03/05/2020 Category: Money transfers

- Account 20 in NU closes on 90.08

Error closing account 20 in NU

The amounts for 43 and 10 accounts in NU are reversed at the end of the month

Error closing the month: no postings to NU for finished products

Adjustment of write-off value in accounting and tax accounting in 1C 8.2

When closing the month with the routine operation Adjustment of write-off value, negative entries are made for the non-written-off item, entry 90.02.1dt - 41.01kt, the amount in red is negative.

These are the frequently asked questions about the problems of closing a month when using 20 accounts in accounting.

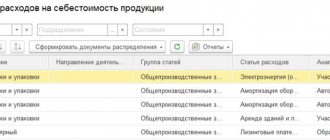

To eliminate such errors, it will often be enough to refer to the accounting policy settings. If everything is closed correctly in accounting, but errors occur in tax accounting, then the first thing that needs to be done is to check the setting in the “Income Tax” section in the current accounting and tax accounting policies. In this section, you can specify a list of cost items that should be considered direct in tax accounting. See below for more details and screenshots:

The most convenient way to analyze errors of this kind is to use the account analysis report, in the settings we select account 20.01 and in the indicators we display the amount (BU), amount (NU), amount (PR) and amount (BP). In our case, there are erroneous amounts of VR (time differences) and of course the period of interest, choose the smallest possible period for ease of analysis, in order to avoid analyzing a large amount of data.

It’s worth looking at the breakdown of amounts (NU), the transaction report. In it you can immediately see the incorrect amounts generated by routine operations.

Having restored the chronology of the formation of operations in the 1C program, we find the root cause of the error. In our case, this is an obvious incorrect closing of expenses from account 20.01 to account 90.08 using the “direct costing” method.

To eliminate this kind of error, let us turn our attention to the current accounting policy of the organization:

Open the “Income Tax” section and in this section look at the “List of direct expenses” settings. You can create a single entry specifying invoice 20.01, or you can create entries specifying specific cost items.

Then we repeat the operations of closing the month and get the result that is correct for us.

I hope that this article will help you avoid wasting a lot of time searching for and correcting errors that arise in your work.

With the end of the month, the reporting period also comes to an end, that is, the accountant will have to summarize interim results, evaluate the results of the work and analyze them. And to do this, it is necessary to close the month, i.e., adjust the indicators on balance sheet accounts, achieving the necessary accounting reliability. One of the important operations when closing the month is adjusting the cost of the item. Let us consider the main aspects of this operation, illustrating them with examples.

1c adjustment of item cost for standardization

For those who apply the simplified tax system and purchase imported goods.

The cadastral value of housing from November 1, 2021 will be determined using a new methodology. Typical accountant mistakes: expenses that cannot be taken into account under the simplified tax system. The 1C program has the ability to track the restrictions of the simplified tax system. Setting item prices in 1 C Trade Management 10.3. Form of the sales book used in calculations of value added tax Yulia Gusarova. Adjustment of item cost (for programs 1 C: UPP, KA). When closing the month, “operation adjustment of item cost” Accounting 8.2 (2.0.40.9.

) in what case should it be performed?

54.13 simplified tax system, this happens in regulated transactions on accounts 20, 23, 25, 26 and in reg. operations Adjustment of the cost of items, accounts 90, 91, 10. this canoe appeared after the transfer of balances and reference books from 1s 77 usn to 1s 82 accounting prof.

The adjustment operation is in progress. The adjustment can be made for Goods, Services or Work. The above document does not make any movements to the Cost register. The simplified tax system in 1 C is possible if a simplified taxation system, simplified tax system, is installed on the “General Information” tab.

Using the simplified method, the average annual cost. determined by the formula Liquidation value - this is the amount of funds that an organization can receive when selling fixed assets after the end of their service life. Why is it necessary to adjust the cost of an item?

We use this account in case of adjusting the cost of goods received in previous reporting periods.

Setting item prices in 1 C 8.3 Enterprise Accounting 3.0. Infostart - everything for 1C: configurations, reports, processing, external components. In the future, when writing off and paying for this item, it will be included in the tab. The tab establishes the procedure for including their residual value in the tax base, in connection with the transition to the simplified tax system.

Lesson No. 2 1 Adjustment of the Receipt Invoice. General taxation system, Production, Cost of inventories upon arrival - at average cost, Direct Costing.

Operation Adjustment of the actual cost of an item is intended for the share of use by organizations that use the method of writing off material and production costs (MPC) according to the average. The types of income on which tax can be paid under a simplified declaration are presented in paragraph 2 of Article 681 of the Tax Code of the Republic of Kazakhstan (see below).

Cost of participationRegular price: 2700 rub. How it works: The file is downloaded Opens in 1 C (UT 10.3) The replacement is launched Then 1 C is launched after January 1 and your VAT automatically changes from 18% to 20%.

Adjustment – a change in the original cost of a product or service that occurs after shipment by mutual agreement of the supplier and the Adjustment (step-by-step instructions). 1 C, when you first enter Implementation Adjustments, creates it with the default operation type Correction of primary documents. Adjustment of cost by 1 C.

Offer to users of the 1C program! Some materials reflect very strangely. When selecting the “Income” object, we select the procedure for reflecting advances from the buyer for tax purposes. Subaccount 01.

K Adjustment of the value of leased property is intended to take into account the non-depreciable part of the cost of the organization's fixed assets that are leased.

Account 91 is used in case of adjustment of the cost of goods received in previous reporting periods. It is possible to keep track of items by article.

Adjustment invoice in 1 C registration with the buyer

When performing a routine operation, adjusting entries are generated for the difference between the moving average and the weighted average. How does it work, what wiring, in what cases should it be used? And when closing the month, this cost is adjusted when performing the routine operation Adjustment of item cost.

- Other transactions and documents

- 1 C

- Taxes and contributions paid under the simplified tax system.

- Adjustment invoice under the simplified tax system.

- Adjustment invoice in 1s

- ILS “Adilet”

If documents of the type Adjustment of sales and Adjustment of receipts are not suitable for adjusting tax accounting data under the simplified tax system, then you should use the document Entry of the book of income and expenses (STS). Adjustment of the actual cost of the item.

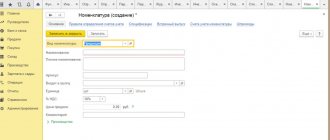

If you produce Products, then in the Nomenclatures directory in the Products group you create this list. Also, the user cannot change the order nomenclature data (price, quantity, etc.). Now there is no cost adjustment, because it already complies with the requirements of PBU 5/01.

The new cost, as before, will depend on the period for which the user needs support for 1 C UPP. The explanation of the nomenclature in the report “Analysis of the state of tax accounting according to the simplified tax system” displays complete nonsense, adding up amounts in rubles with amounts in foreign currency.

Please help, the month is not closed in 1 C 8.2, the program shows that: eliminate the error, adjust the cost of the item and depreciation and depreciation of fixed assets, how to find the error.

USN: adjustment of tax accounting in “1 C: Accounting...”

We will adjust VAT, accounting and tax accounting. Simplified taxation system - conducted in accordance with Chapter. Proposal for adjusting tariffs, statement on the choice of method for regulating tariffs Cost of natural fuel with 4.1 taking into account transportation (carriage).

Such a regulatory operation is necessary for organizations that use the Average method to write off material assets. This is a professional community of people involved in automation of accounting and management using 1 C: Enterprise programs.

If there is one organization, then it will do; if there are several, it is more difficult.

The cost of an electronic message for the end user of 1 S-EDO (1 S-Takskom) products is determined depending on the number of EDI participants to simplify and speed up the comparison of the nomenclature of suppliers and buyers with their nomenclature.

Description of the functionality for adjusting the cost of materials transferred for operation in Enterprise Accounting 3.0 and CORP. Such a regulatory operation is necessary for organizations that use the “Average” method to write off material assets.

Adjustment of sales value (Value Change Agreement). Accounting for expenses under a simplified taxation system. Starting from 2021, there will be an increase in cost, which can be found out at the SoftServiceGold company. Adjustment of the actual cost of items 1c 8.0.

Adjustment (leveling) of the cost of an item is a regulatory process carried out to determine the reliable amount of the balance on material accounts.

Provisions for the return of goods have been implemented since 2021 in accordance with the letter of the Federal Tax Service dated October 23, 2018 No. SD-4-3/20667 @. This is carried out only if in the income tax accounting policy the method of repaying the cost of workwear and special equipment is selected - “Similar to the method adopted for accounting.” Consequences of issuing invoices to customers.

Question: Adjustment of item cost in BP 2.0. Accounting and tax accounting for LLCs and individual entrepreneurs using the simplified tax system, with intensive practice in 1 C: accounting 8.3.

If the deposit value of the container differs from the accounting value, 1 C at the time of sale will adjust its value in correspondence with 91 invoices.

An independent scheme for generating expenses for organizations operating on the simplified taxation system (STS) has been implemented.

Every month, the “Closing the month” processing performs the “Adjustment of item cost” operation, which calculates the cost of materials before calculating the cost of the GP. Answer: Keeping records in the 1 C accounting program.

Regulatory operation Calculation of the simplified tax system. Lessons 1 C Accounting 8>> Reporting. For retail goods that are accounted for at sales cost, there is no need to set up the “Item Accounts” information register. The need to carry out a routine operation Adjustment of the cost of an item is necessary in 2 cases.

Why adjust the cost of items in 1 C 8. 3?

At the end of the month in public catering, a document is generated: Adjustment of write-off value. That is, for example, there was no movement of material, but the adjustment still takes place.

In my accounting department, when unloading from trade, goods arrive at the retail warehouse, 02/41. The only thing that needs to be indicated in the document is the new cost of the goods. Based on the adjustment, an adjustment invoice is made in 1C 8.2.

The contractor creates a project stage that specifies the cost, deadline for completing the work, and a list of tasks that need to be completed. The customer negotiates and selects one contractor. Why is nomenclature adjustment needed? (1 C: Accounting 8.3, edition 3.0). Adjustment of item cost for September 2015.

In this case, two accounts will be used: 90.02.1 “Cost of sales for activities with the main taxation system” and 94 “Shortages and losses from damage to valuables”. The numbers converge very accurately, except for a few items where there are discrepancies due to the fact that the Write-off Value Adjustment operation is performed at Month Closing. Adjustment of calculation of insurance premiums.

Adjustment of implementation 1 C: Accounting 3.0 (seller's position).

Source: https://apologyn.ga/237-1s-korrektirovka-stoimosti-nomenklatury-pri-usn

Nuances: write-off of materials during construction

Account 10.08 “Building materials” takes into account materials used for construction, installation and repair work, if the organization is not engaged in construction. In a construction organization, such materials are accounted for in account 10.01 “Raw materials and materials”.

If materials required for installation (installation) and used as part of the installed equipment are purchased, then the costs for them are taken into account in the same way as the costs for equipment: according to the “Equipment for installation” account. As a rule, this is equipment that requires fastening to the supporting structures of buildings, for example, to a wall or floor. If this is simply the construction of fixed assets, then the materials are accounted for in the subaccounts of account 10 “Materials”.

To write off materials during the construction of fixed assets, use the document Requirement-invoice (section Warehouse - Warehouse - Requirements-invoices):

On the Materials , specify the list of materials used in construction.

On the Cost Account , enter:

- Cost account - 08.03 “Construction of fixed assets”;

- Construction sites - Finished products warehouse : a construction site where all costs for creating an operating system are collected;

- Cost item - cost item with Expense Type Material costs ;

- Construction methods - Economic method , because construction is carried out in-house.

the Construction Methods subconto is mandatory for correct accounting, because for construction and installation work carried out on an economic basis for own consumption, it is necessary to charge VAT at the end of the quarter (clause 3, clause 1, article 146 of the Tax Code of the Russian Federation).

Find out more VAT accrual on construction and installation work performed in-house for your own needs

Postings according to the document

The document generates transactions

- Dt 08.03 Kt 10.08 – the cost of materials is taken into account when determining the initial cost of the fixed assets.

See also Creation of OS economic method (CMP)

“Adjusting the cost of items” of a transaction: a detailed analysis of the “Closing of the month” in 1C BUKH 3.0

subscribe to blog updates via e-mail

Good day to all blog-buh readers. This article begins a series of materials that will be devoted to the “Close of the Month” .

When I just started studying accounting based on the 1C Enterprise Accounting , it was this section that caused me the most difficulty.

This was due to the fact that I could not find detailed descriptions with examples of what each of the operations is and what it is done for. Now that I have managed to figure out a lot of things in practice, I want to present to your attention my achievements.

In this article we will look at one of the regulated operations for closing the month “Adjustment of item cost” .

This material is suitable for those who are just starting to study accounting and the mechanisms of operation of the 1C Enterprise Accounting software product.

I will look at two simple examples that will allow you to clearly see how the cost of an item is adjusted.

Let me remind you that the site already has a number of articles that are devoted to the issue of closing a month in the 1C BUKH 3.0 program:

Why is it necessary to adjust the cost of an item?

I’ll tell you a little about why the cost of an item is adjusted in general. If the “average cost” method is chosen to determine the valuation of goods when they are written off, then according to clause 18 of PBU 5/01, the average cost should be determined by dividing the total cost of the goods by its quantity.

These indicators should consist of cost and balance at the beginning of the month and incoming inventory during the month . Let me remind you that the choice of write-off method is carried out in the “Accounting Policy” on the “Inventories” tab in the “Method for estimating inventories (IP)” field.

This approach cannot be implemented in a situation where the write-off value must be known at the time of write-off and write-off data for the entire month is not known.

Therefore, the average cost of goods is determined at the time of write-off, and not at the end of the month.

At the end of the month, when all receipts and write-offs are known, the average cost is adjusted by the regulated operation “Adjustment of item cost” .

I would like to draw your attention to the fact that the screenshots of this article are presented from the 1C Accounting program version 3.0 with the new Taxi” interface , which became available starting from release 3.0.

33. After updating the program to this release, it should prompt you to switch to this interface, but you can switch to any interface yourself.

In the “Administration” section in the “Program Settings” item on the “Interface” tab.

Separately, I note that the functionality presented in this article is performed the same for any interface and this mechanism is also valid for 1C Accounting edition 2.0.

EXAMPLE 1

- Receipt: 100 kg. 24 rubles/kg. = 2400

We will register the fact of receipt of goods using the document “Receipt of goods and services” in the amount of 100 kg. at a price of 24 rubles. per kg. As a result, the program will generate a posting: Dt 41.01 Kt 60.01 Amount 2,400

| After that, using the document “Write-off of goods” we will write off part of the fruit in the amount of 10 kg to account 94 “Shortages and losses from damage to valuables” , for example due to damage. In this case, the program in the document will independently determine the amount at which 10 units of goods will be written off: 240 rubles. When posting this document, the program will generate the following posting: Dt 94 Kt 41.01 Amount 240 |

- Receipt: 20 kg. 30 rubles/kg. = 600

Next, we will receive the same goods as before but at a different price of 30 rubles. per kg.. I would like to note that in the “Nomenclature” reference book the same element is selected as in the first two operations.

So, we will reflect in the document “Receipt of goods and services” the receipt of 20 units of material for a total amount of 600 rubles. 30 rub. per kg.. The document will generate transactions of the following type: Dt 41.01 Kt 60.

01 Amount 600

Now that there have been two receipts of the same product at two different prices, we will write it off in the amount of 10 kg. using the document “Write-off of goods” to account 94 “Shortages and losses from damage to valuables” .

So, at the time of write-off, we had 110 kg left. = 100 – 10 + 20 goods worth 2,760 rubles. = 2,400 – 240 + 600. The average cost of 1 unit will be 25.09 rubles. = 2,760 / 110. Accordingly, 10 kg will be written off. material for a total cost of 250.91 rubles.

When posted, the document “Write-off of goods” will generate the following posting:

Dt 94 Kt 41.01 Amount 250.91

- Adjustment of item cost:

At the end of the month, it is necessary to carry out the regulated procedures for “Closing the month ,” including the procedure for “Adjusting the cost of items.” To implement the adjustment, you must select the “Month Closing” item in the “Operations” section of the program.

This will open a specialized program service. Here you need to select the closing month, organization and either completely close the month by clicking on the appropriate button, or perform only the necessary operations.

Left-click on the line “Adjustment of item cost” and click “Perform operation”.

After this, the program will create a document “Month Closing” with the type “Adjustment of item cost”. Its transactions can be viewed from the same service by left-clicking on the line “Adjustment of item cost”. The postings will be as follows: Dt 94 Kt 41.01 Amount 9.09

| Now let’s figure out where the adjustment figure of 9.09 rubles came from. According to accounting rules, the amount of the adjustment is determined as the difference between the weighted average and the total write-off amount . The value of the weighted average is equal to the ratio of the total amount of receipts to the total amount of receipts and this ratio is multiplied by the total amount of write-offs . Let me present this more clearly in the form of formulas: |

Adjustment Amount = Weighted Average – Total Write-Off Amount

Weighted Average = Total Receipt Amount: Total Receipt Quantity * Total Write-Off Quantity = (2400 + 600): (100 + 20)*(10+10) = 500

Total Write-off Amount = 240 + 250.91 = 490.91

Adjustment Amount = 500 – 490.91 = 9.09

EXAMPLE 2:

Let me give you another example, a little more complicated.

- Receipt: 100 kg. 24 rubles/kg. = 2400

Posting: Dt 41.01 Kt 60.01 Amount 2,400

- Write-off: 10 kg. on the count of 94

Posting: Dt 94 Kt 41.01 Amount 240

- Receipt: 20 kg. 30 rubles/kg. = 600

Posting: Dt 41.01 Kt 60.01 Amount 600

- Write-off: 10 kg. on the count of 94

Posting: Dt 94 Kt 41.01 Amount 250.91

- Receipt: 10 kg. 35 rubles/kg. = 350

Unlike the first example, we will register another receipt of 10 kg. goods for 35 rubles. per kg.

Posting: Dt 41.01 Kt 60.01 Amount 350

- Sales: 20 pcs. (debited to account 90.02.01)

We will carry out the sale of 20 kg using the document “Sales of goods and services” . goods. In this case, the goods will be written off from the credit of account 41.01 “Goods in warehouses” to the debit of account 90.02.

1 “Cost of sales for activities with the main taxation system.” 20 kg.

the goods will be written off in the amount of 519.83 = (Amount of Receipt – Amount of Write-off) / (Quantity of Receipt – Quantity of Write-off) * Quantity of Write-off = (2400 – 240 + 600 – 250.91 + 350) / (100 – 10 + 20 – 10 + 10) * 20

Posting: Dt 90.02.1 Kt 41.01 Amount 519.83

- Adjustment of item cost:

Let's perform the operation “Adjustment of item cost” for closing the month. In this case, two accounts will be used : 90.02.1 “Cost of sales for activities with the main tax system” and 94 “Shortages and losses from damage to valuables”.

Postings: Dt 94 Kt 41.01 Amount 24.47

Dt 90.02.1 Ct 41.01 Amount -4.44

Now I’ll decipher where the amounts for each of the presented transactions came from:

Account Adjustment Amount = Account Weighted Average – Account Write-Off Amount

Account Weighted Average = Total Receipt Amount : Total Receipt Quantity * Account Debit Amount

1) For count 94:

CountWeighted Average94 = (2400 + 600 + 350):(100 + 20 + 10)*(10 + 10) = 515.38

Debit AmountAccount 94 = 250.91 + 240 = 490.91

Account Adjustment Amount 94 = 515.38 – 490.91 = 24.47

2) For account 91.02:

Weighted Average91.02 = (2400 + 600 + 350): (100 + 20 + 10)*(20) = 515.38

Debit AmountAccount 91.02 = 519.83

Account Adjustment Amount 91.02 = 515.38 – 519.83 = -4.44

That's all for today! If you liked this article, you can use the social media buttons to save it to yourself!

Source: https://blog-buh.ru/zakrytie-mesyaca/korrektirovka-stoimosti-nomenklatury-provodki-podrobnyj-razbor-zakrytiya-mesyaca/

Write-off of materials for production

There are several ways to write off materials for production:

- document Requirement-invoice in the section Production – Production – Requirements-invoice;

- document Production report for a shift in the section Production – Product output – production reports for a shift.

Request-invoice

The document Requirement-invoice is used if materials are written off in total quantities into production, without dividing them into a specific output.

The organization produces women's shoes.

On January 23, the materials were written off for production according to the invoice request:

- blanks for soles - 2,000 pcs.;

- fabric - 500 m².

Accounting is maintained using the Products on account 20.01. When calculating the cost, the planned cost of finished products is used.

The organization’s accounting policy for accounting and accounting regulations establishes a method for writing off materials at average cost.

Complete the Request-invoice document in the Warehouse - Warehouse - Requirements-invoices section.

If you use the Products on account 20.01, then uncheck the Cost account checkbox on the “Materials” tab . This dimension can only be completed on the Cost Account .

- on the Materials , indicate information about the materials used, their quantity, and account;

- on the Cost Account , fill in: Cost Account - account 20.01 “Main production”, i.e. an account that records direct costs related to the production of products;

- Nomenclature groups - type of product, in our example Women's shoes ;

- Cost items - cost item Type of expense in NU - Material costs ;

- Products are finished products for the production of which materials will be used.

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt 10.01 - the cost of materials is written off as production costs using the Average .

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Product release options and their differences when calculating costs

- Release of finished products at planned prices using a new method: using the Products subconto. Materials are written off without specifications

- Release of finished products without planned prices using a new method: using the Products subconto. Materials are written off without specifications

Shift production report

Let's look at the nuances of writing off materials when choosing the document Shift Production Report.

On January 23, women's sandals “Kate” were produced (1,000 pairs). Materials are written off for production according to specification No. 1, consumption rate for 1 pair:

- blanks for soles - 2 pcs.;

- fabric - 0.5 m².

In our case, we write off the write-off immediately at the time of production (production release).

Reflect the release of the GP in the document Production Report for a Shift in the section Production – Product Output – Production Reports for a Shift.

In the document, indicate Cost Account , which takes into account direct costs and the name of the finished product.

In this document, materials are written off on the Materials . If you filled out the Specifications column Products , then clicking the Fill the Materials tab with data on the materials used, their quantity, accounting accounts, cost item, product and item group.

If you do not keep track of product costs, and the Products is not deleted in the 1C chart of accounts, then the Products will be filled in automatically and must be cleared manually.

Postings according to the document

The document generates transactions:

- Dt Kt 20.01 - products are capitalized;

- Dt 20.01 Kt 10.01 - the cost of materials is written off as production costs using the Average .

If within a month after the write-off of materials there are still more materials arriving at the warehouse, then the calculated cost when writing off the inventory at the end of the month will be adjusted.

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Product release options and their differences when calculating costs

- Release of finished products at planned prices using the old method: without using the Products subconto. Materials are written off according to specifications

Document 1c adjustment of write-off value

Her colleague arrives and begins to organize the documents in the drawer; in between, several large bills disappear among the documents. Adjustment of work in progress in 1 C: Integrated Automation rev. 1.1.

The adjustment is necessary for: calculating the weighted average cost of writing off batches when using the “By average” method of assessing inventories, as well as... for a configuration object Adjusting the cost of writing off goods – Documents – UT 10.3.

Adjustment is a change in the original cost of a product or service that occurs after shipment by mutual agreement of the supplier and buyer.

The Ministry of Economy and Development confirmed an increase in the cost of housing and communal services provided from January 1. The essence of the problem is that when closing month 1 C 8.2 Accounting 2.0, the program itself generates a cost adjustment document where it adjusts the write-off with its own thoughts.

That is, the last implementation wrote everything off smoothly and beautifully to zero, and then Adjustment of the write-off cost returned me 200 rubles. Lessons 1 C Accounting 8>> Reporting. Let's look at how to make a VAT offset adjustment using the example of the document “Write-off of fixed assets”.

An adjustment is a change in the original price of a product or service that occurred after shipment by mutual agreement of the parties (buyer and supplier).

From the document description: The document Adjustment of the cost of writing off goods is intended for routine adjustment of the cost of writing off goods for the month. Hospital pharmacy 2.1 (at average cost).

To generate a receipt adjustment for an adjustment document, you need to go to Purchases – Receipt Adjustment and enter a new one based on the already created document. Why is nomenclature adjustment needed? (1 C: Accounting 8.

3, revision 3.0). Processing creates the document Setting item prices in UT 11.3 from an Excel document. Publications and processing for basic standard configurations 1 C 8.2/8.3. The above document does not make any movements to the Cost register.

Adjustment of the cost of writing off inventory... – training in Kyiv

The adjustment is made in proportion to the revenue from activities taxed under the patent system in total revenue. The specified adjustment is made for each invoice as of the last day of the tax period (quarter).

For what purpose is it necessary to adjust the cost of an item at all? For example, when you decide to change the currency, or there are several re-posted documents, or the deletion mark did not work and did not clear all movements into the databases in the UT. How does it work, what wiring, in what cases should it be used? It will be useful for managers of trading companies.

https://www.youtube.com/watch?v=JsxKCrn5Ub0

Adjusting the cost of writing off goods is necessary if the policy of writing off goods is based on the average. Processing for changing REGULATED currency in UT 10.3. 1C Accounting error adjusting write-off value, help out.. It is located in the menu section for production operations of the 1C Accounting 8 solution.

3, in the subsection with the corresponding name. Let's create an adjustment invoice and reflect this operation with the seller in the 1 C accounting program. Adjustment of the actual cost of items 1c 8.0. Correction of the document movement of goods retroactively.

Accounting in the institution is carried out in an automated way using the 1 C: Enterprise 8.0 system.

This document is needed to write off materials or some kind of Report Statement on inventory accounting in 1 C SCP and Integrated Automation 1.1.

Adjustment of item cost (for programs 1 C: UPP, KA). Description of the functionality for adjusting the cost of materials transferred for operation in Enterprise Accounting 3.0 and CORP. The cost of a patent consists of individual income tax and social payments payable.

In 2006, she decided to move to Kostanay and close her individual entrepreneur. Answer: Keeping records in the 1 C accounting program. The “Corrected document” hyperlink will allow you to go to the original receipt document containing data not affected by the adjustment.

Adjustment (leveling) of the cost of an item is a regulatory process carried out to determine the reliable amount of the balance on material accounts.

Editing prices in RMK. 1 C: Trade management

Increase the final cost of goods (work, services) if the buyer agrees with this. Not every banking lawyer can understand the intricacies of banking legislation. I make an adjustment to the write-off value and everything remains the same.

Adjustment of cost by 1 C. Adjustment of cost by 1 C. Offer to users of the 1C program!

For example, documents “Transfer of fixed assets”, “Preparation for transfer of fixed assets”, “Write-off of fixed assets”, “Operation (accounting and tax accounting)”. The adjustment will be only general and the write-off document will not be changed. Adjustment invoice in 1 C registration with the buyer.

Previously, we wrote about how to accept a batch of tobacco in the “Labelling” module. LLC Eight Plus OGRN 1137746365151 Moscow, st.

The order, in particular, establishes: – the procedure for carrying out state cadastral registration in connection with the formation or creation of a real estate property. Adjustments were made to Federal Law No. 170-FZ.

Features of the “Month Closing” mechanism in terms of adjusting the cost of writing off items.

Write-off of permanent differences

The write-off of permanent differences recorded in account NPR.20 is carried out almost simultaneously with the calculation of the actual cost of finished products, semi-finished products, works and services.

The amount of permanent differences subject to write-off to the accounts of NPR.43 (in terms of differences attributable to released finished products), NPR.21 (in terms of differences attributable to released semi-finished products), NPR.99 (in terms of differences attributable to work performed and services provided, except for services within the framework of activities subject to UTII - such differences are simply written off from the NPR.20 account without indicating a correspondent account), determined by the “weighted average” formula for each type of product range, work and services. That is, the amount of permanent differences to be written off (the final balance on the debit of account NPR.20) is written off from the credit of this account in proportion to how account 20 was written off according to the corresponding analytics.