Home — Documents

- How many sections 1 need to be completed?

- Fixed advance payment in section 1

- Under what conditions is the reduction carried out?

- By what amount is the reduction made?

- Examples of filling out form 6-NDFL

Form 6-NDFL, The procedure for filling out and submitting calculations to the tax authority was approved by Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] Let us remind you that the calculation is submitted quarterly (Section 1 is compiled on an accrual basis for the first quarter, half of the year, nine months and a year, and Section 2 includes only data for the last three months of the presentation period). The deadline for submitting calculations for the first quarter, six months and nine months is the last day of the month following the corresponding period, for the year - April 1 of the year following the expired tax period (Clause 2 of Article 230 of the Tax Code of the Russian Federation). The basis for non-submission of calculations is only the absence of employees at the organization (IP) and failure to make income payments to individuals; “zero” calculations under these circumstances do not need to be submitted (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11 / [email protected] ) . At the same time, if a “zero” calculation is submitted, such calculation will be accepted by the tax authority in the prescribed manner (Letter of the Federal Tax Service of Russia dated May 31, 2016 N BS-4-11 / [email protected] ). In all other cases, failure by the tax agent to submit calculations within the prescribed period entails:

- collection of a fine in the amount of 1000 rubles. for each full or partial month from the day specified for submitting the calculation (clause 1.2 of Article 126 of the Tax Code of the Russian Federation);

- suspension of transactions on the tax agent's bank accounts and transfers of his electronic funds if the calculation is not submitted to the tax authority within 10 working days after the expiration of the established period (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

It is also important to fill out the calculation correctly, since the submission by a tax agent to the tax authority of documents containing false information entails a fine of 500 rubles. for each document with an “error” (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). You can avoid liability by submitting updated documents, but only if there is no information that the tax authority itself has already discovered false information. Explanations regarding the submission of an updated calculation in Form 6-NDFL from the Federal Tax Service are set out in Letter No. GD-4-11/14772 dated 08/12/2016.

The company employs foreigners with a patent

The company employs Russian citizens and foreign patent employees. The company withholds personal income tax on all income at a rate of 13 percent.

The salaries of residents and foreigners on patent are subject to personal income tax at a rate of 13 percent. This rate is established by different standards. For residents' salaries - clause 1 of Article 224 of the Tax Code of the Russian Federation. And for foreigners - paragraph 3 of Article 224 of the Tax Code of the Russian Federation. Because of this, the tax authorities do not require you to fill out several blocks with a rate of 13 percent. The company has the right to show all income in one line 010–050.

For example

B - 7 resident employees and 5 foreigners with a patent. She did not reduce the calculated tax on advances for the patent. For the first half of the year, the company accrued income to foreigners - 630,000 rubles, calculated and withheld personal income tax - 81,900 rubles. (RUB 630,000 × 13%). She accrued income to residents - 940,000 rubles, calculated and withheld personal income tax - 122,200 rubles. (RUB 940,000 × 13%). The company recorded the income of foreigners and residents in one block of lines 010–050. In line 020 - 1,570,000 rubles. (630,000 + 940,000), in lines 040 and 070 - 204,100 rubles. (81,900 + 122,200). The company filled out Section 1 as in sample 94.

Sample 94. How to reflect the income of foreigners and residents in the calculation:

Top

Personal income tax on wages of foreigners

Foreign citizens who arrived in the Russian Federation in a manner that does not require a visa and have reached the age of eighteen years can work for hire in the Russian Federation only on the basis of a patent. A patent is issued to a foreign citizen for a period of one to twelve months (clauses 1, 5, article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”).

The specifics of calculating personal income tax from the salaries of such employees are prescribed in Article 227.1 of the Tax Code of the Russian Federation. These features apply, inter alia, to foreigners who are employed:

- in organizations;

- for individual entrepreneurs;

- from notaries engaged in private practice;

- from lawyers who have established law offices;

- from other persons engaged in private practice.

Such foreigners make a fixed advance payment for personal income tax before the start date of the period for which the patent is issued (extended) or reissued (clauses 1, 4 of Article 227.1 of the Tax Code of the Russian Federation). And then employers, fulfilling the duties of a tax agent for personal income tax, reduce the total amount of tax on the income of foreigners by the amount of fixed advance payments paid for the period of validity of the patent in relation to the corresponding tax period.

To offset fixed advance payments, the employer needs to have (clause 6 of Article 227.1 of the Tax Code of the Russian Federation):

- written application of a foreign worker;

- notification from the tax office confirming the right to reduce the calculated amount of personal income tax. The inspectorate issues a notice based on the employer’s application;

- documents confirming payment of fixed advance payments.

The company reduces the calculated personal income tax on advances for a patent

The company employs a foreigner with a patent. Every month the company reduced the calculated personal income tax by the advances that the employee paid for the patent.

The employer has the right to reduce the personal income tax of foreigners for the advances they paid for the patent (clause 6 of article 227.1 of the Tax Code of the Russian Federation). To do this, you need to receive a notification from the inspectorate.

In line 020, write down the accrued income, and in line 040, the calculated personal income tax. The company reflects advances in line 050 of the calculation, and in line 070 the difference between the calculated personal income tax and advances. The difference cannot be negative. If a foreigner’s tax for the quarter is less than he paid for the patent, then the company reduces personal income tax only by part of the advances. Therefore, in line 050, write down only those advances for which personal income tax was actually reduced.

Even if the company did not withhold anything from the foreigner, reflect the salary in section 2. In line 130, show the accrued income, and in line 140 put zero.

For example

The company employs two foreigners with a patent. Every month they pay advances for the patent - 4,200 rubles. The salary of the first employee is 30,000 rubles. per month, personal income tax - 3900 rubles. (30,000 rubles × 13%), second - 32,000 rubles, personal income tax - 4160 rubles. (RUB 32,000 × 13%). Salary taxes are less than monthly advances, so the company does not withhold personal income tax.

Section 1.

During the six months, the company accrued income of 372,000 rubles. ((RUB 30,000 + RUB 32,000) × 6 months). Calculated personal income tax - 48,360 rubles. (RUB 372,000 × 13%). Advances for a patent for 6 months amounted to 50,400 rubles. (RUB 4,200 × 2 × 6 months). In line 050, the company recorded advances within the calculated tax - 48,360 rubles.

Section 2.

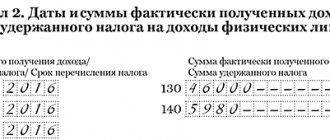

The company issued salaries for April on May 4 - 62,000 rubles. (30,000 + 32,000). Calculated personal income tax - 8060 rubles. (3900 + 4160). The company did not withhold tax. She filled out the calculation as in sample 95.

Sample 95. How to fill in the income of foreigners on a patent:

Top

By what amount is the reduction made?

At this stage, you should understand: the amount of the fixed advance payment by which a reduction can be made, and the amount of the fixed advance payment actually accepted to reduce the calculated personal income tax, may differ. A discrepancy appears if the amount of calculated tax is less than the amount of the fixed advance payment paid for the corresponding period, which can be taken as a reduction.

First, let’s find out what amount can “claim” to be a “deduction”. According to para. 1 clause 6 art. 227.1 of the Tax Code of the Russian Federation, the total amount of personal income tax on the income of taxpayers - foreign citizens with a patent, calculated by the tax agent, is subject to reduction by the amount of fixed advance payments paid by this taxpayer for the period of validity of the patent in relation to the corresponding tax period . This means that after receiving a notification from the tax authority, for example, for 2016, the tax agent has the right to reduce the calculated personal income tax this year only by the amount of paid fixed advance payments due specifically for 2021 (Letter of the Federal Tax Service of Russia dated March 14, 2016 N BS -4-11/ [email protected] ).

There is only one nuance that stands out from the presented rule, which the tax service commented on in Letter dated March 22, 2016 N BS-4-11 / [email protected] It concerns the situation when the validity period of a patent from December of one calendar year passes to January of the next year ( Let's say the patent was issued on March 14, 2021 for a period of 12 months).

Author's opinion. I think this is explained by the fact that the amount of the fixed advance payment is set per month (it is 1200 rubles, this amount is indexed by the corresponding coefficients - clauses 2, 3 of Article 227.1 of the Tax Code of the Russian Federation). At the same time, the procedure for determining the size of a fixed advance payment for a period of less than a month is not fixed in the Tax Code.

Then the amount of the fixed advance payment can be offset by the tax agent in full when reducing the calculated amount of tax for 2021 (we are talking about the monthly amount of the fixed advance payment falling on the period from December 14, 2021 to January 13, 2021). At the same time, the amounts of fixed advance payments made exclusively for 2021 can be taken into account by the tax agent when reducing the calculated tax amount for 2021 after the tax agent receives a notification in the prescribed manner for 2021.

Now about what amount is accepted for reduction. In paragraph 7 of Art. 227.1 of the Tax Code of the Russian Federation stipulates the following.

If the amount of fixed advance payments paid during the validity period of the patent in relation to the corresponding tax period exceeds the amount of tax calculated at the end of this tax period based on the income actually received by the taxpayer, the amount of such excess is not the amount of overpaid tax and is not subject to refund or credit to the taxpayer.

Thus, if the amount of calculated personal income tax is less than the fixed payments paid, then the amount of fixed advance payments in an amount equal to the amount of the calculated tax is taken into account. In this case, when filling out section. 2 forms 6-NDFL on lines 110 “Tax withholding date” and 120 “Tax payment deadline” is indicated “00.00.0000”, and on line 140 “Amount of tax withheld” - “0” (Letter of the Federal Tax Service of Russia dated May 17, 2016 N BS -4/11/ [email protected] ).

The foreigner became a resident in the second quarter

The company withheld personal income tax from the foreigner at a rate of 30 percent. He became a resident in the second quarter.

The income of non-residents is subject to personal income tax at a rate of 30 percent (clause 3 of article 224 of the Tax Code of the Russian Federation). But if an employee has spent 183 calendar days in Russia over the past 12 months, he will become a resident. Tax for the month in which the employee became a resident will need to be calculated at a rate of 13 percent. The company determines the employee’s status at the end of each month (letter of the Federal Tax Service of Russia dated October 22, 2014 No. OA-3-17/ [email protected] ).

Semi-annual calculation.

Do not recalculate the tax for previous months, because the employee can still become a non-resident. In section 1, show the employee’s income in two blocks of lines 010–050 - at a rate of 30 and 13 percent.

Calculation for nine months and for a year.

The company determines the final status of the employee based on the results of the year. At the same time, if during the year an employee stays in the Russian Federation for 183 calendar days, then his status will not change until the end of the year. This will happen in July. This means that this month you can recalculate personal income tax on all income from January to June (letter of the Ministry of Finance of Russia dated February 15, 2016 No. 03-04-06/7958).

Thus, all employee income will be taxed at a rate of 13 percent. When calculating for nine months and for a year, do not divide payments at different rates. In line 040, reflect the tax calculated at a rate of 13 percent. And in line 070 - personal income tax, which was actually withheld from the employee. The company does not have the right, after recalculation, to return money to the employee upon application. Show the overpayment in the 2-NDFL certificate as excessively withheld.

For example

The foreigner arrived in Russia on December 15. The following June he became a resident. The company calculated personal income tax on wages for this month at a rate of 13 percent. On income for January - May - at a rate of 30 percent. Salary for January - May - 450,000 rubles, calculated and withheld personal income tax - 135,000 rubles. (RUB 450,000 × 30%). Salary for June - 50,000 rubles, calculated and withheld personal income tax - 6,500 rubles. (RUB 50,000 × 13%). There are no other employees in the company. Total income - 500,000 rubles. (450,000 + 50,000). Personal income tax - 141,500 rubles. (135,000 + 6500). She filled out section 1 as in sample 96.

Sample 96. How to fill out the half-year calculation if the employee has become a resident:

Top

Under what conditions is the reduction carried out?

The reduction is carried out if the tax agent has:

- a written statement from the taxpayer - a foreign citizen, since he is given the right to choose a tax agent from whom the calculated amount of tax will be reduced during the tax period (calendar year);

- documents confirming the taxpayer's payment of fixed advance payments;

- notification of the tax authority about confirmation of the right to a reduction (the notification form is approved by Order of the Federal Tax Service of Russia dated March 17, 2015 N ММВ-7-11 / [email protected] ).

The tax agent takes care of receiving the notification by sending to the tax authority an application to confirm the right in the form approved by Order of the Federal Tax Service of Russia dated November 13, 2015 N ММВ-7-11/ [email protected] The tax authority sends a notification to the tax agent within 10 working days from the day of receipt of the application, subject to receipt of relevant positive information from the migration authority.

If line 050 is completed (when its value is >0), the fact of the presence of a notice issued to the tax agent will be clarified as part of the desk tax audit of the submitted calculation. If there is no information about the issuance of a notification, the tax authority will consider that the calculated personal income tax has been reduced by the amount of fixed advance payments unlawfully, and will send the tax agent a written notification of detected contradictions (errors) with a requirement to provide the necessary explanations within five working days or to make appropriate corrections to the established term. This follows from paragraph 3 of Art. 88 of the Tax Code of the Russian Federation and is stated in the Control ratios of indicators of tax and accounting reporting forms approved by the Federal Tax Service of Russia on February 26, 2016 <1> (Sent by Letter of the Federal Tax Service of Russia dated March 10, 2016 N BS-4-11 / [email protected] , they contain the Control ratios indicators of the form for calculating personal income tax amounts calculated and withheld by the tax agent).

The company provides deductions to the foreigner and reduces personal income tax on advances

The company employs a foreigner with a patent. He is a resident of the Russian Federation. The company provides him with a child deduction and reduces his calculated personal income tax by advances for the patent.

Foreigners with a patent have the right to receive a child deduction as soon as they become residents of Russia. To receive deductions, a foreigner must write an application and bring birth certificates of children. If the documents are in a foreign language, they must be translated and the translation certified by a notary.

The company has the right to provide a deduction to a foreigner and at the same time reduce the calculated personal income tax for advances for a patent. The Code does not prohibit this. First, reduce the foreigner’s income by deductions and calculate personal income tax. This amount can be reduced by advances.

In line 020, write down the accrued salary. Reflect the deductions that were provided to the employee in line 030 of section 1. And the advances for which the calculated personal income tax was reduced are reflected in line 050. In line 070 reflect the personal income tax that was withheld from the employee.

As for section 2, reflect the operation in it, even if the advances exceeded the calculated personal income tax. On line 130, record accrued income. And in line 140 - withheld personal income tax. If the company did not withhold anything, enter a zero on this line.

For example

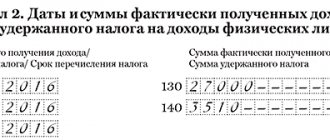

The company employs a foreigner with a patent. Pays a monthly advance of 4,200 rubles. The employee's salary is 50,000 rubles. He has one child, so the company provides a deduction of 1,400 rubles. The company issued salaries for April on May 5. Calculated personal income tax - 6318 rubles. ((RUB 50,000 - RUB 1,400) × 13%). And I withheld tax minus the advance payment - 2118 rubles. (6318 - 4200). The company filled out Section 2 as in sample 97.

Sample 97. How to reflect salary if the company reduced income by deductions:

Top

Fixed advance payment in section 1

In Sect. 1 there is line 050 “Amount of fixed advance payment”, which reflects the sum of fixed advance payments generalized for all individuals - foreigners with patents, accepted to reduce the amount of calculated personal income tax on their income from the beginning of the tax period. To fill out this line, you need to know whether the conditions are met to reduce the calculated amount of personal income tax for a foreigner by the amount of fixed advance payments paid by him and by what specific amount the reduction can be made.

What you need to know

In a letter dated June 29, 2020 No. BS-4-11/10498, the Federal Tax Service of Russia reminded that when receiving wages, the date the taxpayer actually receives such income is the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement/contract (Clause 2 of Article 223 of the Tax Code of the Russian Federation).

When paying income in kind or receiving material benefits, the calculated amount of personal income tax is withheld from any income paid by the tax agent to an individual in cash . In this case, the withheld amount of personal income tax cannot exceed 50% of the income paid in cash.

As the Federal Tax Service notes, there are no .

General rules for filling out form 6-NDFL

Let's look at the procedure for filling out 6-NDFL. If you are submitting a report not through TKS, then you can only use a pen with black, blue, or purple ink for handwriting. It is prohibited to correct errors with a proofreader.

Information is entered into the report lines from left to right, starting from the leftmost cell; empty cells should have a dash. Income amounts are filled in in rubles and kopecks, and the tax amount is only in rubles, kopecks are rounded. Filling out 6-NDFL-2016 occurs separately for each OKTMO. The sheets are numbered consecutively, starting from the first.

Filling out 6-NDFL for the 1st quarter of 2021

6-NDFL consists of a title and two sections. Both sections were not updated; in 2021, the title page was transformed, which became more detailed by adding lines for notes about the form of reorganization of the enterprise and its details. They are completed by the successor firms of the reorganized company in the event that they have to report for it. When filling out the form on its own, the reorganized company indicates “0” in this line and crosses out the TIN/KPP field.

zapolnenie_6-ndfl_za_1_kvartal_2020_goda.jpg

Filling out 6-NDFL for the 1st quarter of 2021 begins with entering the basic details and entering the code “000” (initial report). If refined options are then compiled, then their numbers are indicated in the column according to the numerical series - “001”, “002”, etc.

In salary reports for the 2nd quarter, take into account the changes that came into force in 2021. Experts from the magazine “Salary” summarized all the changes in 6-NDFL. Read how inspectors compare report indicators with each other. If you check them yourself, you will avoid clarifications and will be able to explain any figure from the report. See all the main changes in salary in a convenient presentation and special service.

The organization has foreign employees working under a patent. The employee was hired in January. In May, we received a notification from the Federal Tax Service; from January to April, personal income tax was withheld from him. After receiving the notification, the personal income tax was returned. How to fill out 6-NDFL and sections 1 and 2 (program 1c does not automatically fill out), if tax is not withheld from a foreign citizen on a patent, then is it necessary to include their salary in income, and how to fill it out correctly?

Answer

Section 1 with cumulative totals for the 1st quarter, half-year, 9 months and year. Include the salaries of foreign employees on a patent in section 1, which you fill out at a rate of 13%. Show in lines:

This is interesting: Vladivostok increased labor winds in 2020

In accordance with paragraph 3 of Art. 224 and paragraph 1 of Art. 227.1 of the Tax Code of the Russian Federation, a tax rate of 13% is established for the income of a “patented” foreign employee (regardless of his tax status, that is, regardless of whether he is a resident of the Russian Federation or not).