Membership in a self-regulatory organization is associated with certain expenses: payment of entrance and membership fees, transfer of funds to the compensation fund. Naturally, any entrepreneur is concerned with the question: “How to write off the costs of joining an SRO?”

If membership in an SRO is a production necessity for your company , then contributions and insurance payments in accordance with the Tax Code of the Russian Federation can be taken into account when taxing profits. In this case, membership fees are written off as a lump sum, and insurance payments are written off in equal installments throughout the entire membership period.

Some difficulties arise if you joined an SRO, although there was no direct need to be a member of a self-regulatory organization (for reasons of prestige or to increase the loyalty of future customers and partners). In this situation, the tax office will most likely consider the attribution of these costs to profit as economically unjustified. In this case, experts recommend using the item of other expenses associated with production and sales.

basic information

Let's name the main payments that are paid upon joining an SRO:

- Introductory fees (paid once).

- Membership (paid quarterly).

- To the compensation fund.

- Insurance payments.

The amount of most of these contributions is set by the SRO itself. There are no clear rules regarding the accounting of contributions. Accounting procedures should be based on basic principles. It makes sense to recognize contributions as other expenses within the framework of tax accounting. They are recognized evenly throughout the tax period, which will avoid questions from the tax authorities. The accounting periods are determined by the SRO independently.

IMPORTANT! Membership payments payable quarterly are recognized as other expenses at a time. They are taken into account by the date of payment.

Why is a compensation fund created?

A self-regulatory organization creates a compensation fund to ensure the property liability of members of the association. The Town Planning Code provides for the creation of comp funds in order to ensure property liability arising from:

- as a result of causing harm to the life and health of citizens, the property interests of individuals and legal entities, the environment, and cultural heritage sites;

- as a result of violation of contractual obligations when performing construction work.

The fund is formed in monetary form through contributions from members. The amount of payment is established by the internal administrative documents of the SRO, but must correspond to the minimum amount established in paragraphs 10-13 of Article 55.16 of the Civil Code of the Russian Federation.

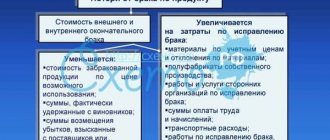

Tax accounting of contributions to SRO

Paragraph 1 of Article 264 of the Tax Code of the Russian Federation states that fees and deposits are considered other expenses. For this accounting procedure, two conditions must be met:

- Payments are required.

- Contributions are a condition for the operation of the company.

Payments to SRO meet all these requirements, so they can be recognized in the structure of other expenses. That is, they are subject to income tax calculation. The corresponding instructions are in letters from the Ministry of Finance. When doing tax accounting, you must adhere to the rules specified in paragraph 1 of Article 272 of the Tax Code of the Russian Federation. They apply to one-time and annual payments. The Tax Code of the Russian Federation states that expenses can be recognized step by step only in the reporting period to which they belong. This does not mean when the payments were actually made.

It is necessary to take into account the explanations of the Ministry of Finance. According to them, the provisions of Article 272 of the Tax Code of the Russian Federation are relevant only in relation to expenses that arose on the basis of civil law agreements. If expenses were incurred for other reasons (for example, a fee for issuing a license), Article 272 of the Tax Code of the Russian Federation is not used. There is also a letter from the Ministry of Finance dated May 31, 2007, which states the possibility of one-time recognition of expenses. What should you be guided by? The company can decide for itself. There is no practice of judicial institutions on this issue.

The safest option is an even distribution of contributions in the structure of other expenses on the basis of paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

However, in this case you need to keep in mind some nuances. The membership payment establishes the firm's right to participate in the SRO during the quarter. That is, the corresponding expenses are taken into account in the quarter to which they belong. The entrance fee is paid once. On its basis, a certificate is issued. Based on Part 9 of Article 55 of the Civil Code of the Russian Federation, it is unlimited. The company has the right to formulate a procedure for accounting for expenses for the payment of the entrance fee and payment to the fund. These expenses can also be distributed evenly throughout the reporting period. This period is set by the company independently, but, according to the letter of the Ministry of Finance dated October 15, 2008, it must be reasonable. Periods for writing off expenses must comply with accounting policies.

Source documents

Accountants have many doubts about primary documents confirming the transfer of contributions. The fact is that self-regulatory organizations do not enter into agreements with their participants. The main document they issue is a certificate of entry into an SRO, but it does not say anything about the amount and timing of payments.

Based on what “primary basis” should the company write off contributions? The answer depends on the document flow adopted in each individual self-regulatory organization. Some issue invoices, and then the invoice serves as a supporting document. Some SROs issue a copy of the regulations on the amount and procedure for paying contributions. This document is also suitable for cost recognition. There are also SROs whose participants do not receive papers at all indicating the amount and date of payment of contributions. In this case, the participant needs to take care of the “primary” independently. The most common way is to go to the website of a self-regulatory organization and print out a document that contains information about the obligation to pay fees (regulations, minutes of a meeting of participants, etc.).

All these documents are approved by officials as documents confirming expenses. In one of the letters dedicated to construction SROs, specialists from the Ministry of Finance explained: costs can be written off on the basis of certificates, payment slips, invoices and other papers issued by a self-regulatory organization (letter dated 04/01/10 No. 03-03-06/1/207).

Accounting

Contributions made by participants are related to the work of the company. For this reason, they are recognized as expenses in ordinary areas of activity on the basis of paragraph 5 of PBU 10/99. The expenses in question are included in the cost of work based on clause 9 of PBU 10/99. When recognizing expenses, the relationship between actual expenses and revenues is taken into account.

Membership fees are quarterly, and entrance fees and payments to the fund are one-time, and therefore expenses cannot be immediately recognized as expenses. Quarterly payments are written off as expenses in the period (quarter) in which the money actually arrived at the company.

IMPORTANT! The period for recognizing one-time payments is determined by the SRO independently, since the period of participation in the SRO is unlimited.

Clause 65 of the Accounting Regulations states that expenses incurred in the reporting period, but attributable to subsequent periods, are recorded in the balance sheet as a separate item. They are recognized as expenses of the following periods and written off in the manner approved by the accounting policy. The company itself must establish the procedure for writing off contributions. The following options are possible:

- Evenly over a given period.

- In accordance with the volume of work performed.

Contributions received by the SRO must be recorded on the debit of account 97. The corresponding account is account 76. Then they are classified as expenses for the main forms of activity. The third section of the Accounting Instructions states that data on expenses for the main forms of activity are collected either on accounts 20-29 or on accounts 20-39. The most optimal account for collecting information is account 26. The accounting procedure is determined by the company independently.

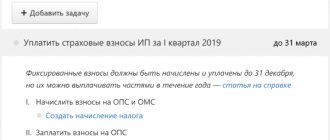

Calculation of insurance premiums in 1C 8.3 Accounting

It is necessary to indicate the contribution rate approved for the organization by the Social Insurance Fund. Each employee is assigned an accrual for payroll calculation.

There are also accruals for paying sick leave or vacation. All of them are available in the accrual directory.

Salaries and personnel/ Directories and settings/ Accruals The accrual form contains the “Type of income” attribute, which determines whether this accrual will be subject to contributions. The reference book already contains the accrual “Payment based on salary”, which has the type of income “Income fully subject to insurance contributions”, and accruals for sick leave with the type of income called “State benefits of compulsory social services”.

insurance paid at the expense of the Social Insurance Fund.”

If you need to create new accruals, you must correctly indicate the type of income for them.

Cost items are needed for proper accounting of contributions. The program already has articles that are used by default: “Insurance contributions” and “Contributions to the Social Insurance Fund from NS and PZ” (as well as similar articles for UTII).

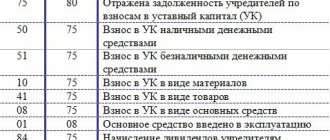

Wiring used

When debiting payments monthly, these entries are used:

- DT76 KT51. Receipt of payment to SRO.

- DT97 KT76. Attribution of contributions to expenses of the following periods.

- DT20 KT97. Systematic write-off of contributions.

When writing off contributions at a time, these transactions are relevant:

- DT76 KT51. Payment of contributions.

- DT20 KT76. Write-off of payments.

Be sure to take into account that transactions will vary depending on the type of payment.

Example

In February 2021, the company joined the SRO and transferred an entrance payment of 90,000 rubles. The payment to the compensation fund amounted to 350,000 rubles.

The head of the company issued an order according to which payments would be written off evenly over 36 months. Certificate of entry received in February 2021. From this month, the company will make monthly payments in the amount of 6,000 rubles every month. In January, these postings must be made:

- DT76 KT51. Receipt of funds in the amount of 440,000 rubles (350,000 + 90,000).

- DT97 KT76. Recognition of two contributions as expenses of subsequent periods.

- DT68 KT77. Deferred tax liability (440 thousand * 20%).

Every month (from February to December 2021), the accountant makes these entries:

- DT76 KT51. Transfer of a monthly payment in the amount of 6,000 rubles.

- DT26 KT76. Write-off of the received contribution for current expenses.

- DT26 KT97. Expenses of the following periods are written off (in parts) for current expenses (440,000/36 months).

- DT77 KT68. Decrease in deferred liability.

Monthly postings are reflected throughout the year.

What is an SRO and what are the costs associated with it?

SRO (self-regulatory organization) is a non-profit organization:

- uniting businessmen based on industry or subjects of a certain profession;

- intended to regulate professional activities in terms of ensuring compliance with legal requirements.

Membership in an SRO can be mandatory or voluntary. In this case, merchants incur expenses to pay for:

- contributions of three types - entrance, compensation and membership;

- civil liability insurance.

We will talk about the accounting features of these payments to SROs in the following sections.

Whether an organization is obliged to report information about joining an SRO to the tax authority was explained by S.V., Actual State Counselor of the Russian Federation, 3rd class. Razgulin. Find out the official's answer by receiving trial demo access to the K+ system. It's free.

Accounting for insurance expenses

Paragraph 6 of Article 270 of the Tax Code of the Russian Federation states that when establishing the tax base, expenses for optional insurance will not be taken into account. The exception is the contributions specified in Articles 255, 263, 291 of the Tax Code of the Russian Federation. Article 263 of the Tax Code of the Russian Federation states that mandatory payments are included in expenses for insurance. These expenses can be taken into account as part of income taxation. They are included in other expenses. Accounting is carried out based on the actual amount of expenses. The procedure for recognizing contributions is specified in paragraph 6 of Article 272 of the Tax Code of the Russian Federation.

Inclusion in other expenses is quite justified from a legal point of view. A number of companies are required to join an SRO. For example, this applies to construction companies. To join an SRO you must pay mandatory fees. That is, spending is considered economically justified. For this reason, they can be taken into account when assessing taxes.

Taxation of non-profit organizations

Organizations that use membership fees to solve statutory problems do not take into account target revenues as part of their income. Expenses aimed at covering statutory activities do not participate in taxation when conducting commercial activities of non-profit organizations.

In business activities, NPOs have the right to apply a general or simplified taxation system. OSNO is assigned by default upon registration; to maintain the simplified tax system, you will need to submit a notification to the registration authority. The transition to the simplified tax system is carried out at the opening of an organization or from the beginning of a new calendar year. Positive features of the simplified system:

| Conditions | Positive sides |

| Possibility of using the object of taxation “income” or income minus expenses” | Each of the objects has its advantages. If there are no expenses, the “income” object takes precedence |

| Tax accounting | The number of reporting forms and types of taxes is minimal |

| Accounting | It is allowed to maintain an abbreviated version using a limited number of accounts |

The document flow under the simplified tax system is less voluminous than under the OSNO. For enterprises with no need to calculate VAT, small numbers and turnover, choosing a system is preferable to the generally established regime.