DSV-3 is a report to the Pension Fund on additional insurance contributions paid. They must be paid and the reporting form must be submitted quarterly.

The employer, in addition to contributions to compulsory pension insurance, has the right to transfer additional payments to employees for the formation of a funded pension. Resolution of the PFR board No. 482p dated 06/09/2016 explains what DSV-3 is and where to submit it - a special report on additional contributions to the funded pension, which is submitted quarterly to the territorial department of the PFR.

DSV 3 - what is it

According to current legislation, each citizen can independently increase his future pension, for which additional contributions are transferred to the funded part . The procedure can be performed independently or through an employer.

If, on the basis of an employment contract, the head of the company transfers funds, then he additionally draws up a DSV-3 NSO report, which is submitted to the Pension Fund department at the place of work. Contributions are transferred only if the employee voluntarily decides. To do this, the employee initially draws up a statement submitted to the employer.

Report submission deadlines

This is a quarterly reporting form for additional insurance premiums. It is submitted to the territorial branch of the Pension Fund of Russia by the 20th day of the month following the reporting quarter. Report for the 3rd quarter of 2020 by 10/20/2020.

All deadlines for submitting DSV-3 reports in 2021 and based on the results of the reporting period:

- 01/20/2020 - for October, November and December 2021;

- 04/20/2020 - for January, February and March 2021;

- 07/20/2020 - for April, May and June 2021;

- 10.20.2020 - for July, August and September 2021;

- 01/20/2021 - for October, November and December 2021

The deadline for paying additional insurance payments is until the 15th day of the month following the reporting month, that is, the same as for paying the main insurance payments.

Who submits the reporting form and where?

A report in the DSV-3 form is compiled only by employers who pay voluntary contributions to various non-state pension funds or a state fund for their hired specialists. The procedure is carried out on the basis of an application drawn up by employees. The money is taken from the official salaries of employees.

When compiling DSV-3 registers, the following rules are taken into account:

- the document is generated in paper form if the number of employees does not exceed 25 people;

- if the staff employs more than 25 people, then it is allowed to draw up a report in electronic form.

If a paper version is used, then all sheets are stitched and numbered.

Filling rules

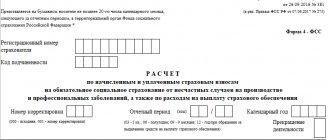

We figured out what DSV-3 is and where to submit the report, we’ll explain how to fill it out. The form is a small introductory part for indicating information about the employer and a table where you write down:

- the amount of funds that should go to the funded part;

- numbers of payment orders for payment of funds;

- SNILS and full name the insured person.

All data is taken from documents. If necessary, it is permitted to submit corrected information.

An important rule: with regard to contributions to funded pensions at the request of employees and with regard to amounts paid by the employer, separate DSV-3 registers are submitted.

IMPORTANT!

One register contains information for only 1 month. But since the reporting is quarterly, 3 registers are submitted simultaneously if the employer paid for all 3 months. If contributions have only been paid for 2 months, 2 forms are submitted.

Now let’s figure out what an extract from DSV-3 is and how to prepare it. The document is generated simply: the tabular part includes only data per employee. Since the legislation does not specify for what period such a document should be issued, experts recommend providing information for the entire payment period. But we must warn you: each form is filled out only for one payment, and if, for example, employee Ivanov worked for 5 years, and additional contributions were paid for him for all 5 years, this is 60 sheets.

Formation rules

Compiling a register in the DSV-3 form is quite simple, and the process is usually handled by an accountant or secretary.

The document contains the following information:

- registration number of the organization in the Pension Fund;

- TIN and checkpoint of the company;

- name of the enterprise;

- details of the payment order on the basis of which contributions for employees were transferred;

- the tabular part contains the full names of the insured persons, their SNILS numbers and the amount of contributions paid, and also indicates the period for which the funds were transferred.

Attention! The basic rules for drawing up this document are given in Part 4 of Art. 9 Federal Law No. 56, and this information was approved by PP No. 482p.

A correctly formed register is initially certified by the banking institution through which the funds were transferred. Only after this the report is transferred to the PF representatives. The procedure is performed quarterly within the established time frame. It is allowed, instead of sending documents directly to PF employees, to use the services of MFC employees.

If the average number of employees exceeds 25 people, then it is not allowed to use a paper report form. You will have to use exclusively electronic documentation, which is signed using an enhanced digital signature before sending.

If reporting is submitted on paper, and there is more than one sheet, then the following rules are taken into account:

- all sheets are numbered;

- a brochure is created;

- sheets are stitched using a special thread;

- the ends of the thread are brought out only from the back side of the document, and are also tied tightly and sealed with a small sheet of paper;

- the sheet contains information that the exact number of sheets is stitched and sealed in the register;

- this inscription is certified by the signature of the head of the organization, as well as the chief accountant of the company;

- at the end the company seal is placed on it.

Reference! If the head of a company submits a DSV-3 report quarterly, then he has to issue a similar form to the citizen upon dismissal of any employee for whom insurance contributions for a funded pension are transferred.

The company accountant is responsible for the preparation of this document. It contains information from other primary papers. You can simply fill it out on a computer or use special accounting programs that simplify the process.

If an individual entrepreneur does not have a hired accountant, then he can use one-time services. You can figure out the rules for drawing up the form yourself, since samples are freely available on the Internet.

Mandatory documents to be issued to an employee

Employment history

It is drawn up on the eve of the day of termination of the employment contract and handed over to the employee against signature on the last working day. If it is not possible to hand it over, you must obtain consent from the former employee to send it by mail or store it in the organization’s office before applying.

If an employee refuses to maintain a paper work book, the package of documents will be supplemented with the STD-R form, which reflects data on work activity and length of service. With the employee’s consent, this form can be prepared electronically. In this case, the employer issues a document certified by an enhanced qualified digital signature.

Medical record (if available)

Issued to an employee upon dismissal. An employer is prohibited from making entries in a personal medical record book.

Pay slip

The pay slip reflects the amount and reasons for deductions from payments, as well as the total amount to be paid. It is issued monthly on payday to each employee, regardless of whether he requests the document (Part 1 of Article 136 of the Labor Code of the Russian Federation). When terminating an employment contract, a payslip must be issued directly on the day of dismissal. It can be issued on paper or by email.

Keep a journal of issuance or a receipt sheet, where employees need to sign for receipt of the pay slip. During an inspection, labor inspectors may require a document that confirms the issuance of pay slips.

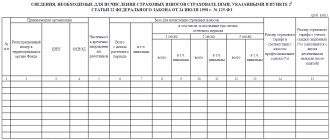

Certificate of earnings 182n

Issued on the day of dismissal (subclause 3, clause 2, article 4.1 of Law No. 255-FZ). Filled out in accordance with the order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n (as amended on January 9, 2017 No. 1n). The certificate indicates: information about the employer and information about the employee; the amount of payments for which insurance premiums were calculated for the current and two previous calendar years; the number of calendar days excluded when calculating benefits (days of illness, maternity leave, parental leave).

The employee will provide this certificate upon acceptance to a new place of work. The new employer will take data from the certificate to calculate sick leave, maternity leave and child care benefits (clause 2.1 of Article 15 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ).

Section 3 of the report Calculation of insurance premiums, filled in with the employee’s personal data

Issued from the beginning of the quarter until the date of termination of the employment contract. In field 020 the period code is indicated: 21 - for the first quarter; 31 - for half a year; 33 - for 9 months; 34 - for the year. The third section of the DAM reflects information about payments to the employee and accrued insurance premiums. The employee needs to be given a copy of the document, which indicates all his personal data - TIN, SNILS, full name, date of birth, citizenship, passport details and identification of the insured person.

Get confirmation from the employee that he received the personalized information. For example, he can sign your copies, or keep a separate journal of the information issued.

Extract from the SZV-STAZH form

Information about the employee’s insurance experience must be provided to the Pension Fund after his dismissal. The organization issues a copy of the report to the employee along with other documents on the day of dismissal. This must be done regardless of whether he asked for it or not. It is necessary to fill out column 14 in the SZV-STAZH form only if the employment contract is terminated on December 31. In other cases, this column remains empty. Sections 4 and 5 of the form are completed if the termination is related to the employee’s retirement.

Extract from the SZV-M form

The SZV-M form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. In order not to violate the law on the protection of personal data, you need to prepare an individual extract from this report, which will contain data only on the resigning employee. The employee will need a copy of the document in the future. An extract from SZV-M is issued to the employee for the last month.

Extract from form DSV-3

This extract is added to the package of documents if the employer transferred additional insurance contributions to the funded part of the pension from its own funds or from the employee’s funds. It is recommended to fill it out for the entire period during which funds were transferred to the funded part of the pension.

Is it required to submit zero certificates?

The legislation does not contain the concept of a “zero” form of DSV-3, so if an employer does not have employees who make a voluntary decision to increase their future pension, then he does not submit such a report to the Pension Fund.

Reporting begins on the first day of the month following the time when the employee submits an application to transfer funds to a fund.

As soon as a citizen resigns or completely refuses voluntary contributions, submitting a corresponding application to the head of the enterprise, then from the next month not only the transfer of funds, but also the submission of reports stops. However, there is no need to warn Pension Fund specialists about such changes.

Important! If an individual entrepreneur does not have employees, then he does not need to submit any reports to PF representatives for hired employees.

Frequency of report submission

Those companies and individual entrepreneurs who submit the DSV-3 form are required to transfer additional contributions on a monthly basis, similar to how they pay regular insurance premiums. Payment deadlines are the same - payments must be made by the 15th of the next month.

IMPORTANT!

As for the preparation of registers, the deadline for submitting DSV-3 reports in 2021 is no later than the 20th day of the month following the quarter. Thus, the third quarter should be reported no later than October 20, and the last quarter no later than January 20.

The month in which the employee quits or asks to stop transferring funds “to the piggy bank” is not included in DSV-3. There is no need to submit any additional notifications to the Pension Fund or anywhere else.

Please note how to submit information. If you have less than 25 employees, you are allowed to do this on paper, but be sure to create 2 copies. If the report contains more than 1 sheet, officials require:

- number and bind sheets;

- sew the brochure itself with threads, and fasten their ends with a sheet of paper on which to indicate their quantity;

- The inscription must be certified with the seal of the organization (if any) and the signatures of the manager or chief accountant.

It is allowed to bring the register on paper either to the Pension Fund or to the MFC.

For all registers, the rules on how to submit DSV-3 if there are 25 people (employees) are unchanged - only in electronic form. The Pension Fund will not accept a different format, even if the employer pays the funded part for 1 employee.

Is it mandatory to issue certificates to employees upon dismissal?

DSV-3 contains information about all insured persons in the company, and also provides the amount of the transferred contributions. Since the funds are transferred by the head of the organization, he has to report not only to the Pension Fund, but also to the direct insured persons.

Upon dismissal, the director is obliged to hand over to the employee a large package of documents, which includes an extract from DSV-3. It is issued exclusively to specialists for whom the employer paid insurance contributions for a funded pension. The basic rules for transferring this document are given in the provisions of Federal Law No. 56.

The statement contains information about all transferred funds for the entire period of work in the company. The head of the company must issue this documentation to the employee on the last day of employment. For this purpose, you cannot require any statement from a specialist. If an employer does not provide a citizen with the required documents, he may be subject to disciplinary or administrative liability.

Normative base

Federal Law No. 56-FZ of April 30, 2008 “On additional insurance contributions for funded pensions and state support for the formation of pension savings”

Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 No. 482p “On approval of the form “Register of insured persons for whom additional insurance contributions for a funded pension are transferred and employer contributions are paid””