The concept of “fuel card” does not exist in Russian legislation. Previously, this term was contained in Moscow Government Order No. 2591-RP dated November 5, 2008 “On the procedure for providing fuel cards to owners of small cars,” according to which a fuel card (smart card with a built-in microcircuit) is a technical means of recording the supply of petroleum products at gas stations, at which are allowed to accept fuel cards, which is a carrier of information confirming the right to receive petroleum products. However, this document has become invalid since June 18, 2013.

According to the clarifications of the Federal Tax Service of the Russian Federation for Moscow, given in letter dated June 30, 2010 No. 16-15 / [email protected] , fuel cards do not have the status of credit or other payment cards issued by a credit institution; they are used as a means of strict reporting , allowing the cardholder to receive a certain amount of goods on behalf of the buyer. The card records the volume of purchased fuel in liters and allows its holder to fill the fuel tank within the consumption limit, which is set in the application of the purchasing organization.

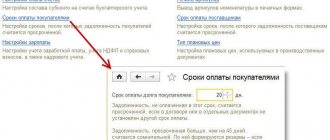

As a rule, the procedure for settlements with fuel suppliers using fuel cards is established in the contract. In it, the parties must determine the limit of fuel that can be dispensed daily (per month), the amount of prepayment for fuel and lubricants and card maintenance, as well as other conditions (for example, providing a discount, the procedure for reconciling payments). Every month, the fuel supplier provides the purchasing organization with an invoice, an acceptance certificate for sold fuels and lubricants (invoice), as well as a report (or register) of card transactions. The report must indicate when and how much fuel was purchased.

Features of working with fuel cards

A fuel card is a special means of payment that allows you to purchase fuel and lubricants.

Only legal entities can use this service. Card payment for fuel is widely used by many large sellers of fuel and lubricants. This is not exactly a means of payment - it does not allow you to pay for any other goods and services. They can only be used at certain gas stations. This procedure for paying for fuel and lubricants is very convenient for any organization: one that is engaged in transport transportation, one that has a large fleet of vehicles, and one that owns only one car. Cards, depending on the order of the service, can be:

- monetary: they are credited with a certain amount of money that can be spent on purchasing fuel and lubricants;

- liter: a certain amount of fuel available for refueling at a gas station is credited.

Cash cards for purchasing fuel have become more widespread. This is what most large gas station chains offer.

Write-off of fuel and lubricants in 1C 8.3

Accounting for the write-off of fuel and lubricants in 1C is carried out according to waybills. This information is verified with reports provided by the reporting employee himself and summarizing the data from waybills and gas station receipts.

The write-off of gasoline and other fuels and lubricants is documented in the same way using the “Demand-invoice” document, which is located in the “Warehouse” section.

Fig. 12 Fragment of the “Warehouse” menu item

In the document, using the “Selection” or “Add” button, the name of the fuel, volume and account to which we will write it off are indicated. The latter, in turn, depends on the type of activity of the company: for example, if the company is a trading company, then the write-off account is 44.01, production (for main production) is 20, and general business needs is account 26. Checking the “Cost accounts” box on the “Materials” tab, will make it possible to indicate accounts on the same line with the item. Otherwise, they will be filled out on a separate tab.

Fig. 13 Filling out the “Requirements-invoice” for writing off fuel and lubricants

When making an invoice claim, the cost of gasoline written off as expenses is taken into account at the average cost.

Fig. 14 Document movement

The same document can also be generated on the basis of an expense report. To do this, open the report itself or the entire “Advance reports” journal, click the “Create based on” button and select the document you are looking for.

Fig. 15 Creating a “Requirement-invoice” from an “Advance report”

If you still have questions about writing off HMS, contact our specialists for advice on the 1C 8.3 program, we will be happy to help you.

How the service works

All major petroleum products sellers offer this service. For example, information about it, as well as about connecting to the program, is provided by Lukoil.

Fuel is written off using legal entity fuel cards in the manner specified in the agreement concluded between the buyer and the gas station supplier.

In your personal account, you can quickly track and control all operations:

- transfer of advance payment to the fuel and lubricants supplier;

- writing off funds as payment;

- report on the quantity and cost of purchased fuel;

- cash balances.

For an employee-driver, this procedure for purchasing fuel and lubricants is also convenient, since there is no need to receive money, collect documents confirming their consumption and submit an advance report.

Examples of using the document “Waybill”

Let's look at the new possibilities for fuel accounting using specific examples. The first example is the recording of fuel purchased using a cash receipt.

Note

The prices in the examples are conditional.

Example 1

| The organization Sewing Factory LLC (OSNO, VAT payer) has its own Volkswagen Passat B7 on its balance sheet. The car is used for administrative purposes. On 08/01/2019, on the basis of an employee’s application, funds were issued from the organization’s cash desk in the amount of RUB 5,000.00 for reporting purposes. to buy gasoline in cash. On August 13, 2019, after completing an official assignment, the employee submitted an advance report, waybill and cash receipt to the organization’s accounting department. The cash receipt indicates: the name of the brand of gasoline is AI-95, the quantity is 70 liters, the cost of one liter is 45 rubles. and the total amount is 3,150 rubles. The VAT amount is not shown as a separate line. Based on the waybill, 60 liters of gasoline were consumed according to the route Moscow - Ivanovo - Moscow (600 km). On August 14, 2019, the balance of the unused accountable amount was handed over to the organization’s cash desk. In accordance with the accounting policy of the organization, expenses for fuel and lubricants are not standardized in tax accounting (they are taken into account in full). |

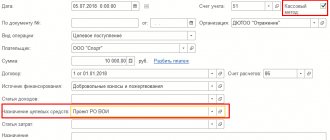

The issuance of cash to an employee for reporting is reflected in the document Cash Withdrawal with the type of transaction Issue to an Accountable Person. When posting the Cash Issue document, an accounting register entry is generated:

Debit 71.01 Credit 50.01 - for the amount of funds issued for the report (5,000 rubles).

Please note that for those accounts where tax accounting is supported, the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes. In the examples discussed in this article, there are no differences between accounting and tax accounting.

Let's reflect the purchase of gasoline using a cash receipt and its consumption using the document Waybill (see Fig. 2). The header of the document states:

- date of the waybill (the number is assigned automatically);

- vehicle;

- an employee who uses a car for business purposes;

- fuel consumption rate for the specified vehicle. By default, the norm is substituted from the vehicle card, but can be changed manually in the Waybill. In this case, the program will offer to save the changed norm for subsequent automatic filling of the Waybill;

- account and cost analytics in the Cost account form, which can be accessed through the appropriate link. By default, the Waybill document has a new predefined article Maintenance of official vehicles with the expense type Other expenses.

If fuel is purchased in cash, its quantity and price are determined at the time of refueling and are indicated on the cash receipt. When filling out the tabular part on the Fuel tab, in the Document field, select the Cash Receipt value, indicate the details of the cash receipt, quantity, price and amount of purchased fuel.

In the tabular section on the Route tab, you should fill in the points of departure and destination, the date, time and odometer readings at the time of departure and arrival, the distance between points and fuel consumption on each section of the route. The total amount of fuel in the tank, taking into account the balance at the beginning of the route, receipt and consumption according to the waybill, is calculated automatically and displayed in a visual form at the bottom of the document. The remaining fuel in the tank is automatically transferred to the next Waybill in chronological order.

When posting a document, the following transactions will be generated:

Debit 10.03.2 Credit 71.01 - for the amount of purchased gasoline (RUB 3,150.00) in the amount of 70 liters;

Debit 26 Credit 10.03.2 - for the amount of gasoline written off (60 l). Since during the month similar fuel can be purchased in different ways and at different prices, the final cost of fuel taken into account in expenses for accounting purposes and for profit tax purposes will be formed at the end of the month when performing the regulatory operation Adjustment of item cost

included in

the month end

.

The return of unused accountable amounts to the organization's cash desk is documented in the document Receipt of cash with the transaction type Return from an accountable person. When posting a document, the following entry is entered into the accounting register:

Debit 50.01 Credit 71.01 - for the amount of returned funds (RUB 1,850.00).

On the last day of the month, August 31, 2019, when performing the routine operation Adjustment of item cost, the cost of written-off gasoline is taken into account in expenses:

Debit 26 Credit 10.03.2 - for the amount of expenses for the purchase of fuel (RUB 2,700.00). At the same time, the amount of gasoline in account 10.03.2 is no longer reflected in this posting.

When purchasing fuel using a cash receipt, the following printable forms are available in the Waybill document using the Print command:

- Waybill - simplified form (see Fig. 4);

- Waybill (No. 3);

- Advance report (AO-1).

Rice. 4. Simplified form of waybill

If, as a result of a business trip, in addition to fuel expenses, other reimbursable expenses of the employee arise (for example, expenses for the purchase of goods and materials or travel expenses), then such a trip is reflected in the accounting system with a combination of documents:

- Waybill - first the employee reports for fuel;

- Advance report or Advance travel report - then the employee reports on other reimbursable expenses.

Let's consider the following example, when fuel and lubricants were purchased using a gas station fuel card.

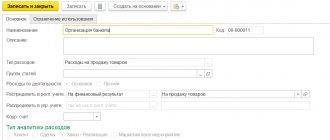

How to account for fuel cards in accounting

A smart card for the purchase of fuel can be provided by the gas station network for a fee or free of charge. This is what determines the order on which account to take fuel cards into account.

Media received free of charge is not reflected on the organization’s balance sheet. To account for them, it is advisable to open a separate off-balance sheet account, assigning it a free number (not indicated in the Chart of Accounts), for example 012. It is also advisable to organize analytical accounting in the context of each medium and the persons who will be responsible for its use.

If the fuel and lubricants supplier charges a fee for the production of electronic media, it is advisable to reflect them upon receipt as part of the inventory and then write off their cost to the organization’s current expenses.

In any case, it is necessary to reflect on which account and how fuel cards are taken into account in the organization’s accounting policies.

Postings for accounting of electronic media at gas stations

| Contents of operation | Debit | Credit |

| Purchase for a fee | ||

| Received acceptance certificate (invoice) for smart cards | 10 | 60 |

| Invoice received (if VAT is applied by the supplier) | 19 | 60 |

| The cost of smart cards is included in the amount of expenses of the current period | 20, 25, 26, 44 | 10 |

| Payment transferred to the supplier | 60 | 51 |

| VAT accepted for refund | 68 | 19 |

| Off-balance sheet accounting (both paid and free receipts) | ||

| Electronic media have been accepted for off-balance sheet accounting | 012warehouse | |

| A gas station smart card was issued to the responsible employee | 012employee | 012warehouse |

| The responsible employee returned the smart card to the organization | 012warehouse | 012employee |

| No longer used electronic media has been decommissioned | 012warehouse | |

Postings through the Labor Code for budgetary entities

The transactions through the TC will be as follows:

- DT120105510, KT1302022730, 120101610. Fixing the cost of purchased cards.

- DT120822560 KT120105610. Fixing the price of cards provided to the driver.

- DT110503340 KT120822660. Fixation of the price of fuel paid by TC in cash type.

- DT110503340 KT120822660. Reflects the price of fuel purchased using a liter card.

- DT140101222 KT110503440. Fixing the cost of a resource aimed at current expenses.

- DT110601310 KT110503440. Fixing the price of fuel used to conduct central activities.

FOR YOUR INFORMATION! These postings must also be based on primary documents. They include not only the content of the transaction, but also the amount for it.

Issuing fuel cards to employees: how to apply

The issuance of electronic media to employees must be formalized. To do this, the organization itself can develop a document form. You can call it, for example, the act of acceptance of transfer.

Sample transfer and acceptance certificate

The return of electronic media from the responsible employee who will no longer use it is processed in a similar way. Give the same smart card to another employee.

If there is a large number of carriers and responsible employees, it is inconvenient to register issuance and return with a separate document each time - to record the movement of smart cards, you can use the issuance and return log.

The choice of documentation procedure is left to the organization. Its procedure and forms of documents must be fixed in a local regulatory act.

Typically, electronic media have a shelf life. After its completion, smart cards that are no longer usable must be written off off-balance sheet. To document the write-off, a write-off act is drawn up.

Fuel card write-off act: sample

Legislative justification

Accounting is carried out on the basis of these regulations:

- Clause 5, 6 PBU 5/01. Fuel receipt procedure.

- Article 223 of the Civil Code of the Russian Federation. Transfer of rights to resources on the date of payment.

- Article 458 of the Civil Code of the Russian Federation. Transfer of rights to the date of actual vacation. That is, this is the date the vehicle was refueled.

- Clause 1 of Article 172 of the Tax Code of the Russian Federation. Acceptance of VAT on fuel purchases for deduction.

- Clause 52 of the Accounting Instructions, approved by Order of the Ministry of Finance No. 148n dated December 30, 2008.

Also, the accounting of labor codes is regulated by paragraph 1 of Article 252 of the Tax Code of the Russian Federation. This regulation states that consumed fuel must be confirmed with documents.

Gasoline accounting using fuel cards in accounting

Electronic media are part of the fuel supply contract. Account 60 of the Chart of Accounts is intended to reflect settlements with the fuel and lubricants supplier. Purchased fuel and lubricants are accounted for as part of inventory and materials on account 10. Receipt is reflected on the basis of documents provided by the supplier. He must convey to the organization:

- invoice (delivery and acceptance certificate);

- invoice;

- fuel card report on dispensed fuel.

To reflect the write-off of fuel and lubricants from accounting and reflect their value in costs, general rules are used.

To confirm the consumption of fuel and lubricants, it is necessary to approve write-off standards and issue waybills. Postings for fuel and lubricants accounting using electronic media

| Contents of operation | Debit | Credit |

| The balance of the gas station network smart card has been replenished | 60advances | 51 |

| Fuel and lubricants released using electronic media have been accepted for accounting | 10 | 60 |

| VAT is reflected on received fuel and lubricants | 19 | 60 |

| The previously transferred advance payment to the supplier has been credited | 60 | 60advances |

| The cost of fuel and lubricants is included in expenses | 20, 25, 26, 44 | 10 |

| VAT is accepted for deduction | 68 | 19 |

Tax accounting

The accounting policy establishes what form of expenses will be used to record the acquisition of technical equipment. VAT on acquisitions will be taken into account after these transactions:

- Acceptance of TC for accounting.

- Receive an invoice.

- Acquisition of technical equipment for performing actions subject to VAT.

Spending on fuel refers to spending on standard areas of work. To reduce the tax base, an accountant must perform these actions:

- Justification of expenses if they do not exceed the norm.

- Preparation of documents that confirm expenses.

- Preparing evidence that the fuel was purchased for profit.

When writing off the cost as an expense, this posting is made: DT20, 23, 26, 44 KT10-3. Write-off of the cost of fuel and lubricants. Posting is carried out on the basis of the waybill.

How to account for gasoline using fuel cards in a budget institution

Budgetary institutions use a special chart of accounts in accounting. But accounting for fuel cards is generally similar to accounting in a commercial organization. The Ministry of Finance recently spoke about this in Letter No. 02-07-10/70752 dated 10/02/2018.

According to the regulatory authority, in order to reflect fuel cards, accounting in the accounting department must be organized on an off-balance sheet account. This is due to the fact that they are not an independent accounting object. Further transfers of funds and their expenditure for the purchase of fuel will be reflected in account 20600 “Settlements for advances issued.”

simplified tax system

If the supplier provides the card free of charge, there is no need to reflect this operation in the income and expenses ledger. In this case, the organization does not have any economic benefit (income) (Article 41 of the Tax Code of the Russian Federation).

If the supplier pledges the card, its receipt and return are also not reflected in the accounting book (clause 1 of Article 346.15, subclause 2 of clause 1 of Article 251, Article 346.16 of the Tax Code of the Russian Federation).

Situation: is it possible to include in expenses the cost of a fuel card provided for a fee when calculating a single tax? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

The list of expenses for the maintenance of official vehicles, given in subparagraph 12 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation, is open. However:

- such expenses must be economically justified and documented;

- a company car must be used by the organization in activities aimed at generating income.

If these conditions are met, the organization has the right to include the cost of the fuel card in expenses when calculating the single tax. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated June 22, 2004 No. 03-02-05/2/40.

Taxation of fuel costs

Transport tax is classified as local, and for this reason local authorities can change at will:

- the procedure for its calculation;

- the amount of vehicle power that is subject to a tax at a certain rate;

- tax rate.

The idea of paying a transport tax according to the European model, where its cost is included in the price of fuel, arose in the government back in 2010.

This taxation principle has many advantages:

- The tax is paid by those who actually use the car.

- If the car is parked in a garage and is not driven, and therefore not refueled, then there is no need to pay tax.

- Simplification of accounting for tax authorities. It is easier to keep track of a limited number of gas stations than a multimillion-dollar crowd of car owners.

- Car owners do not need to submit declarations or monitor the deadlines for their submission; all these issues fall on the shoulders of gas stations.

Consequences of using the new tax style

- The less a driver drives, the less taxes he pays. The amount of tax depends on the amount of gasoline spent by the car owner. From now on, the tax will not be equal for those who do not travel at all and for those who are constantly on the road.

- Reduction of employees of tax authorities , thereby saving the state budget.

- Preservation of benefits for those categories of the population to whom they are entitled.

- The plan under the old style of taxation is carried out by tax officials in the direction of replenishing the state budget by fifty percent. The introduction of a new style implies an increase in the number of taxpayers.

Fuel quantity calculation

Based on the waybill data, calculate the amount of fuel that is written off as expenses. To do this, use the formula:

| Amount of fuel to be written off as expenses (l) | = | Fuel remaining when leaving the car (l) | + | Amount of fuel filled into the vehicle tank (l) | – | Fuel remaining at the end of the day (l) |

Driver's responsibility

Disciplinary responsibility

For damage or loss of “plastic”, as well as disclosure of the PIN code to third parties, drivers, like any employees, can be subject to disciplinary liability in the manner prescribed by Article 192 of the Labor Code of the Russian Federation. They are usually reprimanded or reprimanded. It is inappropriate to apply disciplinary action in the form of dismissal due to the insufficient severity of the offense and the complexity of the procedure.

Material liability

The owners bear financial responsibility both for the media itself and for possible material damage caused by its loss.

Article 244 of the Labor Code of the Russian Federation establishes that employees with whom the corresponding agreement has been concluded bear full financial responsibility for the entrusted property. But such agreements can be concluded with a limited list of positions approved by Appendix 1 to the Resolution of the Ministry of Labor No. 85 of December 31, 2002, which does not include drivers, which means that it is unlawful to enter into an agreement with them for full financial liability.

By virtue of Art. 238 of the Labor Code of the Russian Federation, an employee of an organization bears personal financial responsibility for the valuables transferred to him, as well as for direct damage caused to the employer.

In organizations that practice a system of material incentives in the form of additional payments, employees who have lost their “plastic” may well be deprived of part of the bonus, if such is provided for by the LNA that determines the bonus procedure.