Registration of purchase of components for a new fixed asset (OS)

First of all, in 1C 8.3 all OS components must be capitalized as equipment. A receipt document with the Equipment type is suitable for this. Let’s find the document by going to: Purchases – Receipts (acts, invoices):

Follow the link, click on Receipt and select Equipment from the list that opens:

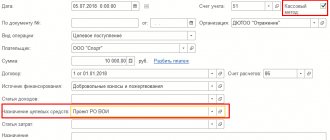

Next, fill out the document according to the rules and put all the necessary information in the header:

- Organization – select the one you need from the list (if there are several);

- Warehouse – where the components will be located;

- Counterparty – indicate the supplier;

- Agreement – indicate the agreement with the supplier:

Then, on the Equipment tab, add the components that arrive using Add:

We will sequentially select the item, indicate the quantity and price. The 1C 8.3 program will calculate the remaining details automatically.

It is important to note here that the accounting account should be 07, since components are purchased for further assembly. VAT account 19.01 VAT on the acquisition of fixed assets.

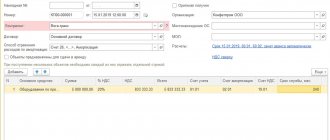

Let’s post the document by clicking Post and using the Dt/Kt button we’ll see what kind of postings we got. From the figure below we see that the 1C 8.3 program made all the necessary postings:

- Dt 07 Kt 60.01 – equipment was received from the supplier to the account Equipment for installation;

- Dt 19.01 Kt 60.01 – for the amount of VAT:

If you need to enter more components into the 1C 8.3 database, but on a different day or from a different supplier, etc., then this is done in a similar way, each time creating a new receipt document.

Myth three - I won’t be able to compete with large manufacturers

So there is no need to compete with them . It is clear that if you start making furniture or producing food, you will face stiff competition. But for a broad category of consumer goods, this rule is completely unfair.

Competitors map

Installation (assembly) of received equipment

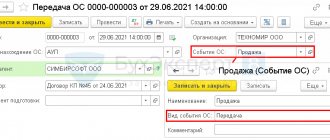

Now that all the necessary components are in stock, you can begin assembling (installing) the equipment. You can easily do this in 1C 8.3 using the document Transfer of equipment for installation: OS and intangible assets – Transfer of equipment for installation:

Let's create a new document and move on to filling out the header:

- Construction object - we will indicate the OS that will be obtained during the assembly process;

- Cost account – account for accounting of the construction project;

- Cost item – indicate the item for accounting for construction costs;

- Organization – indicate the one you need (if there are several);

- Warehouse – specify a warehouse, equipment will be written off from it.

Next, in the document table, we will add all the components that arrived at account 07. We will indicate the quantity, and the invoice will be entered automatically:

Click Post and close. Let's see what postings the document made: the 1C 8.3 Accounting 3.0 program generated the correct postings - Dt 08.03 Kt 07 transfer of equipment for installation:

If installation (assembly) of the OS from components occurs on the side

There are cases when the installation (assembly) of the OS from components occurs externally. Then these expenses are documented in 1C 8.3 with the document Receipt: Purchases - Receipt (acts, invoices). The document is created in the same way as at the stage of purchasing components, and we select the type of operation Equipment:

We are interested in the Services tab. Here we will add a new line where we indicate the name of the service. Be sure to indicate the cost account 03/08 and indicate the construction project in the first subconto:

After completing the document, we will evaluate what movements were generated by the 1C 8.3 program. We see that assembly services are included in the initial cost of the OS:

Pros and cons of own production

Pros:

- Competitive advantage. In trade, it is quite difficult to stand out from your competitors. Everyone has the same suppliers, the same products and services. Often you can defeat your opponents only through service and additional services. When you open your own production, you initially offer a product that no one else has.

- You become a full-service company. From the machine to the counter, as they say. This allows you to control your business from start to finish. You do not depend on suppliers, manufacturers and other intermediaries.

- Ability to control product quality. Remember how many times you got burned by buying bad products? When you produce it yourself, this is impossible.

- You have a ready-made USP. Just what we wrote about at the beginning of the article: “Product from the manufacturer”, “Made in Russia” and so on. The buyer always wants to purchase products directly.

- Limitless possibilities for expansion. You can open new production facilities in different cities, expand your product line, and sell a franchise.

- You can sell excess products to other online stores and retailers.

- High capitalization and business value.

- Easier to find investments. Potential investors are inundated with the same type of proposals and business plans of entrepreneurs in the “buy and sell” sphere. You are initially in a better position to offer something new.

- Governmental support. For manufacturers of certain categories of goods, for example, products for children, socially significant products, state programs are provided in the form of grants, loans, and so on.

- It's profitable. Firstly, you do not depend on the supplier’s prices: you are now the supplier yourself. Secondly, the entire pricing policy is completely in your hands.

- Competitive advantage over other manufacturers. Ask any manufacturer what is their biggest challenge? 9 out of 10 people will answer: “Find a buyer and sell your product.” You don't have this problem. Well, you’ve already learned how to sell. There are established sales channels, a marketing strategy and regular customers.

What is most often purchased in online stores?

Minuses:

- Lack of flexibility. If an ordinary online store can be repurposed to sell another product at the click of a finger, this will not work with your own production. You will need to reconfigure equipment or buy new ones, train staff and do much more.

- Large initial investment. If everything is done at the expense of the investor, this is not so noticeable. But when you invest your own, and even credit, the load will be more serious.

- We need serious staff. Now you can’t get by with just a few managers and technical support specialists. We need workers, craftsmen, equipment adjusters.

- Great responsibility. Now you will have to deal with safety precautions, labor protection and other production issues.

Acceptance of the collected OS for accounting

After all costs have been collected on account 08.3, it is necessary to accept the collected OS for accounting in the 1C 8.3 database. Let's move on: fixed assets and intangible assets - Acceptance for accounting of fixed assets:

By clicking on the link, we will go to the Acceptance for accounting of fixed assets journal, where we will add a new document. Let's fill it out. In the header:

- Organization – select the one you need from the directory (if there are several of them);

- Event – indicate the OS event. For example, Acceptance for accounting with commissioning;

- MOL – we will indicate the financially responsible person;

- OS location – indicate the storage location from the reference. Divisions:

Next, on the Non-current asset tab:

- Type of operation – indicate the type of operation. In the example under consideration – Construction site;

- Method of receipt – method of receipt of the OS;

- Construction object – indicate our construction object;

- Warehouse – where equipment is stored;

- The account is the one where the equipment is accounted for.

If everything is filled out correctly, then after clicking Calculate amounts, the 1C 8.3 program will automatically generate the initial cost of the operating system according to accounting and accounting records. This amount will be debited from the account on 03/08:

Let's go to the Fixed Assets tab. The document table here is not filled in yet. To fill it out, you need to create an OS:

Let's go to the Fixed Assets directory by clicking on the Fixed Assets field in the tabular section. There we will add a new element by clicking Create:

Most of the details will be filled in after the OS is accepted for accounting, so for now we will only fill in the name and accounting group:

Click Record and Close. Let's select a new OS in the document of acceptance for accounting:

Let's move on to the Accounting tab. Let's fill in:

- Accounting account;

- Accounting procedure;

- Depreciation account;

- Method of reflecting depreciation expenses;

- Useful life:

Also, by analogy, fill in the required fields on the Tax Accounting tab:

Let's post the document by clicking Post. Let's see what postings were generated by the 1C 8.3 program. We see that the OS from the components in 1C 8.3 has been successfully accepted for accounting.

From the document of acceptance for accounting in 1C 8.3, you can also print the Certificate of Acceptance and Transfer of OS:

An example of filling out the Certificate of Acceptance and Transfer of OS (OS-1):

We can also create a “turnover” to make sure that all actions are correct: Reports – Balance sheet:

We see that on 07 and 08.03 the accounts were closed, and in 1C 8.3 on 01.01 a new OS, assembled from components, appeared in debit:

Thus, we learned how to assemble the main tool from components in 1C 8.3. On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration. A full list of our offers can be found in the catalog.

How in 1C 8.2 (8.3) to make changes to the information on the fixed assets, in the case when the fixed assets are first used in one division and depreciation is calculated according to one account, then the fixed assets are transferred to another division, the MOL changes, the account for accounting for depreciation costs changes - see our video lesson:

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?