Posting contents debit 99 credit 99

Posting Dt 99 Kt 99 is formed once at the end of the year when summing up the results and is part of the balance sheet reformation.

In fact, this is an operation consisting of several entries Dt 99 Kt 99 inside account 99 “Profit and Loss”, depending on the number of subaccounts. The operation in practice is called “Closing accounts”. It consists of assigning the values accumulated in subaccounts to one subaccount, which reveals the final annual financial result.

To understand how this happens, you need to familiarize yourself with the internal structure of account 99 and consider how subaccounts are opened for it.

Closing

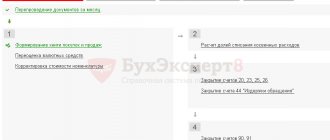

Every month, the accounting department calculates financial results for all balance sheet accounts, and then their amounts are transferred to account 99 and accumulated there throughout the reporting period.

Closing scheme

Account 99 “Profits and losses” is written off only at the end of the reporting period (often the end of the year). Closing account 99 is the final posting on the last day of each year, otherwise called the reformation of balance sheet indicators. The reformation involves resetting subaccounts 90 and 91 (first stage) and resetting account 99 (second stage). Balance sheet reformation is carried out only when each transaction is entered into accounting.

Attention! After the reformation, no more entries are made, and the accounting department can generate a financial report for the reporting period.

How account 99 is closed depends on the current financial result. Closing is carried out by one of two possible transactions:

- Dt99 Kt84 - the implementation of this posting provides information about which account reflects the organization’s profit received in the current year.

- Dt84 Kt99 - this entry is made in order to reflect and write off the net loss of the enterprise in the reporting year.

How the 99 count works and its analytics

The count of 99 is used to summarize results. The resulting performance indicators are included in the financial statements. Accordingly, the analytics device must meet the main goal - the preparation of reliable reporting.

IMPORTANT! The instructions for the Chart of Accounts contain a direct indication of the need to build analytical accounting on account 99 to structure the data included in the financial results report.

Starting from the first month of the year, account 99 serves to accumulate information about the results of the organization’s work. The account accumulates:

- result from sales within the main activity;

- the result of other operations;

- amounts of recalculation of income tax and sanctions.

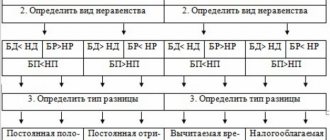

The account also keeps records of the values defined by PBU 18/02 (if the organization is obliged/decided to apply it):

- conditional expense/income (UR/UD);

- permanent tax liabilities and assets (PNO, PNA);

- write-off deferred tax liabilities and assets (ONO, ONA).

When opening sub-accounts, it is advisable to take into account how information should be grouped and reflected in the statement of financial results (Form 2). At the same time, it is important to follow the legal requirements for recording this information. It is optimal to use the following subaccounts:

- 99.1 “Profit and loss”:

- 99.1.1 “Profit (loss) before tax.” To take into account the indicators that form the reporting item of the same name, the result of sales for core activities and other operations.

- 99.1.2 “Other profits and losses.” To account for the amounts of recalculation of income tax, tax sanctions, written off by ONO and ONA, grouped in the item “Other”.

Maximum information content is achieved by maintaining analytics on sub-accounts in the context of the component indicators taken into account. Modern software products allow you to conduct analytics within a subaccount without unnecessarily cluttering up accounting.

- 99.2 “Calculation of income tax.” To account for amounts involved in the disclosure of information on income tax calculations in accordance with PBU 18/02.

- 99.2.1 “Conditional consumption”.

- 99.2.2 “Conditional income”.

- 99.2.3 “PNO (PNA)”.

Other uses of the account

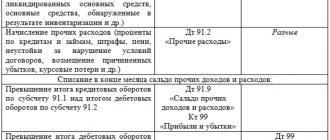

Also, account 99 is used to reflect losses/surpluses of fixed assets and inventory items received under force majeure circumstances (natural disasters, accidents, nationalization, etc.):

| Dt | CT | Description | Document |

| 99.01.1 | 03 | The cost of the fixed asset is reflected as part of extraordinary expenses | Write-off act |

| 99.01.1 | 07 | Losses of equipment for installation | Write-off act |

| 99.01.1 | 08 | Losses of investments in non-current assets | Write-off act |

| 99.01.1 | 10 | The cost of materials is included in extraordinary expenses | Write-off act |

| 10 | 99.01.1 | Excess materials identified | Inventory sheet |

Account 99 reflects the amounts of losses/surpluses of funds identified in emergency circumstances on current accounts and in the cash register:

| Dt | CT | Description | Document |

| 99.01.1 | 50 | Lack of cash in the cash register | Recount act |

| 99.01.1 | 52 | Lack of funds in the current account in foreign currency | Bank statement |

| 55 | 99.01.1 | Excess funds are credited to a special account | Bank statement |

Movement on account 99 and compliance of its data with reporting indicators

Having examined the internal structure of the account, it’s time to start studying the movement on the account. Let's look at a conditional example of what happens inside the account, how the results are reflected by postings Dt 99 Kt 99 , how its data is compared with reporting data.

Example:

The final indicators of the organization for the year are given, presented in the table in order of the articles of Form 2.

| Index | Reporting line code | Amount, rub. | Note |

| Net revenue | 2110 | 10 000 000 | |

| Cost price | 2120 | (9 000 000) | |

| Profit (loss) from sales | 2200 | 1 000 000 | |

| Other income | 2340 | 500 000 | |

| other expenses | 2350 | (440 000) | |

| including other social expenses | (40 000) | The organization did not take into account the amount as expenses to determine taxable profit | |

| Profit (loss) before tax | 2300 | 1 060 000 | |

| Current income tax | 2410 | (220 000) | The value is equal to the tax payable on the tax return: 10 000 000 – 9 000 000 + 500 000 – (440 000 – 40 000) = 1 100 000; 1 100 000 × 20% = 220 000 |

| including PNO (PNA) | 2421 | 8 000 | 40 000 × 20% = 8 000 PNO by amount of social expenditures |

| Other | 2460 | (1 000) | tax penalties |

| Net income (loss) | 2400 | 839 000 | |

| Conditional consumption | (212 000) | 1 060 000 × 20% = 212 000 |

See also the article “Filling out Form 2 of the balance sheet (sample)” .

The table below contains entries using recommended subaccounts and example data.

| Wiring | Sum | Decoding |

| Wiring Dt 90, 91 Kt 99 | ||

| Dt 90.9 Kt 99.1.1 | 1 000 000 | This is how the monthly sales total is summed up, which is added up on account 99.1.1: (10,000,000 – 9,000,000). Note. The example shows a positive result. If a loss is received during the month, then the posting Dt 99 Kt 90 is used. |

| Dt 91.9 Kt 99.1.1 | 60 000 | This is how the monthly total for other transactions is summed up, which is added up on account 99.1.1: (500,000 – 440,000). Note. The example shows a positive result. If a loss is received during the month, then the posting debit 99 credit 91 is applied. |

| Wiring Dt 99 Kt 68 | ||

| Dt 99.1.2 Kt 68 / calculations with the budget | 1 000 | The amount of penalties determined by the tax inspectorate is reflected |

| Dt 99.2.3 Kt 68 / calculation of income tax | 8 000 | Reflected PNO |

| Dt 99.2.1 Kt 68 / calculation of income tax | 212 000 | Conditional consumption generated |

For information on how to record income tax on account 68, read the article “Which accounts are used to record the amount of income tax? ”

When closing subaccounts, it is necessary to generate transactions in the format in question Dt 99 Kt 99:

| Wiring | Sum |

| Dt 99.1.1 Kt 99.9 | 1 060 000 |

| Dt 99.9 Kt 99.1.2 | 1 000 |

| Dt 99.9 Kt 99.2.1 | 212 000 |

| Dt 99.9 Kt 99.2.3 | 8 000 |

The turnover and accumulated balance of account 99 before the reformation and after the closure of sub-accounts, as well as the comparability of account data with the lines of Form 2 are shown in the table:

| Subaccount | Debit turnover | Loan turnover | Debit balance | Credit balance | Reporting line code |

| Before the Reformation | |||||

| 99.1.1 | 1 060 000 | 1 060 000 | 2 300 | ||

| 99.1.2 | 1 000 | 1 000 | 2 460 | ||

| 99.2.1 | 212 000 | 212 000 | conditional flow | ||

| 99.2.3 | 8 000 | 8 000 | 2 421 | ||

| After closing | |||||

| 99.1.1 | 1 060 000 | 1 060 000 | |||

| 99.1.2 | 1 000 | 1 000 | |||

| 99.2.1 | 212 000 | 212 000 | |||

| 99.2.3 | 8 000 | 8 000 | |||

| 99.9 | 221 000 (1 000 + 212 000 + 8 000) | 1 060 000 | 839 000 (1 060 000 – 221 000) | 2 400 | |

As a result of the operation from a series of entries in the format Dt 99 Kt 99, a credit balance was formed in subaccount 99.9 equal to the net profit for the year in the amount of RUB 839,000. The amount must correspond to line 2400 of Form 2.

Correspondence with other accounts

Account 99 corresponds with many accounts in accounting. For debit 99, the corresponding ones are:

- Section 1 “Non-current assets” -03, 07, 08.

- Section 2 “Inventory” - 10, 11.

- Section 3 “Production costs” - 20, 21, 23, 25, 26, 28, 29.

- Section 4 “Finished products and goods” - 41, 43, 44, 45.

- Section 5 “Cash” - 50, 51, 52, 58.

- Section 6 “Calculations” - 68, 69.

- Section 7 “Capital” - 84.

- Section 8 “Financial results” - 90, 91, 94.

Typical correspondence

Correspondence regarding the loan goes as follows:

- Section 2 “Inventory” - 10.

- Section 5 “Cash” - 50, 51, 52, 55.

- Section 6 “Calculations” - 60, 73, 76, 79.

- Section 7 “Capital” - 84.

- Section 8 “Financial results” - 90, 91, 94, 96.

Debit 99 credit 09

This is a posting for writing off the amount of ONA. PBU 18/02 describes 2 cases of write-off of IT:

- If the tax rate changes, then the accumulated IT is changed by recalculating the balance of deductible temporary differences (DTT) at the new rate. The difference between the accumulated and recalculated amounts is posted to account 99, as required by the regulations.

- If the asset that determined the accrual of the tax is disposed of, then the tax is subject to write-off to the extent that the profit for taxation will not be reduced in accordance with the legislation of the Russian Federation.

If the accounting of VVR and ONA is carried out correctly, then IT, as a rule, is completely repaid with a decrease in VVR. If accounting errors have been identified, then when they are corrected, it may be necessary to write off IT as a loss.

Cases of write-off of IT of the same kind are reflected in the same way in accounting: Dt 77 Kt 99.

Reflection of losses of previous years in the declaration

The written-off loss of previous years is reflected in the income tax return:

- Sheet 02, page 110 “The amount of loss or part of a loss that reduces the tax base for the reporting (tax) period (page 150 of Appendix No. 4 to Sheet 02)”; PDF

- Sheet 02 Appendix No. 4 page 150 “The amount of loss or part of the loss that reduces the tax base for the reporting (tax) period - total.” PDF

The balance of the unwritten loss is reflected:

- Sheet 02 Appendix No. 4 page 160 “Balance of uncarried loss at the end of the tax period - total.” PDF

Results

It is difficult to overestimate the importance of creating analytical accounting on account 99. Highly informative analytics is the key to high-quality accounting reporting that provides reliable information to its users. Correct reflection of analytics is ensured, among other things, by postings in the format Dt 99 Kt 99 .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of carrying forward losses from previous years

The procedure for transferring a loss if its write-off needs to be postponed

What actions in the program must be taken if the organization does not want to reduce the tax base for losses from previous years in the current tax period?

Carrying forward losses is a taxpayer's right. It can be applied in the current tax period in relation to all losses starting from 2007 (Clause 16, Article 13 of the Federal Law of November 30, 2016 N 401-FZ). This can be done intermittently, observing only the order of losses (clause 3 of Article 283 of the Tax Code of the Russian Federation). There is also no time limit for transferring losses.

If the Organization is 100% sure that it will never exercise the right to carry forward a loss to the future, then the Transfer of Loss to Future Periods operation does not need to be done in the program.

But situations are different, and perhaps in the future the management of the organization will change its mind and want to reduce the tax base for the loss of previous years.

Therefore, in our opinion, it would still be more correct to formalize this operation, but without indicating the start date for writing off this loss. Then the program will not automatically begin to reduce the tax base for the loss of previous years without the command of an accountant.

If an organization applies PBU 18/02, then the operation Transfer of losses from previous years (PBU 18/02) will have to be created at the end of the year in any case. Otherwise, 1C will not allow you to close the first month of the next tax period.

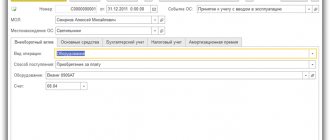

Let's look at the features of setting up analytics for deferred loss write-off.

The directory element Deferred expenses must be filled out as indicated above, but without the start date of the period for writing off the loss.

Later, when the organization decides to reduce the tax base by the amount of this loss, it will be necessary to indicate in the Write-off period from the first date of the tax period from which to start writing off the loss.

It is important to remember the order in which losses are written off (clause 3 of Article 283 of the Tax Code of the Russian Federation). A loss from a later tax period should not be allowed to be written off before one that occurred earlier.

The procedure for transferring a loss if its write-off needs to be interrupted

How can you stop writing off a loss for a while? The organization does not want to reduce tax profit this year by the loss of previous years?

When you need to skip a tax period in the process of writing off a loss, you can create a document Transaction entered manually, transaction type Transaction with the following transactions:

- Dt 97.21 “Other deferred expenses” subconto Remaining Loss 2017 ;

- Kt 97.21 “Other deferred expenses” subconto Loss 2017 .

Subconto account 97.21 “Other deferred expenses” The balance of the Loss 2017 is configured as with a deferred transfer of losses - with empty dates for the write-off period.

In the future, when the write-off needs to be resumed, it will be necessary to carry out an operation with reverse entries.

When carrying out these operations, it is important to follow the same sequence as during the first loss transfer procedure:

- re-processing of documents for December;

- partial closure of the month, skipping the link Reformation of the balance sheet ;

- loss carry forward operation;

- carrying out the document Reformation of the balance sheet .