In cases of remuneration in kind, documents confirming the facts of these calculations are analyzed: orders, contracts, agreements, invoices, bills, invoices, certificates of work performed (services rendered). Turnovers on settlement accounts for insurance premiums, as well as reflected on these in the accounts, the indicators are compared with the amounts reflected in the calculations for accrued and paid insurance premiums of the payer of insurance premiums, presented in Form-4 FSS; 7) organizational and administrative documents, for example, orders valid in the audited period, local acts (collective agreements), employment contracts and additional agreements to them, civil contracts.

How to successfully pass an on-site inspection of the FSS and PFR

What do the FSS authorities check? The FSS and its territorial bodies check: - the correctness of the calculation and payment of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity; - the correctness of the calculation and payment of contributions for compulsory social insurance against industrial accidents and occupational diseases in accordance with the Federal Law dated July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”; - the correctness of the costs of paying compulsory insurance coverage. For your information. Federal compulsory health insurance funds are not control bodies and cannot conduct audits of insurance premiums for compulsory health insurance. The Pension Fund verifies and administers such payments.

Employer's liability

Fines that can be imposed by the FSS are provided for in Law No. 125-FZ and the Code of Administrative Offenses of the Russian Federation. For delay in providing calculation of contributions, a fine will be charged in the amount of 5% of insurance premiums for the last three months in the billing period. In this case, both the maximum and minimum limits must be observed - respectively, no more than 30% of the specified amount, but not less than 1000 rubles.

Let's consider the administrative liability for the employer in case of violation of the requirements of the legislation of the Russian Federation regarding the provision of certain documents:

| Violation | Fine, rubles |

| For violation of the deadline for providing information to the Social Insurance Fund on opening/closing a bank account | 1000 – 2000 |

| For late submission of calculations for social insurance and occupational diseases | 300 – 500 |

| Refusal to provide or untimely provision of information requested during the inspection, as well as provision of information incompletely or with errors | 300 — 500 |

FSS check: what should an accountant know? (Danilova V.)

Attention

At the same time, based on practice, cases when you need to expect an on-site inspection of the Social Insurance Fund can also include the following: - the organization made significant expenses at the expense of the Social Insurance Fund; - the organization received significant amounts from the Social Insurance Fund for expenses on compulsory social insurance; - a desk audit. Therefore, remember: if the policyholder meets one or more of the listed criteria, then the likelihood of an on-site inspection by the Pension Fund of Russia and the Social Insurance Fund in relation to him is quite high. The inspection can be either continuous or selective. Its type depends on the volume of documents and the state of the policyholder’s accounting. But an important factor is the likelihood of detecting violations in the calculation of insurance premiums.

The officials conducting the inspection make their own decisions.

Who's at risk

The Pension Fund of Russia and the Social Insurance Fund have developed criteria that allow them to select organizations for scheduled on-site inspections. In particular, such criteria were set out in the letter of the Pension Fund of the Russian Federation No. TM-30-24/13848, FSS of the Russian Federation No. 02-03-08/13-2872 dated December 21, 2010.

The attention of funds, and now the Federal Tax Service, can be attracted by:

- expenses financed from funds of the Federal Social Insurance Fund of the Russian Federation;

- submission of reports late;

- non-taxable payments;

- application of reduced tariffs;

- inconsistencies in calculations based on the results of desk audits;

- arrears in contributions for several periods in a row;

- constant adjustments to sent reports, etc.

FSS check: what should an accountant know?

The amounts reflected by the payer of insurance premiums in the general ledger for accounting accounts are calculated and compared, in particular, for settlements with personnel for wages, settlements for social insurance and security, for cash and bank accounts, for settlements with accountable persons with amounts (close attention will be paid to the return of unused imprest amounts) reflected for the same accounts in the accounting registers: account card, account analysis, account analysis by subconto, etc. Then the total data reflected in the accounting registers is compared with the data of the primary documents, on which they are based. Turnovers in settlement accounts for insurance premiums, as well as the indicators reflected in these accounts, are compared with the amounts reflected in the calculations for accrued and paid insurance premiums of the payer of insurance premiums, presented in Form 4-FSS; 7) organizational and administrative documents, for example, orders in force during the period under review, local acts (collective agreements), employment contracts and additional agreements thereto, civil contracts. In other words, documents related to establishing the procedure and amount of payments and other remuneration in favor of individuals are being studied; operations on all personal and bank accounts, cash transactions. Particular attention is paid to payments made through non-cash payments, which may not be taken into account when calculating insurance premiums.

Turnovers in settlement accounts for insurance premiums, as well as the indicators reflected in these accounts, are compared with the amounts reflected in the calculations for accrued and paid insurance premiums of the payer of insurance premiums, presented in Form 4-FSS; 7) organizational and administrative documents, for example, orders in force during the period under review, local acts (collective agreements), employment contracts and additional agreements thereto, civil contracts. In other words, documents related to establishing the procedure and amount of payments and other remuneration in favor of individuals are being studied; operations on all personal and bank accounts, cash transactions. Particular attention is paid to payments made through non-cash payments, which may not be taken into account when calculating insurance premiums.

RSV-1 PFR and 4-FSS), identified during desk audits (especially if the policyholder did not provide an explanation); – arrears that are registered with the payer of contributions for more than two reporting periods in a row; – the insurer being among the largest payers; – reduction in the amounts accrued insurance premiums compared to the previous period, provided that the number of insured persons did not change; – repeated adjustments and changes to the reporting of insurance premiums; – receipt of information from the tax authorities about the participation of the policyholder in schemes to minimize the amount of insurance premiums payable.

Checking the FSS and PFR, what documents to prepare for 2018

Important No matter how trite it sounds, inspectors are people too, and if the inspection takes place on your territory, you have the opportunity to establish personal contact with them and try to win them over. However, in order for personal contact with inspectors to be to your benefit and not to your detriment, you need to adhere to certain rules for communicating with inspectors. Communicate with inspectors by adhering to certain rules:

- First of all, prepare yourself psychologically and remember just two things: 1. Everything in your organization is only “white”, 2. You are a competent specialist who knows his job.

Keep these statements in mind at all times: during the test, this is the truth that you must believe in with all your soul, regardless of how things really are. At the same time, you need to behave accordingly, confidently, calmly, and with dignity.

Nowadays, most of the reporting on contributions is controlled by the Federal Tax Service. The funds check all reporting for compliance with benchmarks, and also pay close attention to the use of benefits, reduced tariffs and reimbursement of funds from the fund budget. What funds analyze, what requirements they impose and how to avoid on-site inspections, we will consider below.

There are two types of checks carried out by funds:

All reports submitted to the Social Insurance Fund and the Pension Fund of the Russian Federation undergo desk audits. Such checks are carried out only for the reporting period.

Info

For example, compensation for delayed wages. But companies manage to challenge additional charges in court (resolution of the Arbitration Court of the North-Western District dated January 20, 2015 No. F07-685/2014).

We are waiting for verification from the FSS

Why FSS checks are becoming cheaper and safer For companies, the risk of facing large additional charges after a FSS check is reduced. This is confirmed by the fund’s internal statistics, which we have reviewed.

See how FSS checks changed last year in the chart below. The main reason for additional assessments is that companies do not pay them on some payments. The fund requires contributions from any employee compensation: for fitness, kindergartens, food, etc. The Social Insurance Fund believes that these are payments within the framework of labor relations (FSS letter dated April 14, 2015 No. 02-09-11/06-5250). If the company is not ready to argue, then it is safer to charge contributions. In court, companies manage to cancel additional charges. It should be noted that payments under civil law contracts, the subject of which is the performance of work, provision of services, and (or) contracts regulating copyrights, are also subject to careful verification. Expenditure cash transactions are checked, especially payments made in cash, etc. A reconciliation of the amounts actually accrued and paid to an individual from the organization's cash desk is carried out with the data of his personal account and individual accounting form.

In addition, during the inspection, special attention will be paid to the correctness of determining the amounts not subject to insurance premiums, and their compliance with Art.

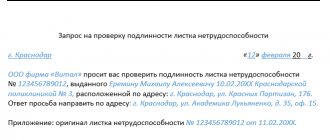

9 of Law No. 212-FZ, as well as documentary evidence and amount of payment. At the same time, based on practice, cases when you need to expect an on-site inspection of the Social Insurance Fund can also include the following: - the organization made significant expenses at the expense of the Social Insurance Fund; - the organization received significant amounts from the Social Insurance Fund for expenses on compulsory social insurance; - a desk audit. Therefore, remember: if the policyholder meets one or more of the listed criteria, then the likelihood of an on-site inspection by the Pension Fund of Russia and the Social Insurance Fund in relation to him is quite high. The check can be either continuous or selective. Its type depends on the volume of documents and the state of the policyholder’s accounting. But an important factor is the likelihood of detecting violations in the calculation of insurance premiums. The officials conducting the inspection make their own decisions. For example, if you do not have a certificate of temporary incapacity for work, in this case you need to contact a medical specialist. institution to issue a duplicate, and provide the inspectors with an explanatory note why the document is missing, and a copy of the request for a duplicate, as confirmation that you have taken action. Or, as was in my case. The inspectors stubbornly insisted that only employee compensation for the use of a personal car, which is owned by right of ownership, is not subject to contributions; if the car is driven by power of attorney, then such payments should be included in the base. However, I found and printed excerpts from the Civil Code of the Russian Federation, from which it follows that property can be owned not only by right of ownership, but also by the right of use and disposal.

List of documents,

necessary for a desk audit carried out in accordance with Part 1 of Article 4.7 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

When applying for a refund.

1. Statement

on the allocation of the necessary funds for the payment of insurance coverage

- in 2 copies

.

2. Help-calculation,

submitted when applying for the allocation of funds for payment of insurance coverage -

in 2 copies.

3. Copies of documents

, confirming the validity and correctness of expenses for compulsory social insurance (according to Order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 N 951n)

4. Reference

about the status of the account with the bank’s blue stamp (information from the card index).

5. Payment documents

, confirming payment of benefits:

— certified copies of cash receipts, pay slips (in case of payment of benefits through the enterprise’s cash desk);

— bank registers, payment orders with a blue bank stamp (in case of payment of benefits through a bank).

Documents for verifying the insured event.

1.Employment history

employee.

2.Employment contract

, all additional agreements to the employment contract.

Benefit for temporary disability, pregnancy and childbirth.

1. Certificates of incapacity for work, calculations of benefits.

2. Application from the employee and Order for the provision of maternity leave.

3. Certificate of registration in the early stages of pregnancy.

4.Employee’s personal account for the pay period.

5. Time sheets for the billing period.

6.Staffing schedules.

7. Payroll statements for employees of the organization for the billing period.

One-time benefit for the birth of a child.

1. Application from an employee for payment of benefits.

2. A certificate of the birth of a child in the established form, issued by the civil registry authorities, and in the case of the birth of a child outside the Russian Federation - a document legalized in the established manner confirming the birth of the child, with a duly certified translation into Russian.

3. A certificate from the other parent’s place of work about non-receipt of benefits or a certificate from the social protection authority at the child’s place of residence stating that the other parent was not awarded benefits - if one of the child’s parents does not work (does not serve) or is studying full-time education in educational institutions of primary vocational, secondary vocational and higher vocational education and institutions of postgraduate vocational education, and the other parent of the child works (serves).

Monthly child care allowance.

1. Application for granting benefits.

2. Order on granting leave.

3. Certificate of birth (adoption) of the child being cared for, or an extract from the decision to establish guardianship over the child.

advance report.online

money paid to an employee without supporting documents is considered his income. There are situations when an employee, through no fault of his own, cannot attach documents to the expense report.

For example, a company participated in an exhibition, the equipment was damaged during transportation, they found out about it only during its installation, and the manager responsible for the event, with the consent of the director, paid cash to the technician who fixed the problem.

The employee must be reimbursed for these expenses and withheld 13% of personal income tax according to the rules. In such a situation, an employee can write a memo stating that he spent the amount on equipment repairs, the documents were lost and indicate the amount + 13% and attach this note to the expense report. The director, knowing the situation, will sign such an advance report and give an order for reimbursement, while the employee will receive as much as he actually spent.

How to pass an on-site FSS inspection

Birth (adoption, death) certificate of the previous child (children).

5. Certificate from the place of work (study, service) of the mother (father, both parents) of the child stating that she (he, they) does not use parental leave and does not receive a monthly child care allowance, and in the case if the mother (father) of the child does not work (does not study, does not serve), a certificate from the social protection authorities at the place of residence of the mother (father) of the child about non-receipt of monthly child care benefits.

6. Certificate(s) from the place of work (service, other activity) with another policyholder, confirming that the assignment and payment of benefits by this policyholder(s) is not carried out (in the case of work for several policyholders).

7.Employee’s personal account for the pay period.

8. Time sheets for the billing period.

9. Calculation of benefits.

Funeral benefit.

1. Statement from the person who has assumed the responsibility to bury the deceased.

2. Death certificate issued by civil registry authorities.

3. Cash documents confirming the fact of payment to the person who took upon himself to carry out the burial of the deceased or documents confirming payment of the cost of services to a specialized funeral service based on an invoice.

4. When paying benefits for a deceased minor - documents confirming the degree of relationship.

Additional days off to care for a disabled child.

1. Application from an employee for additional days off.

2.Order (instruction) to provide additional days off.

3.Employee’s personal account for the pay period.

4.Working time sheets (schedules for summarized recording of working time) for the billing period.

5.Copy of the ITU certificate.

6. Documents confirming the place of residence (stay or actual residence) of a disabled child;

7. Certificate of birth (adoption) of a child or a document confirming the establishment of guardianship or trusteeship of a disabled child.

8. Certificate from the place of work of the other parent (guardian, trustee) about the use of additional days off or copies of documents (work book, etc.) confirming the fact that the second parent is unemployed. In the event of divorce between the parents of a disabled child, death or deprivation of parental rights of one of the parents, and in other cases, provide documents confirming the absence of the second parent (parents) or the impossibility of raising children by him (them).

9. Calculation of payment for additional days off to care for a disabled child.

10. Individual accounting card for the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums.

Specify the list of documents subject to verification

Typically, during on-site and desk audits, PFR specialists review staffing schedules, employment contracts, time sheets, license, copyright and civil law contracts, copies of leave agreements (educational, child care, without pay), copies of orders on admission, dismissal and transfer, personal cards in form No. T-2 (or another form established by the company), work books. Inspectors may also require lists of the company’s employees and their personal files (this especially applies to those employees who are entitled to early retirement benefits). But keep in mind that Pension Fund employees do not have the right to seize documents.

On-site inspections of the FSS of the Russian Federation. New order

The Social Insurance Fund has developed new Guidelines on the procedure for appointing, conducting documentary on-site inspections of policyholders for compulsory social insurance and taking measures based on their results (approved by Resolution of the Federal Social Insurance Fund of the Russian Federation of April 7, 2008 N 81, hereinafter referred to as the Guidelines). The document was registered with the Ministry of Justice of Russia on May 13, 2008 (N 11667) and will come into force 10 days after the day of official publication, but to date it has not been published.

The document is intended to replace the currently existing Methodological Instructions, approved. Resolution of the Federal Tax Service of the Russian Federation dated March 17, 2004 No. 24 (hereinafter referred to as Resolution No. 24).

The Fund conducts documentary on-site and desk audits of policyholders, may request relevant documents from the policyholder and request explanations.

Testing technique

Commenting on the essence of the innovations introduced by Resolution No. 81, we note that the criteria for selecting policyholders for inspection have been changed. Thus, scheduled inspections are abolished (Resolution No. 24 provides for scheduled inspections to be carried out at least once every three years), and the receipt by the policyholder of significant amounts from a department (branch department) of the Fund for the implementation (reimbursement) of expenses for compulsory social insurance may become a reason for an inspection, only if this happens systematically (according to Resolution No. 24, a single similar case served as the basis for ordering an on-site inspection). Other criteria for selecting policyholders for conducting an on-site inspection include, as before, significant expenses incurred by the policyholder for compulsory social insurance, as well as recommendations based on the results of a desk audit of the policyholder.

According to the new rules, an on-site inspection cannot last more than one month (clause

Deadlines for Pension Fund inspections

Depending on the type of inspection, the following deadlines are established:

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week. Subscribe I agree with the terms of personal data processing

- A desk audit (based on documents available to the fund) is carried out within 3 months from the date of receipt of the reports. Only the period for which the reports were submitted is checked.

- The on-site inspection is limited to 2 months, but in some cases the event can be extended to 4 or 6 months.

Why does the FSS check 71 accounts and what does it check?

7 Guidelines). Previously, the standard inspection period was two months, and according to the Methodological Recommendations, it can only in individual cases be extended to two or three months by the decision of the manager (deputy manager) of the Fund’s department. This period includes checking the expenditure of the Fund’s funds also by branches and representative offices of the organization, and only when conducting an independent audit of the branches and representative offices of the insured, the verification period is increased for a period of no more than one month to conduct an audit of each such unit (currently, the period for checking the organization is increased by a month for inspection of each branch and representative office).

Paragraph 7 of the Guidelines also introduces a mechanism for suspending inspections, which was not included in Resolution No. 24.

New circumstances have also emerged that give the Fund the right to conduct a second on-site inspection: the submission by the policyholder of an updated payroll statement for the Fund’s funds, which contains data in a smaller (larger) amount than in the previously submitted payroll statement. At the same time, according to clause 8 of the Methodological Instructions, during a re-inspection, a period not exceeding three calendar years preceding the year in which the decision to conduct a re-inspection was made.

If the policyholder fails to provide the requested documents during the inspection, the inspector has the right to request the documents necessary for the inspection on the basis of the requirement to submit documents (Appendix No. 6 to the Methodological Instructions). Documents must be submitted by the policyholder in the form of duly certified copies. The policyholder has 10 days to submit the requested documents, not five as before (clause 10 of the Guidelines). The policyholder is also given the right to apply for an extension of the period for preparing the requested documents.

The new document more clearly defines the procedure for drawing up and delivering a certificate of completion of the inspection: it must be prepared on the last day of the inspection in the form given in Appendix No. 8 to the Methodological Instructions, and handed over to the head of the organization being inspected or to the individual entrepreneur (their representatives).

Clauses 12 - 22 describe the procedure for drawing up an inspection report of the insured and the requirements for its execution, as well as the procedure for signing and delivering the act to the person being inspected.

The form of the act is given in Appendix No. 9 to the Methodological Instructions. The contents of the act remained the same. It provides information about the person being inspected and the inspectors, indicates violations identified during the inspection and amounts not accepted for credit to the Social Insurance Fund, and also outlines the inspectors’ proposals for correcting errors.

The report must be drawn up during the inspection or no later than two months after drawing up a certificate of the inspection. The act is drawn up in two copies, one of which remains in storage in the department (branch department) of the Fund, the other is transferred to the head of the organization being inspected (separate division) or to the individual entrepreneur (their representatives).

The act must be signed by the inspector(s), the head of the inspected organization (separate division) or an individual entrepreneur (their representatives).

The act signed by the inspector(s) is handed over to the head of the organization (separate unit) or individual entrepreneur (their representatives), about which an entry is made on the last page of the copy of the act remaining in storage in the department (branch of the department) of the Fund: “A copy of the act with attachments on ____ sheets received” signed by the head of the organization (separate division) or individual entrepreneur (their representatives) who received the act, indicating his surname and initials, as well as the date of delivery of the act.

If these persons evade receiving the act (by not appearing at the department (branch office) of the Fund or by refusing to sign a delivery notice from the postman), an entry is made on the last page of the act:

“__________________________________________________________________________ (full name of the head of the organization indicating his position, ______________________________________________________________________________ full name of the organization (separate division), full name of the individual entrepreneur (full name of their representatives)) avoided receiving this act" ,

certified by the signature of the inspector indicating the corresponding date.

In this case, the certificate must be sent to the policyholder by registered mail or transmitted in another way indicating the date of its receipt. A copy of the act, which remains in storage at the department (branch of the department) of the Fund, is accompanied by documents confirming the fact of mailing or another method of transferring the act to the policyholder (his representative). When the act is sent by registered mail, the date of its delivery is considered to be the sixth day starting from the date of its dispatch.

The policyholder has the right, in case of disagreement with the facts stated in the act, as well as with the conclusions and proposals of the inspectors, to submit to the relevant department (branch branch) of the Fund a written explanation of the reasons for the refusal to sign the act or objections to the act as a whole or to its individual provisions. In this case, the policyholder has the right to attach to a written explanation (objection) or, within the above-mentioned period, transfer to the department (branch department) of the Fund documents (their certified copies) confirming the validity of the objections or the reasons for not signing the act.

According to the new rules, the policyholder is given 15 working days from the date of receipt of the act to appeal the act, and not two weeks, as now (clause 23 of the Methodological Instructions).

After the expiration of this period, within 10 days, the head (deputy head) of the department (branch department) of the Fund makes a decision based on the results of consideration of the act and other inspection materials.

The policyholder has the right to be present during the consideration of the act.

Within 10 working days from the date of expiration of the period for consideration of the inspection materials, a decision is made on the facts of violations committed by the insured:

- on non-acceptance of expenses incurred by the policyholder - payer of the unified social tax for the purposes of compulsory social insurance;

- on non-acceptance of expenses incurred by the policyholder - an employer applying a special tax regime, against funds received from the department (branch department) of the Fund for the purposes of compulsory social insurance. This decision is submitted by the department (branch department) of the Fund to the tax office within 10 days from the date of its adoption (clause 29 of the Methodological Instructions. This procedure is still in effect);

- on sending a notification about the presence of arrears in insurance contributions for compulsory social insurance of employees in case of temporary disability to the insured-employer who voluntarily pays insurance contributions to the Fund for compulsory social insurance of employees in case of temporary disability in connection with maternity.

A copy of the decision of the head of the department (branch branch) of the Fund is handed over to the policyholder (his representative) against receipt or in another way indicating the date of its receipt by the policyholder (his representative).

Paragraphs 31 - 33 of the Methodological Guidelines determine the procedure for the execution of decisions of the Social Insurance Fund by policyholders who apply special tax regimes and do not pay the unified social tax.

Verified documentation

The provisions of legal acts do not provide for a specific list of documents that authorized representatives of the FSS have the right to demand during inspection. For this reason, they may request documentation that, in their opinion, is relevant for analyzing the situation at the enterprise. The contents of the papers may not be relevant to the case being verified, but the head of the enterprise is obliged to provide them. Before conducting an inspection, he needs to prepare in advance a set of papers potentially necessary for monitoring the situation:

- Constituent and registration documentation;

- Financial and accounting reporting;

- Banking and cash documentation;

- Documentation required to calculate benefit amounts.

The list of papers for verification is determined for each enterprise by authorized representatives. The manager of the enterprise must be notified in advance of the need to prepare it in order to be able to present them at the time of inspection, and not delay the inspectors with lengthy searches. The papers must be provided in photocopied form for their consideration. The exception is sick leave certificates presented in the original. A certificate of incapacity for work is a document on the basis of which benefits are paid to an employee. For this reason, authorized representatives of the Social Insurance Fund pay special attention to monitoring sick leave during desk and field control. They will check the document form for compliance with state standards and identify current disability certificates from counterfeits.

Payment for the time a person is absent from work due to illness can only be made if the appropriate document is correctly prepared. It must be completed in clear and legible handwriting. The information included in the document is certified by the doctor’s signature and the seal of the medical institution. All information on the sheet must be current and reliable. If there are errors, they must be corrected and certified. Unreliability in the employee’s personal information or in the name of the business entity with which he has an employment relationship is a reason to invalidate the document. The FSS checks not only the section of the sick leave certificate filled out by representatives of the enterprise, but also that part of it for which the medical organization is responsible.

Checking expenses for payment of benefits for temporary disability, pregnancy and childbirth

Contents of section II of the Guidelines has been updated in accordance with current legislation.

Thus, it is indicated that the payment of benefits for temporary disability and pregnancy and childbirth is made not only at the main place of work, but if the insured person works for several employers - by each employer (for insured events occurring from January 1, 2007).

Clause 45 provides for a different procedure for paying benefits for the past:

- the benefit is assigned if the application is made no later than 6 months from the date of restoration of working capacity (establishment of disability with limited ability to work), as well as the end of the period of release from work in cases of caring for a sick family member, quarantine, prosthetics and after-care, or the end of vacation for pregnancy and childbirth;

- benefits for temporary disability, pregnancy and childbirth assigned but not received by the insured person in a timely manner are paid for the entire past time, but not more than for three years preceding the application for them;

- benefits not received by the insured person in whole or in part due to the fault of the employer or the regional branch of the Fund are paid for the entire past time without limitation by any period.

Resolution No. 24 specified other deadlines: temporary disability benefits for the past could be received no more than 12 months from the date of application for benefits.

Clause 47 of the Guidelines provides updated rules for the payment of benefits to preferential categories of insured: disabled people, parents of many children, veterans, Chernobyl victims, donors, persons with post-vaccination complications, northerners, etc. - taking into account the new procedure for applying benefits previously established for these persons, and in accordance with Art. 17 of the Federal Law of December 29, 2006 N 255-FZ “On the provision of benefits for temporary disability, pregnancy and childbirth to citizens subject to compulsory social insurance.”

It is clarified in accordance with the same Law that maternity benefits to an insured woman are paid in the amount of 100% of average earnings if her insurance period is more than six months (otherwise the benefit will be the minimum wage for a full month of maternity leave).

Inspectors are guided by new regulatory documents, links to which appeared in the Guidelines:

The procedure for issuing certificates of incapacity for work by medical organizations, approved by Order of the Ministry of Health and Social Development of Russia dated 01.08.2007 N 514;

Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375;

Order of the Ministry of Health and Social Development of Russia dated 02/06/2007 N 91 “On approval of the Rules for calculating and confirming insurance experience to determine the amount of benefits for temporary disability, pregnancy and childbirth”, etc.

Paragraph 60 of the Guidelines determines which violations in the registration of sick leave made by a doctor are paid special attention to by inspectors. Taking into account the new procedure for issuing sick leave, the list of violations has been significantly changed:

- there are more than two corrections on the front side of the certificate of incapacity for work;

- the place of work is not indicated;

- the reason for the disability is not specified;

- issued by a medical organization, a doctor engaged in private medical practice of a non-medical organization, who does not have a license to carry out the examination of temporary disability;

- issued (extended) to citizens located outside the place of registration at the place of residence, without the permission of the chief physician of a medical organization or his deputy;

- documents confirming the temporary disability of citizens during their stay abroad (after a legalized transfer), without the decision of the medical commission of a medical organization, were replaced with a certificate of incapacity for work established in the Russian Federation;

- issued by a medical worker at a time for a period exceeding 10 calendar days, and independently or without a decision of the medical commission extended for a period exceeding 30 days;

- issued in the past without a decision of the medical commission;

- issued at the place of registration, at the citizen’s place of residence, and extended by a medical organization outside the administrative region without the permission of the chief physician of the medical organization or his deputy;

- when a citizen is discharged after hospital treatment, extended after the date of discharge from the hospital for a period of more than 10 days;

- in case of intermittent periods of release from work, issued for each period of release from work without a decision of the medical commission;

- issued in a clinic of research institutions (institutes) of balneology, physiotherapy and rehabilitation, and not by a medical worker on the basis of a decision of a medical commission when sending a citizen for treatment to the specified clinic;

- extended for a period of over 10 months (in some cases: trauma, conditions after reconstructive operations, tuberculosis - over 12 months);

- extended after the date of registration of documents by the institution of medical and social examination when a disability is established with a degree of limitation in the ability to work;

- extended for a period of more than 24 calendar days when sending patients for follow-up treatment to specialized sanatorium-resort institutions immediately after inpatient treatment by decision of the medical commission of a specialized sanatorium-resort institution;

- issued for the entire period of treatment, follow-up treatment and travel when medical institutions send patients with tuberculosis with vouchers to specialized (anti-tuberculosis) sanatoriums for treatment for the first detected active form of tuberculosis in the case where sanatorium treatment replaces inpatient treatment, as well as for follow-up treatment after inpatient treatment by the attending physician by decision of the medical commission of the anti-tuberculosis dispensary;

- issued by a medical professional to care for a sick family member over 15 years of age - for outpatient treatment for a period of more than 3 days or by decision of a medical commission for a period of more than 7 days;

- issued for a period of more than 15 days to care for a child aged 7 to 15 years - during outpatient treatment or joint stay of one of the family members (guardian) with the child in a stationary medical institution;

- issued to a citizen receiving prosthetics in an outpatient setting.

Expenses on such certificates of incapacity for work will not be accepted by the Social Insurance Fund for credit until the errors are corrected, so the accountant should independently - without waiting for an inspection - monitor these typical violations and indicate to the employee the need to contact a medical institution for corrections.

Checking "children's" benefits

Paragraph 64 of the Methodological Instructions clarifies that documents justifying the payment of benefits for the birth of a child must be kept in the insurer’s accounting department along with an expenditure order for the payment of benefits.

The documents required for the appointment and payment of a monthly child care benefit for a child up to one and a half years old are listed in paragraph 74, and this list also differs significantly from that previously provided:

a) application for granting benefits;

b) an application from a mother on postnatal leave to replace postnatal leave with parental leave (if the amount of child care benefits is higher than the amount of maternity benefits);

c) a copy of the birth (adoption) certificate of the child being cared for;

d) a copy of the birth (adoption, death) certificate of the previous child (children);

e) an extract from the decision to establish guardianship over a child (in case of adoption or establishment of guardianship over a child);

f) a copy of the order granting parental leave;

g) a certificate from the place of work (study, service) of the mother (father, both parents) of the child stating that she (he, they) does not use the specified leave and does not receive benefits, and if the mother (father, both parents) the child does not work (does not study, does not serve), - a certificate from the social protection authorities at the place of residence of the child’s mother, father about non-receipt of monthly child care benefits - for one of the parents in appropriate cases, as well as for persons actually caring for for the child instead of the mother (father, both parents) of the child.

These documents must be kept for each benefit recipient in the policyholder's accounting department.

Paragraph 79 clarifies that in order to assign and pay benefits to women who are registered with medical institutions in the early stages of pregnancy, a certificate from a medical institution must be submitted with a mandatory indication of the specific period of pregnancy. The certificate is kept in the accounting department.

Paragraphs 86 - 89 of the Methodological Instructions clarify the procedure for assigning and verifying the correct payment of four additional paid days off per month to one of the working parents (guardian, trustee) for the care of disabled children and people with disabilities from childhood until they reach the age of 18 years.

In Sect. III of the Methodological Instructions describes the procedure for checking the correctness of spending funds to pay for vouchers for sanatorium-resort treatment of employees, and in section. IV - correctness of expenses for children's health.

Funeral benefit

To be reimbursed for funeral benefits, you must submit:

- application for benefits;

- death certificate issued by the civil registry office;

- a copy of the death certificate.

Let us remind you that from February 1, 2018, the amount of the funeral benefit is 5,701.31 rubles.

Source:

"Clerk"

Categories:

Sick leave, Maternity leave, Child benefits

temporary disability benefit maternity benefit reimbursement of expenses instructions for an accountant

- Inna Kosnova, Clerk columnist, accounting and taxation expert

Sign up 7800

9750 ₽

–20%

* * *

Let us also recall that the Federal Insurance Service of the Russian Federation has issued two more methodological documents, which it will further be guided by when inspecting policyholders:

- Resolution of the Federal Insurance Service of the Russian Federation dated 04/07/2008 N 82 “On approval of methodological instructions on the procedure for appointing, conducting documentary on-site inspections of policyholders for compulsory social insurance against industrial accidents and occupational diseases and taking measures based on their results.”

- Resolution of the Federal Insurance Service of the Russian Federation dated May 21, 2008 N 110 “On approval of guidelines for conducting desk audits of policyholders for compulsory social insurance and compulsory social insurance against industrial accidents and occupational diseases.”

M.A. Semenova

Consultant

magazine "Accounting Bulletin"