Conducted research and the creation of new technological developments must be reflected in accounting. The method of recording data depends on who is performing the work. Research can be ordered from a specialized company or carried out on your own. If research and development work (R&D) is carried out by a third-party organization, in order to take into account expenses in the form of payment for services, this company needs documentary grounds - an agreement.

What is included in R&D expenses on account 04?

IMPORTANT! An agreement with an organization performing R&D work must be in writing.

An agreement between enterprises may provide for a full cycle of research or the solution of part of the problems within the framework of a large-scale project. If the work is carried out on its own, then it is necessary to register the ongoing research activities in the database of the All-Russian Information Center. The notification forms are approved by Order of the Ministry of Education and Science dated March 31, 2016 No. 341. If the rules for reporting ongoing research developments are violated, a fine may be imposed on the organization.

Question: How are R&D expenses associated with the improvement of manufactured products reflected in the accounting of the organization (customer), if this work has yielded a positive result, which is used in production activities? View answer

The essence of R&D in an organization

The essence of R&D is to carry out special activities related to the creation of completely new or improvement of existing products, optimization of technological processes or management methods. It should be taken into account that the result of R&D must be something new and unique, for example, a product or technology - the introduction into the production and economic process of something already created earlier is not the resulting indicator of R&D.

Research and development work can be carried out by both specialized design and research bureaus and directly commercial enterprises for their own purposes or as services to an outside organization.

When carrying out interaction between the two parties, an agreement is concluded, to which a technical specification is attached, according to which the contractor is obliged to complete the task assigned to him, and the customer (contractor) is to check and accept the results obtained. The contract should be one of two types: (click to expand)

| Contract type | Description |

| Research contract | With this type of relationship, the contractor carries out research work specified in the direct terms of reference. The result of the work is information that is obtained through calculations and various studies. |

| Contract for development work | With this type of relationship, the contractor carries out development work, as a result of which a new product or technology is created, for which technical documentation is mandatory. The resulting performance indicator is a new product or new technology, as well as completed documentation for it. |

What is included in R&D expenses?

R&D stands for “scientific research and development.” They are intended to form a new or improved technology, to invent a new type of product with more advanced characteristics. R&D expenditures can be directed towards finding improved methods of organizing production or implementing management functions.

Question: Is it possible to recognize R&D expenses, the results of which began to be used after the expiration of the period allotted for their write-off (clause 2 of Article 262 of the Tax Code of the Russian Federation)? View answer

The composition of expenses incurred by an institution in connection with ongoing R&D is determined by Art. 262 Tax Code of the Russian Federation:

- Depreciation charges for fixed assets and intangible assets involved in the work.

- Compensation for personnel involved in research activities or operations to develop new designs.

- Material costs allocated for R&D. These include the purchase of exclusive rights to the results of inventive activity, to the resulting utility models or unique industrial designs. The transfer of rights is carried out through an alienation agreement. It is allowed to allocate expenses for the acquisition of rights to use intellectual property.

- Other expense transactions that are directly related to R&D. The legislation allows them to be included in the amount of costs for research and development activities not in full, but in the amount of up to 75% of the total amount of expenses incurred.

- Payment of invoices under R&D contracts.

NOTE! For the group of labor costs, their inclusion in R&D is possible if the personnel were engaged in research and development work. If these workers are involved in other tasks, accrued earnings are allocated to various types of expenses in proportion to the time worked at the facilities.

Question: Is it possible to recognize R&D expenses according to the new rules if the taxpayer has already begun to take them into account in the previously existing procedure (paragraphs 2 and 3 of paragraph 2 of Article 262 of the Tax Code of the Russian Federation)? View answer

The purpose and objectives of accounting for R&D

R&D costs should be reflected in the accounts of synthetic and analytical accounting, since they reduce the taxable base for profits. The purpose of reflecting R&D in accounting is to identify all expenses that should be classified as expenses for this type of activity, their reflection in the accounting and tax accounts, as well as to identify the legality of applying PBU 17/02 for accounting for R&D expenses.

In relation to this goal, the following tasks of accounting for R&D can be identified:

- determining whether costs are classified as R&D or should be included in other company expenses;

- identifying a positive result from R&D and determining the period of its useful use;

- correct reflection in the accounts of synthetic and analytical accounting in order to summarize all costs incurred;

- correct write-off of expenses in accounting and tax accounting in accordance with adopted legislation.

Report when applying a multiplying factor

When calculating income tax, the right to apply a multiplying factor to R&D costs must be confirmed. To do this, along with your income tax return, submit reports for each completed R&D or individual stages of work. If, due to the specifics of the work, a report can only be drawn up for R&D as a whole and cannot be submitted in the reporting period when the stages are completed, then the organization does not have the right to apply an increasing factor to expenses for individual stages of work. This procedure follows from the provisions of paragraph 8 of Article 262 of the Tax Code of the Russian Federation and is explained in the letter of the Ministry of Finance of Russia dated August 7, 2013 No. 03-03-10/31889 (brought to the attention of the tax inspectorates by letter of the Federal Tax Service of Russia dated September 9, 2013 No. ED- 4-3/16239).

The R&D report must be drawn up in accordance with the requirements of national standards, in particular, GOST 7.32-2001 (put into effect by Decree of the State Standard of Russia dated September 4, 2001 No. 367-st). Such clarifications are given in the letter of the Ministry of Finance of Russia dated March 5, 2012 No. 03-03-06/1/119.

If an organization submits a declaration in electronic form, then submit the report as a scanned copy in tiff or pdf format. Submit the file with the R&D report via telecommunication channels, taking into account the requirements established for written requests to the tax office (Appendix 5 to the unified format of the transport container, approved by order of the Federal Tax Service of Russia dated November 9, 2010 No. ММВ-7-6/535). Such clarifications are given in the letter of the Ministry of Finance of Russia dated January 23, 2013 No. 03-03-06/1/23.

As a general rule, the file with the R&D report and the tax return must be submitted to the tax office at the same time (clause 8 of Article 262 of the Tax Code of the Russian Federation). However, the Federal Tax Service of Russia recommends submitting a report after receiving a receipt from the tax office confirming the acceptance of the declaration. In this case, in the text of the accompanying message, indicate the name of the file of the submitted declaration and the period for which it was submitted. This will allow the tax office to correlate the R&D report with the income tax return. This procedure follows from the letter of the Federal Tax Service of Russia dated March 26, 2013 No. ED-4-3/5206 (the document is posted on the official website of the Federal Tax Service of Russia).

Failure to submit a report may result in inspectors recalculating the tax base without taking into account the increasing factor of 1.5. An R&D report does not need to be submitted if work according to the list approved by Decree of the Government of the Russian Federation of December 24, 2008 No. 988 was started before January 1, 2012. This procedure follows from the provisions of paragraphs 8 and 11 of Article 262 of the Tax Code of the Russian Federation.

Features of R&D accounting

Accounting for R&D can only be carried out if a number of certain conditions established at the legislative level are met. These points include the following:

- all work performed must have a positive effect or result;

- R&D results should be used in the future in production or economic activities in order to obtain economic benefits;

- the work must be completely completed, that is, some result must be obtained from it;

- Appropriate documentation must be drawn up for all results obtained.

In addition, the legislation specifically identifies expenses that must be considered as related to R&D. If expenses are included in expenses that are not included in this list, the tax authorities will take this as an error and apply certain sanctions, since they consider this action to be a deliberate understatement of the tax base for profits.

R&D accounting

All R&D costs are reflected in accounting after the month in which the company begins to use the results of the work carried out in its production activities. Until this moment, that is, until the result begins to be used for practical purposes, costs cannot be attributed to R&D.

Write-off of R&D expenses is carried out in proportion to the time that is the period of useful use of the R&D result, but it cannot be more than 5 years. In other words, the company determines the useful life period of a new product, fixed asset or technology, takes it in monthly terms, and then divides the entire cost by the calculated number of months. An enterprise can attribute exactly this amount to R&D expenses, but no more.

Tax accounting of R&D

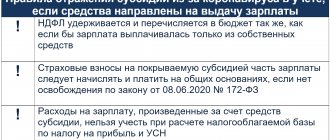

Accounting for R&D expenses in tax accounting is carried out regardless of whether the activity brought a positive result or not. At the same time, only an organization that independently carries out R&D or acts as a customer can use the amount of costs as a way to reduce the tax base. If R&D for an enterprise is its main activity, then such costs are considered as expenses for carrying out production or business activities.

R&D costs for tax accounting are written off within one year in equal shares from the month following the month of completion of research and development work. In a situation where the final results of R&D are no longer used, the costs for them are also not written off as expenses that reduce the tax base for profits.

Accounting for labor costs

R&D expenses associated with the payment of employees while they perform research or development include:

- accruals based on tariff rates, official salaries, piece rates or as a percentage of revenue (clause 1 of Article 255 of the Tax Code of the Russian Federation);

- accruals of an incentive and (or) compensatory nature related to working hours and working conditions, bonuses for working at night, in multi-shift mode, for combining professions, expanding service areas, for working in difficult, harmful, especially harmful working conditions, for overtime work and work on weekends and holidays (clause 3 of article 255 of the Tax Code of the Russian Federation);

- payments (contributions) of employing organizations for compulsory insurance, for the funded part of the labor pension and voluntary non-state pension insurance (clause 16 of article 255 of the Tax Code of the Russian Federation);

- payments to freelance workers under civil contracts, contracts (with the exception of entrepreneurs) (clause 21 of article 255 of the Tax Code of the Russian Federation).

Such a list is given in subparagraph 2 of paragraph 2 of Article 262 of the Tax Code of the Russian Federation.

At the same time, do not include sick leave benefits for the first three days of incapacity for research and development expenses. This is explained by the fact that during the period of illness the employee does not fulfill his job duties. Therefore, take such payments into account as a general rule. Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated May 31, 2013 No. ED-4-3/9941.

Expenses for remuneration of employees not listed in the list can be taken into account as other expenses directly related to R&D (subclause 4, clause 2, clause 5, article 262 of the Tax Code of the Russian Federation).

If employees performing R&D are involved in other work, then take into account labor costs on this basis in proportion to the time of participation in research or development (clause 3 of Article 262 of the Tax Code of the Russian Federation). The procedure for determining such a proportion is not established by tax legislation, therefore the organization must independently establish a methodology for distributing labor costs, enshrining it in the accounting policy for tax purposes (letter of the Ministry of Finance of Russia dated October 12, 2012 No. 03-03-06/1/543) .

Difference between tax and accounting

The difference between these two types of accounting for R&D expenses can be represented as follows: (click to expand)

| Paragraph | Accounting | Tax accounting |

| Moment of reflection of expenses in accounting | After starting to use the resulting R&D results | After completion of R&D |

| Period of cost write-off in accounting | According to useful life period | No more than 1 year |

| Resultant result of R&D | Expenses are reflected if the total is positive on account 08 “Intangible assets”, and if the total is negative – on account 91/2 “Other expenses” | Expenses are taken into account for both positive and negative R&D results |

| Reflection of costs depending on the result | The result relates to intangible assets, fixed assets, other expenses or costs of core activities | The result relates to intangible assets, fixed or other production and sales expenses |

What is included in research and development work?

R&D includes:

- Scientific research;

- development of a new product (sample, documentation, technology).

If a patent or certificate is obtained for the result of R&D, it is recorded in account 04 as an intangible asset. If the rights are not formalized, then they are also taken into account in account 04, but as R&D expenses.

If R&D produces a negative result, it is written off as other expenses.

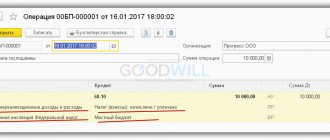

After registering the right to R&D (completion of work), one of the following entries is made:

DEBIT 04 CREDIT 08

– intangible assets are taken into account;

DEBIT 04 subaccount R&D results CREDIT 08

– actual R&D expenses are taken into account;

DEBIT 91-2 CREDIT 08

– R&D expenses that did not produce a positive result were written off.

Accounting for intangible assets is carried out in accordance with PBU 14/2007 “Accounting for intangible assets” (approved by order of the Ministry of Finance of Russia dated December 27, 2007 No. 153n). Their value is written off through depreciation.

An example of typical entries for accounting for R&D at an enterprise

Strela LLC independently carried out R&D in January 2021. The useful life of the results is 2 years. The costs it incurred in doing so are:

- materials RUB 120,000;

- depreciation of equipment and fixed assets RUB 5,000;

- wages of employees performing R&D, 73,000 rubles;

- contributions to extra-budgetary funds 22,000 rubles;

In this case, the accountant must generate the following entries presented in the table below.

| Debit | Credit | Operation description |

| 08 | 02 | the amount of depreciation of equipment and fixed assets was written off |

| 08 | 10 | the amount of materials used is written off |

| 08 | 70 | the amount of wages of employees performing R&D was written off |

| 08 | 69 | the amount of contributions to extra-budgetary funds has been written off |

After all expenses incurred are collected in account 08 and the R&D result begins to be used in the production process, for example, in March 2021), the following entry must be made:

Debit 04 Credit 08 – expenses related to R&D were incurred in the amount of RUB 9,166.67. (RUB 220,000 / 24 months)

In tax accounting, expenses will be taken into account in a slightly different way:

220,000 rub. / 12 months = 18,333.33 rub.

Intangible assets

R&D expenses are included in intangible assets if the following conditions are simultaneously met:

- the result of R&D does not have a tangible form (for example, a patent);

- the work is completed and its completion is documented;

- the results of the R&D are positive (the expected result has been achieved);

- the existence of the object itself and the exclusive rights to it are documented;

- R&D results are used in the production of products (works, services), for the management needs of the organization or to otherwise extract economic benefits (income). However, there are no plans to further sell the property for at least 12 months.

This is stated in paragraphs 2, 3 of PBU 14/2007 and paragraph 3 of PBU 17/02.

For more information about the criteria for intellectual property that are recognized as intangible assets, see What assets are classified as intangible.

If, as a result of R&D, an organization plans to create an intangible asset, then the costs associated with R&D are reflected in non-current assets (account 08-8 “Performance of research, development and technological work”). If R&D expenses were taken into account as part of other expenses of previous periods, then they cannot be taken into account as part of capital investments (clause 10 of PBU 14/2007).

An organization can perform R&D:

- on your own;

- by third party contractors.

Record expenses for carrying out R&D on your own using the following entries:

Debit 08-8 Credit 70 (69, 68, 10, 23...)

– R&D expenses performed in-house are reflected.

If the organization is the customer, and R&D is carried out by the contractor, reflect such expenses by posting:

Debit 08-8 Credit 60 (76)

– expenses for performing R&D on a contract basis are reflected.

After all the conditions for recognizing R&D expenses as part of intangible assets are met, their value from account 08-8 is transferred to account 04 “Intangible assets”:

Debit 04 Credit 08-8

– included in the composition of intangible assets are R&D expenses performed by contract (with the organization’s own resources).

The cost of intangible assets is repaid gradually through depreciation (clause 23 of PBU 14/2007).

An example of how R&D expenses to be included in intangible assets are reflected in accounting

Alpha LLC, using its own design bureau, carries out R&D, as a result of which it plans to obtain a patent for a utility model and use it to generate income. According to the order of the head, the work began in May. R&D completed in July.

The cost of the work amounted to 100,000 rubles, including:

- in May – 40,000 rubles. (including contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases);

- in June – 40,000 rubles. (including contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases);

- in July – 20,000 rubles. (including contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases).

Every month, from May to July, the accountant reflected R&D expenses by posting:

Debit 23 Credit 70 (69, 68, 10, 02...) – 100,000 rubles. – expenses for R&D are reflected.

In July, upon completion of work, the total amount of R&D costs is reflected as part of investments in non-current assets:

Debit 08-8 Credit 23 – 100,000 rub. – R&D costs are taken into account as part of investments in non-current assets.

In August, Alpha received a patent confirming that it owns exclusive rights to the utility model. In the same month, the organization began to use the utility model in production. To account for the received patent, in August the accountant opened a card in form No. NMA-1. In the same month, he formed the initial cost of the intangible asset in the amount of 101,500 rubles, including:

- R&D expenses – 100,000 rubles;

- expenses associated with patent registration – 300 rubles. (fee for filing an application for a utility model patent) and 1200 rubles. (fee for registering a utility model and issuing a patent).

In August, the following entry was made in Alpha’s accounting records:

Debit 04 Credit 08-8 – 101,500 rub. – exclusive rights to a utility model are taken into account as part of intangible assets.