The policy of applying discounts in product sales is a popular marketing ploy used to attract customers. Since the concept of a discount is not legally defined and there is no clear distinction between it and a bonus, we will assume that this term refers to a reduction in the price of a product, as is customary today in accounting.

Fulfillment of the terms of the contract determines the amount of the expected reduction in the price of the goods specified in the agreement. The amount of the discount depends on the nature of the transaction, sales volume, payment features, etc. Its use as a marketing element is enshrined in the company’s accounting policies, reflecting in detail the criteria for provision and size.

Types of incentives

To increase sales and attract new customers, suppliers often use various reward systems.

For example, they provide customers with discounts, bonuses, bonuses, and gifts. The concepts of “discount”, “premium”, “bonus” are not defined in the legislation. However, taking into account current practice and economic meaning, they can be understood as follows.

A discount is usually a reduction in the contract price of a product, work or service for fulfilling certain conditions. One of the forms of discounts can be a reduction in the amount of debt the buyer owes for goods supplied, work performed or services rendered.

Premium is money paid to the buyer for fulfilling certain terms of the contract. For example, a bonus may be given for the volume of purchased goods, works, or services. At the same time, a premium associated with the delivery of goods can also be a form of discounts when this occurs to reduce the cost of delivery (letter of the Ministry of Finance of Russia dated September 7, 2012 No. 03-07-11/364).

Bonus is an incentive in the form of supplying the buyer with an additional batch of goods, performing a scope of work and providing services beyond what was initially agreed upon without payment. In fact, the bonus consists of two interrelated business transactions:

- providing a discount to reduce the price specified in the contract;

- sale of goods, works or services at the expense of the resulting accounts payable to the buyer. In this case, the amount of debt should be considered as an advance received (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-07-15/118).

As a rule, bonuses are provided as part of promotions. For example, when buyers of a specific product are given a gift. This way you can promote new products or sell those that are not in demand. Document the action being carried out by order of the manager.

A gift is another type of incentive for fulfilling the terms of the contract. Like the bonus, it combines several concepts. In this case, one should take into account its economic essence and the mechanism of action of such incentives. For example, a seller may provide a gift if:

- acquisition by the buyer of a set of goods, works, services. For example, when you purchase two units of a product, the third is provided free of charge. This can be regarded as a bonus in kind;

- the buyer achieves the established volume of purchases. This can be seen as a bonus. That is, the buyer is first given a discount on the cost of the gift and it is provided against the resulting accounts payable;

- carrying out an advertising campaign. For example, all clients receive a gift on a holiday. And this is already a gratuitous transfer (clause 2 of article 423, article 572 of the Civil Code of the Russian Federation). This is explained by the fact that the relationship associated with the provision of this kind of gifts is stimulating and not encouraging in nature within the framework of the concluded agreement;

- other promotions and events.

The condition for providing incentives can be provided both directly in the contract with the counterparty, and in a separate agreement that is an integral part of it (clause 2 of Article 424 of the Civil Code of the Russian Federation).

The seller determines the type and amount of the incentive independently and coordinates it with the counterparty, for example, by sending the buyer a notice - a credit note (clause 2 of article 1 and clause 4 of article 421 of the Civil Code of the Russian Federation).

Situation: is it possible to provide a buyer-organization with gifts worth more than 3,000 rubles? The provision of a gift is subject to the buyer's fulfillment of certain terms of the contract.

Yes, you can.

After all, the limit is 3000 rubles. valid only for gift agreements between organizations, when one party transfers or undertakes to transfer ownership of an item free of charge to the other party. This follows from paragraph 1 of Article 572 and paragraph 1 of Article 575 of the Civil Code of the Russian Federation.

But in the situation under consideration, we are not talking about gratuitous transfer. The seller rewards the buyer for fulfilling certain conditions and counter-obligations. This means that the cost of the gift given does not matter.

The courts adhere to a similar point of view (clause 3 of the information letter of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104).

Definition of the term “bonus”

The law does not provide for an interpretation of the term “bonus”. From an economic point of view, it can be equated (only approximately) to a bonus in kind. It has some difference - the bonus is easily provided in the future.

In a separate clause in the contract for the supply of products, enterprises stipulate the conditions, upon fulfilling which the buyer will have the right to receive it. The bonus item should be properly capitalized, taking into account the market price, and the correct entries should be made.

Accounting: discounts

Discounts are provided by:

- at the time of sale or thereafter in respect of future sales;

- after the sale - in relation to goods sold, work performed or services provided. These are so-called retro discounts.

If a discount is provided at the time of sale or after it for future deliveries, then for accounting purposes this can be considered a sale at the price agreed upon by the parties. In this case, the established price may be less than what the seller declares under normal conditions. There is no need to reflect such a discount in accounting. You just need to reflect the implementation using standard postings.

Record the fact of implementation with the following entry:

Debit 62 (50) Credit 90-1

– sales revenue is reflected taking into account the discount.

If you pay VAT and it is levied on goods (works, services), then simultaneously with the sale, reflect its accrual as follows:

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is charged on the actual sales amount;

Well, when you receive payment into your bank account, make the following entry:

Debit 51 Credit 62

– payment has been received from the buyer taking into account the discount.

This procedure follows from the Instructions for the chart of accounts (accounts 50, 51, 62, 68 and 90), paragraph 6 of PBU 9/99 and is explained in the letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027.

If a discount is provided on a product, work or service that has already been sold, then reflect it in accounting depending on when the buyer was rewarded:

- before the end of the year in which the implementation took place;

- after the end of the year in which the implementation took place.

The discount was provided in the same year in which the sale took place. Adjust sales revenue for the period by the amount of the incentive at the time it was granted. In accounting, reflect such transactions as follows.

At the time of sale, before the discount is granted, complete the usual transactions:

Debit 62 Credit 90-1

– revenue from sales is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT has been charged (only post if you pay tax and sales are subject to it).

At the time of discount:

Debit 62 Credit 90-1

– revenue from previously shipped goods, works, and services is reversed in the amount of the discount provided.

After issuing an adjustment invoice to the buyer:

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is reversed from the amount of the discount provided.

This procedure is established by paragraphs 6, 6.5 of PBU 9/99.

The discount is provided in periods following the year in which the sale took place. Reflect it as part of other expenses in the current period as of the date of provision (clause 11 of PBU 10/99).

When identifying expenses from previous years in accounting, make the following entry:

Debit 91-2 Credit 62

– losses from previous years associated with the provision of a discount to the buyer (excluding VAT) were identified.

After issuing an adjustment invoice to the buyer:

Debit 68 subaccount “VAT calculations” Credit 62

– VAT is accepted for deduction from the amount of the discount provided.

This procedure is established by paragraph 39 of the Regulations on accounting and reporting, the Instructions for the chart of accounts (account 91), paragraphs 6 and 6.4 of PBU 9/99 and is explained in the letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027 .

Providing a discount (including in cash), which does not change the price of the goods under the terms of the contract, should be considered as a sale of property.

In accounting, reflect the provision of such a discount in the form of an additional batch of goods with the following entries:

Debit 62 Credit 90-1

– revenue from the sale of a consignment of goods within the discount is reflected (in the amount of the discount);

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT has been charged (only post if you pay tax and sales are subject to it);

Debit 90-2 Credit 62

– the amount of the discount provided to the buyer is included in the cost price (excluding VAT).

This order follows from the Instructions for the chart of accounts (accounts 41, 62, 68, 90).

If you provide a discount in cash, then make the following entries in your accounting:

Debit 90-2 (44) Credit 62

– a cash bonus has been awarded to the buyer;

Debit 62 Credit 51

– premium paid to the buyer.

This order follows from the Instructions for the chart of accounts (accounts 51, 62, 68, 90).

Discounts that change the price of a product

Such discounts can change the price of a product immediately, that is, immediately at the time of shipment of the product.

Or they can apply to past shipments, that is, change the price of goods based on completed deliveries (the so-called retro discount). In the first case, everything is simple: the shipment will be carried out immediately at a reduced price, that is, the price in the delivery note and invoice will be indicated taking into account the discount. Obviously, this option of providing discounts does not require any subsequent adjustments in accounting and documents. Accordingly, there is no expense in the form of discounts.

In the second case, when the discount is granted retroactively, that is, the price of a previously sold product is reduced (retro discount), accounting becomes more complicated. Just as in the first option, there is no expense in the form of a discount. But the seller will have to make adjustments.

Accounting: bonus

Having provided a bonus, two business transactions must be reflected in accounting:

- discount on previously shipped goods, work performed or services provided;

- sale of goods, works or services against the resulting accounts payable to the buyer.

Reflect the first business transaction in the manner prescribed for reflecting the discount.

On the debt incurred, charge VAT on the advance payment. After all, money that was received earlier cannot be considered payment for goods that have already been shipped. In essence, this is an advance payment (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-07-15/118).

In accounting, reflect the recognition of recovered accounts payable in advance and the sale of goods against this advance with the following entries:

Debit 62 subaccount “Settlements for shipped products” Credit 62 subaccount “Settlements for advances received”

– the amount of the restored debt is recognized as an advance received against a future bonus delivery;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT”

– VAT is charged on the prepayment amount, that is, the recovered debt.

After shipping a bonus shipment of goods, performing an additional amount of work or services, make the following entries:

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on advances received”

– VAT accrued on prepayment is accepted for deduction;

Debit 62 subaccount “Settlements for shipped goods” Credit 90-1

– revenue from the sale of bonus goods (works, services) is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations”

– VAT is charged on proceeds from the sale of bonus goods (works, services);

Debit 90-2 Credit 41 (20)

– the cost of sold bonus goods (work, services) is written off;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped goods”

- prepayment has been credited.

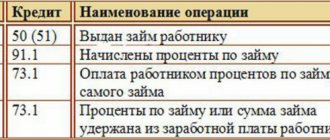

Accounting for bonuses under UTII regime

When an enterprise conducts exclusively activities that are subject to UTII, it is not expected to pay any other taxes on the bonus amount. This fully applies to incentives in the form of a cash bonus. When combining UTII with the “simplified” tax, the income that is taken into account in calculating the tax is part of the bonus. It is determined by the type of activity that does not apply to UTII. This is reflected in accounting as follows:

| Accounts | Description | |

| Debit | Credit | |

| 60 | 91 | The amount of incentive received is reflected |

| 60 | 60 | The bonus is counted towards payment for future product deliveries |

| 51 | 60 | Promotion has arrived |

Retrobonuses received from the supplier entail clarification of the amount of income and expenses (in tax accounting). In the Tax Code, such a procedure is not regulated clearly enough. Therefore, in order to avoid additional problems and claims, it is advisable to omit the clause in the contract that provides for adjustment of the price of goods purchased earlier.

Insurance premiums and personal income tax

If an organization has provided a discount, a bonus, paid a bonus, or reduced the debt of a citizen buyer, then the amount of such incentives does not need to be accrued:

- contributions for compulsory pension, social or health insurance (part 1 of article 1, part 1 of article 7 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

This is due to the fact that the income received by the buyer when providing incentives is not his remuneration within the framework of labor relations or civil contracts.

If an organization has reduced the debt of a citizen-buyer free of charge, that is, without fulfilling any condition, then such an operation is a regular debt forgiveness. Therefore, a person has an income in the amount of incentives. Personal income tax must be withheld from such income. True, under certain conditions this is impossible to do. Then report this to the tax office. All this follows from Article 41, paragraph 1 of Article 210, paragraphs 1 and 3 of Article 224, paragraph 1 of Article 226 of the Tax Code of the Russian Federation, Article 415 of the Civil Code of the Russian Federation. The same conclusion is expressed in the letter of the Federal Tax Service of Russia dated October 11, 2012 No. ED-4-3/17276.

Source documents

In order to avoid risks for entrepreneurs providing discounts and bonuses to their clients, it is necessary to reflect such provision in the primary documents. Since a unified form of the primary document for registering the provision of discounts and bonuses is not provided for by law, an entrepreneur can develop it independently and use it in the future to reflect transactions in accounting. For example, the provision of discounts and bonuses can be reflected in the work completion certificate and the accompanying invoice, showing that the product or service is provided at a discount. At the same time, the final document must also display the cumulative bonuses that are provided to clients at the end of the month, quarter or year.

This will allow you to protect yourself from claims and disputes with tax authorities.

Promotion does not change the price

If the incentive does not change the price, then the income tax basis does not need to be adjusted. Incentives of this kind must be taken into account as part of non-operating expenses in relation to:

- goods - on the basis of subclause 19.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation;

- works, services - on the basis of subparagraph 20 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated July 23, 2013 No. 03-03-06/1/28984, dated December 19, 2012 No. 03-03-06/1/668, dated September 27, 2012 No. 03 -03-06/1/506, dated April 3, 2012 No. 03-03-06/1/175.

When using the accrual method, expenses in the form of incentives provided to the buyer are taken into account when calculating income tax in the reporting (tax) period to which they relate. This is established in Article 272 of the Tax Code of the Russian Federation.

When using the cash method, expenses in the form of incentives provided to the buyer are taken into account when calculating income tax in the reporting (tax) period in which:

- paid the buyer a premium;

- transferred goods provided as a bonus or gift, but only if it was paid to your supplier;

- at the time of debt forgiveness, if a discount is provided that does not reduce the price. All other discounts reduce the price.

This follows from the provisions of paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

Document the provision of incentives to the buyer in a deed.

How to take into account a bonus received from a supplier: postings

If an enterprise produces products, then the supply of raw materials must occur non-stop. Suppliers may provide additional volume as a bonus. The following notes are made in the accounting:

| № | Accounts and correspondence | Description | |

| Debit | Credit | ||

| 1. | 60 | 91 (1) | Bonus taken into account in the form of other income |

| 2. | 10 (1) | 60 | Capitalization of bonus raw materials |

| 3. | 20 | 10 (1) | Raw materials written off for production |

| 4. | 99 | 68 | Reflection of tax liability (permanent) |

Raw materials received as a bonus will be indicated on account 10 “Materials”.

Incentives for the purchase of food products

Situation: is it possible for a trade organization to take into account when calculating income tax the incentive to the buyer provided for in the contract for the supply of food products, which does not change their price?

Yes, it is possible if the incentive meets the requirements of the Law of December 28, 2009 No. 381-FZ.

This law sets out the rules for trading activities on the territory of Russia. They are effective from February 1, 2010.

According to these rules, an agreement for the supply of food products can only provide for one type of remuneration that is not related to a change in the price of the product. This is a reward to the buyer for purchasing a certain volume of goods. It does not matter how this remuneration is named in the supply agreement: discount, premium, bonus or gift (letter of the Ministry of Finance of Russia dated October 11, 2010 No. 03-03-06/1/643). The main thing is that the following conditions are met:

- the amount of the incentive cannot exceed 10 percent of the cost of the goods purchased by the buyer;

- incentives can be provided only for the supply of products that are not mentioned in the list of socially significant food products approved by Decree of the Government of the Russian Federation of July 15, 2010 No. 530.

This procedure is established by parts 4–6 of Article 9 of the Law of December 28, 2009 No. 381-FZ.

If all the specified conditions are met, then take into account the incentive for the purchase of a certain volume of goods when calculating income tax as part of non-operating expenses (subclause 19.1, clause 1, article 265 of the Tax Code of the Russian Federation).

Otherwise, do not take into account the incentive, since its provision does not meet the requirements of Part 4 of Article 9 of the Law of December 28, 2009 No. 381-FZ. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 10, 2015 No. 03-07-11/20448.

Promotion changes price

Accounting for the calculation of income tax using the accrual method depends on when the incentive that changes the price was provided - in the same reporting (tax) period in which the sale took place, or in subsequent ones.

So, if the incentive was provided in the same period, then adjust the basis for calculating income tax in the current reporting (clause 7 of Article 274 of the Tax Code of the Russian Federation).

If a decrease in the price of goods affects the seller’s tax obligations for income tax in past reporting (tax) periods, then you can do one of the following:

- submit updated income tax returns for previous reporting (tax) periods;

- do not submit updated returns, but recalculate the tax base and the amount of tax for the period in which the incentive was provided, and reflect this in the tax return for the same period;

- do not take any measures to adjust the tax base (for example, if the amount of overpayment is insignificant).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated May 22, 2015 No. 03-03-06/1/29540.

For more information about this, see In what cases you need to file an updated tax return.

As for the cash method, sales income is recognized on it on the date of receipt of money from customers. Accordingly, there will be no need to adjust revenue after the incentive is provided. Even if it is a retro discount, that is, when the price of an already sold product changes. Indeed, in this case, the money received earlier must be reclassified as an advance, and under the cash method it is also taken into account in income. This means that the tax base will not change in any way. This follows from paragraph 2 of Article 273 of the Tax Code of the Russian Federation and is confirmed in the letter of the Federal Tax Service of Russia for the Moscow Region dated October 5, 2006 No. 22-22-I/0460.

The costs associated with providing a premium, bonus or gift to offset price changes should be taken into account in the same way as in a situation where prices do not change.

VAT

In an agreement for the supply of non-food products, the parties can establish a condition: the incentive - a discount, bonus, premium or gift - affects the price of the product or not.

If the incentive does not change the price of goods , then the VAT tax base does not need to be adjusted (clause 2.1 of Article 154 of the Tax Code of the Russian Federation).

When an incentive changes the price of an item , adjust the basis for calculating VAT. To do this, issue an adjustment invoice (subclause 4, clause 3, article 170, clause 13, article 171, clause 10, article 172 of the Tax Code of the Russian Federation).

The amount of VAT on the difference resulting from a decrease in the value of the goods can be deducted (paragraph 3, paragraph 3, Article 168, paragraph 3, paragraph 1 and paragraph 2, Article 169, paragraph 13, Article 171, paragraph 10, Article 172 of the Tax Code of the Russian Federation).

Has the price changed for goods listed on multiple primary invoices? Then you can issue a single adjustment invoice to the same buyer (paragraph 2, subclause 13, clause 5.2, article 169 of the Tax Code of the Russian Federation).

For more information, see:

- How to create and register an adjustment invoice;

- Procedure for issuing an adjustment invoice due to a price change;

- Under what conditions can input VAT be deducted?

In a similar manner, take into account the receipt of incentives for work (services) when calculating VAT.

An example of how to reflect in accounting and taxation the payment of a bonus to the buyer for achieving the volume of purchases established by the contract. According to the terms of the contract, the premium does not change the cost of goods

LLC "Torgovaya" sells goods wholesale. The organization uses the accrual method. Income tax is paid monthly.

On October 5, Hermes entered into a purchase and sale agreement with Alpha LLC for the purchase of a consignment of goods. According to the agreement, if Alpha purchases goods from Hermes in the amount of 1,100,000 rubles. (including VAT - 100,000 rubles), Hermes pays Alpha a bonus in the amount of 30,000 rubles.

On October 15, Alpha purchased a batch of goods from Hermes in the amount of 1,100,000 rubles. (including VAT – 100,000 rubles).

The cost of goods sold by Hermes was 500,000 rubles. In pursuance of the terms of the purchase and sale agreement, on October 22, Hermes transferred a cash bonus in the amount of 30,000 rubles to Alpha.

The accountant made the following entries in the Hermes accounting.

October 15:

Debit 62 Credit 90-1 – 1,100,000 rub. – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 100,000 rubles. – VAT is charged on sales proceeds.

22 of October:

Debit 90 (44) Credit 62 – 30,000 rub. – a cash premium has been awarded to the buyer.

Since the incentive in the form of a bonus did not lead to a decrease in the price of the product, the VAT tax base is not adjusted.

Debit 62 Credit 51 – 30,000 rub. – premium paid to the buyer.

Providing a bonus does not change the price of the goods, so the Hermes accountant applied the provisions of subclause 19.1 of clause 1 of Article 265 of the Tax Code of the Russian Federation and took into account the bonus in the amount of 30,000 rubles. as part of non-operating expenses.

In October, when calculating income tax, the accountant included:

- included in income – 1,000,000 rubles;

- included in expenses - 530,000 rubles. (RUB 30,000 + RUB 500,000).

An example of how to reflect in accounting and taxation the payment of a bonus to the buyer for achieving the volume of purchases established by the contract. Under the terms of the contract, the premium changes the value of the goods. The bonus is provided after the sale of goods

LLC "Torgovaya" sells goods wholesale. The organization uses the accrual method. Income tax is paid monthly.

On October 5, Hermes entered into a purchase and sale agreement with Alpha LLC for the purchase of a consignment of goods. According to the agreement, if Alpha purchases goods from Hermes in the amount of 1,100,000 rubles. (including VAT - 100,000 rubles), Hermes reduces their cost by 10 percent.

On October 15, Alpha purchased a batch of goods from Hermes in the amount of 1,100,000 rubles. (including VAT – 100,000 rubles).

The cost of goods sold by Hermes was 500,000 rubles. In pursuance of the terms of the purchase and sale agreement, on October 22, Hermes provided Alpha with a discount of 10 percent of the cost of the goods.

The accountant made the following entries in the Hermes accounting.

October 15:

Debit 62 Credit 90-1 – 1,100,000 rub. – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 100,000 rubles. – VAT is charged on sales proceeds.

22 of October:

Debit 62 Credit 90-1 – 110,000 rub. – revenue from previously shipped goods is reversed (by the amount of the discount provided);

Debit 90-3 Credit 68 subaccount “VAT calculations” – 10,000 rubles. – VAT is reversed from the amount of the discount provided (based on the adjustment invoice).

Since the incentive in the form of a bonus led to a decrease in the price of the product, the tax base for income tax is adjusted in the current reporting period by the amount of the incentive.

In October, when calculating income tax, the accountant included:

- included in income – 900,000 rubles;

- included in expenses - 500,000 rubles.

When supplying food products, the contract may contain a provision for remuneration (bonus) for achieving a certain volume of purchases. The amount of such remuneration should not exceed 10 percent of the price of the purchased goods. This type of incentive does not change the price of goods, regardless of the terms of the contract. This procedure follows from the provisions of paragraph 4 of Article 9 of the Law of December 28, 2009 No. 381-FZ. Having provided remuneration for the volume of purchase, the VAT tax base does not need to be adjusted. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated September 18, 2013 No. 03-07-09/38617.

Situation: should the seller adjust the VAT base if he paid remuneration to a citizen who purchased the goods at retail?

Yes, I should.

In this case, the remuneration paid changes the price of goods sold at retail, even if the contract contains a condition to the contrary.

The fact is that when an organization provides citizens with discounts, bonuses, bonuses, gifts, trading at retail, the provisions of paragraph 2.1 of Article 154 of the Tax Code of the Russian Federation do not apply. This rule should be applied only to wholesale trade, when a contract for the supply of goods is concluded with buyers. Similar clarifications are in the letter of the Ministry of Finance of Russia dated July 11, 2013 No. 03-07-11/26921.

Moreover, according to the logic of the Ministry of Finance of Russia, in the retail trade of food products, the norm of paragraph 4 of Article 9 of Law No. 381-FZ of December 28, 2009 also does not apply. After all, it regulates wholesale supplies.

Consequently, the incentive provided to a citizen changes the price of goods sold to him at retail, regardless of whether these goods are food or non-food. These conclusions are contained in the resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 7, 2012 No. 11637/11 and dated December 22, 2009 No. 11175/09.

That is, in any case, in a situation where an organization pays a remuneration to a citizen-buyer, the initial price of the product changes. Therefore, the VAT tax base will have to be adjusted for the amount of such incentive by drawing up an adjustment invoice. Draw up such a document in one copy, for yourself. After all, citizens who are not engaged in entrepreneurial activities do not pay VAT and therefore simply will not be able to take advantage of the right to deduction. The amount of VAT on the difference resulting from a decrease in the value of the goods can be deducted. All this follows from paragraph 1 of Article 143, paragraph 3 of paragraph 3 of Article 168, paragraph 3 of paragraph 1 and paragraph 2 of Article 169, subparagraph 4 of paragraph 3 of Article 170, paragraph 13 of Article 171, paragraph 10 of Article 172 of the Tax Code of the Russian Federation.

simplified tax system

Organizations that pay a single tax on income do not take into account expenses, including incentives provided to customers, when calculating it (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

For organizations that have chosen such an object of taxation as income reduced by the amount of expenses, the list of expenses taken into account when calculating the tax base is limited by Article 346.16 of the Tax Code of the Russian Federation. The costs of paying or providing customers with appropriate incentives - discounts, bonuses, bonuses or gifts - are not included in this list.

When selling goods at discounts, include in income the amounts actually received from customers, that is, minus the discounts provided. This follows from paragraph 1 of Article 346.15, paragraph 1 of Article 249 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated March 11, 2013 No. 03-11-06/2/7121.

Accounting and tax accounting of discounts

Currently, due to the saturation of the market with a variety of goods and services, organizations provide discounts to their buyers (customers) to increase sales.

The article shows the features of reflecting discounts in accounting and tax accounting. Providing discounts may be conditional on:

- seasonal fluctuations in demand for goods (works, services);

- loss (partial loss) of consumer properties of goods;

- the approaching expiration date for the sale of goods;

- marketing policy, including the development of new sales markets, as well as the promotion of new products, prototypes and samples to the markets in order to familiarize consumers with them;

- stimulating buyers to purchase as many goods (works, services) as possible.

The conditions for providing discounts are stipulated by the parties in the purchase and sale agreement or other agreement.

Discounts can be provided at the time of shipment (transfer) of goods (work, services), as well as after their shipment (transfer) if the appropriate conditions are met, the occurrence of which is provided for in the contract for the provision of discounts.

In practice, accounting for discounts causes difficulties due to the following. Firstly, the procedure for documenting discounts is not legally defined. Secondly, ch. 21 of the Tax Code of the Russian Federation does not contain instructions for accounting for VAT on discounts. Thirdly, ch. 25 of the Tax Code of the Russian Federation establishes two options for recognizing discounts for profit tax purposes.

OSNO and UTII

As a rule, it is always possible to determine what type of activity the incentives provided to customers relate to. Therefore, if an organization applies a general taxation system and pays UTII, incentives provided to customers within the framework of activities transferred to UTII and activities on the general taxation system must be taken into account separately for the purpose of calculating income tax and VAT (clause 9 of Article 274, clause 7 of article 346.26 and clauses 4, 4.1 of article 170 of the Tax Code of the Russian Federation).

Incentives - discounts, bonuses, premiums or gifts that an organization provides to customers as part of its activities under the general taxation system - subject to the conditions for their recognition in the tax base, can increase expenses.

Do not take into account incentives that are provided to the buyer as part of activities transferred to UTII for tax purposes (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Writing off part of the debt

A type of cash bonus is considered to be writing off part of the debt for the amount of the discount. For example, if the buyer has not yet managed to fully repay his debt to the supplier by the time the discount is issued, then it is more convenient for both parties to simply “close” part of the debt for the amount of the discount, so as not to make additional money transfers.

It would seem, what difficulties could there be? After all, in essence, this is the same discount, only provided in a different way. However, it is impossible to completely exclude the possibility of claims with this method of providing discounts.

Thus, tax authorities may consider that in this situation that part of the cost of goods for which the seller has “forgiven” payment is considered transferred free of charge. And the cost of goods transferred free of charge, as is known, is not included in expenses when calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

However, we believe that it is wrong to talk about gratuitousness in this situation. After all, debt write-off occurs in exchange for the buyer fulfilling certain conditions, and not just like that. And the courts take this argument into account (resolution of the Federal Antimonopoly Service of the Moscow District dated January 24, 2011 No. KA-A40/16314-10).