1C:ZUP 3.0 provides the ability to issue salaries through a cash register, according to a salary project, send them to personal accounts or issue them through a distributor

All methods involve the use of appropriate statements.

When paying, you can also use a separate advance document and make the final payment. According to the Labor Code of the Russian Federation, Art. 136, wages to employees must be paid at least every half month. The Labor Code does not contain the concept of advance payment; it contains the wording – payment for the first half of the month. Thus, the employer must pay wages twice a month, on time. For other payments, deadlines are also established, for example, vacation pay - no later than three days before the start of the vacation, payment upon dismissal - on the day of dismissal, sick leave - on the nearest day of payroll. For example, if the next day of issue is the day of the advance payment, then the benefit is paid along with it.

Calculation of wages, KPI, taxes and insurance premiums without errors due to automation based on 1C: ZUP

Step-by-step instruction

In the Organization, according to the local act, wages are paid twice a month: on the 25th and 10th. Payments are made under the salary project to the cards of employees, except for Gordeev N.V., who was hired on May 23, 2021 and indicated in the application a personal card for transferring salaries.

On June 08, 2021 (postponed from June 10), salaries for the second half of May were paid.

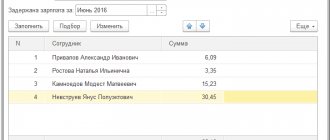

Tab. No. Last name I.O. employee To payoff Payment method 1 Komarov Vladimir Sergeevich 28 200 salary project 4 Mashuk Ksenia Valerievna 16 450 salary project 9 Gordeev Nikolay Vasilievich 10 839 to a personal card Total 55 489 Personal income tax for May 2021 was paid on the same day.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Payment of wages according to the salary project | |||||||

| June 08 | — | — | 44 650 | Formation of payment statement | Statement to the bank - According to the salary project | ||

| 70 | 51 | 44 650 | 44 650 | Salary payment | Write-off from current account - Transfer of wages according to statements | ||

| Paying salaries to employees' personal cards | |||||||

| June 08 | — | — | 10 839 | Formation of payment statement | Statement to the bank - To employees' accounts | ||

| 70 | 51 | 10 839 | 10 839 | Salary payment | Debiting from a current account - Transferring wages to an employee | ||

| Payment of personal income tax to the budget | |||||||

| June 08 | 68.01 | 51 | 13 761 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

For the beginning of the example, see the publications:

- Advance payment

- Payroll

What is it needed for?

Both the entrepreneurs themselves and the workers they hire have a stake in the salary project. By being served by the bank, both parties receive benefits:

- The burden on accounting is reduced. With a salary project, you no longer need to fuss with cash: now the issuance of all payments to employees is simplified and automated.

- Costs are reduced. Participants in the salary project save on cash collection and the accountant's salary.

- Saves time. Employees receive a salary without reference to the place where they are currently located. This is convenient for those who work remotely or have to leave the office frequently.

- There are nice bonuses. Banks return interest on purchases, allow you to increase your balance, and offer other cards and products on preferential terms.

All the advantages of non-cash payments also relate to the salary project. This means speed and security of payments, convenience, and the ability to manage money remotely - through an online account and mobile application.

Favorable tariff from DOM.RF bank

Find out details

Reflection in reporting 6-NDFL

Calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). The date of actual receipt of income in the form of wages is the last day of the month indicated in the Salary field for Payroll document (clause 2 of Article 223 of the Tax Code of the Russian Federation). It will be reflected on page 100 of Section 2 of form 6-NDFL.

Explore Payroll

In Form 6-NDFL, payment of wages is reflected in:

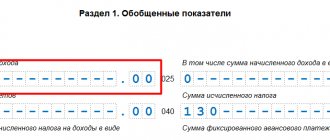

Section 1 “Generalized indicators”:

- pp. 070 - 13,761 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 05/31/2018 , date of actual receipt of income;

- page 110 - 06/08/2018 , tax withholding date.

- page 120 - 06/09/2018 , tax payment deadline.

- pp. 130 - 107,250 , the amount of income actually received.

- Page 140 - 13,761 , the amount of tax withheld.

Mandatory indication of income type codes in 1C software products

Published 05/28/2020 09:33 Author: Administrator From June 1, 2020, when drawing up payment orders for salary payments, you will need to indicate special codes for types of income. This change is introduced by Federal Law No. 12-FZ of February 21, 2019 “On Amendments to the Federal Law “On Enforcement Proceedings”. This innovation will allow banks to distinguish between the amounts from which debts can be withheld under writs of execution and from which they cannot. Today we will tell you how to do this in 1C software products.

Meanwhile, the codes for types of income were approved by the Directive of the Bank of Russia dated October 14, 2021. No. 5286-U “On the procedure for indicating the type of income code in orders for the transfer of funds.”

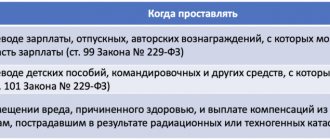

So there are three possible codes:

— code 1 should be indicated when transferring salaries, bonuses, vacation pay, royalties and other income from which part of the amount can be withheld under executive documents in accordance with Article 99 of Law No. 229-FZ;

— code 2 is used when transferring compensation payments, social benefits related to maternity, burial or marriage, travel allowances and other funds from which it is prohibited to withhold debts in accordance with Article 101 of Law No. 229-FZ;

- code 3 will be used for amounts of compensation for harm caused to health, and when transferring compensation payments to victims of radiation or man-made disasters and other income, to which, in accordance with Part 2 of Article 101 of the Federal Law of October 2, 2007 No. 229-FZ, restrictions penalties are not applied upon foreclosure.

For other transfers to individuals that are not their income from work, payment and settlement documents are not coded.

You must enter the code in field 20 “Name.” pl."

Be careful! From June 1, 2021, banks will not accept payments without indicating the type of income.

Codes of types of income in 1C: Accounting 8 ed. 3.0

Starting with release 3.0.77.106, the program has added the ability to indicate the income code when paying salaries through the bank in the document “Statement to the Bank” in the “Salaries and Personnel” section. The update affected both the payroll project statement and the employee account statement.

Let's consider a conditional example: employee Sorokin I.S. Alimony in the amount of 25% of the salary is withheld from wages (45,000*25%=11,250 rubles).

We can see this in the “Payroll” document in the “Payroll and Personnel” section using the “All accruals” link.

Next, we will create a statement for the payment of wages in the same section using the link “Statements to the bank”.

To indicate the type of income code, you should indicate the date 06/01/2020 and later in the created statement, then select the required one in the “Type of income” column.

The filling options are as follows:

Wages and other income with limitation of collection – 1;

Income that cannot be levied (without reservations) – 2;

Income that cannot be levied (with reservations for alimony) – 3.

In addition to the types of income, a column “Collected” has appeared in the statement, in which deductions for employees that were made during the billing month should be indicated. This must be done so that banks do not withhold more than the legal limit from the employee’s account.

The next document where it becomes possible to specify income type codes will be the “Payment order” in the “Bank and cash desk” section. In this regard, the program must be updated to at least release 3.0.77.78 and higher.

In order for the “Deduction by writ of execution” field with the necessary codes to appear, the document date must be 06/01/2020 or more, and the “Type of operation” field must take one of the values:

— other write-offs;

— transfer of wages to the employee;

— transfer to an employee under a contract;

— transfer of deposited wages,

Please note that the “Deduction by writ of execution” field appeared in the document with the ability to select a code, and the entry //VZS//11250-50// was automatically generated in the payment purpose. It stands for “amount collected”.

These rules were approved by the Bank of Russia Information Letter dated February 27, 2021 No. IN-05-45/10 “On indicating the amount collected in the settlement document.”

It turns out that the transfer of the salary to the employee from which the deduction was made will need to be formalized in a separate payment document.

Payment of income, when transferring which the income code should not be indicated, for example, the acquisition of property from an individual, is carried out with the type of operation “Other write-off”, and the type of income with the name “Not produced (this is not the income of an individual)” appears only after selecting a recipient from directory "Counterparties".

Codes of types of income 1C: Salaries and personnel management, edition 3.1

In the software product 1C: Salary and personnel management, edition 3.1, starting with release 3.1.10.443, the indication of new special codes for types of income has been introduced in the documents “Statement to the bank” and “Statement to accounts” in the “Payments” section.

When filling out the payroll slip, pay attention to the new “Type of income” field.

The values in it correspond to the required codes:

Wages and other income with limitation of collection – 1;

Income that cannot be levied (without reservations) – 2;

Income that cannot be levied (with reservations) – 3;

Income without limitation of penalties - when a code is not required.

The “Collected” column has also been added, in which the withheld amounts under enforcement documents should be indicated. If, when filling out a statement with income type code 1, for example, it included amounts that should be transferred for other reasons, then they should be manually removed from this document and a new statement with the required code should be created.

It will be impossible to register documents for payment in the program from 06/01/2020 without indicating the type of income!

Many organizations, when transferring wages and other income to individuals, use the uploading of the register of transfers to the bank. In order for the registers to now be uploaded indicating the code of types of income, you need to go to the “Payments” section, select the “Salary projects” item, go to the desired project and in the “File format” field select “EOI standard with bank (version 3.6)” .

Automatic completion of the income type code when accruing and filling out statements will be implemented starting from version 3.1.14.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #19 Alina Kalendzhan 09/25/2020 04:49 I quote Elena:

Good afternoon I was faced with a recalculation of the BL (credit system): in June, the BL for maternity and childbirth was accrued and paid as an advance payment using code 2, and in the salary accrual there was a recalculation and the amount under code 2 was divided into codes 2 and 1. What about subsequent payments? How should this regrading be reflected in 1C and in the bank?

It turns out that you made a mistake during the transfer that was already made; it cannot be corrected.

Next, look at the charges. Quote 0 #18 Elena 09.14.2020 21:22 Good afternoon! I was faced with a recalculation of the BL (credit system): in June, the BL for maternity and childbirth was accrued and paid as an advance payment using code 2, and in the salary accrual there was a recalculation and the amount under code 2 was divided into codes 2 and 1. What about subsequent payments? How should this regrading be reflected in 1C and in the bank?

Quote

0 #17 Alina Kalendzhan 06.26.2020 03:25 I quote Margarita Zabelina:

I quote Alina Kalendzhan: I quote Natalya: What about the advance payment? What to indicate in the income code or statement to the bank as salary

Good afternoon. The code for paying an advance is 1, if nothing was withheld from it. Gjxbnfq what if child support was withheld from the advance payment or according to regulations up to 50%? isn't the code 1 too? Good afternoon. Also 1. By

Payment of personal income tax to the budget

Payment of personal income tax to the budget is carried out no later than the day following the day of payment of wages to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Payment of personal income tax to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Please pay attention to filling out the fields:

- Transaction type - Tax payment .

- Tax - personal income tax when performing the duties of a tax agent .

- Type of liability - Tax .

- for - May 2018 , the month of accrual of income (salaries).

Postings according to the document

The document generates the posting:

- Dt 68.01 Kt - payment of personal income tax to the budget for May.

Filling out information for paying salaries to employee accounts

When paying employees into separate accounts, each employee must independently open a bank account. According to the received details, the organization transfers funds to employees in separate payment orders. You can select this type of payment in the “Employees”

:

You can fill in your account details using the hyperlink “Fill in a bank account”

.

An alternative way to fill out bank details is in the “Individuals”

on the “Bank Accounts” tab:

If several bank accounts are specified, then you should select one of them (the “Use as main”

) to transfer payments to the details of this account.

Let us next consider how to reflect in the program payments to staff in bank accounts.

Checking mutual settlements

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

In this case, the end date of the report must be the day of payment of wages.

The absence of a final balance in the “Settlements with personnel for wages” account means that there is no wage arrears for each employee.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, wages were paid on June 8, so the end date of the report should be June 09, i.e. the next day after the day the wages were paid.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

See also:

- Salary settings: 1C

- Accounting policy for NU: Insurance premiums

- Registration of salary project

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of an advance through a bank on bank cards Let's consider the features of reflecting in 1C the payment of an employee's advance through a bank....

- Settlements with an employee upon dismissal, including payment of compensation for unused vacation Dismissal of an employee is an operation without which no activity can proceed...

- Payment of dividends to founders: individuals and legal entities Let's consider the features of reflecting the accrual and payment of dividends in 1C...

- Universal report on checking the completion of part 2 of form 6-NDFL Filling out part 2 of form 6-NDFL still causes difficulties for users...

Answer

Use the services of the State Finance System:

Calculation of fuel and lubricants norms

Find out the correct BCC

Accounting policies for the public sector

Fixed assets: OKOF and depreciation groups

Elena Pavlenko answers,

expert

The situation is similar to issuing money from a cash register - pay slips are filed with the cashier’s report. Likewise, the list for crediting salaries is a payroll, so it is filed with the payment order, and, accordingly, with the transaction log No. 2.