Inventory of fixed assets (FA) is carried out in any organization with a certain frequency.

Regular conduct of such audits helps improve the quality of accounting activities at the enterprise. In addition, fixed assets, as a rule, belong to the category of valuable non-current assets. Accordingly, proper accounting of these objects significantly determines the financial well-being of the company.

However, checking the quantitative and qualitative state of the operating system at the enterprise must be carried out in strict accordance with regulatory instructions - this is the only way to ensure the reliability of the results of the audit.

It should be noted that the identification of facts of OS shortages often occurs based on the results of a regulated inventory. Such situations should provoke an adequate response from the management of the relevant organization.

First of all, it is necessary to find out the reasons for the detected shortage, try to establish the circumstances and the real culprits of what happened.

In addition, any discrepancy between the accounting information of fixed assets and the actual state of affairs in this area must be documented and properly posted through the enterprise's accounting system.

It is necessary to consider in detail what is considered a shortage of assets, how the manager should react if one is identified as a result of a complete inventory, how the cost of unfound (lost) objects is taken into account and written off.

Lack of OS was identified during and outside of inventory: we prepare documents

The fact of a shortage of property classified as fixed assets can be identified both in the process of conducting a planned inventory and outside it. In the latter case, it becomes mandatory to order an unscheduled inspection of the availability of property (clause 27 of the PBU for accounting, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n), which should:

- confirm the absence of an OS;

- identify the reasons for this circumstance;

- determine the amount of damage incurred in connection with this;

- establish the presence/absence of those responsible for the loss.

OS, like any property used in the course of the main activity, is assigned to the financially responsible persons. However, such persons are not always guilty of causing damage to the employer. Circumstances excluding guilt include those that arise in situations (Article 239 of the Labor Code of the Russian Federation):

- emergency;

- failure by the employer to take measures to ensure the safety of property.

Therefore, to correctly register the disposal of missing fixed assets, you will need the following:

- OS inventory;

- matching statement;

- conclusions of the inventory commission on the reasons for the shortage;

- the manager’s decisions on whose account the amount of damage will be attributed;

- act of decommissioning of the object;

- a document issued by a law enforcement agency stating that it is impossible to identify those responsible for the loss if the damage was caused by third-party forces;

- a court decision to recover damages from an employee or a third party identified by a law enforcement agency who refused to voluntarily compensate for the losses caused.

At the same time, the employer may refuse to collect damages caused by the employee (Article 240 of the Labor Code of the Russian Federation).

Step-by-step instruction

On July 01, the Organization carried out a scheduled inventory of goods in the warehouse, during which a shortage of goods was identified:

- set of curtains “Versailles” – 2 pcs. (cost price 8,000 rub./piece).

The financially responsible person is recognized as the culprit; the shortage is subject to recovery from him at the market value of the goods.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off of shortages as a result of inventory | |||||||

| July 01 | 94 | 41.01 | 16 000 | 16 000 | 16 000 | Write-off of shortage of goods at book value | Write-off of goods |

| gas turbine engine | — | — | — | Write-off of goods from batch accounting according to the customs declaration | |||

| Attribution of the amount of the shortfall to the guilty party | |||||||

| July 01 | 73.02 | 94 | 16 000 | 16 000 | 16 000 | Attribution of the amount of the shortfall to the guilty party | Manual entry - Operation |

| 73.02 | 91.01 | 2 000 | 2 000 | 2 000 | Reflection of the difference between the book value and market value of the goods | ||

| Withholding damage from an employee's salary | |||||||

| July 31 | 70 | 73.02 | 3 600 | Withholding damage from an employee's salary | Manual entry - Operation | ||

Lack of postings: correspondence and cost (including original)

The correspondence of accounting accounts in entries for the shortage of fixed assets reflects, on the one hand, the disposal of fixed assets, and on the other hand, at the expense of whose funds this occurs. Fixed assets are depreciable property, and at the time of detection of its absence, it can be depreciated either completely or partially. Therefore, first of all, you need to determine the value of its residual value - it will be the amount of damage caused by the disappearance of the equipment.

The formation of the residual value of a retiring fixed asset is usually reflected in a separate subaccount of account 01, where the difference between the original cost and accrued depreciation is shown. That is, the shortage of the device in the postings will be reflected by writing off the original cost within account 01 (Dt 01/disposal Kt 01) and assigning to account 01 the entire amount of depreciation accrued for this fixed asset (Dt 02 Kt 01/disposal).

The result obtained after these postings on the debit of subaccount 01/disposal is subject to write-off from accounting by posting Dt 94 Kt 01/disposal. The use of account 94 in this case is mandatory, since it is precisely this correspondence in the posting that will show that the inventory revealed a shortage of fixed assets or their damage.

Further accounting entries will reflect at whose expense the amount of the shortfall will be taken into account:

- financially responsible person - Dt 73 Kt 94;

- third-party individual or legal entity - Dt 76 Kt 94;

- owner of the missing OS - Dt 91 Kt 94.

If the lost fixed asset was subject to revaluation and the amount of its revaluation is listed on account 83, then this amount should be written off by posting Dt 83 Kt 84.

What it is?

The results of the inventory sometimes reveal that fixed assets that are formally listed on the organization’s balance sheet are actually missing.

In other words, negative discrepancies are revealed between accounting data and the real state of affairs.

Such situations are usually called shortages. Practice shows that they arise not only for inventory items, but also for some categories of non-current assets.

If we talk about shortages of fixed assets, then at each specific enterprise they can be caused by completely different reasons.

Banal errors and failures in the accounting system, negligence of responsible persons, malicious actions of individual employees of the organization or third parties - all this can lead to situations in which property objects appearing in accounting registers will not actually be detected during inventory.

As a rule, such cases in an organization are considered extraordinary, since we are talking about fixed assets of significant value.

Their loss can be very costly for company owners.

Results

The fact of the absence of a fixed asset must be confirmed by an inventory of property.

At the same time, the amount of damage incurred is revealed, the reasons for the loss of the OS are determined, and the presence/absence of the culprit is identified. The missing fixed asset is removed from accounting at its residual value (it is formed on a separate subaccount of account 01), and this disposal is reflected by posting Dt 94 Kt 01. Correspondence for subsequent write-off of the amount from account 94 is selected depending on whose account this procedure is carried out: the employee (Dt 73 Kt 94), a third party (Dt 76 Kt 94), the organization itself that owned the lost OS (Dt 91 Kt 94). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Write-off of shortages as a result of inventory

Regulatory regulation

On the date of completion of the inventory, the organization is obliged to record a shortage of goods in the amount of damage at actual cost:

- Dt Kt 41—shortage of goods is reflected.

In NU, losses from shortages can be taken into account in material expenses for income tax within the limits of natural loss rates (clause 7 of Article 254 of the Tax Code of the Russian Federation). The standards were approved by Decree No. 814 of November 12, 2002 and are applied only if they are established for a specific product in a certain industry.

In accounting, losses within the limits of natural loss norms are written off to the accounts of production costs or sales costs:

- Dt 20 (23, 25, 26, 44) Kt - losses are written off within the limits of natural loss norms.

If there are no standards, the entire shortage is above the standard and must be attributed to the guilty person in full.

Is it necessary to restore VAT when writing off a shortage as a result of an inventory?

This issue has been controversial for a long time. Despite the fact that the write-off of inventory items as a result of a shortage during inventory is not included in the cases in which the Tax Code of the Russian Federation requires the restoration of VAT (clause 3 of Article 170 of the Tax Code of the Russian Federation), tax authorities have repeatedly stated the need to restore the tax (Letter of the Ministry of Finance of the Russian Federation dated May 19. 2010 N 03-07-11/186, dated 01/21/2016 N 03-03-06/1/1997).

However, in 2021, a whole series of letters from controllers was published in which they take the opposite position. Therefore, today we can say that the opinion of the Federal Tax Service is confidently turning towards taxpayers.

At the same time, in our opinion, it is too early to say unequivocally that there is no tax risk if VAT is not restored. At the same time, if claims are made by the tax authorities, your chances of winning in court are very high.

If you decide to restore VAT, we recommend that you study in more detail the article Restoring VAT when writing off inventory items

How to close account 94 in 1C 8.3

Shortages and losses from damage to valuables are reflected in the account “Shortages and losses from damage to valuables” (chart of accounts 1C). The debit of the account indicates:

- actual cost of completely damaged or missing inventory items.

In the credit of the account, shortages and losses from damage to valuables are written off.

Based on the matching statement, the accountant reflects the shortage, i.e. writes off goods in accounting as of the end date of the inventory.

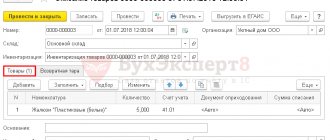

Based on the document Inventory of goods, create a document Write-off of goods :

- from - date of completion of the inventory;

- Warehouse - a place where goods are stored where a shortage was discovered;

- Inventory - document Inventory of goods , on the basis of which a shortage was identified.

Products tab will be filled in automatically. The data will be transferred from the Goods Inventory the Fill button :

- Nomenclature - Set of curtains "Versailles" , from the Nomenclature , inventory items that are subject to write-off are indicated;

- Quantity - the number of inventory items subject to write-off;

- Accounting account - 41.01 “Goods in warehouses”, is filled in automatically when specifying inventory items based on the register of the Item Accounting Account.

Postings according to the document

Closing 94 accounts in 1C 8.3

The document generates transactions:

- Dt Kt 41.01 - write-off of shortage of goods at actual (book) cost;

- Kt GTD - write-off of goods from batch accounting according to GTD.

Documenting

The organization must approve the forms of primary documents, incl. document on write-off of goods. In 1C, the Act on the write-off of goods in the TORG-16 form is used.

The form can be printed by clicking the Print button - Act on write-off of goods (TORG-16) of the document Write-off of goods . PDF

Persons responsible

When intending to bring to justice those responsible for the shortage of workers, you should remember:

- on the existence of a liability agreement;

- about the nature of the responsibility specified in the document (full, partial).

If an agreement was not concluded with an employee, it will be problematic to hold him accountable. Also, if the document only partially states liability, it is impossible to recover the full amount of the deficiency.

In addition to the contract, an employee may be issued a one-time document indicating his financial responsibility (for example, a power of attorney to receive goods and materials, an invoice). These features are discussed in the Labor Code of the Russian Federation, Art. 243-244.

The situation due to shortages does not fall under the cases described in Art. 243 of the Labor Code of the Russian Federation: an employee can be punished only in the amount of average monthly earnings (ibid., Art. 241, letter No. 1746-6-1 dated October 19, 2006, Rostrud).

Legal proceedings are possible if the employee does not agree to voluntarily pay the shortfall or has already quit and there is no way to recover it from earnings. The issue of recovery is also resolved through the court in cases where the employee’s position does not imply the conclusion of a liability agreement. The manager always bears full financial responsibility, regardless of the fact of concluding an agreement with him (Article 277 of the Labor Code of the Russian Federation).

Natural loss rates

The correct application of the norms of natural loss when identifying a shortage plays an important role, since it ultimately affects the solution to the question of the source of repayment of the shortage: from the funds of the guilty parties or at the expense of the organization.

Order No. 95 of the Ministry of Economic Development dated March 31, 2003 establishes general rules for determining such standards. He characterizes natural loss as a natural loss of mass of goods and materials while maintaining their consumer properties. Such a loss must occur within the framework of documented standards. In other words, this is the permissible amount of losses during transportation and storage of valuables.

Losses from defects, technological ones, formed during storage (transportation) in conditions of violations of the rules do not count as loss of a natural nature.

In Art. 254 clause 7-2 of the Tax Code of the Russian Federation, which is used for accounting and accounting purposes simultaneously, states that the procedure for determining standards is established at the government level (post. No. 814 of 11/12/02). The resolution talks about the responsibility of various ministries and departments for the development of specific standards. There are quite a lot of such documents, and members of the inventory commission should be familiar with them: depending on the type of activity of the company, controlled values and other nuances.

Thus, the norms of losses during the transportation of alcohol are regulated by Decree of the USSR State Supply Committee dated 12/18/87 No. 153, confectionery goods during storage - by order of the Ministry of Industry and Trade dated 03/01/13 No. 252, mixed feed - by orders of the Ministry of Agriculture dated 04/06/07 No. 198 (storage), Ministry of Agriculture No. 569, Ministry of Transport No. 164 dated 11/19/07 (transportation), etc.