Zero reporting is standard reporting forms that reflect the absence of activity. For example, when there is a company, but there is no activity. In this case, the organization is already registered and is listed as a taxpayer, depending on the chosen regime. Let's figure out what kind of reporting an individual entrepreneur needs to submit if there is zero reporting and how to report to legal entities?

In this situation, a number of questions arise: what constitutes zero reporting, its composition, how to submit zero reporting to the tax office, what sanctions are provided for delay or failure to submit. I’m also concerned about the process of submitting reports: do I need to fill out all the forms or is one sufficient? For example, does an individual entrepreneur on the OSN need to submit a balance sheet with zero reporting? Can the form be submitted by email or must it be submitted on paper? We figured it out and are ready to answer these and other questions.

Zero reporting on OSNO

For firms and entrepreneurs using the common system, the composition of declaration forms and other documents is as follows:

- VAT return must be submitted quarterly by the 25th day following the end of the tax period.

- Income tax return - the document must be submitted quarterly by the 28th day following the end of the tax period.

- Property tax returns must be submitted quarterly by the 30th day following the end of the tax period.

- A single calculation for insurance premiums is to submit reports quarterly by the 20th day following the end of the tax period. Even zero.

- Accounting statements are required to be submitted once a year by March 31.

In the absence of cash flows and the emergence of taxable objects, you can fill out a single simplified declaration, which will replace income tax and VAT reports. It must be sent to the Federal Tax Service by the 20th after the end of the quarter. Individual entrepreneurs that do not have employees do not submit reports to the funds. Thus, the answer to the question “do I need to submit a zero VAT return?” - positive.

Filling out section 1

In section 1, fill in:

- page 010 - OKTMO code by which insurance premiums were transferred.

The code must be specified in accordance with the Classifier, approved. By Order of Rosstandart dated June 14, 2013 No. 159-st. You can also find out OKTMO using a free service on the website of the Federal Tax Service of the Russian Federation.

- page 020 - BCC for the payment of contributions to the OPS.

Zero reporting on the simplified tax system

Firms and entrepreneurs using the simplified tax system with employees need to submit a zero tax return under the simplified system once a year:

- until March 31 - for companies;

- until April 30 - for individual entrepreneurs.

Zero reporting to the Pension Fund (SZV-M) - until the 15th day of each month and the Social Insurance Fund (4-FSS) - until the 20th day of the month following the quarter. By the way, you can also fill out a single simplified declaration form. This is stated in the letter of the Ministry of Finance dated 08.08.2011 No. AS-4-3 / [email protected] Therefore, zero reporting of individual entrepreneurs on the simplified tax system in 2021 does not have any peculiarities.

The rules for filling out zero reporting on the simplified tax system (for LLC or individual entrepreneur) depend on the selected taxation object. In the simplified mode, there are only two options: income or income minus expenses. Each option has its own nuances for filling out a tax return.

Features for the simplified tax system “Income”:

- It is mandatory to fill out the title page of the zero declaration, as well as sections 1.1 and 2.1.

- Enter information about the taxpayer according to the general rules.

- Submit a zero declaration to the Federal Tax Service at the location of the economic entity.

Features for the simplified tax system “Income minus expenses”:

- The title page, as well as sections No. 1.2 and 2.2 of the zero form, are required to be filled out.

- If the company has separate divisions, then there is no need to file a separate declaration under the simplified tax system.

- If a company has no income, this does not mean that information about the costs incurred need not be included in the zero declaration. Provide information about expenses incurred in accordance with accounting data and/or supporting documents.

Results

If a simplifier did not conduct any activity in 2021, he needs to submit a zero simplified tax return to the tax authority. It is submitted within the same time frame and drawn up on the same form as a regular declaration under the simplified tax system, only with zero values for income, expenses and tax amounts.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Zero reporting for UTII

As for sending a report without data to UTII, everything is not so simple. The tax office does not accept blank imputed tax reports. On imputation, tax calculation does not depend on income received and expenses incurred. Even if no activity was carried out and the taxpayer was not deregistered, he is required to pay tax and prepare reports.

Therefore, it is unacceptable to take “zero” marks for UTII. Fill out the tax return according to the general rules:

- On the title page of the zero declaration, indicate information about the taxpayer. Indicate the code of the Federal Tax Service to which you are submitting reports.

- Start filling out from the second section. If the company is engaged in several types of activities at once, fill out the section separately for each type.

- If activities are carried out at different registration addresses, then section No. 2 must be filled out separately for each OKTMO.

- Enter the activity code in line 010, according to Appendix No. 5.

- We enter OKTMO in line 030. You can find out the code on the official website of the Federal Tax Service.

- Lines 040–110 are filled with information about the calculation of UTII.

- Column 3 on lines 070–090 should be filled out if the economic entity has just switched to imputation or withdrawn from this taxation regime.

- Fill out Section 3 with the amounts of tax payable. In this case, take into account the amounts of insurance premiums and benefits reflected in section No. 2. Reduce the tax payable by these amounts.

- Please fill out Section 1 at the very end.

The deadline for sending the report is the 20th day of the month following the end of the quarter. Accounting statements and reporting to funds can be submitted as zero.

Requirements for filling out the DAM for 2021

When filling out a zero RSV, you must adhere to certain requirements. They are listed in the Procedure for filling out the calculation, approved. By Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] ):

- The calculation is filled out in capital block letters from left to right.

- If data is entered by hand, you can only use blue, black or purple pens. Other colors cannot be used, since the machine will not recognize the information and the report will have to be redone.

- When filling out the RSV on a computer, use Courier New font with a height of 16–18.

- Do not use any corrective or similar products. If an error is made in the calculation, it is better not to correct it, but to redo the sheet completely.

- Also, do not staple printed sheets with a stapler or paperclip if they violate the integrity of the sheet and the barcode at the top of the page. The best option is to submit the calculation for verification in a file.

- Each sheet of the report must be printed on a separate page.

- Each page must be numbered in continuous order, starting with the title page.

- In the fields where you need to indicate quantitative or total indicators, put “0”, and in all others - a dash. If the report is generated using software, then dashes can be omitted.

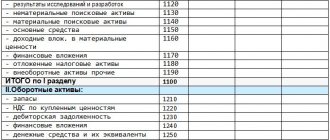

Zero accounting statements

The composition of the financial reporting forms is approved by Order of the Ministry of Finance No. 66n. key forms:

- Balance sheet.

- Income statement.

- Cash flow statement.

- Statement of changes in equity.

- Report on the intended use of funds.

- Appendixes to the balance sheet.

An important point: when preparing financial statements, you also cannot leave all balance sheet columns empty. The organization has an authorized capital, possibly funds in an account or in the cash register, and some property. If there are no business transactions during the reporting period, these figures should be reflected in the financial statements.

Non-zero zero report indicators

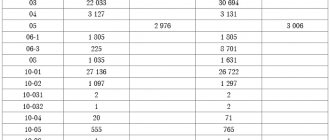

So, in the zero balance sheet it is necessary to reflect the minimum amount of assets and liabilities of the company, due to the presence of authorized capital. The basis for recording this data is the postings in the company’s accounting registers:

D/t 75 K/t 80 – formation of the owners’ obligations to pay the management company.

In the liability side of the balance sheet, the amount of the authorized capital is always indicated in a specially designated line 1310 of the same name, and in the asset side of the balance sheet, variations are possible depending on the situation:

- If by the date of registration of the balance sheet the capital has not yet been deposited into the current account of the enterprise, then a receivable from the participants arises (debit balance in account 75 “Settlements with founders”). It will be reflected in the active part of the balance sheet on line 1230 “Accounts receivable”;

- If the balance sheet is drawn up after the debt of the founders has been repaid and the funds in full (i.e. equal to the authorized capital) have been credited to the company’s account, then the following entry will be made in the company’s accounting: D/t 51 K/t 75, and their amount will be recorded in line 1250 of the balance sheet asset “Cash”. In liabilities, the amount of the authorized capital will continue to be reflected in line 1310;

- If the authorized capital is contributed partly by the founders with money, and partly with property, which is then capitalized into the OS or MPZ, then the balance sheet assets will record the following line values: 1250 in the amount of funds received, 1150 “Fixed assets” in the amount of the initial cost of this property or 1210 “Inventories” at the cost of acquiring these materials;

- If, in the scope of the Criminal Code, only fixed assets were received from business owners, then their value will be reflected in line 1150 of the balance sheet.

The company may also have other fixed assets on its balance sheet, the value of which will be reflected in the balance sheet asset even if there are no other transactions during the reporting year. True, in this situation, the accountant will have to calculate depreciation, record its amount and calculate the residual value of the fixed assets in accounting. In the balance sheet, the value of the fixed assets will remain unchanged, but it is impossible to do without additional operations to maintain these assets, and, therefore, we cannot talk about a zero balance in this case.

Thus, the zero form of the balance sheet states the fact of the absolute absence of activity of the enterprise in the reporting period, and contains only information about the presence of the capital company and the corresponding asset. If this condition is met, the company has the right to create a zero balance. Let's consider what the balance sheet will look like with the minimum values for reflecting the amount of the authorized capital.

Features for Entrepreneurs

Individual entrepreneurs are required to pay insurance premiums for themselves. Even if the business activity of a merchant is suspended, fees will still have to be paid.

Amount of insurance premiums paid by individual entrepreneurs for themselves:

| Type of insurance coverage | Total income from the entrepreneur's activities | |

| With annual income up to 300 thousand rubles | With annual income of more than 300 thousand rubles | |

| Pension contributions for individual entrepreneurs in 2021 or payments for compulsory pension insurance | 2020 — 29,354 rubles 2020 — 32,448 rubles | In the amount of mandatory payments and an additional 1% of the amount of income exceeding RUB 300,000. There are restrictions. The maximum amount of additional contribution for 2021 is 205,478 rubles, the maximum total amount of contributions to compulsory pension insurance for 2021 is 234,832 rubles. |

| Individual entrepreneurs' insurance premiums for themselves 2021, in terms of compulsory health insurance | 2020 — 6,884 rub. 2020 — 8,426 rub. | There are no restrictions on compulsory health insurance coverage. |

| Compulsory social insurance | Not paid | |

Important! Insurance premiums paid by individual entrepreneurs for themselves can be taken into account when taxing the simplified tax system or UTII. Accrued contributions reduce taxes payable to the budget.

Composition of reporting

Zero reporting for individual entrepreneurs without employees includes only sheets of the annual declaration according to the simplified tax system for 2021. Entrepreneurs do not keep accounting records, so an accounting report is not submitted to the Federal Tax Service. Another plus for individual entrepreneurs is that they are not automatically recognized by employers as organizations. Registration as an insurer is carried out only after concluding an employment or civil contract with employees at the request of the employer.

If you did not conduct business and did not enter into such contracts, then you are not an insurer, so you do not submit reports for employees. You are also not required to submit reports on paying insurance premiums for yourself. It is only necessary to submit a zero report to the tax office for individual entrepreneurs at the place of registration (STS reporting for 2021), see the sample filling below.

Zero reporting to the Pension Fund

Pension reporting for 2021 consists of only two forms. These are the monthly SZV-M form and the annual SZV-STAZH report. Information from pension reports discloses information about the insured persons: working citizens, as well as their insurance experience.

According to the rules for filling out reporting forms, pension forms should include information about all employees of the company who are in labor or civil relations with the employer. In other words, the reports include those employees with whom employment or civil law contracts have been concluded.

The latest recommendations from officials have adjusted the procedure for filling out forms. Now it is necessary to include in the report all working citizens, regardless of whether a contract has been concluded with them or not. Thus, Article 16 of the Labor Code of the Russian Federation states that labor relations arise from the moment an employee is allowed to perform duties. That is, with actual permission to work. Therefore, the presence of a well-drafted contract does not matter. Information about such an employee should be included in the report.

The opinion of officials towards employees who do not receive wages has also changed. For example, an employee took a long unpaid leave. Information about it is still included in pension reporting. After all, the employment relationship is not interrupted, and the contract is not terminated during the vacation.

IMPORTANT!

If the company’s activities are temporarily suspended, and there are not a single employee on staff, then submit “zeros” in the SZV-M form. In the report, fill in information about the policyholder, indicate the reporting period, but leave the tabular part empty. Submit SZV-M monthly, no later than the 15th day of the month following the reporting month.

Can a director not receive a salary?

Since mandatory insurance contributions are calculated from wages, the question arises: is the company registered, has one director, but there is no salary? Many organizations in which the founder is a director do not pay wages in the absence of activity.

If claims arise from regulatory authorities, you can refer to the letter of the Ministry of Finance dated 09/07/2009 No. 03-04-07-02/13, which states that if an employment contract has not been concluded with the director, then the responsibilities for calculating wages there is no charge. According to Art. 273 of the Labor Code of the Russian Federation, the sole founder cannot conclude an employment contract with himself. Subsequent payments, subject to profit, will be considered dividends. In addition, the Russian Pension Fund believes that submitting a blank SZV-M report in this case is also not necessary.

However, already in 2021, the opinion of officials changed - see Letter of the Ministry of Labor of Russia dated March 16, 2018 N 17-4/10/B-1846. Now in SZV-M a director without a salary must be submitted to the Pension Fund. Consequently, if the company had only the founder, who is also the director, who did not receive a salary, then until 2021 zero reporting was submitted. Now information about the sole founder-director must be sent to the Pension Fund. Moreover, it makes no difference whether an employment or civil contract has been concluded with him and whether there are wages accrued.

IMPORTANT!

SZV-M for the founder - director without salary must be submitted to the Pension Fund. Also include information about the founder if an employment or civil law contract has not been concluded with him.

6-NDFL and 2-NDFL, if employees have not been paid all year

The 6-NDFL report must be submitted if individuals receive income from you - salary, dividends or interest-free loan. The annual 6-NDFL also includes 2-NDFL certificates, which were submitted separately until 2021.

If you haven't paid physicists all year, you don't need to report because you weren't a tax agent during the tax period. 6-NDFL may be zero.

If a person receives income from you at least once a year, you submit 6-NDFL for the quarter in which you paid, and then until the end of the year.

For example, on April 15, 2021, your LLC issued dividends to the founder. You will have to submit 6-personal income tax for six months, 9 months and a year based on the results of 2021.

About personal income tax reporting in the article “How to prepare a 6-personal income tax report.”

Zero reporting on the SZV-STAZH form

We will separately outline the requirements for submitting the SZV-STAZH pension form. Does the Pension Fund need zero?

To answer the question, let's look at the structure of the form itself. In general, the report is not intended to send an empty table. For example, when filling out SZV-STAZH electronically, the filling program will not allow you to generate a report without information about the insured persons.

Consequently, the answer to the question “is it necessary to register an annual SZV-STAZH if there is no information” is unambiguous. There is no need to pass zeros. A completely different question is how a company functions without employees or even a founder. Controllers are skeptical about such circumstances.

Officials came to the conclusion that an economic entity cannot function without leadership. Consequently, SZV-STAZH will have to include a founder or director working without salary or contract. The rules are the same as for SZV-M.

Filling procedure

For any entrepreneur, filling out a zero declaration will seem quite simple and convenient. You can always download a ready-made form on a specialized website or ask the tax office staff. The form of the document forms is similar to all other declarations, but there are more dashes than any data.

Looking through the finished sample zero declaration, you can highlight several main points:

- an individual entrepreneur fills out the first page of the document with his own hand, correctly indicating his information (TIN, OGRNIP, OKVED, OKTMO code, and so on);

- the remaining pages contain dashes, with the exception of lines 001, 002, 003 201;

- there is no need to make any calculations.

You should fill out the declaration with a black gel pen and strictly block letters. Neglecting these simple requirements will lead to the fact that the document will simply not be accepted and will be forced to redo it. All pages must be numbered and amounts must be indicated in rubles. Only completed pages are returned, empty pages are not. If there is an existing seal, it is placed only on the first sheet of the declaration in the appropriate place. No stitching or binding.

Zero reporting to Social Security

It is necessary to submit a quarterly report to the Social Insurance Fund in Form 4-FSS. Also, policyholders are required to annually confirm the main type of economic activity in order to receive tariff discounts.

In both cases, reporting may be zero. That is, if the company did not conduct business, did not receive income, did not make contributions to employees, then there is nothing to reflect in the 4-FSS and confirmation. But even if there is no information, you need to submit zeros to the FSS. There are no exceptions.

We fill out the zero form according to the general rules. We indicate information about the policyholder; the remaining tables and sections of the 4-FSS calculation remain empty.

Reporting to the Federal Tax Service on insurance premiums

Since an individual entrepreneur is obliged to make contributions to the Pension Fund for himself, and if he has employees, for them, regardless of the financial result of his business activity and the very fact of its implementation, reporting on insurance contributions for pension insurance, by definition, cannot be zero.

If the tax reporting of an individual entrepreneur is zero, this does not affect the procedure for submitting reports on payments to the Pension Fund - it remains the same as for an entrepreneur who has something to write in a tax return.

Individual entrepreneurs are obliged to pay contributions to the Pension Fund and report on this, at least for themselves, even with zero income

A businessman’s obligations to the Social Security Fund are affected only by whether he has employees or not. If they are not there, he does not need to report to the FSS. If there is, the procedure, as in the case of the Pension Fund, is the same as for an individual entrepreneur submitting not zero, but regular tax reporting.

Video: tips for successfully submitting zero reporting on insurance premiums

What happens if you do not send zero reporting?

If the taxpayer does not report on time, he will be fined. Zero reporting of an LLC or individual entrepreneur is no exception. Failure to submit reports will entail sanctions from the tax inspectorate in the form of monetary penalties:

- from the organization - 1000 rubles;

- from officials - from 300 to 500 rubles.

In addition, the Federal Tax Service has the right to block the company’s current account if reports are not submitted within 10 days after the due date.

For failure to submit a zero calculation 4-FSS, Social Insurance provides for similar penalties (Article 15.33 of the Administrative Code):

- the organization will be fined in the amount of 1000 rubles;

- for a responsible official, the fine will be from 300 to 500 rubles.

There are no administrative penalties for failure to provide confirmation of the main type of economic activity. However, you should not count on a reduction in the rate of contributions for injuries. If the company resumes its activities, then contributions from accidents and occupational diseases will be calculated at the maximum rate of 8.5%.

Penalty for failure to submit zero reports to the Pension Fund:

- the form for submitting the report is not followed (the report is submitted on paper, not electronically) - 1000 rubles;

- for an unsubmitted report - 500 rubles for each insured person on the form;

- liability for officials from 300 to 500 rubles.

Where can I get lists and forms?

You can take the forms from any legal reference system (I will list the three largest):

- Consultant Plus

- Guarantee

- Contour-Normative

Reporting forms can also be obtained from specialized accounting websites (Klerk.ru or Buhonline.ru), you can use free programs from the tax office (for example, “Taxpayer”), or paid ones (for example, 1C). I do not recommend using search in Yandex or Rambler, since declaration forms change almost quarterly, and you can easily end up with the old version. This will be considered a failure to submit reports and you will receive a guaranteed fine for failure to submit them.

How to create and send blank reports?

In the general taxation system, in order to report income tax and VAT, you can fill out a single simplified declaration (SUD). Therefore, when asked whether it is necessary to submit a zero VAT return, we answer that it can be submitted in the EUD form. Organizations and individual entrepreneurs on the simplified tax system can use the same form. The report form and the method of filling it out were approved by letter of the Ministry of Finance dated July 10, 2007 No. 62n, taking into account the standards prescribed in letter dated October 17, 2013 No. ED-4-3/18585. Zero reporting to the Social Insurance Fund is submitted on the updated 4-FSS report form. Only the title page and codes are filled in. Accounting reports can be compiled in abbreviated form: balance sheet and income statement.

Starting from 2014, all VAT reporting must be submitted electronically. Since in order to send reports the company must still purchase software and digital signature, there is no point in submitting the remaining reports in paper form. It's easier to send everything by email. For VAT evaders, zero reporting can be submitted to the tax office and Rosstat both in paper and electronic form, at the discretion of the respondent. You can also use the services of authorized representatives to submit zero reports.

You can generate zero reports in any accounting program or online accounting. For software, zeroing is the simplest task. It is conveniently implemented, for example, in the “My Business” service.

How to submit a zero RSV for 2021

The delivery of a regular RSV is directly tied to the number of employees to whom income is paid. If there are more than 10 of them, then the report is submitted only in electronic form; if there are 10 or less, submission of the DAM on paper is allowed.

The zero RSV is not tied to the number of employees, since the reason for its presentation is the lack of payments in general. This means that you can submit it:

- On paper.

You can submit the report to the Federal Tax Service in person, through a representative, or by sending a registered letter with a list of attachments.

- In electronic form.

The DAM in the form of an electronic document is sent to the Federal Tax Service via telecommunication channels through electronic document management operators. Before this, the report is signed with an electronic signature.

The employer chooses the delivery method at his own discretion.

Special services for preparing zero reporting

There are many special services for preparing and submitting zero reports electronically. Almost all accounting programs provide this opportunity. Some of them have special tariffs for such a service, some offer to do this completely free of charge, such as 1C: Nulevka. This service will be especially appreciated by individual entrepreneurs who work without an accountant. After all, not only will they not have to spend even a small amount of money for submitting reports without having any income, but they will also not have to delve into what exactly needs to be submitted and when. If you register in the program, it itself will remind you what zero reporting needs to be submitted and will offer to generate the necessary documents. All that is required from the individual entrepreneur is simply to enter your data, IIN, registration address and OKVED code.

After the reports have been generated, they can be sent to recipients directly via the Internet (this service is paid for by all operators, including 1C), or they can be printed and sent to all recipients by mail or delivered in person. In any case, the use of special services significantly saves time and can help not only an individual entrepreneur, but also an experienced accountant who manages several companies and entrepreneurs, some of whom need to pass the “zero” mark. After all, in this case they also will not have to monitor the deadlines of all reports, and also spend extra effort on filling out forms on their own. The service allows you to do this in literally three clicks.

Zero declaration under the simplified tax system if there are no income and expenses

Zeros in the declaration can easily be explained by the lack of income.

The tax office may doubt the veracity of the information and check your bank account. If there was no income, the questions will disappear. If you did receive money into your account, you will most likely be sent a request for clarification. In such a situation, it is important to explain to the tax office what kind of money it is and why you did not show it in the declaration. For example, replenishing an account with personal money or repaying a debt does not need to be taken into account as part of your income.

Details about the simplified tax system in the article “Simplified taxation system in 2021.”

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months