carried out based on completed transactions and is confirmed by relevant documentation.

At the end of the reporting period, it is mandatory to reconcile synthetic and analytical accounting in the context of turnover and balances. Discrepancies between accounting data and the actual availability of objects are unacceptable.

Accounting for office furniture must be timely and reliable

How to keep furniture records in accounting

Office furniture can be accounted for through account 01 “Fixed Assets” as part of fixed assets or as part of inventories (MPI) on account 10 “Materials”. It depends on the:

- The cost of the purchased piece of furniture.

- Its useful life (hereinafter - SPI).

The procedure for writing off furniture differs in different accounting options.

Currently, PBU 6/01 and PBU 5/01 are still used in accounting. But starting with reporting for 2021, in place of PBU 5/01 it is necessary to use FSBU 5/2019 “Reserves”. This standard can be started to be used earlier, as indicated in paragraph 2 of Order of the Ministry of Finance dated November 15, 2019 No. 180n.

Also see “How to apply the new accounting standard “Inventories” from 2020“.

Next, we will consider accounting for furniture as part of the operating system and inventory.

Rules for the gratuitous transfer of fixed assets using an example - accounting, postings and documents

Yes, the gratuitous transfer of a fixed asset is not prohibited, but if gratuitous property has been received, you should first make sure that this object can actually be capitalized as a fixed asset.

- The number and day on which the document was drawn up.

- The full name of the fixed asset, based on technical documents.

- Names of the developer institution.

- Factory and assigned inventory number of the fixed asset.

- Numbers of the depreciation group, the period of effective use of this product and the actual period of use.

- The depreciation amount accrued at the time of gratuitous transfer of an asset, its residual value.

- Information about whether the composition contains precious metals and stones.

Purchasing furniture: accounting as OS

According to the provisions of PBU 6/01, if the cost of furniture exceeds 40,000 rubles , it is taken into account as part of the operating system.

Such furniture must be registered at original cost (hereinafter referred to as PV). It includes actual purchase and/or manufacturing costs, as well as installation, installation, assembly, and delivery costs.

As a general rule, the cost of fixed assets is repaid through depreciation. It is accrued from the first month following the month the furniture was registered.

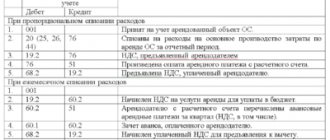

When purchasing furniture - an OS object, the accountant makes the following entries in accounting:

- Debit 08 Credit 60 – purchase of office furniture using a bill of lading or a transfer and acceptance certificate;

- Debit 19 Credit 60 – VAT allocated (if furniture is purchased from a VAT payer);

- Debit 68 Credit 19 – VAT is accepted for deduction (if there is a correctly executed invoice);

- Debit 60 Credit 51 – payment was made to the OS supplier;

- Debit 01 Credit 08 – furniture was put into operation on the basis of the OS-1 act;

- Debit 20 (25, 26, 44 ...) Credit 02 – monthly depreciation.

Import of goods

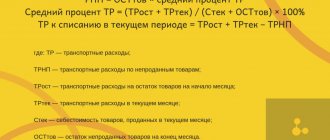

No less important is the correct determination of the accounting value of goods under an agreement with a foreign supplier, i.e., the conversion into rubles of the cost of goods expressed in foreign currency. Let us remind you that the cost of goods is reflected in rubles at the exchange rate valid on the date of their acceptance for accounting (clause 6, clause 9 of PBU 3/2021). If goods are purchased against a previously transferred prepayment to the supplier, the cost of the goods is fixed at the rate in effect on the date of the prepayment, and in the part not covered by the prepayment - at the rate at which the goods are accepted for registration. Read a separate article about the peculiarities of forming a ruble valuation of acquired assets under contracts in foreign currency, including on account of a previously issued advance.

We recommend reading: MMTs in the electric power industry 2021

As you know, goods are accepted for accounting at actual cost (clause 5 of PBU 5/01). It is important to note that when importing goods, as a rule, additional costs arise in the form of customs duties, fees, and other payments paid to intermediaries for customs clearance of goods. All these expenses are also included in the cost of imported goods (clause 6 of PBU 5/01).

Purchase of furniture: accounting as inventory

Typically, the cost of office furniture is low and amounts to less than 40,000 rubles per unit. Such furniture can be taken into account as goods and materials. If the useful life of such furniture is more than 12 months , it is necessary to ensure separate accounting of inventory items for the safety of the furniture.

Inventory and equipment are also taken into account at their original cost. When putting furniture into operation, costs are expenses for ordinary activities. They are written off to expense accounts.

When purchasing inexpensive office furniture, accounting in accounting looks like this:

- Debit 10 Credit 60 – purchase of office furniture according to UPD or delivery note;

- Debit 19 Credit 60 – VAT reflected;

- Debit 68 Credit 19 – VAT presented by the supplier is accepted for deduction on the invoice or UPD;

- Debit 60 Credit 51 – payment was made for office furniture;

- Debit 20 (25, 26, 44...) Credit 10 – furniture has been put into operation.

Now let’s look at deregistration of furniture for various reasons.

Requirements for depreciation groups

Each enterprise uses in its work various fixed assets that are its property and are used in the production of goods, provision of services, and performance of work. To accept them for accounting, the initial cost is determined. Accounting during use is carried out at residual value.

Regardless of the form of ownership of the company, its size and types of activities, the issue of efficient use of fixed assets is one of the paramount ones. The competitiveness of the company's products, its position in industrial production, and the financial condition of the organization depend on it. Therefore, the use of OKOF is especially important.

Disposal of furniture: OS

Taking into account the provisions of PBU 6/01, if the operating system does not bring economic benefits to the company now or in the future or for some reason is removed from economic activity, such an object must be written off from accounting.

In this case, depreciation is not accrued from the month following the month the furniture was written off.

As a result of furniture write-off, the company may incur additional costs. expenses or additional income. For example, broken furniture should be sent for recycling. Or “crosspieces” from discarded office chairs can be used for repairs. Such expenses and income are charged to account 91 “Other income and expenses”.

Postings for writing off furniture from accounting

In accounting, the write-off of furniture accounted for as fixed assets is reflected in the following entries:

- Debit 01.09 Credit 01.XX (sub-account intended for accounting for furniture in use) – write-off of the initial cost of furniture (based on purchase documents);

- Debit 02.XX Credit 01.09 – write-off of the accumulated amount of depreciation on written-off furniture;

- Debit 91.02 Credit 01.09 – write-off of the residual value of furniture;

- Debit 91.02 Credit 26 (60, 76) – write-off of additional expenses associated with the write-off of furniture performed in-house (or by third-party contractors);

- Debit 10 Credit 91.01 – reflection in the accounting of materials obtained as a result of disassembling furniture.

The sale of office furniture on the basis of a transfer and acceptance certificate or a delivery note is reflected as follows:

- Debit 62 Credit 91.01 – recognition of income on the date of transfer of office furniture;

- Debit 91.02 Credit 68 – VAT is charged on the sale of fixed assets (for VAT payers);

- Debit 91.02 Credit 01.XX – the cost of furniture sold is written off from account 01;

- Debit 02.XX Credit 91.02 – depreciation accrued on furniture at the time of its sale is written off.

The balance formed on account 91.02 is then written off to account 99. Profit goes to the credit of account 99, and the loss from the entire operation goes to the debit.

When concluding an agreement for the gratuitous transfer of furniture, the residual value of the fixed assets is taken into account in account 91.02 - as part of other expenses. Such a transaction is subject to VAT.

But the charitable donation of furniture is exempt from VAT. This requires an agreement and a transfer deed. Input VAT on furniture purchases must be restored .

Trade by samples and catalogs

Typically, a visitor to a furniture store purchases a specific model of furniture, and not a specific piece that he had the opportunity to examine, touch and “test” in the showroom. That is, exhibition copies of the product are most often presented on the sales floor, and all color options and modifications are not always available.

The buyer is additionally shown samples of upholstery fabric or other options for a particular model in catalogs. Ultimately, the buyer is delivered a similar product that is in the warehouse of the furniture store or, at the time of making the purchase, has not yet been received by the store from the supplier.

Thus, the store purchases from suppliers only the furniture that has already actually been sold to the buyer, which allows significant savings on costs associated with storing goods and maintaining large retail spaces. If a furniture store has chosen exactly this option – trading according to samples and catalogues, it is necessary to take into account a number of nuances.

Firstly, the legal side of the issue is fundamentally important - how exactly the relationship between furniture buyers, a furniture store and manufacturers (suppliers) is regulated. These can be either intermediary agreements, which we will talk about in more detail below, or standard retail purchase and sale agreements with buyers and supply or purchase agreements with suppliers (manufacturers, wholesalers).

Of course, contractual policy will have a direct impact on accounting records and tax treatment. In this case, one of the most significant terms of the retail purchase and sale agreement will be the moment established in it for the transfer of ownership to the buyer. If these conditions are not regulated, one must be guided by the norms of civil law.

So, according to paragraph 1 of Art. 223 of the Civil Code of the Russian Federation, as a general rule, the ownership right of the acquirer of a thing under a contract arises from the moment of its transfer. And in accordance with paragraph 3 of Art. 497 of the Civil Code of the Russian Federation, unless otherwise provided by law or contract, for the retail sale of goods according to samples or catalogs (remotely), the contract is considered fulfilled from the moment of delivery of the goods to the place of residence of the buyer - an individual (or at the location of the buyer who is a legal entity person) or to another place expressly specified in the contract.

This is important, because one of the five mandatory conditions for recognizing sales revenue, prescribed in paragraphs. “d” clause 12 of PBU 9/99 “Income of the organization” <2>, is the transfer of ownership of the goods to the buyer. And if at least one of these five conditions is not met in relation to cash and other assets received by the organization as payment, the organization’s accounting should recognize not revenue, but accounts payable.

As a rule, the buyer immediately pays for the selected furniture in the showroom (unless he takes out a loan or installment plan, which we will also talk about a little later), but it is not always delivered to him on the same day. Moreover, it is quite possible that such a specific model is not in stock and it will be necessary to order it from the supplier - and then the gap between the moment of receipt of money from the buyer and the date of delivery of the furniture purchased to him may be not just a few days, but several weeks or even months .

Therefore, it must be borne in mind that, according to Art. 487 of the Civil Code of the Russian Federation, in cases where the purchase and sale agreement provides for the buyer’s obligation to pay for the goods in full or in part before the seller transfers the goods, prepayment for the goods takes place. Thus, the amount received from the buyer who chose furniture according to the sample should be recognized as an advance payment and reflected in the credit of account 62 “Settlements with buyers and customers”, to which for these purposes a corresponding sub-account is opened (to account for the received advance payment) and analytical accounts (for accounting of settlements with each specific buyer).

If the activity of a furniture showroom in the retail trade of furniture has not been transferred to the payment of UTII, you should also keep in mind that upon receipt of an advance payment, VAT must be charged. However, later, after shipment of the goods, it will be possible to deduct the tax amount.

Secondly, it matters how trade is organized based on samples and catalogs - through a showroom (that is, an object of a stationary distribution network) or in another way, outside a stationary distribution network.

Trade in furniture by samples, as a rule, presupposes the presence of a stationary retail chain facility - a showroom (shop) where furniture samples are displayed. After all, according to paragraph 1 of Art. 497 of the Civil Code of the Russian Federation, the sale of goods by samples provides for the conclusion of a retail purchase and sale agreement based on the buyer’s familiarization with the sample of goods offered by the seller, which is displayed at the place of sale of goods.

And the Rules for the sale of goods by sample <3> directly state that organizations selling goods by sample must have premises allocated for displaying samples of the goods offered for sale. Moreover, it is necessary to provide samples of the offered goods of all articles, brands and varieties, components and devices, accessories and other related products for buyers’ review.

An example of the second option - when furniture is traded not through the objects of a stationary retail chain - could be, for example, a scheme in which a trading company has an office where not a single sample of furniture is presented, and visitors are only invited to look at catalogs and choose the models they like according to pictures, after which a retail purchase and sale agreement is concluded with the buyer, providing for the obligation to deliver the selected product to the place specified by the buyer.

We invite you to read: Safe share of VAT deductions for the fourth quarter. 2019 by region

The possibility of concluding an agreement on the basis of familiarization of the buyer only with the description of the goods - through catalogues, prospectuses, booklets, photographs, means of communication (television, postal, radio communications, etc.) or other means that exclude the possibility of direct familiarization of the consumer with the goods or a sample of the goods when concluding an agreement , – provided for in paragraph 2 of Art.

The presence of a stationary retail chain facility is fundamentally important for deciding whether the retail sale of furniture in this particular situation will be subject to the taxation system in the form of UTII. The fact is that, according to Art. 346.27 of the Tax Code of the Russian Federation, for the purposes of applying this special regime, retail trade does not include the sale of goods based on samples and catalogs outside a stationary retail network, including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks.

This means that the sale of furniture based on samples in a showroom store (through a stationary retail chain facility) is clearly subject to the payment of UTII (of course, subject to the remaining requirements of Chapter 26.3 of the Tax Code of the Russian Federation, including the area of the sales floor, the number of personnel, the structure of the authorized capital of the company ). The same applies to the sale of furniture through catalogues, if the conclusion of a retail purchase and sale agreement and the receipt of payment for the goods are carried out in the premises of a store recognized as an object of a stationary retail chain.

Such clarifications were given, in particular, in the recent Letter of the Ministry of Finance of Russia dated February 22, 2012 N 03-11-06/3/12. If the execution of transactions - the conclusion of an agreement for the sale of goods according to catalogues, price lists and demonstration samples (regardless of the form of payment) takes place in the office, and the goods are released (shipped) from the warehouse, such activity for the purposes of applying Ch. 26.3 of the Tax Code of the Russian Federation does not apply to retail trade and is not subject to transfer to a special regime in the form of UTII (Letter of the Ministry of Finance of Russia dated January 23, 2012 N 03-11-06/3/2).

Disposal of furniture: MPZ

To ensure the safety of furniture during commissioning, it must be reflected in an off-balance sheet account. Therefore, when writing off inventory as a result of damage, theft and other reasons, the furniture is written off from the off-balance sheet account on the credit of account 013.

If there is a disposal of furniture that has not yet been put into operation, this operation is reflected on the credit of account 10:

- Debit 91.02 Credit 10 - the initial cost of furniture is written off as expenses - inventory.

Sales of used office furniture are reflected as follows:

- Debit 62 Credit 91.01 - income is reflected on the date of transfer of furniture to the buyer.