Let's consider two situations to reflect losses of previous years in 1C Accounting 8.3:

- While working with the 1C 8.3 program, a loss arose for the current period, which must be transferred to the future.

- At the time of starting work with the 1C: Enterprise Accounting 3.0 program, it is necessary to reflect the presence of losses from previous years.

How should the loss of previous years be reflected in the program in both cases? How should the program behave in this case?

The occurrence of a loss during work in 1C

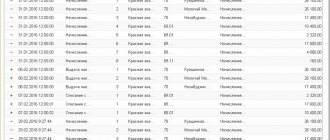

As an example, consider a situation in which a company, based on the results of work in the last quarter of the previous year, received a loss in the amount of 235,593.27 rubles. After the New Year, January ended with a profit of 211,864.41 rubles.

The transactions generated at the end of December of the previous year contain the following data:

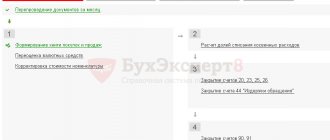

In this case, the data is obtained in the system automatically by Closing the month with the implementation of the established list of routine operations. Conducted through the section “Operations” - “Closing the period” - “Closing the month”.

As a result, recorded losses are reflected as a deferred tax asset. At the end of the month, the postings show a financial result in the amount of 245,762.71 rubles.

To obtain information about financial results for the entire period under review, you will need to generate a “Calculation of income tax” certificate. Access to it is through the section “Operations” - “References-calculations” - “Accounting and tax accounting” - “Calculation of income tax”.

Column 10 in the calculation certificate shows that during the period under review the company incurred losses in the amount of 235,593.27 rubles.

Procedure for accounting for losses

...in accounting

First of all, in accounting, one should distinguish between the concepts of “net profit (loss)” and “retained profit (uncovered loss)”, since these indicators are formed on different accounting accounts and have different meanings. Back in 2002, the Russian Ministry of Finance drew attention to this in a letter dated August 23, 2002 No. 04-02-06/3/60, and since then nothing has changed.

According to the instructions for using the Chart of Accounts for accounting the financial and economic activities of an organization, approved. By order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (hereinafter referred to as the Instructions for the Application of the Chart of Accounts), the net profit (loss) indicator is formed on balance sheet account 99 “Profits and Losses” and represents the final financial result of the organization’s activities for the reporting period.

The credit balance on account 99 at the end of the year indicates the presence of net profit, and the debit balance indicates the presence of a net loss.

At the end of the reporting year, when preparing annual financial statements, account 99 is closed. In this case, by the final entry of December, which is part of the accounting procedure - balance sheet reformation, the balance of account 99 is written off to account 84 “Retained earnings (uncovered loss)”:

- the amount of net profit is written off to the credit of account 84.01 “Profit subject to distribution”;

- the amount of the net loss is written off to the debit of account 84.02 “Loss subject to coverage”.

Thus, balance sheet account 84 summarizes information about the presence and movement of amounts of retained earnings (uncovered loss).

Retained earnings are spent at the discretion of the company's owners. For example, they can use it for dividends, to increase the authorized capital, and also to cover losses of previous years. The loss of previous years can be written off not only from retained earnings, but also from reserve capital, if it was created.

... in tax accounting

A loss is the negative difference between income and expenses (taken into account for tax purposes) received by the taxpayer in the reporting (tax) period. The tax base is recognized as equal to zero in the reporting (tax) period when the loss was incurred (clause 8 of Article 274 of the Tax Code of the Russian Federation).

If a loss is received at the end of the year, then in accordance with the provisions of Article 283 of the Tax Code of the Russian Federation (as amended by Federal Law No. 401-FZ of November 30, 2016), the taxable profit of any subsequent reporting (tax) periods can be reduced by the entire amount of the loss received or by part of it amounts (carry forward the loss to the future).

In this case, the following features must be taken into account:

- it is impossible to carry forward losses for certain types of activities taxed at a rate of 0% (clause 1 of Article 283 of the Tax Code of the Russian Federation);

- a loss not carried forward to the next year may be carried forward in whole or in part to subsequent years;

- profit received for the reporting (tax) periods 2017-2020 cannot be reduced by the amount of losses of previous tax periods by more than 50%. The restriction does not apply to tax bases to which reduced income tax rates apply. Such special rates are established for certain types of organizations, for example, for participants in regional investment projects; for participants of special economic zones (SEZ); organizations that have received the status of resident of the territory of rapid socio-economic development, etc. (clause 2.1 of article 283 of the Tax Code of the Russian Federation);

- Losses from several previous tax periods are carried forward in the order in which they were incurred;

- the taxpayer is obliged to keep documents confirming the amount of loss incurred during the entire period of transfer.

... taking into account the provisions of PBU 18/02

The amount of income tax, which is determined on the basis of accounting profit (loss), is a conditional expense (conditional income) for income tax. In accounting, such a conditional expense (conditional income) is reflected regardless of the amount of taxable profit (loss) (clause 20 of PBU 18/02 “Accounting for income tax calculations”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n, hereinafter - PBU 18/02).

According to the Instructions for using the Chart of Accounts, when a loss is received according to accounting data, conditional income should be accrued, which is reflected in the credit of account 99.02.2 “Conditional income for income tax” in correspondence with the debit of account 68.04.2 “Calculation of income tax”. A loss carried forward that was not used to reduce income tax in the reporting period, but which will be accepted for tax purposes in subsequent reporting periods, results in the formation of a deductible temporary difference. The deductible temporary difference, in turn, leads to the formation of deferred income tax (deferred tax asset - hereinafter referred to as DTA), which should reduce the amount of income tax in subsequent reporting periods. At the same time, the organization recognizes it only if there is a probability that it will receive taxable profit in subsequent reporting periods (clauses 11, 14 of PBU 18/02).

IT is reflected in the debit of account 09 “Deferred tax assets” in correspondence with the credit of account 68.04.2. As the loss is transferred and its amount is reflected in the income tax return, the deductible temporary difference is reduced (until full repayment), and the corresponding amount of IT is written off by an entry in the debit of account 68.04.2 in correspondence with the credit of account 09 (clause 17 of PBU 18/ 02, Instructions for using the Chart of Accounts).

Transfer of losses from previous years to the current period in 1C

The primary task is to create a balance sheet for account 09.

Accordingly, to carry out an operation to transfer last year’s losses to the current period, it is necessary to create a document “Operations entered manually”, filling it with the relevant data.

Accordingly, funds will be redirected from account 09 “Loss of the current period” to account 09 “Expenditures of future periods”.

In the same document, it is required to reflect the changes made in tax accounting, which will lead to the formation of a temporary difference in the amount of the transferred loss.

After this, using the balance sheet generated for account 09, the correctness of the operations performed is checked.

It is noticeable above that the final value of the balance sheet is zero, and the above amount of losses is fully included in the category of deferred expenses.

It is impossible not to ignore the formation of analytics for account 97.21, in particular the expense of future periods. In the situation under consideration, the losses incurred last year are reflected here.

After the formation of the document is completely completed, it is necessary to turn to the operations for closing the last month of the previous year, when the loss in question was formed.

As a result, the user is required to re-post all documents for that month, but must select the “Skip” option.

Instead, only the “Balance Reform” operation is re-performed.

Loss carryover

Before we begin this operation for 2021, we will find out the amount of deferred tax assets (DTA) for this period. This can be done by receiving SALT on account 09 for the entire year 2021. The figure below shows that the amount was 77,627.68 rubles, which is 20% of the loss received for the year in question.

Next, you can proceed directly to transferring losses from 2016 to 2021. We do this using an operation entered manually.

As part of our article, only two lines will be added to the tabular part:

- IT in the amount of 77,627.68 will be transferred to deferred expenses. The score 09 remains unchanged.

- The loss for 2021, which amounted to RUR 338,138.43, will be charged to other expenses of future periods.

As you can see in the figure above, when transferring the loss, we indicated the subconto “Loss for 2021”. In our case, this item in the deferred expenses reference book was created manually.

You can specify any name. “Losses of previous years” will appear as a type for tax accounting. We also point out that these losses will be written off from January 1, 2021 to the end of 2023.

After making all the changes, we will reformat the turnover and see that the final balance, which is 77,627.68 rubles, is included in the expenses of future periods.

We can now go back to the December 2021 close and reform the balance sheet. In this situation, there is no need to transfer the documents again.

Reflection of profit in the current period

We would like to remind you that at the end of January the company made a profit of 211,864.41 rubles. It is necessary to close this month by generating a report with transactions for the “Write-off of losses of previous years” operation.

And operations “Calculation of income tax”

Accounting entries when calculating income tax

If the organization applies PBU 18/02

The procedure for applying PBU 18/02 is configured in the Accounting Policy information register (Main section). If an organization applies the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to one of the positions:

- Maintained using the balance sheet method;

- It is carried out using the costly method (delay method). In the program, this method can be used after 2021, since PBU 18/02 does not contain restrictions on the use by an organization of any of these methods of its choice (Information message of the Ministry of Finance of Russia dated December 28, 2018 No. IS-accounting-13).

If the cost method is installed in the program, then the routine operation Calculation of income tax performs two functions at once: the calculation of tax for payment to the budget (according to tax accounting data), and calculations according to PBU 18/02 (according to accounting data).

If the organization uses the balance sheet method, then the Month Closing processing includes two separate routine operations:

- Calculation of income tax - only calculates tax according to tax accounting data for payment to the budget;

- Calculation of deferred tax according to PBU 18/02 - performs only calculations according to PBU 18/02 according to accounting data (according to the new algorithm, that is, the balance sheet method) for financial statements.

In any case, the calculated amounts of income tax are accrued by posting:

Debit 68.04.2 Credit 68.04.1.

At the same time, tax amounts are distributed among budgets of various levels.

A decrease in amounts due for payment to the budget is reflected by a reversal entry with simultaneous distribution among budgets:

REVERSE Debit 68.04.2 Credit 68.04.1.

Account 68.04.2 “Calculation of income tax” is specifically used in the program to summarize information on the procedure for calculating income tax for organizations in accordance with the provisions of PBU 18/02. Analytical accounting for account 68.04.2 is not provided.

Calculations according to PBU 18/02 include the following operations:

- recognition (settlement) of deferred tax assets (DTA) and deferred tax liabilities (DTL). Accounts 09 “Deferred Tax Assets” and 77 “Deferred Tax Liabilities” are intended to summarize information about the presence and movement of IT and IT. Analytical accounting of IT and IT is carried out by type of assets or liabilities in the assessment of which a temporary difference has arisen;

- determination of conditional income tax expense (income). Conditional income tax expense (income) is calculated as the product of accounting profit for the reporting period and the income tax rate. To summarize information about the amounts of conditional income tax expense (income) in the program, accounts 99.02.1 “Conditional income tax expense” and 99.02.2 “Conditional income tax income” are intended;

- recognition of a constant tax expense (income) for income tax. The permanent tax expense (income) for income tax is calculated as the product of the permanent difference that arose in the reporting period and the income tax rate. To summarize information about the amount of recognized permanent tax expense (income), the program uses account 99.02.3 “Permanent tax liability”.

Note On the advantages of the balance sheet method and how in “1C: Accounting 8” edition 3.0 this method is used when determining temporary differences, see the articles “PBU 18/02: how the balance sheet method is used in “1C: Accounting 8” and “ Application of PBU 18/02 and the balance sheet method in “1C: Accounting 8”.

Postings related to calculations according to PBU 18/02 using the balance sheet method are presented in the table.

Table

Postings generated in the program when performing the routine operation “Calculation of deferred tax according to PBU 18/02”

Please note that income tax is calculated in whole rubles, and the amounts of conditional income tax expense (income), SHE and IT, constant tax expense (income) are in rubles and kopecks. As a result, a difference may arise on account 68.04.2 (even if permanent and temporary differences are reflected correctly in accounting). The resulting balance is automatically written off to account 99.09 “Other profits and losses” by posting:

Debit 99.09 Credit 68.04.2 or Debit 68.04.2 Credit 99.09.

Thus, after performing the regulatory operations Calculation of income tax and Calculation of deferred tax according to PBU 18/02, account 68.04.2 is always closed.

Let's look at a specific example of how income tax calculations are performed when applying PBU 18/02 in “1C: Accounting 8” edition 3.0 and what transactions are generated in this case.

Example 1

| LLC "Trading House "Complex"" applies OSNO and the provisions of PBU 18/02 in accordance with the new edition, approved. Order No. 236n. The income tax rate is 20% (including 3% to the Federal budget, 17% to the regional budget). In January 2021, the organization’s accounting records reflected the following financial indicators:

The tax accounting registers reflect the following indicators:

The deductible temporary difference for the type of asset “Deferred income” is:

The taxable temporary difference for the type of asset “Fixed assets” is:

|

Let's calculate income tax for January 2021 according to tax accounting data:

- 700,000 rub. — tax base (RUB 1,000,000 - (RUB 72,000 + RUB 228,000)).

- 140,000 rub. — income tax (RUB 700,000 x 20%), including RUB 21,000. — to the Federal Budget (RUB 700,000 x 3%); 119,000 rub. — to the regional budget (RUB 700,000 x 17%).

When performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 1).

Rice. 1. Calculation of income tax in correspondence with account 68.04.2

Let's perform calculations according to PBU 18/02 for January 2021 according to accounting data:

- 1,600 rub. — repayment of ONA ((112,000 rub. - 104,000 rub.) x 20%).

- 400 rub. — repayment of IT ((118,000 rub. - 116,000 rub.) x 20%).

- 706,000 rub. - profit according to accounting data ((RUB 1,000,000 + RUB 8,000) - (RUB 230,000 + RUB 72,000)).

- RUB 141,200 — conditional income tax expense (706,000 x 20%).

When performing the routine operation Calculation of deferred tax according to PBU 18/02, the following transactions will be automatically generated (see Fig. 2).

Rice. 2. Calculations using PBU 18/02

Figures 3 and 4 show Analyzes of accounts 68.04.1 and 68.04.2.

Rice. 3. Analysis of account 68.04.1

Rice. 4. Analysis of account 68.04.2

The presented entries and standard reports on income tax settlement accounts demonstrate that account 68.04.2 in the program plays a purely technical (auxiliary) role. For example, in recommendation R-102/2019-KpR “Procedure for accounting for income tax”, adopted by the Committee on the recommendations of the NRBU “BMC” fund on April 26, 2019, account 68.04.2 is not used at all.

If the organization does not apply PBU 18/02

If the organization does not apply the provisions of PBU 18/02, then the switch Accounting for deferred tax assets and liabilities (PBU 18 “Accounting for calculations of corporate income tax”) should be set to the Not maintained position.

In this case, when performing the regulatory operation Calculation of income tax, account 68.04.1 corresponds with account 99.01.1 “Profits and losses on activities with the main tax system” (with the value of the subconto type Income tax and similar payments). The accrual of current income tax amounts payable is reflected by posting with simultaneous distribution among budgets:

Debit 99.01.1 Credit 68.04.1.

Accordingly, the decrease in amounts due for payment is reflected by an entry with distribution by budget:

REVERSE Debit 99.01.1 Credit 68.04.1.

Let’s change the conditions of Example 1 and consider how “1C: Accounting 8” edition 3.0 reflects income tax calculations if the provisions of PBU 18/02 are not applied.

Example 2

| LLC "Trading House "Complex"" applies OSNO, but does not apply the provisions of PBU 18/02. Numerical indicators correspond to the conditions of Example 1. |

In this situation, when performing the routine operation Calculation of income tax, postings will be automatically generated (see Fig. 5).

Rice. 5. Calculation of income tax in correspondence with account 99.01.1

Regardless of the procedure for applying the provisions of PBU 18/02, the credit turnover of account 68.04.1 by type of payment Tax (contributions): accrued / paid for the reporting (tax) period coincides with:

- with the amount of calculated income tax indicated in line 180 of sheet 02 of the income tax return;

- with the amount of current income tax indicated in the statement of financial results (form approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n).

On the calculation of income tax in “1C: Accounting 8” (rev. 3.0), see also the answer from 1C experts (+ video).

If the organization acts as a tax agent

An organization that pays dividends to a company participant (shareholder) - a legal entity, must fulfill the duties of a tax agent and withhold income tax when paying dividends.

To summarize information on settlements with the budget for income tax when paying dividends, a separate account 68.34 “Income tax when performing the duties of a tax agent” is intended. Tax on dividends is always paid to the Federal Budget, therefore analytical accounting in account 68.34 is carried out only by type of payments to the budget.

For limited liability companies, the accrual of dividends and withholding tax on the payment of participation income can be registered in the program automatically using the Accrual of Dividends document (Operations section).

For joint stock companies, the accrual of dividends on shares and tax withholding should be reflected in the Transaction document (section Transactions - Transactions entered manually).

In any case, the withholding of income tax when performing the duties of a tax agent when paying dividends should be reflected by posting:

Debit 75.02 Credit 68.34.

Account 75.02 “Calculations for the payment of income” is intended to summarize information on the payment of income to the founders (participants) of the organization (shareholders of a joint-stock company, participants of a general partnership, members of a cooperative, etc.).

Thus, the “agency” tax is taken into account separately and does not affect the turnover of account 68.04.1.

| 1C:ITS For more information about the procedure for taxation and accounting of corporate income tax, see the practical manual “Practical Annual Report 2018” edited by D.E. Sc., prof. S.A. Kharitonov in the section “Instructions for accounting in 1C programs”. |

Entering initial balances of losses from previous years

If by the time you start using the 1C program the enterprise already has losses from previous periods, they must be reflected in the system. This is required.

First, record the balance of the deferred tax asset with data entered on the last day of the previous year. To create the document “Entering initial data for account 09” you need to go through the menu “Main” - “Initial balances” - “Balance entry assistant”.

Balances are reflected in account 97.21

At the same time, it is important that this balance is entered into 1C not with other balances, but as an independent document. Overall this transfer is complete. Moreover, in situations where the transfer is carried out for a long period, for example, several years, a similar operation will need to be performed at the end of each calendar year.

Answer Profbukh8

Elena Baranova Profbuh8.ru

In accounting, the balance on accounts 09 and 77 should be collapsed, and the resulting balance should be reflected on the corresponding side of account 99: if deferred assets exceed the amount of deferred liabilities, debit 99 (decrease in balance sheet profit), and vice versa.

Tatiana

Elena, good morning, that is, before reforming the balance, it is necessary to enter a manual operation?

- Dt09 51273.81

- Kt 99.01.1 51273.81

- Dt77 873.19

- Kt 99.01.1 873.19?

Work in the current period

How will the program operate within the current period, which turned out to be profitable for the enterprise?

The accountant is required to close the month by generating a report on transactions made under the “Write-off of losses of previous years” transactions.

and “Calculation of income tax”

As a result, profit is reduced by the specified amount of losses of the previous period.

Answer Profbukh8

Elena Baranova Profbuh8.ru

It turns out that yes.

Please rate this question:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

USN: adjustment of tax accounting in “1C: Accounting 8”

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

10/11/2017 subscribe to our channel

We tell you how tax accounting data is adjusted in 1C:Accounting 8 when applying the simplified tax system.

Note: * For information on how to correct errors of the current year and previous years when applying the general taxation system, read the articles:

The general principles for adjusting tax accounting and reporting are set out in Articles 54 and 81 of the Tax Code of the Russian Federation and do not depend on the taxation system used - general or simplified. In accordance with paragraph 1 of Article 81 of the Tax Code of the Russian Federation, a taxpayer who has discovered in the declaration submitted to the tax authority that information is not reflected or is incompletely reflected, as well as errors:

- is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) led to an understatement of the amount of tax payable;

- has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority if errors (distortions) do not lead to an understatement of the amount of tax payable.

Errors (distortions) that did not lead to an understatement of the amount of tax payable when applying the simplified tax system include failure to reflect or understate expenses, as well as overstatement of income.

"1C: Accounting 8" (ed.

3.0): How to reflect the additional accrual of income tax for the previous year so that in the income statement the specified amount is reflected in line 2460 “Other” (+ video)?

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

- Using programs

05/15/2017 subscribe to our channel The organization identified an error that led to an understatement of the tax base for the income tax of the previous tax period. How can I reflect the additional accrual of income tax for the previous year in 1C:Accounting 8, edition 3.0, so that the specified amount is reflected in the financial results statement separately from the current income tax? The video was made in the program “1C: Accounting 8” version 3.0.49.28.

If in the current year a taxpayer organization has identified an error that led to an understatement of the tax base for the income tax of previous years, then it needs to recalculate the tax base and submit an updated tax return for the period in which the error was made (clause 1 of Article 54 , clause 1 of article 81 of the Tax Code of the Russian Federation).

In addition, the organization must assess and pay additional tax, as well as independently calculate and pay penalties. In accounting, an error identified after approval of the financial statements is corrected in the current period in accordance with the Accounting Regulations

“Correcting errors in accounting and reporting”

(PBU 22/2010), approved.

How to transfer last year's loss to 1C 8.3: example

Losses that a commercial organization has received in tax accounting can be carried forward to future years.

In this case, part of the past loss will reduce taxable profit in the current year.

The procedure for such a transfer is strictly regulated by Article 283 of the Tax Code.

Here we will tell you how to transfer last year’s loss to 1c 8.3 and give an example of such a transfer. Losses from previous years are shown in Appendix 4 to sheet 02 of the profit declaration. This application is only available for the 1st quarter and for the year.

At the same time, the tax base for profits for the current period cannot be reduced by the amount of past losses by more than 50%.

How to reflect the transfer of last year's loss in 1s 8.3?

This can be done in 4 steps. The loss received according to tax accounting data is subject to transfer to the next year in 1C 8.3. Its amount can be viewed in the income tax return.

To open a profit declaration, go to the “Reports” section (1) and click on the “Regulated reports” link (2).

A window will open containing a list of declarations. From the list, select “Income Tax Return” (3) for the desired period (for example, last year), and click on it. The declaration will open. You will see the amount of the loss in line 100 of sheet 02 (4): Guest, you have free access to a chat with an expert accountant. Order a call back to connect or call: (free within the Russian Federation).

Losses from previous years are recorded in Appendix 4 to Sheet 02.

As we said above, it is rented out only for the 1st quarter and for the year.

Open the declaration for the 1st quarter.

advocatus54.ru

A list of codes with decryption opens by double clicking the mouse;

- Code of the tax authority at the location of the taxpayer. If the report is submitted for a separate division, then it is necessary to indicate the tax authority with which this division is registered:

Appendix No. 1 to sheet 02 Appendix No. 1 to sheet 02 collects:

- Revenue from the sale of goods for resale (line 020).

Revenue (turnover 90.01.1 in NU) is calculated for the remaining product groups that are not included in the above list: - Revenue from sales of own products (line 010). Revenue (turnover 90.01.1 in NU) is calculated according to item groups specified in the accounting policy settings on the Income Tax tab.

- Non-operating income (line 100).

Filling out the income tax return in 1C 8.3 Accounting 3.0 is fully automated.

However, the user needs to do some “preparatory” work before proceeding with the calculation. It consists of three main stages:

- Setting up the program.

- Correct data entry.

- Routine operations at the end of the month.

Setting up income tax in 1C 8.3 What settings affect the calculation of income tax? First of all, you need to understand the “Income Tax” tab in the accounting policy (Fig. 1).

Fig. 1 The “Apply PBU18...” checkbox does not affect the calculation of tax, or rather, not the final result, but the display of intermediate data and some important reports.