After the end of the reporting period, enterprises sum up the results and report, submitting the relevant declarations to the regulatory authorities, including the income tax declaration (ITD), in which they indicate the amount of profit, calculate and fix the amount of tax (IPT). Since tax payment is carried out by transfer of advance payments, the amount of the advance accrued for the reporting period is formed in declaration line No. 210. Let's figure out what information should be reflected in this line.

Data entered into line 210

The new form and procedure for filling out the income tax return are set out in the Federal Tax Service order No. ММВ-7-3/ [email protected] dated 09.23.2019. In the KND form 1151006 there are several columns 210:

- In section 1 - KBK. In 2021, the BCC for transferring profitable contributions is 182 1 0100 110.

- Sheet 02 contains advances accrued for the reporting period.

- Appendix 3 to sheet 02 contains transactions for the sale of fixed assets, assignments, trust management, etc.

- Sheet 06 contains investments in untraded securities.

- In the appendices to sheet 09 - the profits of foreign companies.

Lines 210, required to be completed by all taxpayers: KBK and line 210 of sheet 02.

Column 210 of sheet 02 indicates information about the calculated and accrued advance payment for the previous reporting period. Correct completion of line 210 of the declaration for six months, 9 months and a year depends on the method of paying the advance to the budget - monthly, quarterly or based on actual profit.

IMPORTANT!

Taxpayers with quarterly advances do not fill out cell 210 of sheet 02 in the declaration for the 1st quarter.

Line 210 is a summary of tax advances, that is, the total amount of the contribution of 20%. The payment is divided into:

- contribution to the federal budget in the amount of 3% (it is necessary to fill out line 220 of the profit declaration for the reporting period);

- contribution to the regional budget in the amount of 17% (fill out page 230).

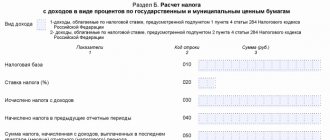

Lines 140–170 Tax rates

On line 140, indicate the income tax rate.

If the declaration is submitted by an organization with separate divisions, put dashes on line 140 and indicate only the federal income tax rate on line 150.

On line 150, indicate:

- federal income tax rate. For example, for a standard rate of 2 percent, enter “2–.0–”;

- or a special income tax rate, if the organization applies exactly that. This is explained by the fact that the tax calculated at special rates is completely transferred to the federal budget (clause 6 of Article 284 of the Tax Code of the Russian Federation).

On line 160, indicate the regional income tax rate. For example, for a standard rate of 18 percent, enter "18.0-."

If the organization applies regional benefits in the form of a reduced income tax rate, indicate the reduced regional tax rate on line 170.

The advance is paid monthly and additionally paid quarterly

For monthly payments with quarterly surcharge, fill out as follows:

- 1st quarter - transfer of information from column 320 of the declaration for 9 months of the previous year;

- sheet 02, line 210 of the profit declaration for the half-year (2nd quarter) - the sum of lines 180 and 290 of page 02 of the form for the 1st quarter of the current tax period;

- 9 months - the amount of 180 and 290 pages 02 of the form for half a year;

- year - the sum of 180 and 290 pages 02 of the report for 9 months.

To correctly fill out all fields of your income tax return, use the instructions from ConsultantPlus for free.

to read.

Methods for making advance payments of profits to the budget

OSNO enterprises are required to make final payments to the budget for profits for the past 2019 by March 30, 2020, taking into account weekends.

But before calculating the final result on profit, taxpayers summarize its indicators three times during the year, and some do this monthly. Both make advances to the treasury, which subsequently reduce the total amount payable. Depending on the profit calculation option used, advances are paid in three different ways:

- Calculation based on the results of the month based on the actual profit achieved. Obligations to transfer advances must be fulfilled before the 28th day of each month following the reporting month. This method can be used by newly created companies immediately after registration, and in order to switch to it from another payment option, existing organizations must notify the inspectorate before December 31 of the year preceding use.

- Monthly advance payments are made (until the 28th day of the current month) with an additional payment, if necessary, for the quarter after the final payment. The amount of these preliminary monthly advances is determined from the estimated profit, taking into account the profit already received in the previous quarter.

- Quarterly advance payments are made without monthly payments within the quarter. Relevant for organizations with average quarterly revenue not exceeding 15 million rubles. for every quarter. A complete list of organizations that still have access to this option for calculating the budget is indicated in paragraph 3 of Art. 286 Tax Code of the Russian Federation.

Tax is transferred based on actual profit

It is filled out in the same way as quarterly mutual settlements, only the information is posted every month.

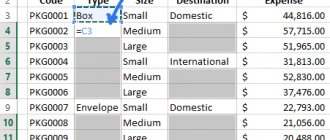

| Reporting period starting from January | The procedure for filling out cell 210 of sheet 02 |

| January | Not filled in |

| February | Transfer of cell 180 from the declaration for January |

| March | Count 180 February |

| April | Count 180 March |

| May | April 180 |

| June | May 180 |

| July | June 180 |

| August | July 180 |

| September | August 180 |

| October | September 180 |

| November | October 180 |

| December (year) | November 180 |

What is income tax

The fee discussed does not apply to individuals, but to companies. At the same time, it has the character of a direct tax. The basis for determining its value is profit, and not the company’s income received as a result of conducting activities of a sales and non-sales nature.

Profit is not just the total amount of funds received by the company in a month. This is her entire total income, from which expenses incurred during a certain taxation period have been deducted.

Features of corporate income tax

Let's give an example. Let's say you own a children's clothing company. To conduct production, you need to purchase materials for reproducing children's costumes every three months, that is, for example:

- textile;

- accessories;

- threads;

- sewing machine needles.

The costs that went out of the company's budget for the purchase of materials once again amounted to about 10 thousand Russian rubles. After sewing the clothes, they were sold for 50 thousand rubles. Profit will be the difference between the total revenue and the costs incurred, that is, in this situation, 40 thousand. Of course, in reality, wages, utilities, costs for purchasing the technical component of the studio and other nuances would be added to the expenses. However, the principle of deducting expenses from income would remain the same.

The calculation of tax, and the formation of a financial base for its calculation, is made from income received from various sources. These funds are divided into two main groups.

Table 1. Income groups

| Income related to sales processes | Income not related to sales |

Production and (or) sale:

|

|

As you can see, the first group is clearly interconnected with the processes of production and sale of goods. The role of the desired commodity item can be not only a specific item, for example, a children's suit, as in the problem above. You can also sell services, for example, in a beauty salon, and work, such as repairs. Completed actions are also considered goods.

Products can be produced by the company itself, or purchased from a third-party manufacturer for the purpose of resale. Then the expenses will include those expenses that were incurred to improve the sales process, and not the sales and production ones.

The amount of a company's income tax is calculated from all the money that has come to it. In this case, value added tax and excise taxes are not taken into account.

The tax service, which checks both the elements that make up the financial base and the expenses that reduce it, when reviewing the declaration form, is also obliged to pay attention to confirmation of the facts indicated in the paper. They are the following elements:

- documentary support;

- validity.

Documentary support refers to official papers associated with expense transactions. The role of justification is the direction of the costs incurred. If funds are given for the sake of continuing or improving the sales or production process, then it is considered that there is justification. If the money is spent on dividends to the directors of the enterprise, the payments made are not considered reasonable expenses, and therefore will not be taken into account by representatives of the tax inspectorate.

Costs related to sales, that is, sales of products, can be divided into:

- indirect;

- having a straight appearance.

Direct costs include material costs and depreciation charges on fixed assets that are used in the production process. Among other things, this category includes wages for employees on the company’s staff who take part in the production and sales processes.

Indirect costs mean all costs not included in the category of direct costs, with the exception of non-operating costs. Calculation and determination are made for a specific reporting period. Upon completion, documents are submitted to the tax service for verification. Transactions included in the papers cannot be included again in the documents for subsequent tax periods.

Data entered into line 220

By analogy with column 210, line 220 of the income tax return on sheet 02 is filled out - accrued advances in the amount of 3% for transfer to the federal budget (clause 1 of Article 284 of the Civil Code of the Russian Federation). The values for the current reporting period are entered into the cell, taking into account the selected method (frequency) of mutual settlements with the budget.

The current page 220 of the income tax return is filled out taking into account information for the previous tax period. Here's how different taxpayers fill it out:

- For monthly deductions, line 220 includes the advance amount from the form for the previous period and the monthly advance payment to be transferred in each month of the ending quarter of the tax period.

- When paying tax on the actual profit received, information from the form for the previous month is entered into cell 220.

- For quarterly settlements, line 220 records the calculated advance according to the previous reporting form and the advances that were accrued based on the results of the desk audit. These payments must be taken into account in the period for which the profit report is submitted.

Here is how column 220 of the income tax return is filled out for monthly settlements with the budget:

- 1st quarter: we transfer page 330 from the report for 9 months of last year.

- Half-year, 9 months, year: p. 220 is defined as p. 300 plus p. 190 minus p. 250 from the previous report.

If the taxpayer calculates the budget from actual profitable income, he fills out column 220 using the formula: line 190 minus line 250 from the previous report. In the form for January, column 220 is not filled in for this payment method.

What does this line consist of?

In line 210 you must indicate the total amount of prepayments for the reporting or tax period.

Taxpayers must calculate the amount of advance payments themselves. It is calculated based on the rate, as well as the income on which the tax is charged. The amount of the prepayment is calculated on an accrual basis from the beginning to the end of the calculation period.

Firms pay advances based on the results of reporting periods, which are the first quarter, six months, nine months and a year.

Some legal entities have the right to pay only quarterly advances, namely:

- companies whose income during the reporting period amounted to less than fifteen million rubles;

- foreign companies operating in Russia through representative offices;

- autonomous organizations;

- companies that do not make a profit from the sale of their products;

- non-profit firms;

- participants of investment and simple partnerships.

Other legal entities must pay both quarterly and monthly advances. Organizations such as museums, libraries and theaters do not pay upfront fees at all.

If the company has not switched to paying monthly payments from the income actually received, it must pay not only quarterly payments, but also monthly ones, namely:

- the amount of the monthly advance payment for the first quarter is equal to the amount of the monthly advance payment that must be paid in the last quarter of the previous year;

- the amount of the monthly advance to be paid in the fourth quarter is equal to one third of the difference between the amount of the advance for nine months and the amount of the advance for six months.

Let's sum it up

As you can see, when it comes to entering information into reporting documents, the tax payment method chosen by the company plays a big role. In one situation the timing and indications will be different than in another. It is important to have a good understanding of how various circumstances affect record keeping. This is the main responsibility of the company's accounting department representatives. Without the appropriate knowledge, a company risks not only getting into trouble with the tax authorities, but also going bankrupt completely. Carefully select a specialist for the position of accountant of your company, and if he has difficulties filling out line 210 in the income statement, let him read our article.

The method of filling out line 210 directly depends on the method of making payments