When the lessee no longer needs the leased property, or is unable to pay for it due to financial difficulties, there is a completely accessible solution - transfer the debt to a third party. This procedure allows you to legally transfer the rights to the leased asset to a third party, who will use and own the leased property, paying regular payments in accordance with the concluded agreement.

Let's take a closer look at the leasing assignment procedure - how the debt is transferred, what documents are needed for this and what difficulties the lessee will have to face.

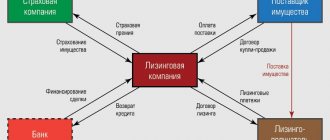

General provisions on the leasing agreement: concept, subject, ownership of the transferred property

The concept of a leasing agreement is defined by the provisions of Art. 665 of the Civil Code of the Russian Federation. According to this article, it is understood as an agreement in which one party undertakes to acquire an object of real estate or movable property specified by the second party and transfer it to the first for temporary use and possession for conducting business activities. At the same time, a financial lease agreement (also known as a leasing agreement), in accordance with the provisions of Art. 625 of the Civil Code of the Russian Federation, is recognized as a type of lease agreement, which allows the norms of § 1 Ch. 34 Civil Code of the Russian Federation.

The subject of leasing, in accordance with paragraph 1 of Art. 3 of the Federal Law “On Financial Lease...” dated October 29, 1998 No. 164, there can be any things that are not subject to consumption (structures, equipment, transport, other real estate and movable objects). According to paragraph 1 of Art. 11 of the same regulatory act, property transferred to the user on the basis of a leasing agreement (i.e., for temporary possession) remains the property of the organization that provides it. The lessee, in turn, receives 2 powers: ownership and use. Moreover, as a general rule, he does not have the right to sell the thing received under the contract or otherwise dispose of it.

However, by virtue of paragraph 1 of Art. 19 Federal Law No. 164, the agreement may also provide for the possibility of transferring ownership rights in favor of the lessee, which can be carried out both after the expiration of the agreement and before its expiration.

We give the leased item for re-rental

The article from the magazine "MAIN BOOK" is current as of October 2, 2015.

Contents of the magazine No. 20 for 2015 L.A. Elina, economist-accountant

Tax accounting for the lessee in the last month of use of the leased property

A leasing agreement is usually concluded for several years. However, the plans or capabilities of the lessee may change - the equipment will no longer be needed or leasing payments will become too high. You can terminate the leasing contract, but this is often fraught with the payment of a penalty or other losses. Therefore, it is better to find a replacement - to enter into a re-lease agreement/agreement, under which another company will become the lessee (there will be a change of party in the original leasing agreement). Of course, if the lessor agrees to such a replacement. 2 tbsp. 615, paragraph 1, art. 389, para. 1, 2 tbsp. 391, art. 392.3 Civil Code of the Russian Federation; clause 1 art. 18 of the Law of October 29, 1998 No. 164-FZ.

After a change of lessee has occurred, accounting issues arise. We will consider the features of “profitable” tax accounting of the operations of the former lessee if the leased asset was taken into account on his balance sheet.

Assignment under a leasing agreement

Assignment under a leasing agreement means the transfer by the lessee of the right to use the leased property to a third party under the conditions established by the provisions of the concluded leasing agreement. The need to assign rights arises if the lessee is unable to independently fulfill its financial obligations or no longer needs the property leased. Termination of a previously concluded agreement is fraught with various sanctions for the party that put forward such an initiative (including the emergence of an obligation to pay fines and penalties). That is why most lessees seek to find a company that can assume the rights and obligations that arise when concluding a leasing agreement.

According to paragraph 2 of Art. 615 of the Civil Code of the Russian Federation, the replacement of the lessee can be qualified as a re-lease. In this case, the new participant in the legal relationship that arose during the transfer of property assumes all the rights and obligations of its previous recipient.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The assignment procedure should be distinguished from the transfer of property for subleasing, which, according to clause 1 of Art. 8 Federal Law No. 164, is a type of sublease of property received under lease, in which the recipient under a leasing agreement transfers it for possession and use to third parties on the basis of a concluded agreement establishing the amount of payment for the use of such property, as well as the terms for which it is transferred to the recipient under the subleasing agreement. In this case, the sublessee does not acquire any rights and obligations to the main lessor - he has legal relations only with the lessee.

Postings to the lessee, if the car is included in the lessor’s balance sheet

In this case, accounting for drugs is a little simpler. The car itself is accounted for in an off-balance sheet account; depreciation on it is not accrued and is not taken into account.

| Agreement conditions | Dt | CT | Posting Contents | Note |

| The car becomes the property of the LP. The purchase price is included in the lease payments | 001 “Property on lease” | Car taken for balance | The posting is made for the amount (cost) of the car for which the LD purchased it. For example, LD purchased a car for 1.5 million rubles. - this means that the LP receives a car for balance at a cost of 1.5 million rubles. | |

| 20 (25,26,44) | 76/ Leasing payments | Another payment accrued | Without VAT | |

| 19 | 76/ Leasing payments | Input VAT reflected | ||

| 76/ Advances issued | 76/ Leasing payments | An advance payment for the purchase price is reflected as part of the lease payment | This posting forms on Kt 76 the final amount payable for the LD period | |

| 76/ Leasing payments | 51 (50) | Payment for LD | ||

| 68 | 19 | Accepted for VAT deduction | In terms of the “closed” lease payment for the expired period under the agreement. The advance payment for repurchase listed as part of the payment is not deducted until the actual repurchase of the object | |

| The car becomes the property of the LP. The purchase price is not included in the lease payments and is paid separately | 001 “Property on lease” | Car taken for balance | ||

| 20 (25, 26, 44) | 76/ Leasing payments | Another payment accrued | Without VAT | |

| 19 | 76/Leasing payments | Input VAT reflected | ||

| 76/ Leasing payments | 51 (50) | Payment for LD | ||

| 68 | 19 | Accepted for VAT deduction |

Change of lessee under a leasing agreement

A prerequisite for the transfer of debt to a third party, in accordance with paragraph 2 of Art. 391 of the Civil Code of the Russian Federation, is the presence of the written consent of the creditor. If it is missing, the concluded transaction will be considered void. The legislator does not establish the exact form and content of such a document, so the lessor can draw it up independently.

The sequence of actions aimed at completing the documentation accompanying the change of lessee is as follows:

- The recipient of property under a leasing agreement applies to the lessor with a written request to obtain permission to transfer the object of the agreement, as well as related rights and obligations to a third party under the terms of a financial lease.

- The lessor reviews the proposal received and gives a written response, which can be either positive or negative. If the answer is negative, the lessee is deprived of the opportunity to make the assignment.

- Based on the permission received, the old and new lessors, as well as the lessee, enter into a tripartite agreement, the provisions of which regulate the procedure for transferring property to the new recipient and making payments to the accounts of counterparties, as well as other issues that the parties to the transaction consider significant.

In the event that the property leased was registered in the name of the original lessee under the agreement, it, in accordance with Art. 20 Federal Law No. 164, it is necessary to re-register with a new lessee.

Accounting with the lessor

For companies that provide services for the transfer of property under leasing conditions, separate accounting standards apply. This is explained by the fact that a significant part of the organization’s assets can be formed by investments in material assets. This happens when the property transferred for use to the lessee is on the balance sheet of the lessor.

Paragraph 5 of PBU 6/01 obliges organizations that transfer their fixed assets to a counterparty on a temporary basis for the purpose of generating income to display them in their financial statements as profitable investments in tangible assets.

Let us now consider the features of leasing transactions when the asset is on the lessor’s balance sheet. We will not change the figures taken in the last section, but we note that now the redemption price will be taken into account in advance in the amount of monthly payments to Stroitel LLC.

The leased asset is on the balance sheet of the lessor, and its useful life is 46 months. We will calculate depreciation using the linear method. Using simple calculations, we establish that depreciation is equal to 26,086.96 rubles (1,200,000 46).

- Debit 08 Credit 60 1,200,000 equipment is credited to the balance sheet of Parus LLC;

- Debit 19 Credit 60,300,000 VAT payment allocated;

- Debit 03 Credit 08 1,200,000 equipment is registered;

- Debit 68 Credit 19,300,000 VAT taken for deduction;

- Debit 03 subaccount “MC provided for temporary use” Credit 03 subaccount “MC in the organization” 1,200,000 equipment transferred to the balance sheet of Stroitel LLC;

- Debit 20 Credit 02 26,086.96 Parus LLC accrued depreciation (a similar entry is made every month);

- Debit 51 Credit 62 40 500 funds were credited from Stroitel LLC;

- Debit 62 Credit 90 40 500 Stroitel LLC records revenue from payments for the use of equipment;

- Debit 90.03 Credit 68 8,100 VAT;

The accountant of Stroitel LLC must carry out the last two operations every month.

- Debit 01 Credit 03 subaccount “MC provided for temporary use” 1,200,000 The initial cost of the equipment was written off after registration of Stroitel LLC;

- Debit 02 Credit 01,939,130.56 (26,086.96×36 months) accrued depreciation of equipment was written off;

- Debit 91.02 Credit 01,260,869.44 (1,200,000,939,130.56) the residual value of the equipment was written off;

- Debit 62 Credit 91.01 18,000 income is taken into account (corresponds to the size of the redemption value);

- Debit 91.02 Credit 68 3,600 VAT payment was charged on the redemption price.

List of documents required for registration of assignment

The package of documents required to transfer all rights and obligations related to the leased property includes:

- A lease agreement for leased property is concluded as an additional agreement to a previously signed agreement between the lessor and the old lessee.

- The act of acceptance and transfer of property.

- Documents attached to the leased object being transferred (for example, a technical equipment passport when transferring a car).

- Documents of the enterprise acting as a new lessee:

- copies of the charter, certificates of state registration and tax registration;

- minutes of a meeting of participants of a legal entity, containing a decision on the need to conclude a leasing transaction, etc.

- Financial documents of the enterprise acting as a new lessee:

- financial statements,

- information about current accounts,

- information about existing loans and leasing obligations, etc.

Redemption of a car at the end of the contract by an individual: current practice and risks

We are starting a series of articles based on questions from portal readers. Mikhail Smagin, CEO of a company from Moscow writes:

“The work of our company involves travel of line-level employees. For this purpose, a company fleet of six vehicles is used. It's time to change it. But, choosing leasing as an acquisition tool, we asked ourselves: is it possible to transfer the car at its residual value to an employee before the end of the contract? This, on the one hand, will provide an incentive for a more careful attitude towards the vehicle, and on the other hand, it will be a good way to financially reward a specialist. Are there any risks in this option?

Carrying out financial settlements when replacing the lessee

One of the main issues that arise when replacing a lessee is the implementation of monetary settlements between the parties to a tripartite agreement. As a rule, in practice, funds are transferred as follows:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- If at the time of conclusion of the agreement the old lessee had an outstanding debt, the advance payment made by him, but not offset at the time of execution of the documents, is used to close the existing debt.

- If the amount of the advance payment that has not been offset at the time of conclusion of the agreement exceeds the amount of debts the lessee has, the overpaid funds are returned to the payer by the lessor or transferred to account for future payments of the new lessee (the latter compensates the old lessee for the expenses incurred by him).

According to the general rule defined in paragraph 1 of Art. 249 of the Tax Code of the Russian Federation, the original lessee is obliged to pay income tax on all funds received by him when re-issuing a leasing agreement from a new lessee (with the exception of VAT included in this amount). In the event that the amount of the advance payment paid by the taxpayer does not completely cover the funds received from the new user of the leased asset, the resulting negative difference is recognized as a loss and must be taken into account when calculating the size of the tax base for the tax on profits received (letter of the Federal Tax Service “On Loss ..." dated 11/11/2011 No. ED-4-3/ [email protected] ).

When calculating the amount of depreciation, taxpayers who are lessees, in accordance with clause 2 of Art. 259.3 of the Tax Code of the Russian Federation, they can apply a special coefficient, the size of which cannot exceed 3. According to the position of the Ministry of Finance of the Russian Federation, set out in letter dated 03/09/2006 No. 03-03-04/1/202, when rehiring property received under lease, the new lessee also may apply the specified coefficient when determining the depreciation value (provided that the property will be taken into account on the balance sheet of its recipient).

Limited Liability Company - 1 (Simplified taxation system) entered into Leasing Agreement No. XXX dated December 15, 201X with the right to transfer ownership of the leased asset upon expiration of the lease agreement, subject to the full fulfillment by the Lessee of all assumed monetary obligations under the Leasing Agreement .

LLC-1 plans to enter into an agreement on the assignment (assignment) of rights and obligations under the leasing agreement to Limited Liability Company - 2 (General taxation system). The leased asset (fixed asset item - movable property) is recorded on the lessee's balance sheet. The redemption payment is not separately allocated in the leasing agreement.

The contractual cost of rehiring the leased property is 1,000 rubles. (including VAT 152.54 rubles).

How to reflect the transaction under an agreement on the assignment of rights and obligations under a leasing agreement in the accounting and tax accounting of the LLC-2 organization, and take the leased asset into account?

How will the leased property be reflected in accounting and tax accounting after the end of the leasing agreement and the transfer of ownership to the new lessee (LLC-2)?

The civil legal features of leasing agreements are defined in § 6 ch. 34 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation) and the provisions of the Federal Law of October 29, 1998 N 164-FZ “On financial rent (leasing)” (Law No. 164-FZ). Thus, leasing is a special case of a rental agreement.

According to Art. 2 of the Federal Law of October 29, 1998 N 164-FZ “On financial lease (leasing)”, a leasing agreement is an agreement according to which the lessor (lessor) undertakes to acquire ownership of the property specified by the lessee (lessee) from the seller specified by him and to provide it to the lessee property for a fee for temporary possession and use.

The possibility of replacing the lessee, that is, transferring his rights and obligations under the leasing agreement to another person (release), follows from clause 2 of Art. 615 of the Civil Code of the Russian Federation, according to which the tenant has the right, with the consent of the lessor, to transfer his rights and obligations under the lease agreement to another person, unless otherwise established by the Civil Code of the Russian Federation, another law or other legal acts. As a result of re-tenancy, the tenant is replaced in the obligation arising from the lease agreement, therefore re-tenancy must be carried out in compliance with the norms of civil law on the assignment of claims and transfer of debt. The transfer of rights and obligations under a financial lease (leasing) agreement is made with the consent of the lessor and is drawn up in appropriate written form (clause 1 of Article 389, clauses 1, 4 of Article 391 of the Civil Code of the Russian Federation).

By agreement of the parties, the leased asset can be taken into account on the balance sheet of any of the parties to the leasing agreement (this right follows from the provisions of clause 4 of Article 421 of the Civil Code of the Russian Federation). In this situation, the property is taken into account on the balance sheet of the lessee.

The procedure for accounting for transactions under a leasing agreement is described in detail in Order of the Ministry of Finance of the Russian Federation dated February 17, 1997 N 15 “On the reflection in accounting of transactions under a leasing agreement” (Instructions No. 15). However, when applying the provisions of this Order, it must be borne in mind that the last edition of this document was adopted in 2001, after which no changes were made to it. Due to significant changes in accounting legislation that have occurred since 2001, it is necessary to follow the procedure set out in the Order taking into account these changes.

1. As a result of concluding an agreement for the assignment (cession) of rights and obligations under the leasing agreement, LLC-2 becomes a new lessee and in its accounting and tax records these transactions are reflected as follows:

Because leasing property is accounted for on the balance sheet of the lessee, then the leased asset is accepted by him for balance sheet accounting as part of fixed assets at its original cost, which, in this case, is equal to the total amount of its debt to the lessor under the leasing agreement (the remaining amount payable by LLC-2 to the lessor) (excluding VAT) (clause 4, PBU 6/01, paragraph 2, clause 8 of Instructions No. 15).

Depreciation on the leased asset for accounting purposes is accrued by the new lessee LLC-2 in the generally established manner (clause 17 of PBU 6/01).

In accordance with paragraph 10 of Art. 258, para. 3 p. 1 art. 257 of the Tax Code of the Russian Federation, the leased asset, recorded on the lessee’s balance sheet, is recognized as depreciable property, the initial cost of which is determined as the amount of the lessor’s expenses for the acquisition of the leased asset. By default, we believe that the lessor's expenses for purchasing the leased asset are specified in the agreement as part of the lease payments.

Consequently, the new lessee has the right to charge depreciation on the leased asset, which is listed on his balance sheet (Letter of the Ministry of Finance of Russia dated May 18, 2012 N 03-03-06/1/253). If the leased asset belongs to the 4th - 10th depreciation groups, then the new lessee has the right to apply an increasing coefficient to the basic depreciation rate (clause 1, clause 2, article 259.3 of the Tax Code of the Russian Federation).

For tax accounting purposes in accordance with paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation, as part of other expenses, the lessee takes into account lease payments for leased property minus the amount of depreciation on this property accrued in accordance with Art. Art. 259.1 and 259.2 of the Tax Code of the Russian Federation.

Thus, the tax expense of the lessee consists of two components:

— depreciation charges;

— leasing payments minus depreciation charges.

If the leasing agreement does not specify the amount of the lessor's expenses for the acquisition of the leased asset, we believe that for tax accounting purposes it would be correct not to recognize the leased asset as depreciable property and to take into account the entire amount of lease payments as other expenses.

2. The fee for obtaining rights under the leasing agreement (the cost of re-leasing the leased property) is taken into account in the accounting records of LLC-2 as an expense.

The current regulations governing the accounting procedure do not provide for a special procedure for accounting for expenses for the re-leasing of leased property, while in their economic meaning these expenses relate to the entire remaining term of the leasing agreement.

We believe that the specified fee can be reflected as part of expenses for ordinary activities at a time on the date of signing the assignment agreement (assignment of rights under a leasing agreement) on the basis of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved. By Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

At the same time, the organization has the right to include the payment for the acquisition of rights under the leasing agreement as expenses evenly over the remaining term of the leasing agreement (especially if the cost of re-leasing is significant). This accounting option is possible on the basis of the norms of clause 19 of PBU 10/99 and clause 8.6.2 of the Concept of Accounting in the Market Economy of Russia.

The chosen procedure for accounting for the fee for rehiring the leased asset must be enshrined in the accounting policy of the organization (clause 7 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008)).

As for the tax accounting of the cost of rehiring, the Tax Code of the Russian Federation also does not establish a special procedure for accounting for such expenses. However, in accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses incurred by the taxpayer. In this regard, in our opinion, LLC-2 can take into account the fee for the right to re-hire as part of the expenses on the basis of paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation, provided that this fee is economically justified. At the same time, according to the explanations of the tax authorities, the rental fee is taken into account as expenses evenly over the remaining term of the lease agreement (see Letters of the Ministry of Taxation of Russia for Moscow dated March 23, 2004 N 26-12/20573, dated January 27, 2004 N 26 -12/5331).

Please note : It is not entirely clear from the question why VAT is included in the contractual cost of rehire of leased property if LLC-1 applies a simplified taxation system (according to Article 346.11 of the Tax Code of the Russian Federation, organizations using a simplified taxation system are not recognized as taxpayers of value added tax). However, if LLC-1 is a VAT payer and provides LLC-2 with all the documents specified by the Tax Code of the Russian Federation (the VAT amount will be allocated in the assignment agreement, a properly executed invoice will be issued, etc.), then LLC-2 will have the right present the appropriate amount of VAT for deduction (Article 171 of the Tax Code of the Russian Federation). Otherwise, the cost of rehiring must be indicated without the allocation of VAT and must be included in expenses in full.

All other transactions related to leasing are reflected in the accounting of LLC-2 in accordance with generally accepted accounting rules for the lessee.

| Account debit | Account credit | A comment |

| 08 “Investments in non-current assets” | 76/Lessor subaccount “Rental obligations” | The leased asset received from the first lessee under the lease agreement was accepted for registration |

| 19 | 76/Lessor subaccount “Rental obligations” | VAT payable to the lessor is reflected; |

| 01 “Fixed assets” subaccount “Property received under a leasing agreement” | 08 “Investments in non-current assets” | The leased asset received is reflected in fixed assets |

| 20 (25, 26…) | 02 “Depreciation” subaccount “Property received under a leasing agreement” | Depreciation is calculated (monthly from the month following the month of acceptance of the leased asset as part of fixed assets). |

| 20 (25, 26… ) | 76 / LLC-1 | Including the cost of re-leasing leased property as expenses |

| 19 | 76/OOO-1 | Allocation of VAT from the cost of rehire, provided that LLC-1 is a VAT payer |

| 76/Lessor subaccount “Rental obligations” | 76/Lessor subaccount “Debt on leasing payments” | Calculation of the monthly lease payment (paragraph 2, clause 9 of the Instructions) |

| 68, subaccount “VAT calculations” | 19 | Accepted for deduction of VAT on the monthly lease payment (based on the invoice issued by the lessor) |

| 76/Lessor sub-account “Debt on lease payments” | 51 | Lease payment transferred to the lessor |

In the event of permanent and/or temporary differences between accounting expenses and expenses accepted for tax purposes, resulting from the application of various rules for the recognition of expenses, which are established in regulatory legal acts on accounting and the legislation of the Russian Federation on taxes and fees in accounting, a need arises reflection of temporary and permanent tax assets and liabilities in accordance with the requirements of PBU 18/02.

3. As for the procedure for reflecting leased property in accounting after the end of the leasing agreement and the transfer of ownership to a new lessee (LLC-2), this procedure does not contain any features related to obtaining the rights and obligations of the lessee under the assignment agreement: if, according to the terms of the agreement leasing, the leased property is taken into account on the balance sheet of the lessee, then when the leased property is purchased and transferred into the ownership of the lessee, subject to the repayment of the entire amount of leasing payments stipulated by the leasing agreement, an internal entry related to the transfer is made on accounts 01 “Fixed Assets” and 02 “Depreciation of Fixed Assets” data from the subaccount for leased property to the subaccount of own fixed assets.

For tax purposes, an organization can take into account in expenses an amount not exceeding the total amount of leasing payments under the agreement (clause 5 of Article 252 of the Tax Code of the Russian Federation), therefore, after the expiration of the leasing agreement, depreciation for tax accounting purposes ceases.

| Account debit | Account credit | A comment |

| 01 "Fixed assets" | 01 “Fixed assets” subaccount “Property received under a leasing agreement” | Transfer of ownership of the leased asset |

| 02 “Depreciation of fixed assets” subaccount “Property received under a leasing agreement” | 02 “Depreciation of fixed assets” |

Please note: The question contains information that the redemption payment is not separately allocated in the leasing agreement.

As established by Art. 624 of the Civil Code of the Russian Federation and clause 1 of Art. 19 of Law N 164-FZ, a leasing agreement may provide that the leased asset becomes the property of the lessee upon expiration of the term of this agreement or before its expiration on the terms stipulated by agreement of the parties. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee (Clause 1.Article 28 of Law No. 164-FZ).

If the condition for the redemption of the leased property is not provided for in the lease agreement, it can be established by an additional agreement of the parties, who in this case have the right to agree on the offset of previously paid leasing payments into the redemption price.

In this case, a certain conflict arises due to the possibility of different interpretations of tax legislation.

On the one hand, Chapter 25 of the Tax Code of the Russian Federation does not contain any specific features for assigning costs under a leasing agreement to the cost price if the latter provides for the transfer of ownership to the lessee.

The legislation on taxes and fees does not contain the concept of leasing payment. Consequently, by virtue of paragraph 1 of Art. 11 of the Tax Code of the Russian Federation should be guided by their concepts given in civil legislation.

In accordance with Art. 28 of Law N 164-FZ, leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement , as well as the lessor's income. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee.

Thus, leasing payments are determined by the leasing agreement and are expenses associated with the production and sale of the period in which the obligation to pay them under the terms of the agreement arises, regardless of the date of transfer of the leased asset to the lessee.

It follows from the above that a lease payment, which includes several independent payments, is a single payment and is made under a single leasing agreement and is not subject to separate accounting for tax purposes.

However, the position of the Russian Ministry of Finance differs from the above. Referring to the same provisions of the law, the Ministry of Finance indicates that in accordance with paragraph 5 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base for income tax, expenses for the acquisition and (or) creation of depreciable property are not taken into account.

For profit tax purposes, the lessee's expenses in the form of the redemption price of the leased asset upon transfer of ownership of the leased asset to the lessee are expenses for the acquisition of depreciable property and on the basis of clause 5 of Art. 270 of the Tax Code of the Russian Federation are not taken into account when calculating the tax base for income tax. Thus, according to the Ministry of Finance of the Russian Federation, the redemption price of the leased asset as part of lease payments included in other expenses in accordance with paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation, is not taken into account. Moreover, the Ministry of Finance and the Federal Tax Service of Russia insist that if the leasing agreement stipulates that the leased asset becomes the property of the lessee after payment of all leasing payments, without indicating the purchase price in the leasing agreement, the entire amount of leasing payments should be considered as an expense directed for the acquisition of ownership of a leased asset, which is depreciable property, included in the initial cost of depreciable property after the transfer of ownership of it to the lessee (see Letter of the Federal Tax Service of Russia dated May 26, 2010 N ShS-37-3 / [email protected] , Letters of the Ministry of Finance Russia dated 09.11.2005 N 03-03-04/1/348, dated 27.04.2007 N 03-03-05/104, dated 04.03.2008 N 03-03-06/1/138).

To avoid disputes with the tax authorities, we recommend concluding a separate purchase and sale agreement or an additional agreement on the amount of the redemption price of the leased asset and the procedure for its payment, and also take into account the acquisition costs (redemption price) separately from current lease payments. This will help reduce risks during inspections by regulatory authorities to document that when determining the tax base for income tax, the organization did not take into account the costs of acquiring and (or) creating depreciable property.

Deputy General Director Maydanchik M.I.

CJSC AK "Hold-Invest-Audit"

+7916 685 55 19 – mobile.

May 19, 2021

Change of lessor upon assignment

Not only the lessee, but also the lessor can assign the rights that arose when concluding a leasing agreement - this is indicated by the provisions of Art. 18 Federal Law No. 164. According to this rule, the lessor can transfer its rights under the agreement to a third party by notifying the lessee about this. The absence of such notification is grounds for termination of the agreement at the initiative of the lessee (Clause 2 of Article 450 of the Civil Code of the Russian Federation).

The assignment of claims by the lessor involves the transfer to a third party of the right to receive lease payments from the lessor or to collect the debt generated at the time of conclusion of the relevant agreement. After the agreement on the assignment of claims is concluded, the lessee will have the obligation to make mandatory payments to the new lessor. Failure to fulfill such obligations entails the imposition of sanctions provided for by the concluded additional agreement or other document regulating the procedure for resolving this issue.

***

So, the assignment of a leasing agreement allows the lessee to transfer the leased property, as well as the rights and obligations arising upon its receipt, to a party that was not a party to the previously concluded agreement. A change of lessee entails the need for the participants in the new agreement to perform a number of actions, including the preparation of related documents and the reflection of completed financial transactions in the accounting and tax records of the enterprise.

More information about lease assignment

Ideally, such subtleties should be indicated when drawing up a leasing agreement. Leasing is actively used by people who own their own enterprises in order to optimize the production process. For this reason, the legal norms of the Russian Federation regulate the subtleties of the transaction, including cases of assignment of leased property. Moreover, over the life of leasing, a practice has developed among its participants that makes it possible to draw up a conditional list of cases that allows the parties to a leasing transaction to resort to the assignment of leasing. Among the cases and mechanisms , through which a leasing company can resort to the procedure of assignment of leasing, the following can be distinguished: The lessor can carry out the procedure at his discretion at any time, subject to advance notification of the lessee’s intentions. In order to more profitably attract profits, accept

What risks are there?

— A leasing agreement, under which at the end of its term the ownership rights are transferred to the lessee, is a buyout leasing agreement. The buy-out nature of this agreement implies that the leasing payments to be paid include not only rental payments for the use of property, but also payments that are due for the transfer of ownership to the lessee, says Kirill Zimarev, head of leasing practice. — The minimum redemption price, which is established in the leasing agreement, is obviously not the market price of the leased asset; it is allocated in the agreement so that at the end of the lease agreement, the parties can sign a purchase and sale agreement that is understandable for accounting and administrative bodies, under which ownership rights are transferred . That is, a purchase and sale agreement at a minimum purchase price is a part and continuation of the leasing agreement, and in isolation from the leasing agreement (concluded with another person), such a purchase and sale agreement can create a number of problems.

Such a transaction to repurchase the leased asset may be challenged by the bankruptcy trustee in the event of bankruptcy of the lessee. In this case, the leased item may be confiscated from the buyer or funds in the amount of the market value of the property may be collected.