In the Calculation according to Form 6-NDFL, the tax agent must indicate a number of mandatory details on the title page. Among them, many questions arise when filling out the field “At location (accounting) (code)”. This detail must be entered very carefully; if you specify an erroneous value, the subject will have problems with regulatory authorities. You cannot leave the field empty or put dashes in it either.

How to correctly indicate the code at the location in the 6-NDFL declaration in 2021? Where can I find this prop? The answers to these and other questions are in our material.

Which Federal Tax Service Inspectorate should I submit payments for contributions from 2021?

Since 2021, control over reporting on insurance premiums has come under the control of the Federal Tax Service (Chapter 34 of the Tax Code of the Russian Federation). Therefore, starting from 2021, submit calculations of insurance contributions for compulsory pension (social, medical) insurance to the tax office. You must report according to the new form approved by Order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551. See “Calculation of insurance premiums (DAM) for the 1st quarter of 2021: example of filling out.” At the same time, pay attention to some features of the reporting direction.

General approach

Calculations for insurance premiums from 2021, as a general rule, must be submitted to the Federal Tax Service at the location of the organization or the place of residence of the individual entrepreneur.

Separate units

A separate division of an organization must pay its employees if it independently accrues payments and rewards to them. In this case, the division submits the calculation to the Federal Tax Service at its location. In the calculation itself, the checkpoint of the separate unit is then indicated.

If the separate division does not meet these criteria, data on the employees of the separate division should be reflected in the calculation for the parent company (parts 11 and 14 of Article 431 of the Tax Code of the Russian Federation). Also see “How can separate divisions pay insurance premiums and submit reports to the Federal Tax Service from 2021.”

Largest taxpayers

The largest taxpayers transfer insurance premiums and submit settlements for them in 2021 to the Federal Tax Service at their location:

- the organization itself (not at the place of registration as the largest payer);

- its separate divisions (if they themselves accrue payments and benefits to employees) - subclause 7 of clause 3.4 of Article 23 and clause 11 of Article 431 of the Tax Code of the Russian Federation.

Starting from 2021, there is no need to submit calculations for insurance premiums to the Federal Tax Service at the place of registration of the largest taxpayer. In relation to calculations for insurance premiums, paragraph 7 of paragraph 3 of Article 80 of the Tax Code of the Russian Federation does not apply. This is confirmed by letters of the Federal Tax Service of Russia dated January 23, 2021 No. BS-4-11/993 and dated January 10, 2021 No. BS-4/11-100.

Which organizations must indicate code “213” in the 6-NDFL report?

The Federal Tax Service order No. MM-3-06/308 dated May 16, 2007 (as amended on September 28, 2018) lists the criteria according to which an organization can be classified as a large taxpayer. The main criterion is the company’s annual income, which is:

- from 10 billion rubles up to 35 billion rubles — for the largest taxpayers at the regional level;

- over 35 billion rubles. – for federal largest taxpayers.

Non-profit organizations can also be recognized as the largest taxpayer. “Special regimes” do not belong to the category of the largest payers.

It should be noted that organizations that do not meet the established criteria may also fall into this category. This happens if the tax service makes an appropriate decision in relation to certain entities.

Code “by location” on the title page

On the title page of the calculation of insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2021 No. ММВ-7-11/551, there is a field called “At the location (accounting) (code)”. It must indicate the code for the place of reporting. The codes are taken from Appendix No. 4 to the Procedure for filling out the calculation. Here is a table of codes with decoding.

| Code | Where is the payment submitted? |

| 112 | At the place of residence of an individual who is not recognized as an individual entrepreneur |

| 120 | At the place of residence of the individual entrepreneur |

| 121 | At the place of residence of the lawyer who established the law office |

| 122 | At the place of residence of the notary engaged in private practice |

| 124 | At the place of residence of the member (head) of the peasant (farm) enterprise |

| 214 | At the location of the Russian organization |

| 217 | At the place of registration of the legal successor of the Russian organization |

| 222 | At the place of registration of the Russian organization at the location of the separate division |

| 335 | At the location of a separate division of a foreign organization in the Russian Federation |

| 350 | At the place of registration of the international organization in the Russian Federation |

Thus, if in 2021 the payment is submitted, for example, at the location of a Russian company, enter the code “214”. Accordingly, on the title page it will look like this:

Keep in mind

Until 2021, in calculations according to the RSV-1 form, there was no field for codes “At location (accounting)”.

Read also

06.02.2017

Composition of RSV-1

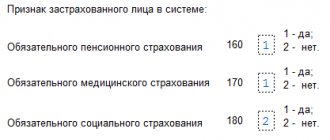

From now on, the new calculation form containing information on insurance premiums consists of the following pages:

- Title page (title page).

- A sheet with information about a person who is not an individual entrepreneur.

- Data on the obligations of who must pay insurance premiums (first section):

- the first appendix, which contains a calculation of the amounts required to pay compulsory pension and health insurance;

- the second appendix, which takes into account the calculation of the amounts required to pay for social insurance in the event of a citizen’s temporary incapacity or pregnancy;

- the third appendix, which includes the costs required for compulsory insurance for temporary loss of the ability to work, as well as for maternity expenses;

- the fourth application, which contains payments made from the federal budget;

- fifth appendix with calculations subject to a reduced tariff of insurance premiums under subparagraph 3 of paragraph 1 of Article 427 of the Tax Code;

- sixth appendix with calculations subject to a reduced tariff of insurance premiums under subparagraph 5 of paragraph 1 of Article 427 of the Tax Code;

- seventh appendix with calculations subject to a reduced tariff of insurance premiums under subparagraph 7 of paragraph 1 of Article 427 of the Tax Code;

- the eighth appendix with information subject to a reduced tariff of insurance premiums under subparagraph 9 of paragraph 1 of Article 427 of the Tax Code;

- the ninth appendix, which takes into account all the information necessary for applying the tariff for insurance premiums, according to subparagraph 2 of paragraph 2 of Article 425 of the Tax Code;

- the tenth appendix, with information that is necessary for the payment of remuneration for full-time students in professional institutions;

- Data on the obligations of those payers who are heads of farms (second section):

- the first application with calculations of the amounts for insurance premiums to be paid by the head and members of the farm.

- Information about each of the insured persons separately (third section).

Article 427. Reduced rates of insurance premiums

Basic designations for accounting

Having studied all the tables in detail, you can notice that organizations that are not the largest taxpayers and apply the general taxation system indicate the same numbers in all reports - 214. The difference is only for the “simplified”: in reporting according to the simplified tax system, organizations enter 210. And individual entrepreneurs indicate 120 in all reports they submit. Thus, the main values used are:

- 214 - for companies;

- 120 - for individual entrepreneurs.

How to fill out a declaration

It is not at all difficult to reflect the data in the declaration, and its composition is not so massive - just three sections and a title page.

An important rule for all sections: cost indicators are indicated in whole rubles, and physical indicators - in whole units, using mathematical rounding. For example, 50 kopecks should be rounded to the full ruble.

All pages of the declaration are numbered. Page numbers are recorded using the column provided for this, which has three cells. So, for example, the fifth page is “005”, the eighth page is “008”, etc.

First you need to fill out section 2, then section 3, and section 1 will be the final one.

Filling procedure

The calculation consists of a title page and three sections with appendices.

Small businesses and individual entrepreneurs prefer to use the “simplified” tax system (TS). Lists of OKVED codes for reduced insurance premium rates in 2020 under the simplified tax system can be seen in our article. The deadline for paying insurance premiums for September 2021 can be found here.

Anyone required to file a claims report must include these parts on the form:

- Title page.

- First section.

- First subsection of the first application.

- Second subsection of the first application.

- Second application.

- Third section.

The remaining applications and sections are required to be completed only if the relevant data is available. Payments must be made strictly in the national currency (ruble). If there is a cell in which there is nothing to fill, then a dash is placed. All words must be capitalized.

For convenience, you should fill out the reports in the following order:

- First, you should turn to the personalized information in the third section, which includes data about each individual individual.

- Next, go to subsection 1.1 of Appendix 1 in the first section. To do this, you need to sum up all the indicators for each employee from the third section.

- Then fill out subsection 1.2 of Appendix 1 in the first section. This is done because only here the data for health insurance premiums is indicated.

- Now you can fill out Appendix 2 of the first section.

- Then fill out the free section 1, where you enter the full amount required to pay as insurance premiums.

- Now you can fill out the remaining sections if there is information on them.

- The last step is to number the sheets.

What do these numbers mean?

This three-digit combination helps the tax authority determine from whom the reporting or calculation was received:

- from the largest taxpayer or ordinary organization;

- from the parent enterprise or a separate division;

- from a foreign or Russian company;

- from an individual entrepreneur or organization;

- from an individual entrepreneur, an individual, a notary or a lawyer;

- and so on.

The Tax Service needs this information for accounting, control and collection of information.

Line by line instructions for filling

In line 010, the checkpoint of the division of a foreign entity that is registered for tax purposes in Russia is filled in. Lines 020–030 contain the data (name and TIN, if available) of foreign entities - tax evaders, lessors from among state and municipal authorities and sellers of state property. In line 040 the KBK is entered, 050 is the OKTMO code of the tax agent submitting the report. The amount of tax payable is reflected in line 060 and the transaction code in line 070.

According to clause 37.8 of the Procedure for filling out the declaration, the amount of VAT payable is determined taking into account indicators for shipment (080) and receipt of partial or full advance payment (090) by tax agents, which are (clauses 4–5 of Article 161 of the Tax Code of the Russian Federation):

- intermediaries selling goods, works or services (except for services in electronic form) from foreign sellers in the Russian Federation;

- sellers of confiscated property by court decision, as well as sellers of ownerless valuables and treasures.

In this case, the amount of tax payable, displayed in line 060, will be calculated using the formula: line 080 + line 090 – line 100.

Example of filling out section. 2 VAT returns by a tax agent from ConsultantPlus Organization "Alpha" rented premises from the Moscow Property Department. The rental price per month is 129,600 rubles, including VAT. In the first quarter of 2021, the Alpha organization, as a tax agent, calculated VAT on the rental amount in the amount of RUB 64,800. ((RUB 129,600 x 3 months) x 20/120). Fragment of section. 2 VAT returns in this situation will look like this: You can view the full example in K+. Trial access to the system is provided free of charge.

Section 1. The amount of single tax on imputed income subject to payment to the budget

Section 1 is intended to reflect the amount of tax that must be paid to the budget.

This section is filled in automatically based on the information reflected in sections 2 and 3.

By line 010

The code is automatically indicated according to the All-Russian Classifier of Municipal Territories (OKTMO) of the municipality in which the activity is carried out (where the taxpayer is registered as a UTII payer). When filling out this line, the code is selected from the classifier. You can find out your OKTMO code using the electronic services of the Federal Tax Service “Find out OK” (https://nalog.ru, section “All services”).

Attention! For reorganized organizations, the OKTMO code of the municipality in whose territory the organization was registered as a UTII taxpayer before the reorganization is indicated.

By line 020

The amount of tax payable to the budget for the tax period is automatically reflected.

If a UTII subject operates under one OKTMO code, then line 020

is equal to the indicator

in line 050

of section 3. If the taxpayer operates on the territory of several municipalities, then line 020 is determined as follows:

page 020 = page 050 section 3 * (∑ (page 110 of all sections 2 for a given OKTMO code) / page 010 section 3)

Also in section 1, in the field “I confirm the accuracy and completeness of the information indicated on this page”

The date is automatically indicated.