Issues discussed in the material:

- What is the difference between management accounting and accounting?

- Can management accounting completely replace accounting?

- Why is management accounting needed in an organization?

- What are the benefits of management accounting for an organization

In order to correctly generate reporting, employees of the financial department of any organization must know the difference between accounting and management accounting and how they are similar. Providing reliable reporting not only to the company’s management, but also to the tax authorities is possible only if these nuances are clearly understood.

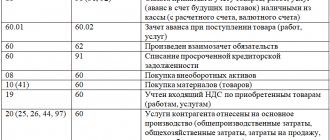

Differences between accounting and management accounting: visual table

Since there are certain differences between accounting and management accounting, they should be classified in somewhat more detail.

| Sign | Classification | |

| Management Accounting | Accounting | |

| Who is the information intended for? | For internal use (enterprise owners, managers, department heads) | For external use (state regulatory authorities, counterparties). For internal use (owners, managers, accounting, economic department) |

| To what extent is information reflected? | Accounting objects are reflected in detail, among them special features or characteristics are identified | Accounting is carried out in aggregate; classification or detailing is not required |

| Transaction Display Methodology | Not regulated by law, there are no strictly established frameworks | Regulated at the legislative level, a clear mechanism for performing certain operations is prescribed |

| How compulsory is it to keep records? | Legal entities and individual entrepreneurs conduct it on a voluntary basis | The need for reporting is enshrined at the legislative level for all business entities |

| Time periods | Data can be generated both at a certain date in the past and present, and in the future, that is, they can form the basis for a forecast assessment | Reports are generated for a specific date; forecast plans are not expected to be drawn up |

Types of accounting

As trade developed, accounting became more sophisticated and diversified; special forms, books, and then programs appeared, but the essence and importance of accounting remained the same.

At the moment, there are three types of accounting in organizations:

- accounting;

- tax;

- managerial.

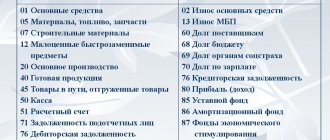

Accounting is maintained by an organization continuously from the moment of its formation until the moment of liquidation. It serves to demonstrate the company’s activities: it is submitted to the tax authorities, and OJSCs publish excerpts of it in the media to attract investors.

Accounting contains information about what resources, in what quantities and in what place the enterprise has or had at a certain point in time, what goods are in the warehouse or in transit, how much money is in the cash register and in the current account, whether there are receivables or creditors debts, loans and credits. And most importantly, accounting shows the results of the financial and economic activities of the organization - an indicator of the efficiency of the enterprise.

Accounting in Russia is written according to the standards of PBU (accounting rules), but to enter the global investment market, reporting must be prepared according to the rules of IAS (International Accounting Standards) or GAAP (Generally Accepted Accounting Principles). in USA).

Tax accounting is closely related to accounting, but its regulatory sources are the Tax Code, laws and instructions of the State Tax Service and other bodies, and the main goal is to provide the information necessary to monitor compliance with legislation on taxes and fees.

The taxpayer is obliged to keep records of his income, expenses and other taxable items in accordance with the established procedure, if such an obligation is provided for by the legislation on taxes and fees. Tax accounting provides the head of the company and the tax authorities with information about the objects of taxation, the feasibility of business operations and the use of resources in accordance with norms, standards and estimates, and also allows you to calculate taxes for timely payment to the budget.

Due to the high requirements of tax authorities for reporting and the optionality of accounting for individual entrepreneurs, tax accounting in Russia is increasingly highlighted as the main one.

Management accounting is a completely different, and for many, new type of accounting. If for accounting and tax purposes general numbers and standard forms of writing are sufficient, then for management purposes a personal approach is required in each individual case.

The main goal of management accounting is to increase the profit of the enterprise by competently informing the manager about the current situation. Since the specifics of each individual business require different approaches to financial information, the reports should be different. It is important for some entrepreneurs to know the results of the activities of the totality of their enterprises; others need data on the cost of each type of product, the cost of transporting a particular consignment of cargo.

In other words, management accounting can solve those tasks that accounting and tax accounting are not capable of:

- keep operational records of settlements with individual counterparties and mutual settlements between their own legal entities;

- provide the management of the enterprise with information about the results of a business consisting of an unlimited number of legal entities and structural divisions;

- exercise control over costs by accounting for types and cost centers;

- show the results of the work of individual areas (by type of activity, product groups, etc.), regardless of how these areas are distributed among legal entities included in the business.

The place of management accounting in the financial system of an enterprise is special; its implementation requires different approaches and other specialists than those who maintain accounting and tax records, but it is management accounting that helps make correct, informed decisions, avoiding conclusions drawn intuitively.

All three types of accounting help control the process of production and sale of goods and services, provide the necessary financial data to investors and government services, and make competent management decisions.

Moreover, accounting allows us to minimize the human factor both in the assessment of activities and in the activity itself, because people can forget about a particular purchase, make a slip of the tongue or make a typo. It’s good when the storekeeper knows what, where and how much he has stored, but he may get sick or quit, and then the manager will be left without this information if it has not been entered into the accounting system database.

Reporting pl

The abbreviation pl stands for Profit and Loses. The Russian equivalent is a profit and loss statement. Contains detailed information about income and expenses for a certain period of time. Enables management to understand how to increase business profitability. To improve the financial situation, they are working to increase income and reduce expenses. Also, work can be carried out simultaneously on two groups of indicators.

With this report, financiers, investors and analysts gain a complete understanding of the company's production processes. Thanks to this, they can form an opinion about its profitability.

Publication of these reports is mandatory for public companies. Late filing will result in penalties.

Comparing pl over several years allows the company to develop long-term development plans and evaluate the performance of management. This reporting form can be used to calculate an important indicator - net profit.

Net profit

Net income is calculated by subtracting all expenses from gross income. Used for investments, creation of funds. Also, funds from the net profit received are used to pay dividends to shareholders.

The amount of net profit directly affects the investment attractiveness of the company. Also, high net profit has a positive effect on your credit rating.

Income includes the following:

- revenue;

- income from all projects;

- receiving dividends.

The following expenses are taken into account:

- regular payments;

- cost of sales;

- administrative expenses;

- dividend payments;

- tax deductions;

- advertising expenses.

Most often, pl is calculated using special programs that process the received data. Data is entered regularly throughout the reporting period.

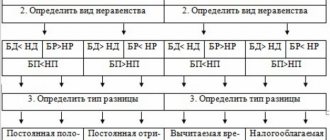

Differences

Although these two types of reporting have many similarities, do not forget that these are different types of documentation, because their differences are quite serious:

- Logical continuation . A system aimed at measuring, processing and transmitting information is accounting. Accounting information available for both internal and external use – financial accounting. Financial is the end result of accounting. Because all data is taken from accounting. The financial report contains space for making forecasts, explanations, and plans for the further financial future of the organization. Since financial accounting is aimed at external users, much of the information specified in accounting is not used. It remains secret - a trade secret. After all, competing companies monitor each other’s activities.

- Purpose of accounting . Accounting systematization of truthful data to control and identify hidden resources. Compiled for internal employees who understand the nomenclature, without explanatory notes. Subject to mandatory verification by an audit company. It is understandable to people whose professions are directly related to accounting. Financial - aimed at external users, generates information about the company’s capabilities. Used, for example, by investors who need to understand the feasibility of investing their resources in the organization. Or lenders to assess the risks and possibilities of receiving interest on the loan.

- Users . Accounting is created for use by two large groups of people: administration and users with direct financial interest. The first group includes: the board of directors, senior management personnel, individual co-owners and owners, foremen, managers, heads of departments. To the second, current or potential investors or creditors. Financial accounting is aimed at people indirectly involved in production. These include customers, suppliers, buyers, and investors.

- Obligation to maintain . Accounting employees are required to submit documentation. The department responsible for the company’s finances does so at its own discretion. But every year in Russia there is a tendency to create a declaration. This is done to attract new sponsors and retain customers.

- Availability . Accounting statements are not available to external users. Since it is one of the most important conditions for creating a strategy for the next period. But financial information is not only available to external users. But even sometimes it is published in the media and on the official pages of the company. It contains explanatory notes that, if desired, people far from economics can understand.

To summarize, it should be noted that financial reporting cannot exist without accounting , because the data is taken from it. In addition, financial reporting is the logical conclusion of accounting. They are not only connected to each other, but also complement each other. Based on the information that firms provide in their documents, fateful decisions are made for the entire organization. Therefore, the data must be reliable, complete, significant, and neutral.

FinanceComment

ADVANTAGES

Let's consider the main advantages of management accounting over accounting (see diagram).

Compared to accounting, management accounting is more operational and more detailed. Consequently, it allows you to analyze activities in any context .

Accounting does not provide all the operational information for making management decisions. Assessing the state of affairs at an enterprise based only on accounting data is not enough.

Accounting takes into account documented, already accomplished facts of economic activity. Management accounting can work for the future, make forecasts, and evaluate the effectiveness of a transaction before it is completed.

Management accounting is not limited by legal framework, therefore each organization adapts this accounting to itself, that is, chooses accounting methods that are convenient for it. The accounting methodology must comply with the accounting regulations.

EXAMPLE

As a result of the introduction of a management accounting system , the production facility, which produces interior items, received a tangible economic effect :

- reduction of accounts receivable at the end of the year;

- optimization of accounts payable.

A similar result was achieved through control over accounts receivable, based on online registration of shipments with appropriate payment terms. Monetary discipline was also strengthened due to strict control over the validity of payments.

After the implementation of the management system, payments are made only on the basis of payment documents registered in the system that comply with contractual obligations. This made it possible to eliminate overdue advance payments and introduce limits on the payment of advances for each obligation. Result : advance payments reduced by 15%.

The introduction of management accounting made it possible to effectively manage costs, create an effective mechanism for cost planning, operational accounting tools and control of actual costs in the main production departments. Thanks to this, it can keep operational records of costs in value and physical terms, and generate standard costs for the actual volume of production. In addition, the manufacturing company received additional opportunities when planning capacity utilization and material resources.

Thanks to the implementation of the management system, the company's inventories were reduced by 15 %.

Final conclusions

Despite the above clearly identified differences between financial accounting and accounting, one cannot help but recognize the fact of their close similarity . Most of the information collected by financial accounting is used simultaneously in the management part of accounting. To avoid data duplication, uniform rules for collecting primary information and accounting principles are applied.

Both types of accounting are used as a tool for making clear management decisions and assessing the state of affairs at the enterprise and the correct prospects, which gives the main similarity to financial and accounting accounting.

FinanceComment