When and what kind of zero reports must a non-profit organization (NPO) submit?

The specifics of NPO activities can be very diverse. The status of NPOs is determined by Federal Law No. 7-FZ of January 12, 1996 “On Non-Profit Organizations” (hereinafter referred to as Law No. 7-FZ). The main difference between an NPO and other legal entities is that making a profit is not its main goal of activity, and the profit received is not distributed among the participants, but is directed towards the implementation of the main goals (Clause 1, Article 2 of Law No. 7-FZ).

Thus, the activities of NPOs (regardless of the form created) do not involve making a profit as their main goal.

Tax legislation provides significant benefits for NPOs, exempting a number of transactions from taxation. In this case, even if there are transactions, the amount of taxes payable by the NPO will be zero.

NPOs can apply a general taxation system and a simplified taxation system.

When applying the general taxation system, NPOs must take into account a number of features determined by the nature of their activities.

An NPO that has temporarily suspended its activities is required to submit: accounting, tax reporting, reporting to Rosstat, special reporting to the Ministry of Justice, as well as reporting to the Pension Fund and social security. In addition, the NPO must once a year submit information to the tax office about the average number of employees.

As we can see, despite the fact that the NPO does not make a profit, it is obliged to keep accounts and report to the tax authorities, the Pension Fund of the Russian Federation, the Social Insurance Fund, Rosstat, and the Ministry of Justice.

And in this situation, even an experienced accountant can face serious difficulties. To avoid such a situation, you should trust the professionals and entrust the accounting services of non-profit organizations to specialists.

Accounting services for non-profit organizations include:

- full accounting support;

- preparation and submission of the necessary reports;

- consultations on all accounting issues.

New declaration form from 2021

There have been no changes in the current form of the income tax return for the 3rd quarter of 2021: submit the report on the form from the Federal Tax Service order No. ММВ-7-3/ [email protected] The deadline for submission is 10/28/2020.

The final reports for 2021 (the ones submitted in 2021) will have to be sent using a new form (Federal Tax Order No. ED-7-3/ [email protected] ). The order approved a new form and the procedure for filling it out. Main innovations:

- The purpose of Appendix No. 2 has been changed. New title: “Information on income (expenses) received (incurred) during the execution of agreements on the protection and encouragement of investments, as well as on the tax base and the amount of tax.”

- Barcodes have been changed.

- We finalized sheet 02, appendices No. 4 (taxpayer characteristics), No. 5 (calculation of tax distribution for separate divisions), No. 7 (sections A and D) to sheet 02.

- We added sheet 04 with calculations for rates that differ from clause 1 of Art. 284 Tax Code of the Russian Federation.

- We included a page with the barcode “00214339” in sheet 08.

From 2021, the declaration will take into account preferential tax treatment for:

- residents of the Arctic (Russian part);

- IT companies;

- enterprises that process hydrocarbons into petrochemical products and produce liquefied natural gas.

Reporting to the Ministry of Justice of the Russian Federation

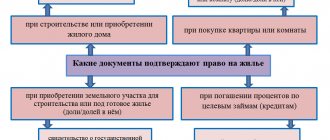

The legislation defines different reporting compositions for:

- public associations

- all other NPOs

- NPOs included in the register of non-profit organizations performing the functions of a “foreign agent”.

Public associations (public organization, social movement).

Report on form ОН0003

A report on the volume of funds and other property received by a public association from international and foreign organizations, foreign citizens and stateless persons, on the purposes of their expenditure or use and on their actual expenditure or use is posted on the portal of the Ministry of Justice of Russia.

In addition, the report can be submitted in person (by proxy) or sent by mail to the territorial body of the Ministry of Justice of Russia at the place of registration of the organization in the form of a postal item with a list of attachments. Deadline: April 15 (following the reporting year).

New form in 2021

Officials approved a new form: the profit declaration of a non-profit organization was approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] Changes in the 2020 form:

- The new form barcodes are “0021 4018”.

- There is no longer a field on the title page to reflect the OKVED code.

- The title page is also supplemented with fields to reflect information if the company changes the powers of a separate division or closes it. Then the code, tax identification number and checkpoint of such unit are indicated.

- We reflect the taxpayer's attribute code in two digits, and not one, as was the case before. Code 01 is suitable for most organizations. For example, new codes and company categories for 2021:

- 09 - for an educational organization;

- 10 - for a medical organization;

- 11 - for a company combining both types of activities (education and medicine);

- 12 - for legal entities engaged in social services for the population;

- 13 - for legal entities that carry out tourism and recreational activities;

- 14 — for regional operators for MSW management;

- other codes are given in the order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

- On sheet 02, line 171 was introduced to reflect the details of regional legislation, provided that reduced tax rates have been established for transfer to the budget of the constituent entity of the Russian Federation. It is required to sequentially indicate the number, clause and subclause of the article of the law of the region.

IMPORTANT!

The new declaration form applies to final reports for 2019. The declaration will have to be prepared in 2021 according to new rules. Otherwise, tax authorities will reject the report and impose fines.

Accounting financial statements of socially oriented non-profit organizations

For the first time, mention of socially oriented non-profit organizations appeared in the law “On amendments to certain legislative acts of the Russian Federation on the issue of supporting socially oriented non-profit organizations” dated 04/05/2010 No. 40-FZ. These include:

- public and religious organizations;

- Cossack societies;

- autonomous non-profit organizations;

- societies of indigenous and small peoples in the Russian Federation;

- organizations whose activities are aimed at solving social problems, issues and helping citizens (for example, providing legal assistance to citizens, supporting the population after natural disasters and catastrophes, dealing with environmental protection, protection and restoration of cultural sites, burial sites, etc.).

Socially oriented non-profit organizations can submit accounting reports using a simplified form.

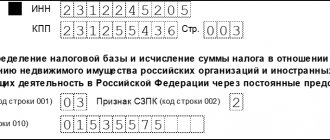

Who submits the declaration

A declaration in form KND 1151006 is submitted to the territorial tax office by institutions that directly pay tax to the budget. The form and procedure for filling out the income tax return in 2021 are fixed by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected]

The list of all taxpayers is given in Article 246 of the Tax Code of the Russian Federation. Paying organizations include:

- domestic enterprises, companies and industries that are subject to the general taxation system;

- foreign companies operating and receiving profits from sources located in Russia;

- foreign companies with representative offices in Russia.

What is an NPO?

A non-profit organization is an organization whose purpose is not to make a profit, and the income from its activities is not distributed among the founders.

Such a business entity has all the characteristics of a legal entity:

- has an independent balance;

- can open bank accounts;

- has the right to stamps with its name;

- acts on the basis of the charter;

- is created for an unlimited period of activity.

These enterprises are created for social, cultural, educational, political and other similar activities, the purpose of which is to achieve public benefits. The most famous such organizations are charities.

Entities of this kind can carry out commercial activities, but only if it is intended to achieve the goals of the company and the distribution of income received among the founders is not intended. Their activities are regulated by Law No. 7-FZ.

When to take it

The income tax report is submitted either once a month or once a quarter. Therefore, the tax period for the declaration is a quarter or a month. At the end of the reporting year, a final declaration is submitted. The filing procedure is determined by the frequency of advance payment of the collection (clause 2 of Article 285, clause 1 of Article 287, clause 3 of Article 289 of the Tax Code of the Russian Federation). According to the provisions of the Tax Code, advance payments are sent to:

- Monthly (until the 28th day of the month following the reporting month) - based on the actual amount of profit.

- Quarterly. The sample is provided by organizations that have received an amount of income not exceeding 15 million rubles over the previous four quarters.

If reporting is submitted to the territorial inspection every quarter, then report on time (clauses 3, 4 of Article 289 of the Tax Code of the Russian Federation):

- for 2021 - 03/30/2020;

- for the first quarter of 2021 - 04/28/2020;

- for the 1st half of 2021 - 07/28/2020;

- for 9 months - 10/28/2020;

- for 2021 - until March 29, 2021.

If a taxpayer is required to file a return monthly, he must comply with the following deadlines:

| Period | Deadline for submission |

| January 2020 | 28.02.2020 |

| February 2020 | 30.03.2020 |

| March 2020 | 28.04.2020 |

| April 2020 | 28.05.2020 |

| May 2020 | 29.06.2020 |

| June 2020 | 28.07.2020 |

| July 2020 | 28.08.2020 |

| August 2020 | 28.09.2020 |

| September 2020 | 28.10.2020 |

| October 2020 | 30.11.2020 |

| November 2020 | 28.12.2020 |

| December 2020 | 28.01.2021 |

Other documentation

NPOs also submit calculations to other government agencies.

Off-budget funds

The company must report the amounts of contributions paid during the year for employees. In total, you need to fill out two forms:

- Form 4-FSS . Submitted to the social insurance fund if the number of employees exceeds 25 people. The dates for submitting documents electronically and in paper form differ: paper submissions must be submitted by January 20;

- Electronic calculations are allowed to be submitted until January 25.

- February 15, if the report is generated on paper;

Federal State Statistics Service

In addition to the reports that are submitted by the organization included in the sample, two mandatory documents must be submitted to the territorial body of Rosstat:

- Form No. 1-NPO . Information on the activities of the enterprise must be submitted by April 1 of the year following the reporting year.

- Form No. 11 (short). The document contains information about the movement of fixed assets. It must also be submitted to the territorial authorities before April 1.

Ministry of Justice

Non-profit enterprises are required to submit reports on their activities to the Ministry of Justice:

- Form No. 0Н0001 . It should reflect information about the managers, as well as the nature of the organization’s activities.

- Form No. 0Н0002 . The completed form contains information about the expenditure of targeted funds, as well as the use of property.

- Form No. 0Н0003 . To be filled out on the official website of the ministry.

In some cases, companies may not provide these reports. This opportunity appears if:

- the NPO did not receive assets from foreign persons, international enterprises, etc.;

- the founders or participants are not foreign citizens;

- the total amount of receipts for the year does not exceed 3 million rubles.

In this case, instead of forms No. 0Н0001 and 0Н0002, a statement of compliance with legal requirements is submitted. It is compiled in any form.

All of the listed reports must be submitted to the territorial department of the ministry by April 15 of the year following the reporting year.

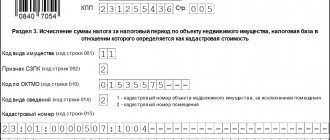

Rules for filling out the declaration

The rules provide for filling out all sections of the report. It does not matter whether the payer files a monthly or quarterly form. For all organizations, step-by-step instructions for filling out an income tax return in 2021 are as follows:

- Fill out the title page.

- Enter the information in section 1.

- We form subsection 1.1, sheet 02 and appendices No. 1 and No. 2 to it.

The remaining sheets and sections are filled out as necessary.

When generating a report, it is necessary to observe a number of nuances and features:

- The title page contains information about the taxpayer institution. If the declaration is filled out by the legal successors of the reorganized company, then they must indicate the TIN and KPP that they had before the reorganization. Provide similar information when changing the powers of a separate division or closing it. For codes for reorganization and liquidation procedures, see the regulations for filling out the declaration (Appendix No. 1 to the procedure).

- Sheets 08 and 09 have been added to the form for KND 1151006. Sheet 08 reflects information about tax reductions based on transactions carried out with dependent counterparties at prices set below market prices. Sheet 09 and Appendix No. 1 indicate data on accounting for the profitability of controlled foreign companies. This information is filled in directly by the controlling persons.

- Sheet 02 provides a field for entering income tax payer codes. Several new codes have appeared on the form. Some lines are intended to be filled in by organizations participating in regional investment projects. Sheet 02 also contains information about trading fees, which reduce the payment amount.

- In sheet 03, the tax on income in the form of dividends is calculated. The current rate of 13% is taken as a basis. When filling out section B of sheet 03, enter the value “1” for income taxed at the rate according to paragraphs. 1 clause 4 art. 284 of the Tax Code of the Russian Federation, and “2” - for the rate according to paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation.

- When filling out lines with codes 241 and 242 in sheet 06 (Appendix No. 1), indicate deductions for the formation of property to ensure the main activities according to the charter and the insurance reserve, respectively. There are no items on this sheet to indicate losses.

- Sheet 08 reflects information about non-operating income; Appendix No. 2 to Sheet 08 contains the codes of income tax payers.

- Insurance premiums are reflected in the same way as basic tax payments. They are indicated in lines 040, 041 of Appendix No. 2 to sheet 02. Contributions deducted for accidents and occupational diseases are reflected as a general rule. If, in accordance with the accounting policy, part of the contributions to the NS relates to direct expenses, then they are recorded in line 010 of Appendix No. 2. The rest of the contributions to injuries, which relates to indirect expenses, is indicated only in line 040 of Appendix No. 2 to sheet 02 .

What kind of financial statements do non-profit organizations submit?

When preparing financial statements of non-profit organizations for 2021, you must be guided by:

- Law “On Accounting” dated December 6, 2011 No. 402-FZ;

- Regulations on maintaining accounting and financial statements in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n;

- PBU 4/99;

- accounting chart of accounts and instructions for its use;

- Order of the Ministry of Finance of Russia “On the forms of financial statements of organizations” dated 07/02/2010 No. 66n, etc.

It is also useful to familiarize yourself with the information of the Ministry of Finance of Russia “On the peculiarities of the formation of financial statements of non-profit organizations” (PZ-1/2015).

According to paragraph 4 of Art. 6 of Law No. 402-FZ, non-profit organizations can submit reports using the simplified form KND 0710096, which includes:

- balance sheet (OKUD 0710001);

IMPORTANT! Accounting reports for 2021 must be submitted exclusively in electronic format. Tax authorities will not accept a paper report. Read more about changes to the rules for presenting financial statements here.

On our website you will learn how to fill it out correctly using the article “Procedure for drawing up a balance sheet (example)” .

balance sheet on our website in the article “Filling out Form 1 of the balance sheet (sample)” .

- financial results report (OKUD 0710002);

Read the rules for filling it out on our website in the article “Filling out Form 2 of the balance sheet (sample)” .

- report on the intended use of funds (OKUD 0710006).

Find out how to fill out the report on our website from the article “Filling out forms 3, 4 and 6 of the balance sheet” .

IMPORTANT! From 06/01/2019, updated accounting forms approved by Order of the Ministry of Finance dated 04/19/2019 No. 61n are in effect. According to these amendments, all indicators should be entered in thousands of rubles, because unit of measurement “million rubles” and the code “385” denoting it are excluded. In addition, instead of OKVED, OKVED 2 is in effect, and in the report on the intended use of funds, the OKUD code has been corrected from 0710006 to 071003.

You can download the updated forms of the simplified balance sheet, income statement and report on the intended use of funds using the link below:

The electronic format for submitting simplified reporting was sent by letter of the Federal Tax Service dated July 16, 2018 No. PA-4-6/ [email protected]

In the ConsultantPlus guide you will find a step-by-step guide to filling out financial statements for 2021. To do everything right, get trial access to the K+ system and go to the material for free.

At the same time, such organizations can present financial statements in full. The decision is made by the organization independently.

Non-profit organizations may not submit a cash flow statement (OKUD 0710004) unless they are required to do so by law. For example, in accordance with paragraph 5 of Art. 12 of the Law “On the Fund for Assistance to the Reform of Housing and Communal Services” dated July 21, 2007 No. 185-FZ, the annual reporting of the Fund for Assistance to Reform of Housing and Communal Services includes a cash flow report, a report on the results of investing temporarily free funds of the fund, and a report on the execution of the fund’s budget. According to PBU 4/99, non-profit organizations are not required to disclose information about changes in capital in their reporting (OKUD 0710003).

Non-profit organizations that do not conduct business activities and do not have sales turnover can represent accounts. reporting in a simplified form once a year. It will also consist of a balance sheet, an income statement and a report on the intended use of funds. Religious organizations that do not have obligations to pay taxes may not submit accounting reports.

A non-profit organization can develop a tabular form of explanations for the balance sheet and financial statements independently. According to the Accounting Regulations, non-profit structures can independently establish the detail of indicators for accounting items and determine the level of their materiality.

Read about how the accounting policy of a non-profit organization is formed in this material.

The changes that came into force in 2021 affected a whole range of regulations and introduced a number of innovations into the accounting reporting of non-profit organizations. Find out more about the new accounting requirements in ConsultantPlus. If you don't have access to the system, get a free trial online.

Features for state employees

Budgetary institutions and non-profit organizations must pay income tax and report to the territorial Federal Tax Service on the same basis as commercial enterprises. The object of taxation is the profit tax, and profit is the final difference between revenues and costs (Chapter 25 of the Tax Code of the Russian Federation). For budgetary institutions and NPOs, profit is only income received from business activities carried out for the purpose of making a profit. Write this down in your accounting policy, as well as the procedure for calculating income tax.

Not all receipts of funds from a budgetary institution are included in the taxable base. The basis for financing BUs are subsidies allocated from the budget; they are not subject to income tax. The tax is levied only on income from the sale of paid services to the population directly related to the main type of activity, but carried out in excess of the state or municipal assignment. For this purpose, state employees keep separate records of income - in order to distinguish between income received for targeted financing and profit from the provision of entrepreneurial activities.

The entire list of possible income should be clearly stated in the accounting policies and internal regulations. All receipts and expenses for paid services must be distributed in the appropriate section of the financial and economic activity plan of the budgetary institution. Such profitability takes into account:

- income from business activities (additional classes, clubs, sections in educational institutions);

- non-operating income (leasing of property, dividends, cost of inventory and materials transferred to the institution free of charge).

Rates for public sector employees are similar to companies from the commercial and non-profit sectors. Budgetary institutions contribute 20% to the treasury (3% to the federal and 17% to the regional budgets) or issue a preferential rate of 0%.

State employees keep separate records not only of income, but also of expenses, since some types of expenses reduce the tax base. All costs that reduce the base must be confirmed by primary documents.

IMPORTANT!

Conducting commercial activities of a budgetary institution, and therefore making a profit, must strictly comply with the statutory goals, be recorded in the constituent documents and be agreed upon with a higher body (founder).

State employees are included in the list of organizations that pay quarterly advance payments for income tax, regardless of the amount of cash receipts, which means they must report quarterly. Declarations are submitted for the first quarter, half a year, 9 months and at the end of the year in paper or electronic form. Submission deadlines are similar to other companies.

Still have questions? Use a free step-by-step guide from ConsultantPlus experts.

to read.

Forms of non-profit organizations

The Civil Code of the Russian Federation specifies several organizational and legal forms of enterprises that are created on a non-profit basis:

- Consumer cooperatives (unions, societies). It is generally accepted that such enterprises are formed only for commercial purposes. However, in the non-profit sphere, they can be organized with the purpose of bringing together individuals and legal entities to meet the needs of their members and solve common problems. For example, housing cooperatives, credit societies of citizens, gardening and dacha associations, agricultural unions, etc. Financing of such organizations is carried out at the expense of the participants by making shares.

- Funds. They exist through voluntary contributions from citizens and legal entities. Foundations pursue goals that are beneficial to the whole society: educational, social, cultural. Charitable organizations often operate in the form of foundations.

- Public and religious organizations. These are voluntary unions and associations of citizens with common interests and intangible (for example, spiritual) needs. Such associations can also function in the form of an institution, a social movement, or a foundation. The founders can be individuals, legal entities, or their associations.

- Associations of legal entities (associations, unions). They are created to coordinate commercial enterprises and protect them, as well as common interests. The constituent documentation is the constituent agreement, signed by all participants of the association, and the charter. Upon joining such an association, the independence of each member is preserved.

- Institutions. These include organizations created by the founder(s) to carry out educational, social, cultural and managerial functions. In this case, institutions can be either fully funded by the founders or partially. To conduct their activities, institutions can attract charitable contributions from legal entities and individuals.

Reporting by separate divisions

If, within a company operating under the general taxation system, separate divisions (SUs) are identified, then the declaration is submitted both to the Federal Tax Service at the registration address of the head enterprise, and for each UB and their place of registration (Clause 1, Article 289 of the Tax Code of the Russian Federation ).

There is a rule that if the OP and the parent organization are registered in the same subject of the Russian Federation and the main company officially pays income tax for its division, then there is no need to submit a separate declaration to the Federal Tax Service of the separate division. The same rule applies if the parent organization has a number of OPs in one subject. In such a situation, reporting is submitted to the Federal Tax Service at the location of the responsible unit (clause 1.4 of the procedure approved by Order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] ). The deadline for filing a declaration does not differ from the generally established ones.

The declaration is submitted for the period during which this separate division was removed from tax registration. Submit reports both for subsequent periods of the reporting year and for the entire year in which the OP was closed.

Is it possible to fill out a VAT return online?

There is no officially permitted option to fill out a VAT return online. Through the Federal Tax Service website you can only send declarations to the inspectorate. How to do this is described in the “Presentation of tax and accounting reports in electronic form” section of the tax service website.

However, the Federal Tax Service website has many other useful services that can, among other things, help you fill out a VAT return.

Important! Tip from ConsultantPlus The procedure for submitting a VAT return electronically depends on who submits it. Read about possible ways to submit a VAT return online in K+. Trial access to the material is free.