Some of the information on the sick leave certificate is encoded. It is understandable only to medical workers who draw up the newsletter, and to the personnel inspector and accountant who calculates the payment. The reason for disability has 2 main cells and 5 explanatory cells: additional code (3) and change code (2). All types of diseases are summarized in 15 categories: from 01 to 15. The amount of payment largely depends on the specified code. The designation of disability also takes into account the reason for which the impairment was determined. In the article we will talk about what code 02 means on a sick leave certificate.

What is written on a sick leave sheet

The following data is entered into a document such as a certificate of incapacity for work:

- Full name of the sick patient (the basis is an identity card, namely a passport).

- The date, month and year of his birth.

- Floor.

- Name of the organization (factory) where the patient works (based on the patient’s words). If the patient works for an individual entrepreneur or is one himself, then the full name of the employer is indicated in this column.

- Information about where the sick leave was issued: at the place of work or residence.

- Patient Taxpayer Identification Number.

- Reason for disability.

- Date of opening and filling out sick leave.

- The period during which a person was unable to work.

- All kinds of violations of the regime.

- Other information.

- Conditions for calculating cash benefits.

All codes in the document, starting from the first to the penultimate one, are entered by the doctor who opens the sick leave. But the conditions for calculating disability benefits (in coded form) are entered by the employer, namely the employee dealing with these issues.

Why do you need to encode information?

What is the purpose of coding? And it is as follows:

- fully preserve confidential information about the patient’s illness;

- minimize the likelihood of any counterfeit;

- desire to use medical forms economically and compactly;

- have the opportunity to cooperate with various medical institutions abroad;

- significantly simplify (sometimes a doctor’s handwriting is very difficult to read) and optimize the activities of HR workers.

On a note! Not only the personnel officer, but also the patient himself can familiarize himself with the decoding of these codes: it is presented on the back of the sick leave. Just turn it over and read it.

Who needs these codes

The most important part of the certificate of incapacity for work is the columns in which codes are entered indicating certain reasons why patients cannot be at work and carry out their professional activities as usual. Several cells are allocated for this encoded information:

- the first two are the main code (numbers from 01 to 15);

- the next three are an additional code (numbers from 017 to 021);

- the final two are a clarifying code (fixed if the diagnosis has been clarified).

Why do you need to use so many codes? Who needs them? And they are needed both by medical workers and by management (that is, the employer).

Basic codes

So, let's take a look at the list of basic codes that the doctor writes in the first two cells of the medical document:

- 01 – the presence of any disease that does not require the patient to be at work.

- 02 is a sick leave code indicating a person’s incapacity for work as a result of being injured.

- 03 – quarantine is declared, preventing a person from being at work.

- 04 – the patient received an injury (or consequences after it) directly at the workplace.

- 05 – leave was granted for the period of pregnancy and childbirth.

- 06 – the need for prosthetics in a medical hospital.

- 07 – exacerbation of a previously identified disease or detection of an illness associated with professional activity.

- 08 – rehabilitation period in a sanatorium after an illness.

- 09 – exemption from work, which is issued in case of caring for a sick close relative.

- 10 – other circumstances entailing the release of a person from the need to be at the workplace.

- 11 – a disease specified in a special list (for example, mental disorder, hepatitis, diabetes mellitus or other similar ones) approved by the government.

- 12 – the need to care for a child (under 7 years of age) who has one of the ailments listed in the list of diseases approved by the Ministry of Health and Social Development.

- 13 – presence of disability in a child who needs care.

- 14 – a case when a child is diagnosed with a malignant disease or certain complications arise after vaccination.

- 15 – caring for a child with HIV infection.

Additional codes

Now let’s find out what additional codes are put down in the next three cells of the disability sheet:

- 017 – the need for treatment in a special-purpose medical institution.

- 018 – staying in a sanatorium (or resort) after undergoing treatment for an injury received as a result of an accident at work.

- 019 – therapeutic activities carried out in rehabilitation clinics.

- 020 – maternity leave provided in addition to the main one.

- 021 – release due to illness or injury resulting from intoxication (drugs, alcohol or toxic).

Important! If the reason for the employee’s absence from his place is fully reflected in the first two cells of the sick leave sheet, then the next three do not need to be filled out. But if such a need exists, then the medical worker enters both the main code and the additional one.

Reducing the amount of benefits provided

An injured employee must undergo prescribed treatment and follow the prescribed regimen. If the conditions are violated, the benefit amount will be reduced. In practice, there are 3 common reasons. The medical worker enters additional codes on the certificate of incapacity for work.

After deciphering the indicators, the employer decides to reduce the payment amount. Reducing the amount of payment due to violation of the regime is not the responsibility of the employer. The benefit can be paid in full if the employee has a valid reason, for example, the illness of a relative.

| Basis for additional marking | Reflection in LN |

| Getting injured while under the influence of alcohol, toxicology or drugs | In the certificate of incapacity for work, the medical worker enters an additional code for the cause of the disease 021 |

| Violation by an employee of the established treatment regimen, failure of a person to appear for a medical examination at the appointed time without good reason | In the LN, the corresponding indicator is recorded in the line “Notation of violation of the regime.” Code 23 is indicated in case of non-compliance with the regime and 24 in case of failure to appear for a medical examination |

If violations are detected, monthly benefits are paid based on the minimum wage (Article 8 of the Federal Law of December 29, 2006 No. 255-FZ). From January 2021, the minimum wage will be 11,280 rubles. In remote regions with regional coefficients, the amount of payment is determined taking into account the increase. The minimum amount of benefits is also provided for employees with less than 6 months of service.

Payment of sick leave for a domestic injury

What is sick leave? This is a medical document that indicates the reasons for a person’s temporary disability and on the basis of which he can receive (for the entire period of absence from work) a certain amount of money.

How is sick leave paid? That is, what factors are fundamental in determining the amount intended to be paid to the employee?

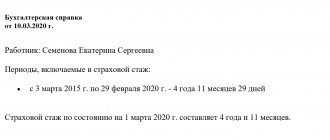

- The insurance record of the person presenting sick leave for payment. Moreover, if this length of service is up to 5 years, then the amount of the benefit will be equal to 60% of the average salary; if from 5 to 8 years, then the employee receives 80% of the PPP; and if more than 8 years, then he has a chance to get 100%.

- Average annual earnings.

Important! Keep in mind that there are significant limitations in determining average earnings per year. So, in 2021, its largest amount was 670,000 rubles. That is, even if, during the actual calculation, your average annual income significantly exceeds this figure, the value that is officially determined to be the highest will be taken into account in the calculation of hospital compensation.

- Average daily earnings.

- The number of days during which the employee may be absent from work.

Important! If the reason for the employee’s absence is illness (for example, the flu) or a domestic injury, then payment for the first three days is the responsibility of the employer directly, and the subsequent days are paid exclusively from the Social Insurance Fund (SIF) - see Law No. 255-FZ (clause 1, part 2, article 3).

Answers to common questions

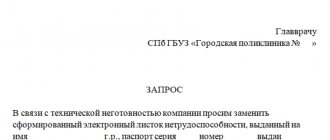

Question No. 1. Does the employer participate in confirming the fact of domestic injuries?

The employer or commission does not participate in establishing the fact, time of receipt of another injury by the employee, or the circumstances of the incident. Employer involvement is limited to work-related injuries.

Question No. 2. Are there any restrictions on the period of disability for a domestic injury paid by the employer?

The legislator has established restrictions on the paid period of incapacity for work for other injuries sustained during a fixed-term contract. An injury sustained during the validity of a six-month contract is paid for no more than 75 days (Article 6 of the Federal Law of December 29, 2006 No. 255-FZ).

Example of calculating hospital compensation

Theoretically, of course, everything is extremely clear. Let's see how in practice you can independently determine the amount due to you.

Let's say citizen Ivan Ivanovich Ivanov was absent from work due to a domestic injury (or due to the flu) for 10 days (note, calendar days). Ivan Ivanovich’s average daily earnings is 1,600 rubles, and his insurance experience is 7 years. The benefit amount will be 12,800 rubles (1,600 x 10 x 80%). Of these, 3840 rubles (1600 x 3 x 80%) will be paid by the employer, and the remaining amount will be 8960 rubles from the Social Insurance Fund.

Deadlines for submitting sick leave to guarantee receipt of benefits

A sick leave certificate issued due to illness, disability - code 02 (deciphering is presented above) - or for other circumstances, the employee must present before six months (or rather, 6 months) have passed from the date indicated in the medical document (and exactly in the column “by what date”).

Remember! In case of delay, sick leave benefits are not paid. For example, if the last day on sick leave is May 15, then the latest date for presenting the document is November 15. If you do this even a day later, you will not receive benefits.

General information

A code instead of a diagnosis on new sick leave is one of the requirements of the form. Certificates are provided to the company’s accounting department to calculate benefits. In order to correctly carry out the calculation, it is necessary to identify the cause of the disability: an accident or occupational disease, a domestic injury or a common pathology. The benefit is calculated in the manner prescribed by Federal Law No. 255, which regulates the rules of compulsory social insurance for the employee. Decoding of disease codes on sick leave certificates is given on the reverse side of the form. This information is used by both the health worker and the accountant when filling out certificates.

Number of days for which benefits will be paid

There are certain deadlines for assigning and paying sick leave:

- The period for consideration and assignment of benefits is 10 calendar days. The countdown begins from the day the sick leave is presented. This is stated in Law No. 255-FZ (Part 5, Article 13, Part 1, Article 15).

- Payment of benefits is made at the earliest (after it is assigned) date of payment of the next salary in accordance with the same Law (Part 8, Article 13, Part 1, Article 15).

On a note! For each day of delay, you have the right to demand compensation in accordance with the Labor Code of the Russian Federation (Article 236).

How is sickness paid?

The period during which a person was considered incapacitated must be confirmed by a sick leave certificate. Payment for this period is made as standard, as for general diseases.

The time it takes an employee to recover from an injury is paid in full. It does not matter what regimen the doctor prescribed - home or hospital.

The company pays for the first three days from its own budget . The remaining days of sick leave are paid by the Social Insurance Fund in the form of benefits.

Number of paid days on sick leave

If an employee is sick or absent from work due to disability - code 02 (explained above), then the benefit must be guaranteed to be paid for the entire period of exemption from performing his professional activities (or more precisely, for all calendar days indicated in the medical document) . This is clearly stated in Law No. 255-FZ (Part 1, Article 9). Moreover, there are no restrictions on the maximum duration of the paid period. The only exceptions are sick leave benefits for employees hired for temporary work or with disabilities.

Important! If an employee falls ill or is absent from the workplace due to incapacity for work - code 02 (explained above) during the next paid leave, then benefits are paid for the entire period of incapacity for work. The vacation (by agreement) is either extended or postponed to another convenient time. This seems very fair.

Errors made when registering and calculating personal injury claims

Error No. 1. Employees hired under civil contracts do not have the right to payment for the period of incapacity for work. It is a mistaken position that the injury must be paid.

Error No. 2. Employees who change jobs must provide information about their earnings in a certificate in Form 182n. Employers who do not have information about an employee’s earnings in the previous 2 years refuse to pay the person personal compensation. The employer's refusal is erroneous. The employer has the right to make calculations based on available data. In addition, information about a person’s income during the period of work with previous employers can be requested from the Pension Fund. If the employee provides income data after the benefit is calculated, the amount is recalculated.