Moscow is an advanced region in which there is the largest number of benefits, compensation and benefits for a wide variety of segments of the population.

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone for any region.

Social support for Muscovites is one of the priority areas of the capital’s mayor’s policy. Assistance to different categories of citizens is mostly targeted, and the amount of payments is determined taking into account the opinions of residents of the capital.

Unlike other regions, the amount of benefits in Moscow is quite large, which is explained by constantly rising prices.

Who is entitled to the benefit: basis

The benefit is assigned to residents of any region of Russia with a low income. To receive social assistance, the family's total monthly income must be below the subsistence level.

Material payments are due:

- single or divorced parents receiving the minimum wage;

- a low-income couple with several children;

- a family where one of the parents works and the other takes care of the children.

Payments are also given to persons raising a disabled child under 18 years of age.

Payments for a child: features of the accrual scheme

Benefits are calculated according to the total income of family members and a number of other factors. You can determine the amount yourself using the tips below.

- Add up the official income of the spouses.

- Find out your local PM.

- The amount of income received is compared with the subsistence level.

When a family's monthly income is below the subsistence minimum level, they may qualify for government assistance.

Average monthly income of parents

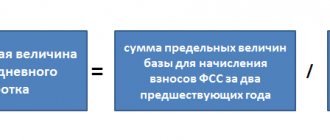

When calculating the amount of monthly payments, the monthly income of each parent is taken into account. Not only the official salary is taken into account, but also interest from the deposit account, funds received for renting out real estate, unofficial earnings, and alimony. A calculation period of 3 calendar months is taken before submitting an application for financial assistance for a child.

Regional cost of living

The municipal cost of living is periodically announced by local authorities on websites or in the media. When a standard for a region is not established, the federal standard is taken as the basis for calculating the amount of payments.

How much child benefit is paid for a child under 18 years of age: table

You can familiarize yourself with the amounts of payments for children by age and category of beneficiaries using the table below.

| Title of the manual | Amount in ruble currency for 2021 | Amount in ruble currency for 2021 |

| One-time payment when placing a child under guardianship or adoption | 16.350.33 when adopting a disabled person or several children at once - 124.929.83 | 16.759.09 when adopting a disabled person or several children at once - 128.053.08 |

| Maternal capital | 453.026 (the amount of the one-time payment is fixed until January 1, 2020 inclusive) | |

| Monthly payments | ||

| Caring for an infant under 1.5 years old | 40% of average monthly earnings. There is a minimum prescribed by law, beyond which benefits cannot go. | |

| Child care for a military personnel (not under contract) | 11.096.76 | 11.374.18 |

| Survivor's benefit (father died in military action) | 2.231.85 | 2.287.65 |

| Caring for a descendant living in the Chernobyl zone | 3.162 – child up to 1.5 years old 6.324 – child up to 3 years old | 3.241.05 – child up to 1.5 years old 6.482.10 – child up to 3 years old |

| Monthly payment for large families after the birth of the third child until he reaches 3 years of age | Living wage per child, established by regional legislation | |

| Help for low-income families with a minor | The amount is calculated by the Social Protection Fund. The payment is individual for each region and family. The amount of the benefit depends on the information about the family budget that was submitted to the fund. | |

In areas for which regional salary coefficients are used in accordance with the established procedure, the indicated amounts of payments are determined in multiples of

Basic provisions

Thanks to state support, social assistance to families in the form of benefits or allowances is established from the period of pregnancy and in some situations is valid until the child reaches adulthood.

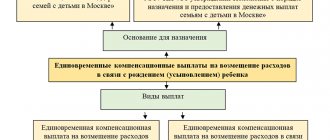

Both one-time and permanent payments are prescribed at the federal level. Regional authorities are responsible for the following issues:

- development of grounds for making charges;

- creating rules for processing benefits;

- determining the amount of compensation.

Despite the fact that the initiative for child benefits comes from representatives of the highest level of government, representatives of municipal authorities are responsible for the amount and procedure for calculation. This leads to the fact that depending on the subject of the Russian Federation, the amount to be paid will change.

Local officials provide subsidies for minors

All types of children's monetary compensation operating in the Russian Federation are divided into 2 groups according to the frequency of payments:

- one-time - paid once if there is an appropriate basis;

- monthly - carried out once a month until the child reaches 16 years of age or comes of age.

In addition, according to the form of providing material compensation, payments are divided into the following types:

- related to compulsory social insurance;

- related to government social support.

Monthly charges for a minor are determined for one of the child’s parents. Due to the fact that such a bonus is regional, its size may differ by several thousand rubles depending on the region. This is due to the financial capabilities of the local budget and the standards prescribed by local officials.

Video - Up to what age is child benefit paid?

What is the amount for children under 18 years of age in different regions

The size of government payments varies depending on the regional subsistence level, since the amount is calculated relative to its value.

This is due to the fact that Russian cities have different standards of living and monthly salaries. Prices for food, gasoline, and utilities vary. Below are the basic rates for cities without taking into account additional factors. The actual calculation is carried out by social service workers on an individual basis.

Moscow

Moscow families are considered the most affluent in the country.

Low-income spouses are paid 4,000 rubles as a base rate, 6,000 rubles for single parents, military families and in the absence of assistance in the form of alimony.

St. Petersburg

In St. Petersburg, the standard benefit is 723 rubles. Children of military personnel or from single-parent families are entitled to 1,045 rubles.

Krasnodar region

The Krasnodar Territory has the lowest benefits. Poor two-parent families receive 170 rubles for each offspring. A single parent is entitled to 333 rubles, and a descendant of a military serviceman is entitled to 246 rubles.

Penza

In the Penza region, families are entitled to an average of 290 rubles of financial assistance per month. For military personnel in fixed-term uniform - 435 rubles, and for children of single parents 580 rubles are paid.

Preferential conditions for children

Residents of Moscow and the Moscow region have the rights:

- Receive budget medicines and vitamin complexes at a clinic or social pharmacy until the child is three years old. For large families, this opportunity will last for another three years.

- Women who have more than 10 children can, if desired, have a dental prosthesis (with the exception of precious materials).

- Free leisure activities are provided for little Muscovites. Up to 7 years of age, they can visit museums, thematic exhibitions, all zoos, local cultural and recreation parks absolutely free of charge.

- Children under 7 years of age, accompanied by their parents, can use public transport free of charge, in addition to minibuses.

- As prescribed by a doctor, children under 2 years of age are provided with preferential milk nutrition. An exception is patients with chronic diseases; they are provided with food and necessary medications for up to 15 years on a budgetary basis.

Moscow is the largest city in the Russian Federation. Raising young children in this city is an expensive proposition. But thanks to financial assistance from the state and annual indexation of child benefits, the standard of living of young families is noticeably improving.

How to make a payment

The process of processing payments for a child under 18 years of age takes place in several stages:

- collection of necessary documentation;

- presentation of papers to the required authority;

- waiting for a response from services.

Low-income families are extremely rarely refused. Usually, if their income still exceeds the subsistence level in the region.

List of documents

You should first prepare the necessary papers. Their list is as follows:

- income certificate in form 2-NDFL for 3 months for a working parent or both spouses, if officially employed;

- copies of children's birth certificates;

- photocopies of parents' passports;

- social card details or account of any Russian bank.

Upon arrival at the social service, find an application for accrual of child benefits at the stand, ask the employee for a form, and fill it out.

Where to contact

The package of papers should be submitted to the regional branch of the Social Security Authorities. The location of the service can be found on the website.

When the child turns over 16 years old, he must provide a certificate from the school that he is continuing his education. If you don't do this, your payments will end.

Submission of documents

When the list of papers has been prepared, it should be sent to the social security service department. This is done in several ways:

- personally carry the documentation;

- send them via Russian Post by registered mail with notification;

- send scanned papers through the government services portal.

Within 10 days from the date of receipt of the papers, social services must make a decision on the assignment of child benefits.

If the decision is made in favor of the applicant, after 2 or 3 months, the first payments are awarded.

Payments and benefits for pregnancy and childbirth from 30 weeks of pregnancy

When you reach 30 weeks of pregnancy (28 for multiple pregnancies), the antenatal clinic will issue you with a certificate of incapacity for work, which will be required at your place of work to receive maternity benefits (maternity benefits), paid to the employee in the amount of 100% of the average earnings. Maternity benefits are assigned within ten days after submitting all necessary documents. Maternity payments calculator.

The amount of the one-time benefit for women registered in the early stages of pregnancy is 675.15 rubles until February 2021. (indexation is planned from February 2021). You will need a certificate from a medical institution confirming registration for up to 12 weeks. Documents should be submitted at the place where you receive maternity benefits.

Along with the certificate of incapacity for work, the housing complex will give you a birth certificate. Coupon No. 1 of the birth certificate will remain in the antenatal clinic, you will need coupon No. 2 in the maternity hospital, and coupon No. 3 - in the children's clinic.

Perhaps your constituent entity of the Russian Federation pays additional regional benefits for the birth of a child. Muscovites are paid 600 rubles. for registration up to 20 weeks of pregnancy.

What to do in case of refusal

Social assistance for children is rarely denied.

Employees will formalize the refusal in writing, stating the reason. Why they may refuse:

- the child is fully supported by the state;

- the firstborn appeared on the account before January 1, 2021;

- applicants do not have parental rights;

- family income exceeds the subsistence standard;

- the applicant has not provided the necessary documents or their authenticity is questionable.

Parents can appeal the decision to higher authorities. In the latter situation, you can deliver documents or prove their authenticity in court with the help of lawyers.

Normative base

The need and conditions for calculating child benefits in Moscow in 2020 are provided for on the basis of the following federal and regional legislative acts:

- Constitution of the Russian Federation.

- Labor Code of the Russian Federation.

- Family Code of the Russian Federation.

- Federal Law No. dated May 19, 1995 – determines the procedure for paying benefits for minors.

- Federal Law No. 255-FZ of December 29, 2006 – regulates issues of compulsory social insurance, including temporary loss of ability to work due to pregnancy and birth of a child.

- Law of the Russian Federation No. 1244-1 of May 15, 1991. on taking measures to support citizens affected by the consequences of the disaster at the Chernobyl nuclear power plant.

- Presidential Decree No. 175 of February 26, 2013. – provides assistance to families with disabled children.

- Moscow Law No. dated November 23, 2005. on providing social support to citizens raising children.

- Decree of the Moscow Government No. 37-PP dated January 24, 2006. – establishes the procedure for cash payments to minors.

- Decree of the Moscow Government No. 1753-PP dated December 17, 2019. – makes changes regarding the size of regional children's assessments in 2021.

- Decree of the Moscow Government No. 1005-PP dated November 27, 2007. on the assignment of benefits for children from the city budget.

- Moscow Law No. dated September 30, 2009. – aimed at supporting young families.

- Decree of the Moscow Government No. 199-PP dated 04/06/2004. on additional one-time payments to the above category of citizens.

- Moscow Law No. dated November 3, 2004. – assigns the calculation of monthly child benefits to low-income families.

- Decree of the Moscow Government No. 911-PP dated December 27, 2004. similar content.

In 2021, the standards of the city authorities allow citizens with Moscow registration to receive additional assistance for children, but the requirements of these legislative acts apply only to recipients officially registered in the capital.

Are there additional subsidies for a child under 18 years of age?

Additional benefits for raising a minor include payments to single mothers with disabled children in their care.

The base rate is 6,000 rubles per month. The application is submitted to the Pension Fund along with the mother’s work record and medical examination certificates. Russian legislation helps parents with low incomes raise their children with the help of cash benefits. It is not difficult to obtain them, the main thing is to collect the necessary documents.

Refusals are rare; usually the decision is made by social workers in favor of low-income spouses. If your application for state assistance is rejected, you must go to court. It is realistic to win the case only if the parents are completely right, the documents are true, and their income is below the subsistence level.