You have opened your own business, and now you need to understand what goods acceptance and how to accept goods in a store or warehouse. This is quite difficult, because there are a lot of nuances.

The main thing is to know what documents are needed to register the arrival of goods at the warehouse. There are several of them, and they are required for correct record keeping and protection of your rights. Correctly completed documents are a guarantee that you will not lose money and, if something happens, you will protect your interests in court. If you do not take care of the correct registration of goods acceptance, you do not have the right to demand anything from suppliers and transport companies and may incur losses.

All the documents you will need can be downloaded from MySklad: we have blank forms, completed samples to test yourself, and instructions for registration.

Try MySklad

But it’s much more convenient to do everything online. In MyWarehouse you can keep records of goods, arrange acceptance and shipment. There is no need to fill out paperwork by hand again and again, the risk of error is minimal. It’s easy to start working with our service: it’s very simple, there are convenient video instructions. Register and try it now: it's free!

Documents for registration of goods receipt

The posting of goods includes the reception and initial accounting of receipts. The goods can be accepted by a financially responsible person or a person by proxy. The receipt of goods is accompanied by the execution of primary documents by the supplier. These include:

- packing list;

- waybill (Bill of Lading) - it is needed to take into account the movements of goods and materials and pay for road transport;

- invoice.

An invoice is issued if the supplier pays VAT. An invoice allows you to offset VAT on the goods received for reimbursement. Organizations and entrepreneurs operating under the simplified taxation system do not pay value added tax and may not issue an invoice, and if the document is issued by the supplier on OSNO, they may not accept input VAT for reimbursement.

Before accepting the goods, check the correctness of the invoice: it must contain the details of the buyer and supplier, name of the product, quantity, price, cost, VAT.

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

To post the goods after acceptance, the invoice is stamped and signed by the responsible persons. The invoice is drawn up in two copies: one remains with the buyer, and the other is given to the seller. For the buyer, the invoice is a receipt document, and for the seller it is an expense document.

Accounting info

2.1.1. The procedure for documenting, receiving and accepting goodsLike any other accounting transactions, transactions related to the turnover of goods must be confirmed by primary documents. You should be very careful when preparing documents related to the receipt and disposal of goods, since this directly affects the material side of the activities of a trading organization.

You should start with how the goods enter the warehouse of the trading company.

The consignment of goods must be accompanied by an appropriate document, which must contain the name of the supplier and buyer, their addresses, the name of the supplied goods, units of measurement of the goods, their quantity, price and value of the goods, as well as the signatures of the responsible representatives of the supplier and buyer, certified by seals. There may be no buyer's seal if the goods are received by the buyer's representative by proxy. The regulatory document on this issue is “Methodological recommendations for accounting and registration of the operation of receiving, storing and dispensing goods in trade organizations” (approved by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5). Responsibility for registration, timely transmission for reflection in accounting and the reliability of the information contained in the primary documents lies with the persons who created and signed these documents. The forms of primary accounting documents are determined and established by a trade organization in accordance with the accounting documentation system it uses in accordance with the Album of forms of primary accounting documentation in trade and public catering, approved by Order of the Ministry of Trade of the RSFSR dated November 28, 1988 No. 229. Primary documents are filled out in ink or pen by hand, as well as on printed devices. When using computer accounting in an organization, the primary document is a document created in an accounting program and printed on paper. Printing of the document on paper for the buyer is carried out by the supplier at his own expense. Marks, erasures, and any unreadable corrections in primary documents are not permitted. Corrections in documents are made by crossing out incorrect information and making an appropriate inscription above the crossed out text (or numbers). Corrections must be specified in the document itself and certified by the signatures of the relevant persons. As a rule, primary documents are drawn up in at least two copies (for the buyer and the supplier). In this case, corrections are made simultaneously to all copies of the document.

The movement of goods from the supplier to the buyer is accompanied by shipping documents provided for by the terms of delivery of goods and the rules of cargo transportation. These can be documents such as a waybill, a waybill, an invoice, an invoice, or a railway waybill.

The same delivery note acts as both a receipt and an expenditure document. For the supplier, the invoice serves as a document justifying the disposal of goods, and for the buyer the same invoice is the basis for the receipt of goods. The invoice is issued by the financially responsible person of the supplier organization when goods are shipped from the warehouse. The required details of the invoice are the number and date of the document, the name of the supplier and the buyer, the name (brief description) of the goods, quantity in units of measurement, price per unit of goods, the total amount of goods sold including value added tax. The invoice is signed on the part of the supplier by the financially responsible person who delivered the goods, and when accepting the goods - by the financially responsible person on the buyer’s side who accepted the goods.

As mentioned above, the document must be certified with round seals of the supplier and the buyer. The buyer's signature on the invoice confirms that the goods have been accepted in quantity, assortment and at the prices indicated in the invoice. It is almost impossible to make a claim against the supplier regarding any discrepancies between the goods actually received and the invoice data after the document is signed by the buyer. The exception is cases when quantitative or qualitative defects of the goods cannot be detected during the initial inspection. For example, if the number of large sealed packages (boxes) is correctly indicated, the buyer signs the invoice for their receipt, and when opening the boxes, a shortage is discovered.

Consignment notes and railway invoices can be used as receipt documents for goods in cases where the goods are delivered by road or rail. The consignment note consists of commodity and transport sections. It may be accompanied by other documents accompanying the cargo. The railway waybill may also be accompanied by packing slips and specifications; in this case, a corresponding note is made in the invoice. When transporting goods in railway containers, a consignment note is issued for the carriage of goods in a universal container.

As mentioned above, the Methodological Recommendations for accounting and registration of the operation of receiving, storing and releasing goods in trade organizations allow for the posting of goods according to an invoice and invoice.

An invoice (Form 868a) is issued if there is a large list of goods. The second document mentioned in the Methodological Recommendations for Accounting and Registration of the Operation of Receipt, Storage and Release of Goods in Trade Organizations is an invoice (Form 868). It should be similar in content to an invoice. The invoice is the basis for payment for goods.

However, in practice, when receiving goods, it is commodity and transport invoices that are most often used, including the Torg-12 form invoice. The use of the remaining above-mentioned documents is recommended only in cases where it is not possible to accompany the goods with a bill of lading, for example, for intercity delivery of goods.

As already mentioned, the invoice is certified by the signatures of financially responsible persons on both sides and by round seals. If the goods are not accepted at the buyer's warehouse, the buyer's authorized representative must present an identification document and a power of attorney to receive the goods upon receipt of the goods. In this case, the details of the power of attorney are entered in the invoice, and the power of attorney itself is attached to a copy of the supplier’s invoice and stored with it. If these requirements are not met, the operation of shipment and acceptance of goods is not considered properly completed and may be protested.

Checking the conformity of the quantity, nomenclature and quality of goods upon arrival at the buyer’s warehouse is carried out through external inspection and counting. If discrepancies are discovered upon acceptance of the goods, they must be included in the shipping document in accordance with the requirements for making corrections to primary documents.

Corrections are confirmed by the signatures of the financially responsible persons of the supplier and the buyer, and the responsible person from the buyer is the employee who directly accepts the goods, and from the seller (if the employee who issued the invoice does not accompany the cargo) is the forwarder or other person accompanying the goods to the buyer’s warehouse.

Received goods are accounted for in account 41 “Goods”, which is intended to summarize information about the availability and movement of inventory items purchased as goods for sale. Trade organizations on account 41 also take into account containers (both purchased and their own production). Containers serving for the economic (production) needs of the enterprise itself are accounted for either on account 01 “Fixed assets” or on account 10 “Materials”.

If a trade organization accepts goods for safekeeping, they must be accounted for in off-balance sheet account 002 “Inventory accepted for safekeeping.” Commissioned goods are accounted for in off-balance sheet account 004 “Goods accepted on commission.”

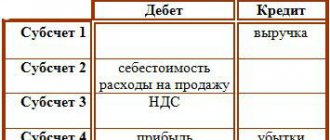

For account 41, the current Chart of Accounts recommends:

1) subaccount 1 “Goods in warehouses”;

2) subaccount 2 “Goods in retail trade”;

3) subaccount 3 “Containers under goods and empty”;

4) subaccount 4 “Purchased items”.

If necessary, based on the specifics of its activities, the organization can open other sub-accounts.

If the goods are supplied directly to retail trade, for example, if the trade organization is small and consists of one retail store, the division into recommended subaccounts 41.1 and 41.2 is usually not made.

The receipt of goods is reflected in the debit of account 41, and its disposal is reflected in the credit of account 41.

Account 41 “Goods” corresponds with the following accounts (Table 1).

Table 1

Goods (as well as packaging) received at the organization’s warehouse are reflected in the debit of account 41 in correspondence with account 60 “Settlements with suppliers and contractors” at the cost of their acquisition. Some retailers record goods at sales prices rather than purchase prices. In this case, when the goods arrive, simultaneously with the debit of account 41 and the credit of account 60, an entry is made in the debit of account 41 and the credit of account 42 “Trade margin” for the difference between the purchase price of the goods and its value at sales prices.

When recognizing revenue from a sale in the accounting records of an enterprise, the cost of the goods is written off from the credit of account 41 to the debit of account 90 “Sales”. In cases where revenue from the sale of goods cannot be recognized in accounting immediately, until it is recognized, the goods are written off from the credit of account 41 to the debit of account 45 “Goods shipped”.

The accounting policy of the enterprise must specify the method of accounting for goods. Accounting for goods can be carried out in several ways:

1) at purchase prices;

2) at actual cost;

3) at discount prices;

4) at sales prices.

As a rule, goods are accounted for at purchase prices at wholesale trade enterprises, and retail trade organizations can use, depending on their accounting policies, accounting for goods both at actual cost (directly on account 41) and at sales prices (using account 42). In practice, accounting at sales prices is not often used, and the most common method is accounting at actual cost.

Example

Lazur LLC purchased from Razdolye CJSC for retail trade a consignment of goods worth 118,000 rubles, including VAT 18% - 18,000 rubles. CJSC Razdolye provided LLC Lazur with a bill of lading and an invoice for this batch of goods. Lazur LLC paid for the goods by bank transfer on the day they were received. The accountant of Lazur LLC made the following entries in accounting: Debit account 41 “Goods”, Credit account 60 “Settlements with suppliers and contractors” - 100,000 rubles. – received goods are capitalized; Debit account 19 “VAT on purchased assets”, Credit account 60 “Settlements with suppliers and contractors” - 18,000 rubles. – VAT on purchased goods is taken into account; Debit account 68 “Calculations for taxes and duties”, Credit account 19 “VAT on purchased values” - 18,000 rubles. – a tax deduction for VAT was made; Debit of account 60 “Settlements with suppliers and contractors”, Credit of account 51 “Settlement accounts” - 118,000 rubles. – payment for goods to the supplier has been made.

According to the Letter of Roskomtorg dated March 17, 1994 No. 1-314/ /32-9 “On the Model Rules for the Operation of a Retail Trade Enterprise and the Basic Requirements for the Operation of a Small Retail Trading Network,” operations for the acceptance, posting and storage of goods in the buyer’s warehouse must comply with the following conditions :

1) acceptance of goods in terms of quantity and quality at enterprises of all forms of ownership must be carried out in accordance with current regulations and accompanying documents of the supplier (seller), as well as other necessary documents;

2) goods accepted by the enterprise in the prescribed manner are recorded on the day of receipt based on their actual availability. If it is impossible to post the goods by the date of their actual receipt (calling an expert, checking the price, quality, quantity), in the text part of the product report after the total receipt, a record is made about the receipt of goods indicating the supplier (seller), the total cost of the goods at retail prices, as well as the reasons impossibility of capitalization;

3) goods with expired shelf life, storage, or sale that do not meet quality requirements and standards are not subject to acceptance by the enterprise;

4) when storing goods in warehouses, placing and displaying them in trading floors, small retail chains, employees of the enterprise are obliged to strictly comply with the principles of commodity proximity, sanitary rules, warehousing standards and fire safety requirements.

If the batch of goods is large enough that it can be posted within 1 working day, it is permissible to post the goods on the day of the actual end of its receipt in terms of quantity, amount and nomenclature.

2.1.2. Reception of goods at the buyer's warehouse. Control over the quantity and quality of goods

As mentioned above, goods are accepted at the buyer’s warehouse on the basis of shipping documents. At the time of receipt of the goods, the shipping document (for convenience, we will assume that such a document is the invoice) must be signed by the financially responsible person who released the goods and certified with the seal of the supplier. The financially responsible person from the buyer checks the compliance of the goods actually received and the information specified in the invoice. The quantity of goods, their nomenclature and quality are checked. With regard to the quantity and quality of the goods, the absence of discrepancies that could be detected during an external inspection is checked. Thus, if the goods arrived in sealed packaging, it is not considered necessary to open the packaging to check the goods at the time of receipt of the goods. It is enough to make sure that there is no damage to the container and that the number of items (packages) specified in the invoice corresponds. After checking the compliance of the actual quantity of goods with that indicated in the invoice, as well as the absence of external damage, the financially responsible person from the buyer certifies the invoice with his signature and the seal of the company. When accepting goods, you should also pay attention to the expiration dates of the goods (if they are indicated on the packaging) and the availability of documents required by law for the sale of this product (certificates, technical documentation, instructions, etc.). It must be remembered that when selling goods, for example, those subject to mandatory certification, without the appropriate certificates, responsibility for this will fall on the seller, even if the relevant documents should have been available, but were not provided by the supplier. And it can be very difficult to obtain the necessary documents after the buyer has already signed the invoice and accepted the goods, especially if the agreement with the supplier is one-time and long-term cooperation is not planned.

If during acceptance of the goods any discrepancies are discovered between the actual and declared delivery, they must be immediately reflected in both copies of the invoice and certified by the signatures of the financially responsible persons of the supplier and the buyer. We remind you that corrections must be made clearly and readably, the corrected text or number must be crossed out and the correct entry must be made at the top (next to it).

I would like to warn trade organizations acting as buyers against “gentlemen’s agreements”. Unfortunately, sometimes such a scheme is practiced - some discrepancies are found between the invoice and the actual delivery, and the supplier offers to either deliver the undelivered goods or bring another invoice corresponding to the actual goods received. Such situations do occur between small, constantly cooperating organizations located in the same city.

I would like to remind financially responsible persons that document flow must correspond to the actual state of affairs. What should you do if a product that has not actually arrived at the warehouse is capitalized on the supplier’s word of honor, but for some reason the missing part was never delivered? You have to pay the shortfall out of your own pocket, despite the fact that this product was never actually in the warehouse and existed only on paper.

But deficiencies related to quantity or quality can be discovered even after the goods have been accepted. These are internal discrepancies that cannot be detected during an external, even very thorough examination. The delivery agreement, as a rule, stipulates the terms of internal acceptance of goods and the terms for filing claims regarding it. The law usually uses the term “reasonable time”.

So, if a shortage or defect in the goods is detected that could not be detected visually upon initial receipt of the goods, the buyer is obliged to immediately notify the seller about this (it is best to use a fax, since this is a fairly fast method and, if necessary, can serve as evidence that the buyer really notified the supplier).

The supplier must send its representative to the buyer's warehouse. Representatives of the buyer and supplier draw up a report on the discovery of a shortage (or discovery of a defect, violation of the presentation).

If within a reasonable time (usually 1 or 2 days, provided that both counterparties are located in the same city or within reach) after the buyer notified the supplier about the occurrence of discrepancies in the quantity or quality of the goods during internal acceptance, the supplier did not send his responsible representative, the corresponding act can be drawn up and signed unilaterally without the participation of the supplier’s representative. The buyer also has the right to involve a third disinterested party (independent experts) when drawing up a report on discrepancies in the quantity and quality of goods.

If a shortage of goods is detected, “... the buyer has the right, unless otherwise provided by the contract, to either demand the transfer of the missing quantity of goods, or refuse the transferred goods and payment for them, and if the goods have been paid for, demand the return of the amount of money paid” (Art. 466 of the Civil Code of the Russian Federation).

Violation of delivery conditions for the range of goods in accordance with Art. 468 of the Civil Code of the Russian Federation has the following consequences:

1) when the seller transfers the goods provided for in the purchase and sale agreement in an assortment that does not comply with the agreement, the buyer has the right to refuse to accept and pay for them, and if they are paid, to demand the return of the amount of money paid;

2) if the seller has transferred to the buyer, along with goods whose assortment corresponds to the purchase and sale agreement, goods in violation of the assortment condition, the buyer has the right, at his choice:

a) accept goods that meet the assortment requirement and reject the remaining goods;

b) refuse all transferred goods;

c) demand that goods that do not meet the assortment condition be replaced with goods in the assortment stipulated by the contract;

d) accept all transferred goods;

3 when refusing goods whose assortment does not correspond to the terms of the purchase and sale agreement, or submitting a demand for replacement of goods that do not meet the assortment terms, the buyer also has the right to refuse to pay for these goods, and if they have been paid, to demand the return of the paid amount;

4) goods that do not comply with the terms of the purchase and sale agreement regarding the assortment are considered accepted if the buyer does not inform the seller of his refusal of the goods within a reasonable time after receiving them;

5) if the buyer has not refused the goods, the range of which does not correspond to the purchase and sale agreement, he is obliged to pay for them at the price agreed with the seller. In the event that the seller does not take the necessary measures to agree on a price within a reasonable time, the buyer pays for the goods at the price that, at the time of conclusion of the contract, under comparable circumstances, was usually charged for similar goods.

It should be noted that the rules of this article come into force if the supply agreement concluded between the supplier and the buyer does not provide for other conditions.

2.1.3. Synthetic and analytical accounting of goods receipt

At trading enterprises, goods are usually accounted for both in the warehouse (at the place of direct acceptance and storage) and in accounting. In accounting, only a synthetic accounting method can be used (although most enterprises prefer to use analytical accounting in accounting), while warehouse accounting implies mandatory analytical accounting.

Analytical accounting is accounting that provides detailed indicators in monetary terms, and, if necessary, in physical terms. Analytical accounting is associated with synthetic accounting and cannot exist without it. In accounting, analytical accounting is carried out using additional subaccounts linked to synthetic accounts. Subaccounts in synthetic accounting should be created in cases where the requirements of analytical accounting are dictated by the requirements of financial reporting or the procedure for calculating taxes. The order on the accounting policy of the enterprise approves, among other things, the working chart of accounts, which contains synthetic and analytical accounts necessary for accounting based on the specifics of the activities of a particular enterprise.

In accordance with the methodological recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations (approved by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5), trade organizations need to maintain analytical records in the following sections:

1) “for business entities that are legal entities and their separate divisions;

2) for each economic entity - for financially responsible persons;

3) for each financially responsible person - by assortment of goods;

4) and also in a section convenient for the enterprise.”

What does accounting for goods by business entities provide? If we are talking about a large trading company with a network of stores or warehouses, then it is quite natural that in this case it is convenient for the accounting department to keep records of goods for each individual store or warehouse. This helps to track the movement of goods (primarily to prevent and promptly identify possible shortages), and also provides information about the profitability of a particular department. The same division of accounting for goods by storage location is recommended in large stores that have several departments (for each department). At the same time, for an individual entrepreneur or a small company that has one retail outlet without division into departments, such analytics are absolutely useless.

There is no need to argue about the need to keep records of goods for financially responsible persons. Of course, such data does not matter for tax accounting and financial reporting, however, within an enterprise, analytical accounting for financially responsible persons is not carried out in practice only if the terms of the employment contract provide for collective financial responsibility. But, as a rule, such contract terms are rare, since it is unlikely that any employee who is not directly related to the receipt, storage and release of goods will like the idea of being responsible for someone else's shortages. For the same reasons, it is recommended to keep analytical records for financially responsible persons in the context of the range of goods.

Regarding the point about “a cut convenient for the enterprise,” let’s consider several situations for clarity. Let us assume that a trade organization, being a legal entity, carries out both wholesale and retail trade, i.e., its activities involve a general form of taxation, and at the same time the organization is a payer of a single tax on imputed income. Naturally, for the correct calculation of taxes, it would be appropriate to keep records of the receipt and disposal of goods separately for wholesale and retail trade transactions. If an organization is on a common taxation system and the goods it works with are subject to VAT at different rates, it is convenient to keep analytical accounting of goods separately for goods with 18% VAT, 10% VAT and non-taxable VAT. Such analytics, unlike, for example, accounting for financially responsible persons, is directly related to the correct performance by the enterprise of its obligations to calculate and pay taxes.

In practice, analytical accounting of goods in trade organizations is also carried out according to the assortment of goods, most often for each of its names.

When accounting for receivables and payables, it is useful to analytically record the receipt and disposal of goods for each supplier and buyer (in wholesale trade), even in the context of individual contracts for each counterparty. In general, we can say that at first it seems that the more subaccounts, the more analytical sections, the more labor-intensive accounting is. However, practice shows that the more detailed and diverse the analytical accounting of the receipt, storage and disposal of goods, the easier and clearer the preparation of financial statements, the calculation of taxes, and almost all aspects of accounting will be in the future. It should also be added that detailed analytical accounting also facilitates the prompt identification of errors made in accounting, from which even the most experienced and careful accountant is not immune. Therefore, when developing an enterprise’s accounting policy, try to imagine, as accurately as possible, exactly what sections of analytical accounting you will need in your work, what analytical sub-accounts will be involved. Of course, in the course of the economic activity of an enterprise, there will be a need to adjust analytical subaccounts: some of them will turn out to be unnecessary for the activities of this particular enterprise, while in others, on the contrary, there will be a clear need. It is quite possible to determine the general directions of analytical accounting in advance.

Despite the fact that detailed analytical accounting, as we have already said, is very convenient due to its clarity, it is not worth overloading the working chart of accounts with obviously unnecessary subaccounts and subaccounts. Any labor costs must be justified. A small bakery store will probably not need to account for goods by individual divisions, and a wholesale trade enterprise that deals only with goods subject to 18% VAT, of course, does not need to account for goods in terms of VAT rates.

A few words about commission trading. In this case, records are kept for each unit of goods, since the commission agent pays the commission principal for each item accepted for commission separately. For commission agents accepting goods under a commission agreement from wholesalers, it is recommended to keep analytical records by product groups, by counterparties and, if necessary, under contracts concluded with each principal.

Accounting for goods is carried out on the basis of primary receipts and expenditure documents by financially responsible persons in value or in kind and value terms. For detailed analytical accounting of the movement of goods, the second option is preferable.

At the beginning of economic activity, a trading organization determines which method of storing goods - batch or varietal - it will use. The method of accounting for goods will also depend on the choice of storage method.

With the batch method, as its name implies, accounting is carried out by batches of goods. This method is especially convenient for enterprises that trade in food products, medicines, cosmetics and other groups of goods that have relatively short expiration dates. In this case, especially at wholesale trade enterprises, the risk of “hanging” goods with a shorter shelf life is minimized, when a later batch of goods is sold to the buyer, and an earlier one remains in the warehouse of the supplier organization. A competent storekeeper, of course, will try to prevent such a situation even with the varietal accounting method, but in this case too much depends on the human factor. After all, in the end, goods from an earlier batch become increasingly difficult to sell, and they may remain in the warehouse until the expiration date, and this is a direct and serious loss for the company.

If the company uses computer accounting in its activities, then the program can be configured in such a way that goods from a late batch simply cannot be sold while the balance of goods received earlier is listed in the database. When manually maintaining documentation, batch accounting is carried out as follows. For each batch of goods, a batch card is created, which indicates the name of the product, grade, article, quantity (weight, volume) and price of the product.

A batch of goods is a homogeneous product that arrived at the enterprise using one transport (receipt) document, as well as a product of the same name that arrived from one supplier simultaneously using several invoices. The financially responsible person draws up a batch card in two copies, one of which is transferred to the accounting department of the enterprise, and the second is stored in the warehouse (the place where the product is stored). A copy of the party card stored in the warehouse is registered in a special book. The number under which the batch card is registered is the batch number of the goods. As goods are disposed of from a given batch, data on the date of release of the goods, its quantity and details of the expenditure document are entered into the card. After disposal of the entire consignment of goods, a warehouse copy of the card is transferred to the accounting department for verification. Thus, the compliance of goods disposal data can be checked without waiting for a complete inventory of the warehouse. In the accounting copy of the batch card, entries are made on the basis of receipt and expenditure documents as they are received by the accounting department. On the first day of each month, based on the entries in the batch card, the accountant draws up a turnover sheet indicating each batch of goods on a separate line. The indicators on this statement in their physical terms are verified with the data of batch cards in the warehouse, and the totals on the compiled statement are verified with the turnover and balance of the turnover sheet in synthetic account 41 “Goods”.

As for the sorted method of storing goods, in this case the movement of goods is recorded in the goods book or on goods accounting cards. In this case, each specific name and type of product is assigned a separate accounting card or page of the product book. If the number of transactions for the receipt and consumption of a given product is large enough, several pages may be allocated for it in the product book. The title of a product card or a page of a product book must contain the name, price, grade (condition) and other distinctive features of the product. Based on the primary receipt and expenditure documents, entries are made in the product card or on the corresponding page of the product book about the receipt of goods, their disposal and the balance. If the range of goods in the warehouse is limited or the quantity of goods in the warehouse and its turnover are not too large, then with the sorted method of storing and accounting for goods, the financially responsible person can keep records of the movement of goods directly in the goods report, without using a goods book or accounting cards.

The parameters used when deciding on the issue of accounting for goods according to a product book (registration cards) or according to a product report are established by the enterprise independently; this issue is not regulated by law. In accounting, accounting is carried out as follows. On the first day of each month, data on receipt, consumption and balance of goods is summarized. For all analytical subaccounts opened to account 41 “Goods”, a turnover sheet is drawn up, which indicates the balance of goods at the beginning of the reporting (expired) month, its receipt and consumption during the reporting period and the balance at the end of the month (on the first day of the month following for reporting). Data must be indicated for all names of goods (as well as for all varieties) in monetary and physical terms. Physical indicators on the statement are verified with warehouse accounting data. The total indicators must coincide, respectively, with the opening and closing balances, as well as with the turnover in the synthetic account 41 “Goods”.

Accounting may not duplicate warehouse accounting registers. With the operational accounting (balance) method, the accountant responsible for accounting for goods periodically (the frequency is set by the enterprise independently) checks the accuracy of the entries made in warehouse accounting. Identified errors are corrected as soon as they are discovered. On the first day of each month, based on warehouse accounting data, a balance sheet is compiled indicating the balance of goods by their names, grades, quantities and prices. The total cost of all balances of goods according to this statement should be equal to the final balance of synthetic account 41 “Goods” on the first day of the month following the reporting one. The accounting department of an enterprise can, for its own convenience, compile these statements for enlarged groups of goods, as well as for financially responsible persons.

To summarize information about the availability and movement of goods, as already mentioned, account 41 “Goods” is used. Trade organizations in this account also take into account purchased containers and containers of their own production that are not intended for their own needs.

To record and summarize information on the availability and movement of goods accepted by the committing organization for commission, off-balance sheet account 004 “Goods accepted for commission” is used. The accounting of goods on this account is carried out at the prices specified in the acceptance certificates.

Comments:

- In contact with

Download SocComments v1.3

| Next > |

Universal transfer document (UDD)

This document is both a waybill and an invoice. Legislatively introduced in 2013 and not mandatory for use. You can decide for yourself whether you want to draw up two documents or just the UPD. Like an invoice, UTD provides the basis for obtaining a tax deduction.

The use of a universal document simplifies the process of transfer and acceptance of inventory items. Use it to formalize the supply of goods, works or services and the transfer of property rights. The UPD is signed by the authorized person responsible for the preparation of primary documents or purchase and sale transactions.

In the legally established form of the UPD there is a status field. It determines which document you are submitting the UPD instead of:

- Invoice and delivery note;

- Packing list;

- Invoice (for electronic form).

The status of the document changes the order in which it is filled out: for status 2, you do not need to fill out some lines, the UPD number and the required signatures change. To use the UPD in an organization, its form must be approved. The official form is advisory in nature, and the organization may make changes to it. But all mandatory details of the primary documents must comply with the requirements.

The procedure for reflecting receipts

The document “Receipt of cash documents” is intended for acceptance for accounting. It is entered in the journal of the same name by clicking the “Create” button.

Fig.2 Receipt of monetary documents

Fig.3 Magazine

The document provides for the following types of receipt transactions:

- From the supplier;

- From an accountable person;

- Other.

Fig. 4 Types of receipt transactions

Often, tickets are purchased by the organization directly from the carrier or from an intermediary agency, with payment made by transferring non-cash funds, and not by the employee himself, from the money that he received for travel allowances.

Let's consider an example of processing transactions with monetary documents - the purchase and transfer of transportation tickets to an employee sent on a business trip.

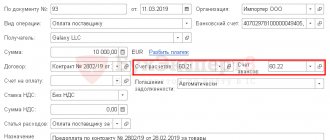

To reflect the purchase of air tickets from Avia PJSC, fill in the necessary information in the created receipt document - indicate the counterparty, agreement, data on the incoming document and select settlement account 76.09 - "Other settlements with various debtors and creditors" (you can use account 60.01 - "Settlements with suppliers and contractors"). Accounting account 50.03 is installed automatically.

Fig.5 Example of processing transactions with monetary documents

On the next tab, to fill out the table, click the “Add” button and enter the document data into the “Nomenclature of Monetary Documents” directory (the “Create” button). In our example, air tickets Stavropol-Moscow (light economy) and Moscow-Stavropol (light economy).

Fig.6 Nomenclature of monetary documents

Fig.7 Receipt of monetary documents (creation)

The program provides a printed form of the document – the “Receipt Order” button.

Fig.8 Receipt order

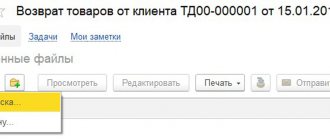

When saved and posted, the document is displayed in the journal. In the journal, in addition to the printed form, you can prepare and print a register of documents. By clicking the “Show transactions and other movements” button, we see a report on the movement of the receipt document.

Fig.9 Register of documents

Fig. 10 Register of documents

Fig. 11 Postings and other movements

Acceptance of goods

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

At the first stage of acceptance of goods, we check whether the type and quantity of goods corresponds to the information in the accompanying documents. This is necessary to ensure completeness of accounting. The second stage is acceptance of the goods for quality and completeness. Acceptance of goods is carried out by the materially responsible person in the presence of a representative of the supplier, unless other conditions are specified in the contract. If all goods are in place and no defects are found, confirm compliance with the organization’s stamp and signature.

Based on the results of acceptance of the goods, a TORG-1 act and a TORG-11 product label are drawn up. Product label data is needed to conduct an inventory list.

Violation of the inspection deadlines and acceptance rules will deprive you of the right to file a claim against the supplier or carrier. For certain types of goods, the terms are established by law, for others they are specified in the contract. Registration of the return of low-quality goods depends on the moment of detection of the defect:

- if a shortage of goods or defects is detected during acceptance, the commission draws up a report on the discrepancy in quantity and quality; the act is drawn up in the TORG-2 form; if properly executed, it will serve as the basis for making claims;

- when a defect is discovered after the goods are registered, an invoice is drawn up indicating the quantity of the goods being returned, a statement of identified defects, a letter of claim and a return invoice;

- if one of the types of goods was not delivered to you, cross them out from the invoice and adjust the invoice.

At the end of acceptance, capitalize the received goods and materials according to the actual quantity and amount.

Why are some shapes the same?

The table shows that the same forms are used for admission and departure. The difference is that the warehouse invoice TORG-12 and the invoice for the release of materials on the M-15 side are filled out by different sides. Upon receipt, this function is assigned to the sending party; upon departure, this function is assigned to the warehouse employees.

The same applies to the requirement-invoice M-11. When moving internally, it is registered in the department, when leaving - in the warehouse.

What to do if there are no accompanying documents

The cloud service Kontur.Accounting allows you to store all information about goods in one place and simplifies the procedure for posting goods. Get free access for 14 days

For accounting, the main thing is documents. If there is no document, there is no accounting object. When a supply agreement is available, but the supplier has not provided accompanying documents, the goods received must also be capitalized.

For such cases, a TORG-4 acceptance certificate is provided. In the absence of a delivery note and an invoice, it is difficult to determine the price at which the goods arrive. The price must be taken from the contract, and if there is no contract, then the goods are purchased at the market price. The TORG-4 act contains information about the actual availability of the received goods.

The acceptance certificate is drawn up by a special commission that accepts the goods. TORG-4 is drawn up in two copies, one is transferred to the financially responsible person of the supplier, and the other to the accounting department.

Why is it necessary?

When a room has been allocated for storage purposes and responsible persons have been appointed, it’s time to move on to the most difficult part - document management. If the first two actions are rather organizational, then the last one is accounting. It is obvious that accounting, warehouse management and other types are always closely related.

Let's consider these questions:

- what applies to warehouse documents;

- in what situations each of them is used;

- where can I get the template?

Let's start right away with the last point. The list of main warehouse documents and their forms is contained in Appendix 2 to Order of the Ministry of Finance of Russia No. 52n dated March 30, 2015. But they are mandatory only for budget organizations. Private firms have the right to develop their own forms, although using ready-made ones is not prohibited. Download them in the table.

Receipt through an accountable employee

Let's consider and reflect this operation using the example of purchasing envelopes. We select the appropriate type of operation and fill in the necessary details, and list them on the second tab (the “Add” button).

Fig. 18 Receipt through an accountable employee

Fig. 19 Receipt through an accountable employee

Wiring has formed.

Fig.20 Wiring

The issuance of marked envelopes to the accountant occurs on the basis of a memo, which indicates their quantity, as well as information about the debt on previously issued envelopes.

Envelopes can also be issued as described above (menu section “Bank and cash desk”). To make it clearer, we will issue them to another accountable person, who in the future must account for them.

Fig.21 Issuing envelopes

Fig.22 Issuing stamped envelopes

The accounting policy sets the deadline for issuing cash documents - usually within a month.

Upon its expiration, the accountant fills out the document “Advance report” (f. 0504049), reflecting information about the number and cost of envelopes issued, as well as the fact of their consumption. The fact is recognized after they are actually sent by mail on the basis of a completed register signed by the accountable. Accountants often make the mistake of immediately writing off all purchased documents when issuing them to an employee. But here the question may arise of how to justify such a write-off if, in fact, fewer letters were sent per month. Therefore, it is better to write off on the basis of documents confirming their expenditure - a register of correspondence; in case of damage, provide the damaged envelopes directly, and when spending vouchers - their marked stubs. The specified documents are attached to the “Advance report”, which is compiled in the section “Bank and cash desk” - “Advance report”.

Fig.23 Advance report

When filling it out, on the “Other” tab we indicate the necessary data and expense account.

Fig. 24 We indicate the necessary data and expense account

Similarly, the reporting employee reports for other types of monetary documents.

Retail price

When a product is entered into the database, the retail price is calculated for it. Retail price is the price at which a product is sold in retail trade to the public and some organizations. Typically, a general markup is used for one category of goods (for example, for alcohol - 20%), or the price is set individually for each product. What retail price to set is decided by the store management. Retail prices for some goods (for example, tobacco) are subject to government regulation. In this case, instead of the recommended retail price, the concepts of minimum and maximum retail prices are used, compliance with which is strictly mandatory.

Supply contract

To ensure that goods are delivered on time and in the required volume, an agreement is concluded with the supplier. The main conditions that must be specified in this document are:

- division of responsibilities between employees of both parties;

- marking of cargo packages;

- terms of acceptance of goods;

- Delivery time;

- list of shipping documents;

- boundary levels of deviation of price and volume of declared and delivered products;

- methods for resolving claims in case of non-compliance of goods or documents with the agreed requirements.

The agreement will put both the receiving party and the supplier within certain limits that they will be forced to comply with in their work. It will increase the discipline of all participants in the process and significantly speed up the resolution of emerging disputes.

Purchase from the public

The primary document confirming the purchase of goods from the population is the act. If agricultural products are purchased, then you can use form No. OP-5. When accepting scrap metal from the population, the organization is obliged to draw up an acceptance certificate in the form approved by Decree of the Government of the Russian Federation of May 11, 2001 No. 369. In other cases, draw up a report in any form with the required details (clause 2 of Article 9 of the Law of December 6 2011 No. 402-FZ).

When purchasing agricultural products, attach to the purchase act:

- a certificate of ownership of the seller for these products (this can be obtained from the local administration or from the board of the dacha cooperative);

- veterinary inspection conclusion on the good quality of these products.

Such rules are established in paragraphs 7.3 and 7.6 of the Methodological Recommendations, approved by letter of the RF Committee on Trade dated July 10, 1996 No. 1-794/32-5.

The procedure for reflecting the issue

Here the filling procedure is similar to that described for the previous case, with the only difference being that we go to the “Issue of monetary documents” section.

Fig. 12 Issuance of monetary documents

Fig. 13 Issuance of monetary documents

The document provides for several types of operations:

- Return of monetary documents to the supplier;

- Issuance to an accountable person;

- Other issuance is issued when the documents in question are removed from the cash desk, for example, damage, shortage, etc.

Fig. 14 Types of operations

We will report the issuance of our tickets to the accountant. We fill in all the details, indicating our air tickets on the second tab.

Fig. 15 Reflection of issue

I note that we purchased tickets for two employees. Accordingly, the issuance of air tickets to the accountable person is documented in two documents - for each accountable person separately. After completing the document, you can print the “Expense Order” and click the “Show transactions and other document movements” button to view the generated account correspondence.

Fig. 16 Expense order

Fig. 17 Postings and other document movements

Please note that monetary documents that have no time interval between storage and use, for example, a used ticket purchased by an employee at the ticket office of a transport enterprise, are not reflected in account 50.03, but are immediately included in the advance report.

Payment and delivery

The terms of payment for goods are also specified in the contract. Supply contracts concluded between suppliers and buyers may provide for different conditions, both for the supply of goods and for different terms of payment. For example, the terms of the contract stipulate that the supplier delivers goods to the buyer subject to subsequent payment. Such agreements are not uncommon, however, as a rule, they are concluded between counterparties who have been working together for a long time and trust each other.

If the buyer is not familiar, then, as a rule, the parties enter into a supply agreement, according to which the buyer makes 100% advance payment for the consignment of goods, and the supplier ships the goods after receipt of funds.

In addition to these types, the supply agreement may provide for the buyer to pay a partial advance with an additional payment of the remaining amount after receipt of the goods.