Oddly enough, contributions and taxes are sometimes confused. Insurance contributions of the simplified tax system are contributions from taxpayers under the simplified taxation system to the Social, Medical and Pension Insurance Funds, which have recently been administered by the tax office (almost all contributions). They are listed by both organizations and individual entrepreneurs. There is a very important and useful feature of payment - timely paid insurance premiums of the simplified tax system reduce the tax due to the simplified tax system for payment. This is done not automatically, and not on the tax side - something one could only dream of - but voluntarily and independently. This, of course, is a catch for some; in fact, it turns out that reducing insurance premiums under the simplified tax system is a right. Entrepreneur's right. It’s not a tax obligation, it’s an opportunity that you can take advantage of. But certain conditions must be met. First, you can figure out how things are going for legal entities on the simplified tax system.

What are insurance premiums

Insurance contributions are mandatory payments that organizations and individuals pay for their employees for compulsory social insurance, and entrepreneurs also pay contributions for themselves.

There are four types of compulsory social insurance:

- Pension;

- In case of temporary disability and maternity;

- Medical;

- From industrial accidents and occupational diseases.

Sometimes beginning businessmen confuse taxes and contributions. Let's clarify: a tax is a mandatory payment from the income of a business or individual in favor of the state or municipalities. And insurance premiums are contributions to the Pension, Social and Health Insurance Funds. The budgets of these funds are formed separately from the federal one - namely from contributions from policyholders, which is why the funds are called extra-budgetary. They provide support to citizens who have suffered an insured event: for example, the Pension Fund assigns a pension upon reaching retirement age, the Social Insurance Fund pays benefits upon pregnancy and the birth of a child.

Insurance premiums differ from personal income tax in that they are paid from the policyholder’s own funds. Whereas the employer withholds personal income tax from payments to his employee.

To whom reduced rates on insurance premiums have been canceled since 2021

As you can see, the basic insurance premium rates for 2021 have not changed. But with reduced tariffs the situation is different.

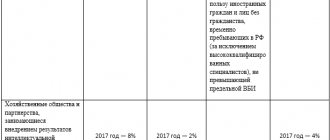

From 2021, fewer companies can apply reduced contribution rates. Thus, the reduced tariffs for 3 categories :

- business entities and partnerships that practically apply or implement the results of intellectual activity, the exclusive rights to which belong to their founders or participants - budgetary or autonomous scientific institutions or budgetary or autonomous educational organizations of higher education;

- organizations and individual entrepreneurs that have entered into agreements on technology-innovation activities and make payments to employees working in technology-innovation special economic zones or industrial-production special economic zones;

- organizations and entrepreneurs who have entered into agreements on the conduct of tourism and recreational activities and who make payments to those employees who work in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster.

Since 2021, these companies and individual entrepreneurs have been applying normal tariffs for insurance premiums (clause 2 of Article 425 of the Tax Code of the Russian Federation).

Who pays insurance premiums

Individual entrepreneurs, lawyers, mediators, arbitration managers, notaries, etc. additionally transfer contributions for themselves in a clearly established amount. Every year, officials review the amount of these contributions.

Individual entrepreneurs, organizations and ordinary individuals who are employers also pay monthly insurance premiums for employees for all types of compulsory social insurance. If an individual entrepreneur transfers contributions as an employer-insurer, this does not exempt him from paying contributions for himself.

Who can work for the simplified tax system and do “simplified” workers pay insurance premiums?

The possibility of using the simplified taxation system (STS) is available to legal entities and individual entrepreneurs that meet certain restrictions established by Art.

346.12 Tax Code of the Russian Federation. These restrictions also include engaging in certain types of activities. At the same time, most existing types of activities can be transferred to the simplified tax system. Read about the conditions for applying the simplified tax system in 2021 here.

The presence of hired personnel in organizations and individual entrepreneurs allows them to be regarded as persons who pay remunerations and are obliged to pay insurance premiums from these remunerations (subparagraph 1, paragraph 1, article 419 of the Tax Code of the Russian Federation, article 3 of the law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

An individual entrepreneur may not have employees and, accordingly, will not pay remuneration to them. But he must also pay contributions (subclause 2, clause 1, article 419 of the Tax Code of the Russian Federation), although in a different order from that which applies to hired employees (Articles 421, 422, 430 of the Tax Code of the Russian Federation).

An individual entrepreneur with employees will have to pay contributions simultaneously on 2 grounds (clause 2 of Article 419 of the Tax Code of the Russian Federation):

- for myself;

- from the remuneration of these employees.

The amount of insurance premiums for individual entrepreneurs for themselves in 2020 and 2021

In 2021, individual entrepreneurs using the simplified tax system will pay 40,874 rubles in fixed insurance premiums for themselves. Of this, 32,448 rubles are paid for pension insurance. 8,426 rubles are transferred for medical insurance. In 2021, insurance premiums were the same. The amounts were not increased so as not to put additional tax burden on entrepreneurs in a difficult situation.

Individual entrepreneurs from the industries most affected by the coronavirus in 2021 received a discount on contributions to the Pension Fund in the amount of one minimum wage. They pay 20,318 rubles per year for mandatory pension insurance. Individual entrepreneurs do not have to pay contributions to the Social Insurance Fund, but if an entrepreneur wants to obtain the right to social benefits (sick leave, maternity leave, child care), then he needs to transfer contributions to the Social Insurance Fund voluntarily.

Additionally, the individual entrepreneur must transfer to the Pension Fund 1% of those income for the year that exceed 300,000 rubles. But their size in 2021 and 2021 cannot be more than 259,584 rubles. The calculation of income depends on the taxation system of the entrepreneur:

- OSNO - income received from entrepreneurial and other professional activities, reduced by professional deductions;

- STS “income” - the income of an entrepreneur, determined according to the rules of Art. 346.15 Tax Code of the Russian Federation;

- The simplified tax system “income minus expenses” is the income of an entrepreneur, determined according to the rules of Art. 346.15 of the Tax Code of the Russian Federation, reduced by expenses calculated according to the rules of Art. 346.16 Tax Code of the Russian Federation;

- UTII and PSN - imputed or estimated income.

The BCC of the additional contribution to the compulsory pension insurance is the same as for the fixed contribution - 182 1 0210 160.

Calculation of taxes and contributions, advance payments

Advance payments are calculated by simplified taxation system payers independently and are paid no later than the 25th day of the month following the reporting period (April 25, July, October, respectively). Calculated advance payments are taken into account when calculating the tax amount for the year.

When applying the simplified tax system, the tax base for calculating tax depends on the selected object of taxation: income or income minus expenses. The selected object of taxation on the simplified tax system affects the right to take into account your expenses when determining the tax base. Thus, the tax base under the simplified tax system with the object “income” is the monetary expression of all income of the entrepreneur.

When applying the simplified tax system with the object “income minus expenses,” the base is the difference between income and expenses. Income and expenses are determined on an accrual basis from the beginning of the year.

To calculate the tax, you need to multiply the tax base by the tax rate.

Based on the results of filling out the tax return, it will be clear how much tax should be paid for the reporting year, taking into account advance payments and insurance premiums paid during the year.

Insurance premiums for employees in 2020 and 2021

For individual entrepreneurs and LLCs acting as insurers, the total amount of contributions to various funds is in most cases 30% of the employee’s salary. This amount is not deducted from the salary, like personal income tax, but is paid by the employer to funds from the enterprise’s funds. 22% of the salary amount is sent to the Pension Fund, 5.1% to the Federal Compulsory Medical Insurance Fund, and 2.9% to the Social Insurance Fund for compulsory social insurance.

For certain types of activities, reduced contribution rates have been established. Thus, companies from the IT sector in 2021 will be able to pay contributions at a rate of 7%: to the Pension Fund - 6%, to VNiM - 1.5%, to the Federal Compulsory Medical Insurance Fund - 0.1%.

There are also additional FSS tariffs for insurance against work-related injuries and occupational diseases. They are established for each policyholder depending on the type of activity. It is to clarify this tariff that employers annually submit a report to the Social Insurance Fund confirming their main type of activity. The tariff rate ranges from 0.2% to 8.5%.

Insurance premiums are calculated monthly. The calculation principle is as follows:

Step 1. For each employee for each type of insurance, the base for calculating contributions is determined monthly. The base is the total amount of payments to the employee from which contributions are calculated. It is calculated on an accrual basis from the beginning of the year and compared with the maximum base. If the maximum base is exceeded, then contributions from the excess amount are either not paid at all or are paid at a reduced rate. Here are the limits for recent years:

| 2021 | 2020 | 2019 | |

| Pension insurance | RUB 1,465,000 | RUB 1,292,000 | RUB 1,150,000 |

| Temporary disability and motherhood | RUB 966,000 | 912,000 rub. | 865,000 rub. |

| Health insurance | not installed | ||

| Industrial injuries and occupational diseases | not installed | ||

For excess amounts, pension insurance contributions are paid at a rate of 10%, and individual entrepreneurs and LLCs from preferential categories do not pay contributions at all. There is no need to pay contributions to VNiM for excess amounts. But there is no limit for contributions to the FFOMS and for injuries, so contributions must always be paid.

Step 2 . The base calculated in the first step is multiplied by the established tariff for contributions.

Step 3 . The amounts of contributions previously accrued during the year are deducted from the amount of contributions received. The difference is paid to the budget.

The tax rate depends on the object of taxation:

- 6% – for the object “income”;

- 15% – for the object “income minus expenses”.

The laws of the constituent entities of the Russian Federation can establish tax rates ranging from 1 to 6%, depending on the categories of taxpayers.

According to the laws of the constituent entities of the Russian Federation, the tax rate can be reduced to 5%.

According to the laws of the Republic of Crimea and the federal city of Sevastopol, the tax rate can be reduced in the territories of the corresponding constituent entities of the Russian Federation for all or certain categories of taxpayers:

- for the periods 2015 - 2021 - up to 0%,

- for the periods 2021 - 2021 - up to 3%, if the object of taxation is “income minus expenses.

The laws of the constituent entities of the Russian Federation may establish a tax rate of 0% for taxpayers - individual entrepreneurs who have chosen the object of taxation in the form of income or in the form of income reduced by the amount of expenses first registered after the entry into force of these laws and carrying out business activities in production, social and (or) scientific spheres, as well as in the field of consumer services to the population and services for providing places for temporary residence.

For the object “income”

To calculate the tax, the company's income from sales and non-operating income are taken into account. The amount of income is multiplied by a rate of 6%.

We count in detail

Let’s say an individual entrepreneur applies the simplified tax system (the object of taxation is “income”). Amount of income received during the first half of the year:

| Period | Income, rub. |

| January | 600 000 |

| February | 840 000 |

| March | 720 000 |

| TOTAL for the first quarter | 2 160 000 |

| April | 930 000 |

| May | 640 000 |

| June | 810 000 |

| TOTAL for the first half of the year | 4 540 000 |

1. Calculate the amount of advance payments

The amount for the first quarter will be 129,600 rubles: 2,160,000 rubles. × 6%.

2. Determine the amount of advance payments

The amount for the first half of the year will be 272,400 rubles: 4,540,000 rubles. × 6%.

3. Calculate the tax amount

Taking into account the advance payment, which was paid at the end of the first quarter, for the first half of the year you need to pay 142,800 rubles: 272,400 rubles. — 129,600 rub.

With the object “income”, an individual entrepreneur who makes payments and other rewards to individuals has the right to reduce the amount of tax (advance tax payment) by the amount of paid insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases paid (within the calculated amounts) in a given tax (reporting) period in accordance with the legislation of the Russian Federation, but not more than 50%.

Attention!

The restriction does not apply to individual entrepreneurs who do not have employees. In this case, the tax (advance payment) can be reduced by the entire amount of insurance premiums paid for yourself in a fixed amount.

We count in detail

Let’s say that in the first quarter of 2021 an individual entrepreneur received an income of 2,160,000 rubles. From payments to employees, he paid insurance premiums in the amount of 75,000 rubles.

1. Calculate the advance payment

For the first quarter - 129,600 rubles: 2,160,000 rubles. × 6%.

2. Reduce the down payment

The advance payment can be reduced not by the entire amount of insurance premiums, but only by the maximum amount - 64,800 rubles: 129,600 rubles. × 50%.

Let’s assume that an individual entrepreneur has no employees.

In this case, an individual entrepreneur pays insurance premiums for compulsory pension insurance and compulsory medical insurance only for himself - 46,590 rubles. (7,500*12*26% +(2,160,000 – 300,000)*1% + 4590)

The advance payment for the first quarter of 2021 will be 83,010 rubles: 129,600 rubles. – 46,590 rub.

For the object “income minus expenses”

To calculate the tax, expenses are subtracted from the amount of income, and the resulting result is multiplied by a rate of 15%. Please note that income cannot be reduced by all expenses.

Law and order

The list of expenses by which income can be reduced is determined by clause 1 of Art. 346.16 of the Internal Revenue Code.

For example, when determining the object of taxation, it is possible to reduce the costs of all types of compulsory insurance for employees, property and liability, including insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity and other types of insurance provided for by the legislation of the Russian Federation. Federation.

At the same time, fines and penalties for violating the terms of business contracts are not included in this list. This means that when calculating the single tax according to the simplified tax system, they are not taken into account.

We count in detail

Let’s say an individual entrepreneur applies the simplified tax system (the object “income minus expenses”). The amounts of income received, expenses incurred and tax base will be:

| Period | Income, rub. | Expenses, rub. | Tax base, rub. |

| January | 600 000 | 460 000 | 140 000 |

| February | 840 000 | 650 000 | 190 000 |

| March | 720 000 | 500 000 | 220 000 |

| Total for the first quarter | 2 160 000 | 1 610 000 | 550 000 |

| April | 930 000 | 880 000 | 50 000 |

| May | 640 000 | 560 000 | 80 000 |

| June | 810 000 | 680 000 | 130 000 |

| Total for the first half of the year | 4 540 000 | 3 730 000 | 810 000 |

1. Calculate the amount of advance payments

The amount for the first quarter will be 82,500 rubles: 550,000 rubles. × 15%.

2. Determine the amount of advance payments

The amount for the first half of the year will be 121,500 rubles: 810,000 rubles. × 15%.

3. Calculate the tax amount

Taking into account the advance payment, which was paid based on the results of the first quarter, for the first half of the year you need to pay 39,000 rubles: 121,500 rubles. — 82,500 rub.

Attention!

For entrepreneurs who have chosen the “income minus expenses” object, the minimum tax rule applies: if at the end of the year the amount of calculated tax is less than 1% of the income received for the year, a minimum tax is paid in the amount of 1% of the actual income received.

We count in detail

An individual entrepreneur applies the simplified tax system (the object “income reduced by the amount of expenses”). During the tax period, he received income in the amount of 25,000,000 rubles, and his expenses amounted to 24,000,000 rubles.

1. Determine the tax base

The tax base is equal to 1,000,000 rubles: 25,000,000 rubles. — 24,000,000 rub.

2. Determine the amount of tax

The tax amount will be 150,000 rubles: 1,000,000 rubles. × 15%.

3. Calculate the minimum tax

The minimum tax is 250,000 rubles: 25,000,000 rubles. × 1%.

You need to pay exactly this amount, and not the amount of tax calculated in the general manner.

How to reduce tax on contributions

Pay taxes and insurance premiums in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

At the simplified tax system of 15%, all contributions for employees or individual entrepreneurs for themselves fall into the “Expenses” column in the Accounting Book and reduce the tax base.

At the simplified tax system of 6%, the policyholder or individual entrepreneur without employees has the right to include insurance premiums in the tax deduction:

- An individual entrepreneur without employees can reduce the tax by the amount of all contributions paid, even if the tax is canceled.

- Individual entrepreneurs and LLCs with employees can also reduce the tax by the amount of insurance premiums paid, but not more than 50%.

Results

The use of the simplified tax system does not exempt either legal entities or individual entrepreneurs from paying insurance premiums.

Contributions for both must be paid from payments in favor of employees. At the same time, the individual entrepreneur has the obligation to pay contributions for himself, regardless of whether he has employees. The procedure for determining the amount of contributions accrued for employees and individual entrepreneurs is different. For contributions to employees, three types of tariffs can be applied: basic, additional, reduced. The ability to use the latter has been limited since 2019. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who is allowed to apply reduced rates from 2021

Since 2021, new benefits on insurance premiums have come into force (subclause 16, clause 1 and subclause 7, clause 2, article 427 of the Tax Code of the Russian Federation).

Thus, organizations and entrepreneurs that have received the status of a participant in a special administrative region (Federal Law dated August 3, 2018 No. 291-FZ) that pay income to crew members of ships registered in the Russian Open Register can apply a 0% rate on all types of contributions until 2027 inclusive. ships by the specified payers, for the performance of labor duties of a member of the ship's crew.

In this case, zero rates can only be applied to payments to specified crew members. For the income of other employees, employers apply regular rates.

Many people believe that insurance premiums for payments to disabled people of groups 1, 2 and 3 are charged at reduced rates. Is this legal? There is a clear answer in ConsultantPlus:

From payments to disabled people of groups I – III, charge contributions to compulsory health insurance, compulsory medical insurance and VNIM according to... (read in full).

Employer contributions for employees

The contributions that employers make for the insurance of their employees do not have a set fixed amount. These amounts are calculated as a percentage of employee payments (salaries, vacation pay, bonuses, etc.).

Payments listed in Article 422 of the Tax Code of the Russian Federation and Article 20.2 of Law No. 125-FZ of July 24, 1998 are not subject to insurance contributions. For example, benefits for temporary disability, pregnancy and childbirth, at the birth of a child, compensation, financial assistance, etc.

What insurance premiums must be paid for employees in 2021? There are more categories here than for individual entrepreneurs for themselves, namely:

- for pension provision (mandatory and additional contributions);

- for medical support;

- for social security for disability and maternity;

- for social security in case of injuries and occupational diseases.

The rates of insurance premiums for employees depend on the main type of activity of the employer; we will consider them below in a convenient table. In addition, the size of the amount paid to the employee for the year matters.

Calculation of contributions

Insurance premiums this year continue to be paid not only for employees hired on staff. It is also necessary to transfer them for persons hired under civil contracts, in addition to payments to the social fund.

For each of the insured citizens, the basis for calculating insurance premiums is determined. It includes all payments that the employer made to this person, except for those listed in Article 422 of the Tax Code of the Russian Federation. The corresponding tariff is applied to the base.

Example of calculating contributions for April

| ✏ Entrepreneur Petr Petrovich Sokolov is a small business. He has 1 employee who receives 30,000 rubles monthly. Insurance premiums in 2021 for our individual entrepreneur for the 1st quarter were calculated at the standard rate, totaling 30% (22% + 5.1% + 2.9%). But from April 1, it became possible to apply reduced tariffs. Let's calculate how much an entrepreneur will now pay for insurance for his employee. |

First of all, you need to divide your salary into 2 parts:

- Part 1 – within the minimum wage, that is, 12,130 rubles;

- Part 2 – above the minimum wage, that is, 30,000 – 12,130 = 17,870 rubles.

Let's check whether the employee's income since the beginning of the year does not exceed the maximum base. For each month he received 30,000 rubles, that is, for January-April his income will be 30,000 * 4 = 120,000 rubles. This amount is within the limit, so we apply the appropriate rates from the table above:

- We will calculate insurance contributions towards the future pension for April as follows: 12,130 * 22% + 17,870 * 10% = 2,668.6 + 1,787 = 4,455.6 rubles.

- Contributions for medicine will be: 12,130 * 5.1% + 17,870 * 5% = 618.63 + 893.5 = 1,512.13 rubles.

- Sick leave deductions will be equal to: 12,130 * 2.9% + 17,870 * 0% = 351.77 rubles.

Total the individual entrepreneur will pay for his employee for April: 4,455.6 + 1,512.13 + 351.77 = 6,319.5 rubles.

Free consultation on accounting services

To learn how individual entrepreneurs and employees fill out the quarterly DAM calculation form, read this article.

Reduced insurance premium rates in 2020: summary table (excluding coronavirus)

| Who can apply | Contribution rates, % | ||

| Pension Fund | FSS | Compulsory Medical Insurance Fund | |

| Non-profit companies on the simplified tax system with activities in the field of culture, healthcare, education, science | 20 | 0 | 0 |

| Charitable organizations on the simplified tax system | 20 | 0 | 0 |

| Businesses operating in the IT industry: software developers, testers, installers and sellers of computer programs | 8 | 2 | 4 |

| Employers of crew members of Russian ships | 0 | 0 | 0 |

| Skolkovo resident enterprises | 14 | 0 | 0 |

| Manufacturers of cartoons, video and audio products | 8 | 2 | 4 |

| Residents of the free economic zone in Crimea and Sevastopol | 6 | 1,5 | 0,1 |

| Enterprises operating in territories of rapid economic development | 6 | 1,5 | 0,1 |

| Residents of the port of Vladivostok | 6 | 1,5 | 0,1 |

| Residents of the free economic zone in the Kaliningrad region | 6 | 1,5 | 0,1 |

In 2021, many small and medium-sized businesses affected by coronavirus received the right to a reduced rate on insurance premiums. How to use it is explained in detail in ConsultantPlus:

But you need to take into account that the reduced tariffs do not apply to the entire amount of monthly payments to an individual, but only... (read the instructions in full).