22.02.2019

In accordance with Art. 262 of the Labor Code of the Russian Federation, one of the parents (guardian, trustee) to care for disabled children, upon his written application, is provided with four additional paid days off per month, which can be used by one of these persons or divided among themselves at their discretion. Payment for each additional day off is made in the amount of average earnings. In this consultation we will consider the nuances of applying this norm.

Who is considered a child with disabilities according to Russian law?

Any benefits or financial assistance from the state can only be discussed in the case of officially established disability. The latter is confirmed by a corresponding certificate from the ITU Bureau.

The decision that a child has a disability is made on the basis of the relevant state of health, worsened by acquired or congenital diseases or injuries. For adults, disability is divided into several groups; for young citizens of the Russian Federation this is not the case - they are simply assigned the status of a disabled person, and if their health has not improved even after reaching adulthood, they are assigned the appropriate group. It is the corresponding certificate that is presented to the authorities when applying for certain preferences, including vacations.

Social services for caring for a disabled child

The status of a child with disabilities is assigned when:

- serious disturbances in the functioning of the body (injuries, damage, developmental features, serious illnesses);

- inability to lead full life activities;

- undeniable need for support to meet mandatory needs, social assistance.

The final decision is made by members of the expert commission, on the basis of which the parent is issued a certificate.

Age criterion

Be sure to take into account the age of the person. It is already clear from the term itself that a citizen who has celebrated his eighteenth birthday will not be called a disabled child. An adult citizen undergoes a re-examination, where the degree of his need for help will be determined and the appropriate group will be assigned - or it will be recognized that there are no longer objective reasons to consider him disabled.

Preferential rights of parents if the child has a disability

The responsibility for undergoing examination and receiving various benefits falls on the parents. The baby himself cannot yet manage the money appropriately; official guardians do this for him - but in any case, all spending and use of help occurs solely for the sake of the sick son or daughter.

Find out detailed information about guardianship of a group 2 disabled person, payments, as well as types of benefits and benefits, in our new article.

Employment (hiring)

The Labor Code directly prohibits an employer from refusing to hire women for reasons related to the presence of children, regardless of whether they are disabled or not (part three of Article 64 of the Labor Code of the Russian Federation). This rule also applies to fathers raising children without a mother, guardians and trustees of minors (Article 264 of the Labor Code of the Russian Federation). When hiring, an employee is required to present a number of mandatory documents to the employer, and he is not obliged to inform the company about the health status of his child (Article 65 of the Labor Code of the Russian Federation).

Labor legislation provides for a number of benefits and guarantees for employees raising disabled children. In order to use them, the employee must present the child’s birth certificate and documents confirming his disability. Depending on the degree of impairment of body functions and limitations in life activity, children under 18 years of age are assigned the category “disabled child” (Part 3 of Article 1 of Federal Law No. 181-FZ of November 24, 1995, hereinafter referred to as Law No. 181-FZ)

To confirm the child’s disability, the employee must provide the employer with a certificate of the established form with the decision of the medical and social examination - MSE (Appendix No. 1 to the order of the Ministry of Health and Social Development of Russia dated November 24, 2010 No. 1031n). Disability can be established for a period of one year, two years or until the child reaches the age of 18 years. The specific deadline is indicated in the ITU certificate. Re-examination of children is carried out once during the period for which the child is diagnosed with a disability. Therefore, if the previous certificate has expired and the parents of a disabled child have not submitted a new ITU certificate, they are not provided with benefits at the place of work.

Documents confirming the assignment of disability (certificate, examination report, etc.) must be kept in the employee’s hands; the employer can only keep copies of these documents.

Social benefits for citizens with children with disabilities

Parents raising a child with disabilities have the right to receive some concessions regarding

- civil;

- tax;

- labor;

- pension legislation.

This possibility is regulated by Federal Law No. 181-FZ.

Federal Law “On Social Protection of Disabled Persons in the Russian Federation” dated November 24, 1995 N 181-FZ

As for labor relations, strictly speaking, there are no special concessions given to the parents of such children. Just like ordinary employees, they have the right to maternity, standard and additional leave, as well as leave to care for a son or daughter up to one and a half years old. True, they give additional days off, which are also paid, but this must be stated in the employment contract.

Attention! All guarantees apply only to those citizens who work under an official employment contract. Labor standards do not apply to civil legal relations, especially work without any official confirmation at all. So if an employer, in response to a request for a week of vacation at his own expense, offers to say goodbye, it is worth first of all remembering what kind of contract was signed when you were hired.

Insurance premiums.

The issue of charging insurance premiums for payments to parents for providing additional days off to care for a disabled child is also controversial.

The official position is that insurance premiums must be calculated from these amounts (Part 17, Article 37 of Federal Law No. 213-FZ dated July 24, 2009, Letter of the Ministry of Finance of the Russian Federation dated March 30, 2017 No. 03-15-05/18599). In particular, in accordance with paragraph 17 of Art. 37 of Federal Law No. 213-FZ financial support for the costs of paying for additional days off provided for caring for disabled children in accordance with Art. 262 of the Labor Code of the Russian Federation, including accrued insurance contributions to state extra-budgetary funds, is carried out at the expense of interbudgetary transfers from the federal budget provided to the Social Insurance Fund budget.

That is, they must be accrued and paid (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” ):

– insurance contributions for compulsory pension insurance; – insurance premiums for health insurance and compulsory social insurance in case of temporary disability and in connection with maternity; – insurance contributions for compulsory social insurance against accidents at work and occupational diseases.

There is an alternative position supported by judges in all districts. According to the arbitrators, since payment for additional days off provided to care for disabled children does not fall into the category of remuneration for labor, but is a means of ensuring social protection for the relevant categories of citizens, it is not subject to insurance contributions:

– Ruling of the Supreme Court of the Russian Federation dated April 19, 2018 No. 306-KG18-3498 in case No. A12-8078/2017; – Ruling of the Supreme Court of the Russian Federation dated April 19, 2018 No. 306-KG18-3492 in case No. A12-8081/2017; – Resolution of the Supreme Court of the Russian Federation of October 3, 2018 No. F01-4399/2018 in case No. A29-16002/2017; – Resolution of the Supreme Court of the Supreme Soviet of July 2, 2018 No. F02-2352/2018 in case No. A74-12264/2017; – Resolution of the Supreme Court of the Russian Federation of November 8, 2017 No. F03-3640/2017 in case No. A73-1890/2017; – Resolution of the AS ZSO dated May 30, 2018 No. F04-1817/2018 in case No. A70-9326/2017; – Resolution of the AS MO dated June 28, 2018 No. F05-8607/2018 in case No. A40-136588/2017; – Resolution of the AS PO dated August 15, 2018 No. F06-35197/2018 in case No. A06-8864/2017; – Resolution of the AS SZO dated September 19, 2018 No. F07-10646/2018 in case No. A13-19088/2017; – Resolution of the AS SKO dated 06/08/2017 No. F08-3553/2017 in case No. A32-23265/2016; – Resolution of the AS UO dated November 9, 2018 No. F09-6672/18 in case No. A76-24776/2017; – Resolution of the AS CO dated March 22, 2018 No. F10-520/2018 in case No. A48-3193/2017.

In fairness, we note that all court decisions adopted to date are based on the provisions of the Federal Law of July 24, 2009 No. 212-FZ “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund,” which has become invalid from 01/01/2017, and not according to the norms of the Tax Code of the Russian Federation. However, since the wording of these two documents is almost identical, we believe that the arbitrators will not change their opinion in the future.

What advice should you give to policyholders? If they are not afraid of being in a courtroom, payments for additional days off provided to employees with disabled children may not be subject to insurance premiums. For those who are more careful - in order to avoid controversial situations - it is better to charge insurance premiums.

Standard holiday

According to the standard rule, every person working under an employment contract has the right to take a break from work and receive compensation for it. Planned holidays last twenty-eight days and are provided according to a vacation schedule pre-established in the company, mandatory for all participants in labor relations (Article 114; 115 of the Labor Code).

A person working under an employment contract with a disabled child has the right to take a break from work and receive compensation for this

The same applies to employees with disabled children. The only difference is that they have the right not to wait in line, but to receive leave at their preferred time. Such vacations are also paid according to the standard rule - based on a person’s average income.

Attention! When talking about annual planned holidays, you should clearly understand which year is meant. The working year begins on the day the person was hired for the position, and not on the first of January, like the calendar year.

Planned rest is provided on the basis of an application and a supporting document - a certificate from the ITU. It is necessary to provide it, because after all, we are talking about privileges here - the opportunity to get leave bypassing the main line (Article 262.1 of the Labor Code; Federal Law No. 242-FZ).

Can a parent of a disabled child be fired while on vacation?

Benefits for parents and guardians of disabled children

There is an opinion that the father or mother of a child with disabilities cannot lose their job. This is true if we are talking about the initiative of the employer himself. However, if force majeure circumstances occur and a decision is made to close the company and cease its activities, the entire staff is fired, including those who are forced to raise seriously ill children, even if the employee is on legal vacation or is sick himself.

True, the head of the company is obliged to inform about such a measure in advance by a special letter with notification and an inventory of the investment. The text must clearly state that the company ceases to exist as a result of bankruptcy. After dismissal, such a subordinate must be paid, in addition to salary, bonuses, compensation for vacations, severance pay and average earnings for the time that he will look for a new place.

If the company goes out of business, all payments must be made to the subordinate after dismissal

Important! Often, employers, not wanting to part with money, ask their subordinates to quickly resolve everything - after all, it is better to devote time to a sick child than to waste it on routine - and write a statement of their own free will (Article 77 of the Labor Code), and they will quickly pay them everything. However, it should be remembered that in this case the employee will receive only bonuses and compensation, there is no talk of any additional payments.

Leave granted to parents of a disabled child

Parents of a child who has a disability may enjoy all standard rights. Among these rights is the provision of annual leave with all payments, the calculation of which is based on the average salary of the employee. Such rest time is provided on a first-come, first-served basis, in strict accordance with the vacation schedule adopted by the manager.

In 2015, changes were made to the labor legislation, a new article 262.1 appeared, according to which parents raising a child with a disability can count on receiving additional guarantees:

- The opportunity to go on vacation at a time chosen by the parent, but only on the condition that such a need is due to the need to provide a child with a disability with proper care.

- The right to receive additional days off.

All of the above guarantees apply only to parents of minor children.

Download for viewing and printing:

Article 262.1. The order of granting annual paid leave to persons raising disabled children by the Labor Code of the Russian Federation

Right to extra days off

In addition to standard days off, employees with disabled children are entitled to four additional days off. And they must also be paid. They are given every month upon a corresponding application from the father or mother of a child with disabilities, after which the head of the company issues an order.

The application is written in the form specified in Order of the Ministry of Labor No. 1055-n.

Order dated December 19, 2014 N 1055n

Sick leave

Sick leave when it is necessary to care for a sick disabled child under the age of 15 is paid for the entire period of outpatient treatment or joint stay with the child in a stationary medical institution. At the same time, a limitation has been introduced on the total duration of such periods - no more than 120 calendar days in the current year for all cases of caring for this child (clause 3, part 5, article 6 of the Federal Law of December 29, 2006 No. 255-FZ).

The Supreme Court of the Russian Federation, in Decision dated April 17, 2013 No. AKPI13-178, canceled the effect of paragraph 4 of clause 35 of the Procedure for issuing certificates of incapacity for work (approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). This norm linked the payment of sick leave while caring for a child in an inpatient treatment facility with an acute illness or exacerbation of a chronic disease. A certificate of incapacity for work is issued and paid to employees in all cases of being in a hospital with a child.

Additional standards

The law also regulates some features regarding the duration of the working day, namely:

- if a person has to work more than four hours, he is required to take a lunch break;

- the possibility of receiving reduced time - in agreement with the employer, for which they write a corresponding application with a draft of a more convenient work schedule.

As for overtime work and business trips, they are possible only with the official written consent of the employee. The mother or father of a disabled child has the legal right to refuse to participate in them (Article 259 of the Labor Code).

Article of the Labor Code of the Russian Federation 259 “Guarantees for pregnant women and persons with family responsibilities..”

Important! The employer must stipulate in advance that the subordinate has the right to refuse additional work.

How to apply

To exercise the right to a weekend, the parent follows a certain procedure provided for by PP No. 1048 of October 13, 2014.

You can agree on a shorter working week or month by proceeding in the following sequence:

- Drawing up an application requesting time off due to the need to care for a minor child with a disability.

- Preparation and submission of attached documents for review.

- Upon review of the paper and receipt of the manager’s visa, the personnel service issues an internal order signed by the director. For registration, use the T-6 form, or a template valid within the company.

- An order without the employee’s signature on familiarization is considered invalid. The personnel employee is obliged to familiarize him with it.

- How to write a vacation application: samples by type of vacation

It is not difficult to draw up a vacation application - a standard template accepted by the organization is used, only the text must indicate the days that the employee would like to use. As a rule, the period of absence from work is determined by mutual agreement. For this reason, before submitting an application, it is recommended to discuss the situation with your supervisor.

The law obliges such an employee to be given additional leave (a day off) if the manager has received an application form and supporting papers from a subordinate. You should be more careful when refusing a ward, because... an employee has the right to contact supervisory authorities and report a violation of rights. A manager who violates the law will face punishment in the form of a fine of 30-50 thousand rubles, or a three-month suspension from work.

Benefits for unemployed people

Even unemployed citizens who have to raise a son or daughter with disabilities have the right to receive assistance from the state, namely:

- social pension;

- one-time benefit;

- monthly payments.

In order to receive them, you must submit an application to the territorial division of the Pension Fund of the Russian Federation. This can be done through a personal visit or through Multifunctional). The main document from the guardian here is a certificate from the ITU, confirming the condition of the little citizen.

Unemployed citizens who have to raise a son or daughter with disabilities have the right to receive assistance from the state by contacting the Pension Fund of Russia

Rules for granting additional leave

As for the possibility of additional paid time off for parents with disabled children, this is not enshrined in labor legislation at all. As already mentioned, such an employee has the right to request:

- standard planned twenty-eight-day vacations at any time of the year without waiting in line like all other team members;

- maternity leave;

- leave to care for a son or daughter until they are three years old;

- additional days off.

It is the latter that is most often meant by the common term “additional paid leave” among ordinary people. Moreover, in terms of the principle of providing additional days off, it is closest to it (Article 262 of the Labor Code). In order to receive them, the father or mother writes a corresponding application addressed to the head of the company. Weekends are compensated at standard rates.

Labor Code of the Russian Federation N 197-FZ Article 262

Attention! However, only one guardian has the right to such an indulgence!

In addition, local regulations of large companies also often provide for the possibility of additional leave for parents of children with disabilities. If the CEO makes such a decision, appropriate changes are made to all internal regulations of the company.

How are additional days off paid under Art. 262 of the Labor Code of the Russian Federation?

Only weekends provided in accordance with Part 1 of Art. 262 of the Labor Code of the Russian Federation, that is, for disabled children.

Payment is made based on the standard calculation of average daily earnings for the previous 12 months.

For more details, see the article “How to calculate the average monthly salary (formula)?”

IMPORTANT! If a business maintains aggregated time records, the calculation time is the sum of the hours worked per day multiplied by 4 (or the actual number of days used).

Whether additional days off are subject to insurance premiums was clarified by L.A. Kotova, an active state adviser of the Russian Federation, 3rd class. Get acquainted with the official's point of view by getting free trial access to the ConsultantPlus system.

How to write a statement

The application is written in the first person addressed to the head of the company. The text of the document contains:

- date and place of compilation;

- full name of the company;

- to whom it is addressed - passport information, job title;

- from whom - position, surname, initials;

- title of the document - statement;

- the actual request for days off, indicating the dates;

- reference to the law;

- list of applications;

- signature with transcript.

An example of a sample application for additional paid days off to care for a disabled child

The subordinate must support his request with a number of documents.

| What are you entitled to? | Where to go | What documents are required |

| Establishment of a part-time working day (shift) or part-time working week for the employer for one of the parents (guardian, trustee) with a disabled child under the age of eighteen (Article 93 of the Labor Code of the Russian Federation) | To the employer | Written application, ITU certificate |

| Sending on business trips, engaging the employer to work overtime, night work, weekends and non-working holidays of employees with disabled children, only with their written consent (Article 259 of the Labor Code of the Russian Federation) | To the employer | ITU help |

| The impossibility of terminating, at the initiative of the employer, an employment contract with the employer with a single mother raising a disabled child under the age of eighteen, with a parent who is the sole breadwinner of a disabled child under the age of eighteen, if the other parent is not in an employment relationship (Article 261 Labor Code of the Russian Federation) | To the employer | ITU help |

| Additional paid days off (4 days per month) to the employer for one of the parents (guardian, trustee) for child care | disabled people (Article 262 of the Labor Code of the Russian Federation) | To the employer | Written application, ITU certificate |

| Providing one of the parents (guardian, trustee, foster parent) raising a disabled child under the age of eighteen with annual paid leave at his request at a time convenient for him (Article 262.1 of the Labor Code of the Russian Federation) | To the employer | Written application, ITU certificate |

What other documents are needed to take advantage of the benefit?

In addition to a certificate of non-use of days off by another person (or documents allowing it not to be issued), the employee submits to the employer:

- ITU certificate about the child’s disability;

- document confirming the registration of the child at the place of residence;

- documents confirming parental rights (birth certificate, adoption certificate, guardianship certificate, etc.).

These documents are submitted once during their validity period. For example, if a certificate from the Bureau of Medical and Social Expertise is issued for 1 year, it is enough to present it once this year.

The employer's representative, after reviewing the original documents, must return them to the employee, making the necessary copies for himself.

Find out how the latest judicial practice develops in the event of an employer’s refusal to provide additional days off to the parent of a disabled child, from an analytical selection from ConsultantPlus. If you don't already have access to the system, get a free trial online.

Required Documentation

To receive preferential holidays, an employee collects the following documents:

- certificate confirming birth or adoption (court decision);

- conclusion of the ITU Bureau;

- an extract from the house register;

- a certificate from the second guardian's work that he has not yet received such days off and has not requested them from his boss.

Required documentation to receive preferential holidays

Typically, a complete package of papers is collected only once. For subsequent applications, as a rule, a certificate from the ITU is sufficient. Directors most often do not even ask for a certificate from their father or mother that they have not yet taken advantage of this privilege, especially if a trusting relationship has developed with a subordinate. However, such a document should always be prepared by default and provided to the head of the company upon request.

Attention! None of this means that the other caregiver won't be able to get more rest. Weekends - as mentioned, there are four of them - can be divided. For example, a mother writes an application for two days off, and the father requests the remaining two days, at his place of work.

Certificate stating that the person is caring for a disabled child

Certificate from the other parent’s place of work: features

If the second parent is in an employment relationship, everything is simple. He takes from his employer something like this:

If the mother and father are not in contact, one of them avoids raising the child, then it will no longer be possible to demand a certificate of employment from the applicant himself. Although the personnel officer himself can try to make a request to the company, and perhaps receive an official response. But, to be honest, it’s better not to count on it. That is, there must be other documents. But, according to officials, the employer has the right to demand confirmation of the fact of evasion of education. One of the possible options in this case is a certificate of arrears in the payment of alimony from the bailiff service, according to the FSS. Fund specialists do not say what other documents could be brought in such a situation.

But they clarify that if no contact has been established with a person for a long time (more than one year), then in accordance with Article 42 of the Civil Code of the Russian Federation, you can go to court with an application to recognize the citizen as missing. In this case, the corresponding judicial act will become a replacement for a certificate from the other parent’s place of work.

In a situation where one of the parents is not employed, his/her spouse can provide a copy of the work record book to confirm that no one has previously used the benefit. Or you can bring a document from the employment service. If a citizen has not worked anywhere before, does not have a work book, and is not registered, then FSS specialists suggest writing about this application (in free form). Additionally, the employee must add that he is personally responsible for providing knowingly false information.

Unpaid holidays

In addition to standard holidays, teachers of children with disabilities have the right to request unpaid leave. True, such a possibility should be spelled out in the collective agreement that the employer is obliged to provide this kind of time off.

This type of vacation has other restrictions:

- it lasts a maximum of fourteen days;

- the employee has no right to ask for compensation for him;

- It is not allowed to transfer unused unpaid vacations to the next year.

At the same time, the employee has the right to choose when it is convenient for him to receive such leave. These two weeks can be added to the standard twenty-eight-day rest, used at other times of the year, at once or in “portions.” This concession applies to all workers, including part-time workers (Resolution of the Plenum of the Supreme Court of the Russian Federation No. 1 of January 28, 2014).

Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 28, 2014 N 1 “On the application of legislation regulating the work of women, persons with family responsibilities and minors”

Vacation registration

Registration of leave occurs with the obligatory execution of an order from the head of the organization. In turn, it is enough for the employee to present an application and documents confirming the right to receive such a state guarantee.

Procedure for drawing up an application

The application contains the following information:

- Personal information of the parent.

- Information about a child with a disability.

- The name of the organization where the employee works.

- The basis on which an employee has the right to receive additional days of rest.

- The nature of the work activity carried out by the citizen.

- Date of application and signature of the applicant.

Attention! A distinctive feature of such days of rest is that it is given to both parents at once. Therefore, if the child’s mother applied for part of the vacation days, the father can only use the remaining part after that.

Documentation

To apply for leave, the employee must provide the head of the enterprise with the following documents:

- Document confirming the completion of the examination.

- Statement.

- Certificate of permanent residence of the child.

- Certificate of birth of the baby.

- A certificate received from the spouse’s place of work and confirming that he did not exercise his right to receive additional leave.

How to Get More Compensable Time Off

In order to receive additional days off, the following system of rules is provided:

Step 1. The citizen determines on which days he needs to be free from work in order to devote this time to caring for a person with disabilities.

Step 2. Negotiations with the employer, verbal agreement on dates.

Step 3. Collection of necessary documentation.

Step 4. Writing an application.

Step 5. The head of the company endorses the application and issues an order in form T-6 for review against signature.

Despite the fact that time off should be provided upon first request and the presence of all required papers, for reasons of business ethics it is better to coordinate your plans with the directorate in advance so as not to slow down the production process and explain which day is desired and why. This will serve as an additional advantage in establishing trust between the boss and subordinate.

“Code of the Russian Federation on Administrative Offenses” dated December 30, 2001 N 195-FZ (as amended on March 18, 2019) Code of Administrative Offenses of the Russian Federation Article 5.27

Attention! The employer does not have the right to refuse if the subordinate has provided a complete package of papers. For tyranny and unreasonable refusal, the company can receive a fine of up to fifty thousand rubles, or even suspension of activities for three months (Article 5.27 of the Administrative Code).

Video - Four days of caring for a disabled child

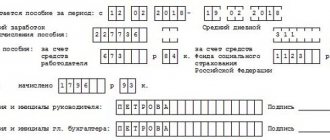

Calculation of average earnings to pay for days of care for disabled children.

According to Art. 139 of the Labor Code of the Russian Federation, payment for each additional day of care for disabled children is made in the amount of average earnings, determined in accordance with the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as the Regulations).

The average salary is calculated based on the salary actually accrued to the employee and the time actually worked by him for the 12 calendar months preceding the period in which the employee is given an additional day off to care for a disabled child. In this case, the calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive) (Part 3 of Article 139 of the Labor Code of the Russian Federation, p. 4 Regulations). Thus, the calculation period for calculating average earnings for paying for days of care for disabled children provided in February 2019 is the period from 02/01/2018 to 01/31/2019.

When determining average earnings, all types of payments provided for by the remuneration system and applied in the relevant institution are taken into account, regardless of the sources of these payments, including wages accrued to the employee (clause “a”, clause 2 of the Regulations). In this case, time, as well as amounts accrued during this time, are excluded from the billing period if (clause 5 of the Regulations):

– the employee was on regular paid leave, a business trip, he was paid the average salary on other grounds provided for by the Labor Code of the Russian Federation (clause “a”); – the employee received temporary disability benefits (paragraph “b”); – the employee was provided with additional paid days off to care for disabled children (paragraph “e”).

In addition, when calculating average earnings, social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account (clause 3 of the Regulations).

In practice, when checking the correctness of expenses for the payment of insurance coverage for compulsory social insurance, disputes often arise between FSS inspectors and employers about the legality of including certain payments in the calculation of average earnings. For example, SZO arbitrators believe that if financial assistance is provided for in the wage system, then it should be included in the calculation.

| Judges' conclusion | Details of the resolution |

| The amount of financial assistance is rightfully included in the calculation of average earnings to pay for days to care for disabled children, since it relates to incentive payments and is part of the remuneration system (in the case under consideration, financial assistance to employees of a state government institution was paid in accordance with the regulations on remuneration for their taking annual paid leave) | Resolutions of the AS SZO dated September 27, 2018 No. F07-11091/2018 in case No. A66-8838/2017, dated November 27, 2017 No. F07-12522/2017 in case No. A66-13705/2016 (Determination of the Supreme Court of the Russian Federation dated May 10, 2018 No. 307 -KG18-918 refused to transfer the case to the Judicial Collegium for Economic Disputes of the RF Armed Forces) |

To avoid disputes, the institution's accountant must weigh the pros and cons of adopting this approach.

How do they pay?

According to current regulations (Federal Law No. 213-FZ, Article 17), additional free days are paid by the Social Insurance Fund based on the average income of the applicant.

For example, an application was received for additional days off from the cleaning manager Nikolaeva. Her average earnings per shift is one thousand rubles. Accordingly, she is owed 4 thousand rubles for the four requested days.

The same rule applies to part-time workers, however, here the Social Insurance Fund often does not want to pay for the requested days, citing the fact that part-time workers have already been compensated for them at their main place. Such a refusal is illegal - benefits apply to all places where the parent of a son or daughter with disabilities works, and not just to basic ones (Article 287 of the Labor Code). So if this is the answer from the employer, it is worth referring to the norm of the Labor Code and demanding all due compensation.

According to current regulations (Federal Law No. 213-FZ, Article 17), additional free days are paid for by the Social Insurance Fund

How to deal with personal income tax

Speaking about compensation, we cannot ignore the topic of withholding personal income tax from them. The question of whether personal income tax should be withheld from parents when calculating compensation for additional days off remains one of the most frequently asked questions - because there is no consensus on this matter even among lawyers.

Many experts are inclined to answer - yes, it is necessary to deduct tax. And that's why. The Social Security Fund pays for the requested time off. There is an exhaustive list of financial income from which personal income tax cannot be deducted; it is established by the norms of Art. 217 of the Tax Code of the Russian Federation. That is, we are talking about government compensation, benefits, and other payments required by law. Their list is contained in Federal Law No. 81-FZ. There is nothing said there about additional days off for fathers and mothers of children with disabilities. Consequently, this privilege does not apply to them and it is necessary to deduct personal income tax. The Ministry of Finance of the Russian Federation took exactly the same position (Letter No. 03-04-05-01/407; Letter No. 03-04-06-01/184, Letter No. 03-04-06-01/117; Letter No. 03- 04-06-01/47, published in 2007).

| Type of form | Form | Sample |

| Blank report form 4-FSS |

However, there are other points of view on this issue, which also have significant justifications. Many accountants are confident that there is no need to calculate personal income tax on such compensation, because this benefit, by its original nature, cannot be considered a reward for work performed or a material benefit. This is precisely compensation from the state for those people who are forced to raise disabled children and waste days on this when they could work and receive an appropriate income. After all, it is not subject to dispute that raising a son or daughter with disabilities, rehabilitation measures, and caring for them require much more time than ordinary children and this cannot be done on a standard weekend. Since this is compensation, according to the same Article 217 of the Tax Code, personal income tax may not be deducted from it.

Thus, everything here initially depends on the financial policy of the company and on the position that businessmen adhere to regarding this issue.

Certificate issued to a disabled child

Personal income tax.

By virtue of paragraph 1 of Art. 217 of the Tax Code of the Russian Federation, state benefits are not subject to personal income tax, except for temporary disability benefits (including benefits for caring for a sick child), as well as other payments and compensations made in accordance with current legislation.

For a long time, the question of whether this norm of tax law applies to the payment of average earnings for additional days off provided to employees caring for disabled children in accordance with Art. 262 of the Labor Code of the Russian Federation, was controversial. Officials gave a negative answer. However, the issue has now been resolved in favor of taxpayers. The Presidium of the Supreme Arbitration Court expressed the opinion that payments for additional days off to care for disabled children are not subject to personal income tax, and the tax authorities had no choice but to agree:

– Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/08/2010 No. 1798/10; – Letter of the Federal Tax Service of the Russian Federation dated December 11, 2018 No. BS-3-11/ [email protected]

If the employer withheld personal income tax from the amounts paid for additional days of rest provided for in Art. 262 of the Labor Code of the Russian Federation, the employee has the right to return the excessively withheld amount of tax by submitting a corresponding application to the employer.

Possibility of early retirement

The state also provides for the opportunity for educators of disabled children to retire from working life early. Moreover, the time that a person spent caring for a disabled person is counted towards the insurance period based on the application. The rule is: 1.8 pension units per year.

It is important to remember that the citizen himself is obliged to think about this possibility and whether he needs such inclusion in the insurance record. He must submit the corresponding application independently - during a personal visit to the Pension Fund or by means of a general power of attorney. If care for a disabled child is terminated due to some factors, a statement about this must be submitted immediately, otherwise the Pension Fund of Russia will still reveal this during an audit and oblige the citizen to return the funds allocated to him.

So, it turns out that citizens with disabled children actually have exactly the same opportunities as ordinary employees. Privileges include extraordinary receipt of twenty-eight days of leave, unpaid vacations and paid additional non-working days. The legislation of the Russian Federation does not provide for a special second paid vacation.

Manager's order

Based on the employee’s application, the employer issues an order (in any form) to provide additional days off. It should indicate:

- FULL NAME. and the position of the employee;

- dates for providing days off;

- reasons for providing additional days off;

- payment information.

In addition, the document should include a line indicating that the employee is familiar with the order.

Read in the taker

A manager’s order to provide an employee with additional days off may look like what is shown in the berator