A sample payment order under the simplified tax system is a document confirming the payment of tax by organizations and individual entrepreneurs applying the special tax regime of the simplified tax system, which provides for the payment of three advance payments during the year and payment of the tax at the end of the year.

Taxpayers with the object “income minus expenses” at the end of the year calculate the minimum tax and compare it with the amount of tax in connection with the simplified tax system, calculated at the rate in force in the region. The larger of the two amounts received is paid to the budget.

An important change: from 2021, the minimum tax is paid not on a separate BCC, as before, but on the BCC for the simplified tax system “income minus expenses”.

If the simplified tax system is paid for 2021, the payment order may contain only two BCC values, depending on the selected taxation object.

Table of KBK used by taxpayers of the simplified tax system in 2020

The simplified tax system with the object “income minus expenses” and the minimum tax should be calculated and paid according to the following BCC:

- 18210501021011000110 - tax;

- 18210501021012100110 - penalties;

- 18210501021012200110 - interest;

- 18210501021013000110 - fines.

The simplified tax system with the object “income” should be accrued and paid according to the following BCC:

- 18210501011011000110 - tax;

- 18210501011012100110 - penalties;

- 18210501011012200110 - interest;

- 18210501011013000110 - fines.

The sample payment system for the simplified tax system “income minus expenses” 2021 contains details that are applicable both for paying tax in connection with the simplified tax system and for paying the minimum tax calculated at a rate of 1% of annual income. The only difference will be in the purpose of payment.

When paying tax in connection with the simplified tax system, in the purpose of payment we write: “Tax in connection with the application of the simplified tax system for the 1st quarter of 2021.”

When paying the minimum payment, the following text is appropriate in the purpose of payment: “Minimum tax for 2021.”

The minimum tax is calculated at the end of the year; at the end of the quarter, advance payments are made according to the simplified tax system.

Where to get a receipt for payment of the simplified tax system

A payment order allows you to pay tax from an individual entrepreneur’s current account. You can also make payments from your personal account. person or through a bank cash desk, for this you will need a payment receipt with correctly filled in details.

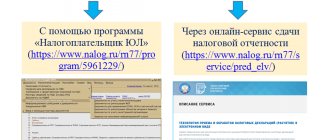

A receipt for payment of tax according to the simplified tax system can be generated using:

- service “Payment of taxes and duties” on the Federal Tax Service website;

- accounting programs for individual entrepreneurs;

- Internet banking.

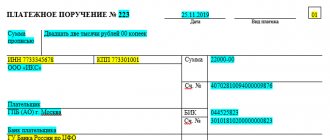

Sample payment order for payment of the minimum tax in 2020 for individual entrepreneurs

Since the minimum tax is paid only at the end of the year, field 107 should always contain the value KV.04.2019; For advance payments, use the value of the quarter for which the payment is made.

The sample payment system for the simplified tax system “income” 2021 contains the same values of fields from 104 to 110 for both organizations and individual entrepreneurs.

What to do if you didn’t pay advance payments on time

First, pay them as quickly as possible, because for every day of delay you will be charged a penalty. You can calculate the approximate amount of penalties using a calculator; a reconciliation with the tax office will show you the exact amount. According to the law, failure to pay advance payments is punishable only by penalties, but in reality everything turns out to be more complicated.

The tax office will understand how many advances you had to pay only next year on your declaration. Therefore, if you have not paid advances, there is a risk that the tax office will demand that you pay them immediately after you report. Even if at the end of the year there is no longer any tax debt. For example, if you paid your contributions in December and reduced your tax for the year to 0.

Why is that

The Federal Tax Service program takes the amount of your advances from the declaration under the simplified tax system and notes how much you had to pay on a specific date. Then it checks the amounts you paid. If there are fewer of them than accrued, then they send you a demand. And even if you paid or reduced the entire tax once at the end of the year, the tax office will see this only on March 31 for an LLC or April 30 for an individual entrepreneur - according to the deadline for paying the tax for the year.

No matter what you do, you cannot avoid unnecessary hassle: if you ignore the payment requirements, the tax office will still withdraw money from the account, then an overpayment will form and you will have to go to the tax office with an application for a refund or credit.

But there is one trick that will help you avoid the tax authorities’ requirements altogether: submit your return under the simplified tax system a couple of days before the end of the term. The tax office simply won’t have time to make a demand.

General procedure for processing tax payment orders

Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n determines the mandatory details for paying taxes and insurance premiums:

- 101 - status of the payer who issued the payment document;

- 104 - twenty-digit budget classification code, where the first three digits correspond to the tax administrator number;

- 105 - OKATO;

- 106 - basis of payment, consists of two letters (TP, ZD, AR);

- 107 - frequency of tax payment - month, quarter, half year, year;

- 108 — document date, filled in depending on the indicator of field 106;

- 109 - document number, if the debt is repaid on demand;

- 110 - payment type, currently not filled in.

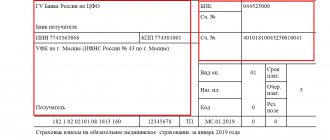

How to correctly fill out an individual entrepreneur’s payment slip on the simplified tax system “income”

Basic details can be divided into several groups.

1. Information about the taxpayer

You must indicate your last name, first name, patronymic, tax identification number and registration address. It is necessary to indicate the address; without it, the bank will not miss the tax payment. The payment order also indicates the taxpayer's current account, the bank where it is opened, his BIC and correspondent account, the checkpoint remains blank.

For additional identification of the taxpayer status, indicate in the fields:

- 101 - code 09;

- 105 - OKTMO code corresponding to the municipality where you are registered.

2. Information about the payee

The details are filled in taking into account the information received about the payment details of the tax office.

Despite the fact that the funds are intended for the tax inspectorate, the actual recipient of the payment must indicate the federal treasury department for the corresponding region, and the name of the specific inspection must be written in brackets.

The correspondent account number is not filled in.

3. Payment information

Basic data is entered in the fields:

- 6 and 7 - payment amount in words and numbers, respectively;

- 24 - purpose of payment;

- 104 - KBK;

- 106 - basis for payment;

- 107 - tax period;

- 108 and 109 - document number and date.

The BCC determines the type of tax payment. For the simplified tax system “income” the following codes are used:

- 182 1 0500 110 — basic amount of tax;

- 182 1 0500 110 - tax penalties;

- 182 1 0500 110 — interest on tax;

- 182 1 0500 110 - fines for late tax payment.

The most common reasons for payment:

- TP - payments within the established payment period;

- ZD - repayment of overdue debts on a voluntary basis;

- TR - repayment of debt after a requirement issued by the tax authority.

For other cases, specific codes are provided; they can be clarified on the tax website or using reference services.

The tax period when paying an advance according to the simplified tax system is a quarter, when paying the last payment - a year. If payment is made in response to a demand for repayment of a debt, the due date specified in it is set.

The document number and date are entered in accordance with the received request. When the payment grounds are TP and ZD, zeros are placed instead.

The received request may also indicate the UIN; it must be reflected in field 22.

We recommend reading: Transition of individual entrepreneurs from UTII to simplified tax system: transfer rules, deadlines and necessary documents.

KBK codes according to the simplified tax system “income” 6% in 2017–2018

Incorrect indication of the income code can lead to serious troubles. However, at the same time, mistakes happen quite rarely. The fact is that even if the payment code contains the code for the previous year, the funds will still be sent to their intended destination. Therefore, there are no grounds for imposing sanctions. It is even more difficult for those who use the KBK under the simplified tax system for “income” to make a mistake, because the codes for this system have not changed since 2014.

The BCC for the simplified tax system for 2014–2016 for various taxation objects (including the BCC for the simplified tax system of 15% for 2014–2016) can be clarified in reference books. We are now only interested in the BCC under the simplified tax system of 6% for 2017–2018. They are shown in the table.

Codes according to the simplified tax system “income” 6% for 2017–2018

182 1 0500 110

182 1 0500 110

As you can see, the KBK according to the simplified tax system “income” of 6% for 2021 for each type of payment is no different from the KBK according to the simplified tax system “income” for 2017 for the same types of payments. The difference in the codes for the main tax, penalties and fines is only in one digit - in the 14th digit, which characterizes the subtype of budget revenues.

To what budget is the simplified tax system paid and when do you need to give the payment to the bank?

Simplified taxation is a special tax regime (Article 18 of the Tax Code of the Russian Federation). Taxes paid under special regimes are a type of federal taxes (clause 7 of Article 12 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated April 20, 2006 No. 03-02-07/2-30). However, the answer to the question: “To what budget is the simplified tax system paid?” - not so obvious.

The fact is that the Tax Code of the Russian Federation does not connect the type of tax with the type of budget to which it goes. In accordance with paragraph 2 of Art. 56 of the Budget Code of the Russian Federation, the simplified tax in full (including its minimum part) is subject to credit to the regional budget.

Current simplified tax payments are made quarterly in advance until the 25th day of the month following the reporting quarter. To determine the final annual amount, you need to perform the following actions according to the deadlines indicated below:

Tax payment is carried out by submitting a receipt to the bank (this is only possible for individual entrepreneurs) or a payment slip according to the simplified tax system - in 2018 you need to pay for 2021. The moment of payment (clause 3 of Article 45 of the Tax Code of the Russian Federation) is considered the moment of submission of the payment to the bank, provided that the required amount of funds is available in the payer’s account. The last days for the formation and transfer of payment slips to the bank - taking into account postponements due to weekends - will be April 2 (for legal entities) and April 30 (for individual entrepreneurs) 2018.

Innovations in the BCC from January 1, 2021

From 2021, the BCC must be taken from Appendix 1 to the Procedure approved by Order of the Ministry of Finance of Russia dated 06.06.2019 N 85n, Appendices 1, 2 to Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n. This is new. In 2021, the codes were taken from Appendices 1, 2, 3 to the Procedure approved by Order of the Ministry of Finance of Russia dated June 8, 2018 N 132n;

We have, conditionally, summarized the new BCCs from January 1, 2021 into several groups of changes.

Change No. 1: New BCC for state duty

New BCCs from 2021 concern new payments that will be transferred. For example, starting from 2021, the Federal Tax Service will begin to maintain a unified accounting reporting resource. Tax authorities will provide data from balance sheets, but will require a fee for this. The money must be transferred according to KBK 182 1 1300 130 (Appendix 2.1 to Order No. 86n as amended by Order No. 149n).

We also added codes for the state fee for a comprehensive environmental permit (048 1 0800 110), payments for information from the Unified State Register of Real Estate (321 1 1301 130).

Change No. 2: new BCCs for fines for violations

In 2021, a specific BCC is provided for fines for each type of tax violation. Instead of two BCCs for fines from Chapter 16 of the Tax Code, you need to use 20 codes (details in the table below).

New codes have also been introduced for administrative fines for late returns, failure to provide information to the Federal Tax Service and other violations in the field of finance, taxes and fees (see below the KBK table on administrative tax fines).

Separate codes were also introduced for fines for violations of state registration legislation, illegal sale of goods, and non-use of cash registers (see the KBK table for fines for violations in business activities).

We also added codes for paying administrative fines for violating environmental protection rules, traffic rules for heavy trucks, etc.

Changes No. 3: new BCC for excise taxes

For excise taxes on ethyl alcohol from food and non-food raw materials, which was produced in Russia, one code was established: 182 1 03 02011 01 1000 110 instead of codes 182 1 0300 110 and 182 1 03 02012 01 1000 110. Codes for excise taxes on imported ethyl alcohol and wine, grape, fruit, cognac, Calvados, and whiskey distillates remain the same. See the table with the BCC of excise taxes on goods produced in Russia.

This might also be useful:

- When should an individual entrepreneur pay the simplified tax system?

- Minimum tax under the simplified tax system in 2021

- simplified tax system for individual entrepreneurs in 2021

- How to calculate the simplified tax system?

- How to reduce the simplified tax system for insurance premiums?

- How to work on the simplified tax system income 6%

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payment amounts

The total mandatory fixed payment for insurance premiums of individual entrepreneurs for 2021 is 40,874 rubles. It includes a contribution to compulsory health insurance – 32,448 rubles. and compulsory medical insurance contribution – 8426 rubles. (clauses 1, 2, clause 1, article 430 of the Tax Code of the Russian Federation).

The deadline for payment of the fixed payment for 2021 is no later than December 31, 2020. You can pay your fees in installments throughout the year or in one lump sum. Transfer contributions for compulsory medical insurance and compulsory medical insurance to the Federal Tax Service in two separate payments:

BCC of a fixed contribution to OPS – 182 1 02 02140 06 1110 160.

BCC of a fixed contribution for compulsory medical insurance – 182 1 02 02103 08 1013 160.

| Type of contribution | KBK |

| Insurance premiums for compulsory health insurance for yourself (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance for yourself | 182 1 0213 160 |

If the fee is paid to the wrong BCC, it will be stuck in unclear payments. The tax office will not see it and may charge a penalty on the amount owed. However, this is illegal - after all, an error in the KBK is not a basis for recognizing the obligation to pay the contribution as unfulfilled (Letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/[email protected]).

If you made a mistake with the KBK, fill out an application to search (clarify) the payment. In the application, indicate the type of insurance premium, the BCC for which it was paid and the tax period (the year for which it was paid). A document confirming payment of this fee must be attached to the application.

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles.

Registration of penalties and debts according to the simplified tax system

A penalty on the tax paid is a necessary condition, not a penalty. It facilitates timely payment of taxes and has almost no difference with the original example of the simplified tax system for profit and is filled out in the same way. There are several distinctive nuances, one of which requires a description of the KBK code. Before providing the penalty form, you must enter the appropriate code, and when paying the income-expense penalty, enter the code 18210501021012100110.

There is one more nuance regarding the “Basis of payment” field. If the entrepreneur decides to recalculate the penalty himself with an arbitrary payment, then when paying, he must indicate - ZD. If the payer has received a written notification of payment, the TP code is written in this column. If the recalculation of penalties is made on the basis of an act after the corresponding tax audit, then the AP is indicated in the column. These conditions are met when paying the minimum tax.

The field that prescribes the terms of repayment, in a payment order according to the usn, is sometimes set to 0. This happens when the penalty is paid in an arbitrary manner, or in the presence of a drawn up act, and therefore does not require a specific date. In other cases, the column indicates the numbers corresponding to the appointed date. And if the calculation is carried out upon request, then the number indicated in the resolution is written in the column.

In addition to the above aspects, in case of arbitrary payment of penalties, without the presence of various regulations, it is recommended to indicate 0 in the order number and date. After the control audit, the numbers specified in the requirement are indicated in this line.

What details are needed to pay the simplified tax system and where to find them

Entrepreneurs and organizations that use the “simplified” tax system make payments under the simplified tax system several times throughout the year. In accordance with accepted reporting periods (quarter, half-year and 9 months), upon completion of each quarter, advance payments are made within 25 days:

- until April 25 - for the first quarter;

- no later than July 25 - for half a year;

- October 25 is the payment date for 9 months of the current year.

There is no advance payment for the last quarter, since the tax period ends at the same time. In this regard, the taxpayer has the obligation to report and pay tax based on the results of work for the entire year. The deadlines established for the transfer of tax to the simplified tax system by legal entities and individual entrepreneurs are: until March 31 and April 30, respectively.

Important advice for entrepreneurs: do not waste your time, even on simple routine tasks that can be delegated. Transfer them to the freelancers “Ispolnyu.ru”. Guarantee of quality work on time or refund. Prices even for website development start from 500 rubles.

Where can I get the details for transferring taxes?

The transfer of the single tax amount under the simplified tax scheme is made to the account of the territorial inspection of the Federal Tax Service, which is located at the place of activity of the enterprise or in the area of residence of the entrepreneur. Therefore, there are no common details for paying the simplified tax system for all.

You can clarify the payment details of your tax department by contacting the inspectorate directly, but it is easier to do this on the official portal of the Federal Tax Service. To do this, on the website of the tax department there is a service “Determining the details of the Federal Tax Service”, where you need to enter the code of your inspection. If you don’t remember its number, you need to select your region, district, or municipality name from the drop-down list.

If you use specialized services for entrepreneurs, payment orders for paying under the simplified tax system are generated automatically, independently “loading” the necessary details.

Important clarifications on the BCC for paying taxes under the simplified tax system

“Simplified” is the most attractive tax system for small and medium-sized businesses. Its popularity is explained by its minimal tax burden and the simplest reporting and accounting procedure among all systems. This is especially convenient for individual entrepreneurs. The two versions of this system differ in the tax rate, base and method of calculating taxes:

- STS - Income (or STS -6%): 6% of the entrepreneur’s profit is allocated to the state;

- STS - Income minus expenses (or STS-15%): the state is entitled to 15% of the difference declared in the title of the tax.

Should I follow one or the other of these varieties? An entrepreneur can change the decision annually by notifying the tax authority of his intention before the end of the year.

Can everyone choose the simplified tax system?

In order to switch to the “simplified” system, the enterprise must meet some conditions that are not difficult for small businesses:

- have less than 100 employees;

- do not aim at an income of more than 60 thousand rubles;

- have a residual value of less than 100 million rubles.

For legal entities, these requirements are supplemented by a ban on branches and representative offices and a share of participation of other organizations exceeding a quarter.

IMPORTANT INFORMATION! A pleasant tax innovation regarding the simplified tax system: the 6% rate on the simplified tax system - Income, already the lowest among taxation systems, can be reduced to 1% from 2021 according to a regional initiative. And the USN-15 rate can turn into 5% if regional legislation so dictates.

We pay a single tax

A tax that replaces several deductions common to other tax systems (personal income tax, VAT, property tax) is called a single tax. Regardless of what type of simplified tax system is chosen by the entrepreneur, it must be deducted in advance payments at the end of each quarter.

The tax amount at the end of the year will need to be calculated, taking into account the advance payments made.

To transfer the tax amount to the budget, you must fill out the payment order correctly, because taxes cannot be paid in cash.

In field 104, you must indicate the correct BCC for paying the single tax to the simplified tax system:

- for simplified tax system-6% – 182 1 0500 110;

- for simplified tax system-15% – 182 1 0500 110.

If advance payments are not made on time, penalties are imposed for each missed day. To pay them, you need the following BCCs:

Penalties according to the simplified tax system

Incorrectly specified code, although not always, can lead to unnecessary hassle. A payment order with an incorrect code is either subject to return or falls into the “Unclear” category. In this case, the taxpayer will have to shell out additional money for late payment of taxes.

Without a guideline for accepting the tax amount (code), the tax office will not see the transferred amount, so in addition to penalties for delayed tax payments, you will have to pay again. It is possible that the amount for the erroneous BCC will go to the account for a different tax, but this situation is still unfavorable: you will also have to tinker with the refund of the overpaid tax.

The way out of the situation is a written application to transfer the amount of overpayment from one tax account to another (offset). However, penalties under the simplified tax system due to an incorrect BCC in this case will still be accrued (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation). If the KBK code according to the simplified tax system was indicated incorrectly, but the money was received as intended, then there will be no penalty (see letter of the Ministry of Finance of Russia dated July 17, 2013 No. 03-02-07/2/27977).

BCC under the simplified tax system “income” (penalties) in 2017-2018 - 18210 50101 10121 00110.

You can calculate the amount of penalties using our service “Fine Calculator” .

The BCCs used for the simplified tax system have remained unchanged since 2014. However, they differ depending on the objects of taxation and the type of payment (tax, penalty, fine). Incorrect indication of the BCC in the payment document may result in the payment not being credited for its intended purpose.

nalog-nalog.ru