When carrying out trading activities, quite often there are situations when the buyer refuses the purchase and sale transaction and returns the goods. Let's consider how to reflect a return from a buyer in accounting, what accounting entries are generated when returning goods from a buyer.

The buyer has the right to return the goods supplied by the seller if one of the conditions is not met:

- Documents for the goods are incorrectly drawn up or missing;

- The quantity differs;

- The quality is different;

- The assortment is disrupted;

- The product is not packaged or packaged incorrectly, etc.

How to arrange for a buyer to return goods to a supplier

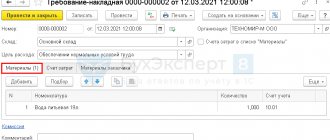

The return of goods to the supplier is accompanied by a return invoice (for example, in form N TORG-12 with the note: “Return of goods”) or an act of returning goods to the supplier.

Documents for returning goods from the buyer to the supplier are transferred along with the returned goods.

In addition, the buyer sends a letter (claim) to the supplier demanding acceptance of the returned goods, indicating the reason for their return.

If the goods are returned to the supplier by power of attorney, then in this case, when registering it, you can use form No. M-2 (clause 2.1.4 of the Methodological Recommendations, approved by Letter of the RF Committee on Trade dated July 10, 1996 N 1-794/32-5 ).

In this case, the buyer does not need to issue an invoice for the return of goods.

Documentation of goods from the seller in retail trade

When returning goods on the same day, that is, before the Z-report is taken at the checkout, the seller must:

- collect the cash receipt from the client and sign it from the manager;

- draw up a money return act in the KM-3 form;

- issue an invoice for the returned goods;

- return the money.

The invoice can be drawn up in the TORG-13 form (invoice for internal movement, transfer of goods, containers). The check signed by the manager is presented to the operating cash desk, and the money is returned to the buyer.

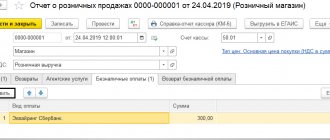

The check received from the buyer is attached to the act (in the KM-3 form) and submitted to the accounting department. Amounts paid for returned customers and unused cash receipts are reflected in the cashier-operator's journal in column 15. The amount of revenue for a given day is reduced by these amounts.

If the goods are returned to the seller later than the day the goods were purchased, the following documents are drawn up:

- the buyer draws up an application and attaches a cash receipt or sales receipt to it;

- the seller issues an invoice for the returned goods in two copies (one is attached to the product report, and the second is given to the buyer and is the basis for receiving a sum of money for the returned goods);

- the seller gives the buyer money and draws up a cash order;

- the seller makes accounting corrections.

Letter of claim requesting the supplier to accept goods returned by the buyer

If, during the acceptance of the delivered goods or after its acceptance, it is revealed that the goods do not comply with the requirements for their quality, the buyer has the right, at his own discretion, to refuse to execute the sales contract, return the low-quality goods and demand a refund of the amount of money paid for it, or demand replacement of this product with a product of proper quality (clause 2 of Article 475 of the Civil Code of the Russian Federation).

The buyer sets out his requirements in the form of a claim, which is sent to the supplier (for example, for the return of goods). The norms of the current legislation of the Russian Federation do not provide for an established form of claim for the return of goods to the supplier.

The letter of claim is drawn up in any form.

The letter states:

- full name and details of the buyer and supplier;

- number and date of the purchase and sale (supply) agreement;

- number and date of accompanying documents for the delivered goods;

- name of the product, its quantity and cost;

- detected discrepancy (malfunction);

- links to regulations;

- requirement to satisfy the claim (request for replacement, refund, reduction of amount, etc.).

The claim is signed by the head of the organization, indicating his position and his full name, and certified by the company seal (if any).

The letter of claim is handed over to the authorized representative of the supplier against signature or sent to him by registered mail with a list of the attachments.

Basic Concepts

When purchasing a product for further sale (wholesale), the seller is called the supplier, and the buyer is called the counterparty. The role of the supplier can be directly from the manufacturer (manufacturer) of the product, a legal organization or an individual. In relation to the buyer, the supplier is obliged to:

- provide a certain number of purchased products of appropriate quality;

- fully satisfy legal claims regarding the acquisition from the counterparty;

- make deliveries within the terms specified in the contract, without delays.

The counterparty is obliged to accept the supplied objects and pay for everything provided to him in the manner specified in the contract: advance (preliminary) payment, upon receipt, upon sale (according to schedule).

If payment terms are violated, the seller has the right to file a payment claim against the consumer.

How to reflect the return of goods in tax accounting for income tax ?

If the supplier fails to comply with the terms of the agreement, the buyer has the right to return the goods in whole or in part. Problems with return transfer often arise due to a lack of completeness of the delivery or non-compliance with quality parameters. The supplier and counterparty document the transaction by making the necessary accounting entries.

By the way! By agreement, it is possible to replace the purchase or eliminate violations within a specified time frame. If the seller evades fulfillment of claims, the counterparty has the right to send a statement of claim to the judicial authorities.

VAT when returning goods to the supplier

VAT when returning goods to the supplier is required to be processed according to the following rules:

- The seller prepares an adjustment invoice and records it in the purchase ledger.

- The buyer registers the seller's adjustment invoice in the sales book (if he managed to accept VAT for deduction, if not, then he accepts the deduction in the non-refundable part).

Please note that it does not matter for what reason the return occurs.

This is how the return of both defective and high-quality goods is processed if it does not comply with the contract.