Balance sheet changes 2013:

First of all, it should be noted that when filling out the balance sheet for 2013, you need to rely on the Law “On Accounting” No. 402 of December 6, 2011.

The main change is that since 2013 the balance sheet must be submitted only once a year: the annual balance sheet for 2013 - until the end of March 2014 (no later than 3 months after the end of the reporting year). There is no longer a need to submit interim reports during the year.

Another important change is that from January 1, 2013, all organizations had to maintain accounting records using any taxation system. Accordingly, all organizations must fill out and submit a balance sheet for 2013. This change did not affect individual entrepreneurs; individual entrepreneurs still do not need to do accounting and submit financial statements.

For 2013, you need to fill out 2 copies of the balance sheet: one for the tax office, the other for the State Statistics Committee.

For small enterprises, some simplifications have been made; special abbreviated financial statements for small enterprises have been developed for them, including a balance sheet and a statement of financial results. In these forms, information is indicated in an abbreviated, collapsed form.

When filling out the balance sheet for 2013, you must use the form approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n (as amended on December 4, 2012).

The developed form of the balance sheet is not mandatory for use; an organization can change the standard form depending on its needs, while maintaining the necessary set of mandatory details. The forms of the amended forms must be approved by management and reflected in the accounting policies of the organization.

Structure

Sample and example of drawing up a balance sheet

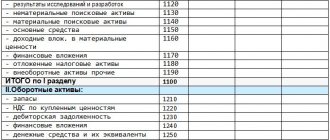

The balance sheet has two main sections: assets and liabilities.

The balance sheet asset contains information about the resources available to the organization. These resources are divided into two groups, representing two parts of the asset:

- non-current assets (first section);

- current assets (second section).

The balance sheet liability allows you to get an idea of the sources of the company's resources. The liability includes three sections:

- capital and reserves (third section);

- long-term liabilities (fourth section);

- short-term liabilities (fifth section).

Balance sheet form 1 sample for 2013

The procedure for filling out the balance sheet for 2013 has not changed; you still need to indicate data for 3 consecutive years: the reporting year and the two previous ones. As an example of filling out Form 1, you can use the sample balance sheet presented on our website, which can be found in this article.

Balance form 1 download the current form for 2013: [wpdm_file id=219]

Along with the balance sheet for 2013, you must also provide a statement of financial results, a statement of changes in capital, form 3, and a statement of cash flows, form 4.

Composition of financial statements

The forms of financial statements and the Instructions on the procedure for preparing financial statements were approved by Resolution of the Ministry of Finance of the Republic of Belarus dated October 31, 2011 No. 111.

The accounting statements of organizations (with the exception of non-profit organizations that do not carry out entrepreneurial activities and do not have, with the exception of retired assets, turnover for the sale of goods, performance of work, provision of services) for the quarter and year consist of:

– from the balance sheet;

– profit and loss statement;

– statement of changes in capital;

– cash flow statement;

– explanatory note.

The financial statements of organizations for the month consist only of a balance sheet.

Basic rules for preparing financial statements

Financial statements are presented in millions of Belarusian rubles in whole numbers.

Indicators of all forms of financial statements for which there are no numerical values are crossed out. Subtracted and negative numerical values of indicators are given in parentheses.

The organization's financial statements are compiled taking into account the performance indicators of its branches, representative offices and other separate divisions, incl. having a separate balance.

If additional details and information are entered into the financial reporting forms, they must comply with the structure (line codes and columns) of the financial reporting forms.

For each numerical value of financial reporting indicators, with the exception of financial reporting compiled for the 1st reporting period of the organization’s activities, data for the reporting period and the period of the previous year similar to the reporting period must be provided. If data for the period of the previous year, similar to the reporting period, are not comparable with the data for the reporting period, then the first of these data are subject to adjustment in accordance with the law, as well as taking into account changes in accounting policies.

Offsetting between items of assets, liabilities, equity capital, income and expenses is not allowed in the financial statements, except in cases where such offset is established by law.

Initial data for drawing up a balance sheet

In gr. 3 of the balance sheet shows data on the value of assets, equity capital and liabilities as of December 31, 2013. In gr. 4 of the balance sheet shows data on the value of assets, equity capital and liabilities at the end of the previous year, i.e. as of December 31, 2012

The balance sheet divides assets and liabilities into long-term and short-term. The main criterion for dividing balance sheet assets into long-term and short-term is their circulation period. Thus, long-term assets are involved in several production cycles and are used for more than 1 year. Short-term assets are in current economic circulation and are used, as a rule, within 1 year. In gr. 3 of the balance sheet shows long-term assets and liabilities, the repayment of which is expected after December 31, 2014, in gr. 4 – after December 31, 2013

Let's look at the features of filling out the balance sheet using the initial data in the table.

Taking into account the above data, we will consider the procedure for calculating balance sheet indicators.

Section I “Long-term assets”

This section reflects information on the balances of fixed assets, intangible assets, profitable investments in tangible assets, investments in long-term assets, equipment for installation and construction materials, long-term financial investments, long-term accounts receivable, deferred tax assets and other long-term assets.

Section II “Current assets”

This section provides information on the balances of inventories, long-term assets intended for sale, deferred expenses, taxes on purchased goods, works, services, short-term accounts receivable, short-term financial investments, cash and cash equivalents, and other short-term assets.

Section III "Equity"

This section provides information on the amount of equity capital.

Section IV “Long-term liabilities”

This section provides information about the organization's long-term liabilities, the repayment of which is expected more than 12 months after the reporting date.

Section V “Short-term liabilities”

This section provides information about the organization's short-term liabilities, the repayment of which is expected within 12 months after the reporting date.

From the editor:

We bring to your attention the interrelation of balance sheet indicators.

Page 130 (gr. 3 and 4) = page 131 + page 132 + page 133 (gr. 3 and 4).

Page 190 (gr. 3 and 4) = page 110 + page 120 + page 130 + page 140 + page 150 + page 160 + page 170 + page 180 (gr. 3 and 4).

Page 210 (gr. 3 and 4) = page 211 + page 212 + page 213 + page 214 + page 215 + page 216 (gr. 3 and 4).

Page 290 (gr. 3 and 4) = page 210 + page 220 + page 230 + page 240 + page 250 + page 260 + page 270 + page 280 (gr. 3 and 4).

Page 490 (gr. 3 and 4) = page 410 – page 420 – page 430 + page 440 + page 450 + page 460 + page 470 + page 480 (gr. 3 and 4).

Page 590 (gr. 3 and 4) = page 510 + page 520 + page 530 + page 540 + page 550 + page 560 (gr. 3 and 4).

Page 630 (gr. 3 and 4) = page 631 + page 632 + page 633 + page 634 + page 635 + page 636 + page 637 + page 638 (gr. 3 and 4).

Page 690 (gr. 3 and 4) = page 610 + page 620 + page 630 + page 640 + page 650 + page 660 + page 670 (gr. 3 and 4).

Page 300 (gr. 3 and 4) = page 190 + page 290 (gr. 3 and 4).

Page 700 (gr. 3 and 4) = page 490 + page 590 + page 690 (gr. 3 and 4).

Page 700 (gr. 3 and 4) = page 300 (gr. 3 and 4).

Where can I see an example of filling out a balance?

An example of a balance sheet compiled in both full and simplified form can also be found on our website, for example, in this article.

You can download a sample balance sheet in the new edition with comments on completion from K+ experts in the ConsultantPlus legal reference system. To do this, get a free trial demo access to K+:

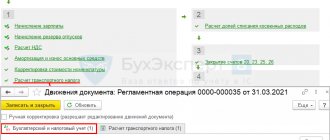

An example of a balance sheet would be a form automatically filled out in an accounting program. You just need to remember the need to reconcile the data of such reporting with the balances on the accounting accounts and to comply with other rules for filling out the balance sheet:

- debit and credit balances on balance sheet accounts are shown in detail;

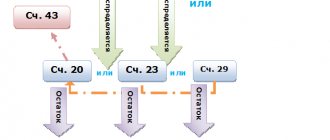

- Fixed assets and intangible assets are reflected at their residual value;

- Inventory and materials are shown at cost less reserves;

- interest on long-term loans refers to short-term debt;

- interest on financial investments is reflected as part of settlements with the counterparty;

- the amount of VAT accrued on advances received may reduce the debt to buyers for these advances.

Read about some of the nuances of drawing up a balance sheet in the material “Drawing up a balance sheet .

For information on options for reflecting VAT on the balance sheet, read the article “How is VAT reflected on the balance sheet?” .