Unfortunately, each of us is familiar with the situation when you feel that you are getting sick... Weakness, headache, chills are just a small list of unpleasant symptoms. The next day, as a rule, health worsens, and the person can no longer work fully at his workplace. The employee becomes temporarily unable to work, and the doctor prescribes bed rest to the patient. Unfortunately, not only a banal ARVI can cause a sick leave, and in some cases this document does not indicate the employee’s illness at all.

So, sick leave. What it is? To whom is it entitled by law? How are working disabled citizens paid for sick leave benefits?

General information about sick leave

A sick leave certificate is an official document with a stamp that confirms the temporary disability of a working citizen. The updated form of the certificate of incapacity for work was approved by Order of the Ministry of Health and Social Development of the Russian Federation No. 347 n. dated April 26, 2011.

In fact, a sick leave certificate is an official document that confirms a valid reason for an employee’s absence from the workplace. The sick leave record reflects the time period of the “vacation” and the reason for its opening.

There are many valid reasons, the justification of which leads to the issuance of sick leave. To make the procedure for filling out the form much faster and easier, instead of long names and expressions, you can simply enter the appropriate codes. At the same time, the doctor’s time is significantly saved, and text filling of information is reduced to a minimum. The list of codes can be found on the back of the form.

The certificate of incapacity for work, being a financial document, is regulated by the following regulatory framework:

- Labor Code of the Russian Federation;

- Order of the Ministry of Health and Social Development “On approval of the procedure for issuing certificates of incapacity for work” dated June 29, 2011 No. 624n .

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ .

The sick leave must reflect clear terms, full name. patient, and full name medical worker who issued the sick leave. The authenticity of the financial document is confirmed by the seal of the medical organization. The Letter of the FSS of the Russian Federation No. 14-03-18/15-12956 dated October 28, 2011 (clause 2, paragraph 2) states that the seal impression can contain only 2 text options:

- “for sick leave”;

- "for certificates of incapacity for work."

The current disability form has a high degree of protection against counterfeiting. At the very top of the document, in different corners, there are elements of its protection:

- In the upper right corner there is a barcode containing 12 digits;

- In the upper left corner there is a binary code that completely eliminates the possibility of falsification.

According to FSS statistics, as a result of thorough checks of machine-readable forms, the number of fake sick leave certificates in Russia at the end of 2021 decreased by more than 20%. Complex security codes on forms help reduce the number of counterfeit sheets.

In 2021, verification of sick leave certificates will become even more stringent, and there is hope that electronic sick leave will eventually reduce falsification to zero. On the official website of the FSS there are recommendations explaining how you can identify a fake certificate of incapacity for work. Now it is no longer possible to turn to “your” doctor for help in obtaining a sick leave certificate. No law-abiding doctor will put a false start or end date on sick leave. The Federal Social Insurance Fund of the Russian Federation monitors each paid certificate of incapacity for work.

A necessary condition for issuing a sick leave certificate is that the medical worker has the appropriate position and a license to carry out medical activities. Recently, it has been additionally checked whether the doctor who issued the sick leave certificate has a license to examine the temporary disability of a working citizen.

Based on a correctly completed form, the employee is legally paid a benefit, the amount of which, like any citizen’s income, is subject to income tax of 13% ( Article 217 of the Tax Code of the Russian Federation ).

Typically, the first 3 days of sick leave are paid by the employer, and the subsequent days - by the territorial body of the Social Insurance Fund. An exception is the temporary disability of an employee due to caring for a sick family member, quarantine and treatment in a sanatorium. In the listed cases, temporary disability benefits are paid in full from the budget of the Social Insurance Fund of the Russian Federation.

The Social Insurance Fund compensates the employer for the costs of paying disability benefits. But in the regions participating in the “Direct Payments” pilot project, when the Social Insurance Fund pays full benefits to an employee, the funds are directly transferred to the citizen’s bank card, excluding compensation of funds to the employer from the chain of the system.

According to statistics from the Social Insurance Fund, at the end of 2021, over 40 million sick leaves were issued to citizens of the Russian Federation, and more than 300 billion rubles were allocated to pay for them.

Circumstances in which a working citizen has the right to receive sick leave

The legislation of the Russian Federation provides for special life situations and circumstances when a working citizen is officially allowed not to attend the workplace.

An incomplete list of the most important and common reasons for registration of sick leave by citizens of the Russian Federation:

- Illness of the citizen himself (infectious, cold - in severe form, exacerbation of chronic diseases requiring treatment in hospital, surgical intervention);

- Employee injury;

- Caring for a sick family member;

- Sanatorium and resort treatment in the Russian Federation, prescribed by the attending physician;

- Quarantine (including for a child under 7 years of age who attends kindergarten);

- Maternity leave. In this case, a certificate of incapacity for work is issued by an obstetrician, with whom the woman is officially registered for pregnancy at 30 full weeks. The duration of sick leave is 70 calendar days before childbirth and the same amount after childbirth. In case of multiple pregnancy, sick leave starts from the 28th week and continues until 110 days after the day of delivery.

The importance of correct filling

Like all government forms, the disability certificate is machine readable and requires special attention to complete. When drawing up a certificate of incapacity for work manually, the doctor must use exclusively black ink, and also follow the following rules:

- Fill out the sheet with letters of the Russian alphabet;

- Assign one symbol to each cell;

- Leave a space (one empty cell) between the last name and first name and in the name of the organization, if required;

- Use only capital letters when filling out;

- The doctor who issues sick leave must be familiar with the document on the rules for issuing sick leave, namely, Letter of the Federal Social Insurance Fund of the Russian Federation dated August 5, 2011 No. 14-03-11/05-8545 .

The employer must pay special attention to the correctness of filling out the employee’s sick leave, otherwise, if errors are made, the Federal Social Insurance Fund of the Russian Federation has the right to refuse reimbursement of expenses. And then the employer will receive unexpected financial damage in the amount of the benefit payment.

If an error is detected, the attending physician may issue a duplicate sheet.

Interesting fact! If a financial document is lost, the right to receive benefits by a temporarily disabled citizen is legally retained for another six months (this time is given for the possibility of restoring the document in the form of a duplicate - Article 12 Part 1 of Federal Law No. 255 of December 29, 2006).

Employer's liability for late payment of sick leave

Payment for days of incapacity for working citizens is guaranteed by labor legislation.

Violation of the deadlines for payment of benefits or accrual of the required amounts not in full is fraught with administrative punishment for the employer:

- warning;

- fine

Among other things, if due payments are delayed, a penalty must be charged on the day of final settlement.

You can appeal against illegal actions (inaction) of an employer not only through the court, but also by contacting supervisory authorities - the labor inspectorate, the prosecutor's office.

The procedure for issuing a certificate of incapacity for work for working citizens in 2021

In the life of every person, at least once a situation has occurred in which he temporarily became unable to work. What does an officially employed citizen need to do to confirm his inability to work? First of all, contact a specialist for a medical examination of what happened.

After being examined by a doctor, the date for opening a sick leave depends on the specific situation:

- The patient is issued sick leave on the first day of seeking medical help;

- After some time (if the situation is not critical, for example, requiring the necessary tests and additional examinations).

The recovery of an employee or a member of his family is also certified by a doctor. On the day of discharge from sick leave, the doctor fills out the sick leave sheet to the end and hands it to the patient. The calculation of sick leave includes all days, including weekends, vacations and holidays.

The employee must notify the employer about the opening and closing of sick leave. On the first day of going to work, the employee must submit a financial document to the personnel department or accounting department for further calculation of benefits (Clause 1 of the Procedure approved by order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n.)

Temporary disability benefits are accrued within 10 working days. The funds are transferred in full to the employee’s account along with the next payment of salary or advance payment of the monthly salary (Article 15, Part 1 of Federal Law No. 255).

However, the amount of benefit payment may be reduced to a minimum due to the temporarily disabled person’s failure to comply with the hospital regime. For example, if a patient does not show up for a scheduled appointment with the attending physician without warning and indicating a valid reason. In this case, a mark is placed in the corresponding paragraph of the sick leave certificate, confirmed by the doctor’s signature.

Only officially employed citizens are entitled to receive sick leave benefits. That is, officially employed individuals who pay taxes to the Social Insurance Fund ( Article 2 of Law 255-FZ ).

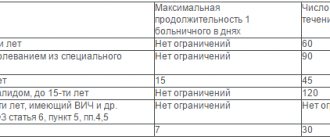

How long can you stay on sick leave?

This will depend on the disease and its severity. Unless doctors believe that a citizen should receive disability, they can issue sick leave for the period required to return to work.

However, there are still a number of restrictions:

- paramedics and dentists can issue sick leave for no more than 10 days,

- other specialists can provide sick leave themselves for up to 15 days; for a longer period of time it can be issued by a medical commission.

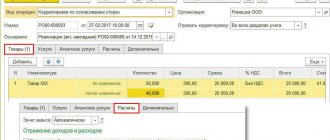

Calculation of sick leave in 2018

To calculate disability benefits, you must follow the following step-by-step “instructions”:

- Calculate the employee’s total earnings for the last 2 years (for which insurance premiums were calculated);

Attention! It is necessary to take into account whether the amount of earnings exceeds the established maximum limit (for 2021 - 755,000 rubles, for 2021 - 718,000 rubles). If not, take the actual amount into account. - Calculate average daily earnings. To do this, the total amount of earnings (point 1) must be divided by 730 (this is the standard value for calculations - 2 calendar years).

- Determine the average daily benefit depending on length of service (paying attention to exception cases).

- Calculate the total amount of benefits payable: multiply the daily amount of benefits (point 3) by the number of days of incapacity for work of the employee indicated on the stamped sick leave certificate.

Federal Law No. 255 spells out in detail all the conditions and algorithm for providing temporarily disabled working citizens with cash benefits. The amount of cash payments for sick leave benefits directly depends on the employee’s length of service.

As a rule, benefits are calculated based on the employee’s average earnings over two calendar years. If the employee has been on maternity leave for the last 2 years or this period coincided with her maternity leave, in this case one or two years of work experience can be replaced.

In accordance with Article 15 of Federal Law No. 255, insurance experience is counted only with the provision of supporting documents:

- Work under an employment contract (employment contract, work book);

- Municipal service (work book);

- Military, law enforcement service (military ID);

- The time period when an individual, being an individual entrepreneur, voluntarily contributed contributions to the Social Insurance Fund (receipts for payment of contributions).

The influence of insurance experience on the calculation of benefits for temporary disability of an employee

The ratio of the insurance period and the percentage accrual of benefits to the employee in 2021:

| Insurance experience | %, calculation of benefits based on average earnings |

| Up to 6 months | from the minimum wage |

| 6 months – 5 years | 60% |

| 5-8 years | 80% |

| 8 years or more | 100% |

By the way, the minimum wage (minimum wage) in 2021 is 9489.00 rubles.

However, there are exceptions to the above table. For example, if an employee has a Chernobyl certificate or the employee worked in the Far North until 2007, then the sick leave benefit is paid 100%, regardless of his length of service. And also if a certificate of incapacity for work was opened due to the illness of a minor child undergoing outpatient treatment. In this case, for the first 10 days, cash benefits are accrued according to the employee’s length of service, and the remaining days of sick leave are calculated in the amount of 50% of his average earnings.

The exclusion of the dependence of the benefit amount on the employee’s insurance record also includes sick leave accrued for pregnancy and childbirth. In this case, cash benefits are paid in the amount of 100% of average earnings. And in the same way, sick pay is calculated for employees who have received work-related injuries.

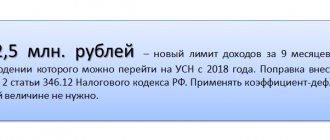

Minimum and maximum sick leave benefits in 2018

There are often situations where an employee has not had any earnings over the past few years. Or the average earnings over the last two working years were below the minimum wage. In these cases, sick leave benefits will be calculated from the minimum wage.

As for the minimum amount of sick leave benefits, everything is very clear. But not everyone understands the concept of a “maximum sick leave benefit.” It is based on a constant value of the maximum daily earnings of citizens. This monetary value is equal to 2021.81 rubles. That is, if an employee has a higher average earnings, then the Social Insurance Fund will not pay extra for the difference between the actual calculation of benefits and the maximum possible amount of benefits. The employer will have the choice of paying extra “out of pocket” or withdrawing the amount of sick leave benefits equal to the maximum possible.

Why was this particular amount approved as the maximum daily earnings of an employee? In 2021, the maximum base for calculating insurance premiums was 718,000 rubles, and in 2017 – 755,000 rubles. From this the maximum daily allowance is calculated: 718,000 rubles. + 755,000 rub. = 1,473,000 rub. The result is divided into 730 days (standard). It turns out 2021.81 rubles.

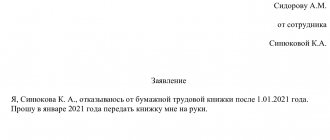

Electronic sick leave is an innovation that is not available to everyone

Russia's massive transition to electronic services has also affected the medical industry. Along with the idea of the emergence of electronic policies, in 2014 there was a proposal to introduce a system of electronic disability certificates into the healthcare system.

The pilot project was launched in 2015 in the cities of Astrakhan, Tambov, Khabarovsk, Samara, the implementation of which showed results in the form of a reduction in forged documents, as well as a reduction in the load on the staff of medical institutions and the work of accountants of employer organizations.

From July 1, 2021, the electronic certificate of incapacity for work officially received the status of a legal financial document in the Russian Federation. There are no plans to cancel the paper form; the electronic analogue will for now only become an alternative to the usual classics.

In 2021, a patient who is issued a sick leave certificate has the right to choose in what form the financial document will be issued: paper or electronic. An electronic version of a sick leave certificate can be issued only with the written consent (application) of the citizen.

However, even if the patient writes an application for an electronic certificate of incapacity for work, the law does not yet oblige medical institutions to fulfill this desire of the citizen due to the following circumstances:

- The medical institution does not have an enhanced qualified electronic signature (Federal Law No. 86 of May 1, 2017);

- Lack of technical capabilities for data exchange (for example, a problem with installing a special computer program);

- Lack of a strong Internet connection necessary to work on the website www.cabinets.fss.ru.

The idea of creating and introducing an electronic sick leave certificate into mass social use has great prospects for development. This system can significantly facilitate the work of medical institutions, employers and the Social Insurance Fund of the Russian Federation. The regions participating in the pilot project have already experienced the convenience of using the electronic sick leave certificate, which they share in their regional reports.

Electronic certificates of incapacity for work certainly have a number of significant advantages over paper forms:

| Advantages | ||

| For medical workers | For employers | For temporarily disabled citizens |

| 1. Reducing the cost of storing documentation; 2. The likelihood of making mistakes in filling out the document is reduced; 3. Guaranteed safety of the patient’s medical history, because it will be stored in a single database; 4. Reduction of additional functional load. | 1. Prompt receipt of information about the opening and closing of sick leave by an employee;2. Confidence in the authenticity of the document;3. Simplified system for transmitting information to the Social Insurance Fund; 4. Simplicity in calculations for benefit payments. | 1. The risk of document loss is eliminated; 2. Reducing the time for opening and closing a certificate of incapacity for work; 3. Elimination of repeated visits to medical services. institution if the doctor makes an error in filling out the form. |

Despite all the advantages and the progressive development of the experimental system in the cities selected for the implementation of pilot projects, difficulties in widespread use of the system remain. Some citizens of the country are only now beginning to learn about the existence of this innovation, despite the fact that the project has actually existed for more than 4 years. The transition to electronic sick leave certificates will require a lot of time, effort and financial support from the state.