Who borrows money and why?

If there is not enough personal funds to open or develop your own business, an entrepreneur can take out a bank loan. This is a standard option, but there is another option - to borrow money from a third party or through relatives/friends. At the same time, with the exception of the closest people, the other party rarely lends money for free... it is obvious that in the case of borrowing a large amount, it is fair to compensate the lender for at least inflation. Since it is usually easier to regulate various situations with an individual than with a bank (which may not issue a loan at all), the option of private lending is quite common. To guarantee the return of funds and protect the interests of both parties, they need to enter into a loan agreement.

Concept and form of loan agreement

The concept of a loan agreement

The concept of a loan agreement is enshrined in Article 807 of the Civil Code of the Russian Federation. The law calls the person who transfers money a lender, and the person who accepts money a borrower. A loan agreement is an agreement between the parties, according to which the lender transfers money (other things) to the borrower in ownership, and the borrower assumes the obligation to return this amount (or other things).

Transfer of money into ownership means that the borrower has the right to freely own, use and dispose of the money received. If it is necessary to limit the rights of the borrower, a targeted loan is issued, when the money received can be spent only on certain needs (for example, buying real estate or a car).

Drawing up the text of an agreement and signing it by the parties does not mean that it has already been concluded. The loan agreement becomes concluded only from the moment the funds are transferred. A receipt is usually drawn up on behalf of the borrower regarding the receipt of money.

Monetary obligations for a loan must be determined in rubles. If the loan of funds is issued in a foreign currency, then the debt is repaid in rubles in accordance with the official exchange rate of this currency on the day of payment. The parties may stipulate in the agreement a different rate and a different date on which the corresponding exchange rate is determined.

Loan agreement form

The Civil Code provides for both oral and written forms of loan agreements. A written form of the agreement is required if the loan amount is more than 1000 rubles, which corresponds to 10 minimum wages. A loan agreement between legal entities or a loan agreement between an individual and a legal entity is drawn up in writing, and the size of the borrowed amount does not matter.

It is recommended in all cases to use only a written form of the loan agreement. This will help prove your case in court, since it will be difficult for the lender to present other evidence, and the testimony of witnesses under the terms of the transaction, which must be concluded in writing, is not accepted by the court.

Instead of drawing up a loan agreement, you can use a written form of a promissory note, where the borrower confirms the amount of the borrowed amount, indicates the period and procedure for its repayment.

Interest on the loan agreement

Paid loan agreement

Interest under a loan agreement is the borrower's payment for the time of using the lender's funds. All loan agreements are considered compensated (that is, issued with interest), even if the amount of this interest is not fixed in the agreement itself, the lender has the right to apply the refinancing rate of the Central Bank of Russia. An exception to this rule are interest-free contracts.

The amount of interest under the agreement is determined by agreement of the parties; it can be expressed as a percentage for each day, month, year or any other period of use of borrowed funds. The amount of interest can be expressed in relation to the borrowed amount (for example, 20% per annum) or determined in a fixed amount (500 rubles for each day the loan amount is used).

It should be taken into account that the condition of the loan agreement regarding inflated interest rates, significantly exceeding those established in business transactions, may be recognized by the court as an enslaving transaction.

Interest-free loan agreement

As an exception to the general rule on the repayment of a loan, an agreement between individuals that does not relate to entrepreneurial activity should be considered. In this case, the amount of such a loan should not exceed 5,000 rubles. In this case, the loan agreement will be interest-free, unless the text of the agreement itself directly states the payment of interest.

Loans in which not money, but some other things are transferred are also considered interest-free. However, this does not prevent the parties to the agreement from fixing the interest clause, based on the cost of things or accepting other remuneration for the provision of the loan.

Why do you need to indicate the purpose of the payment?

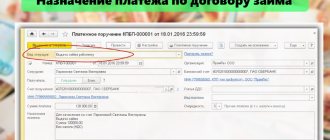

Filling out accounting statements for the company's loans and borrowings requires mandatory indication of the purpose of payment. According to the current requirements, any payment documents that reflect the movement of funds in the bank account of its owner must be marked. It fully reveals the essence of the transfer or payment.

The purpose of payment must be indicated in field number 24. According to this section, there is an important note indicating that the purpose of payment column can contain no more than 210 characters. Such a limit obliges the filler to think carefully in order to formulate the essence of the financial transaction as succinctly as possible, but at the same time quite briefly.

When providing such information, it is also necessary to understand that all documents must be completed using competent and correct wording. Do not forget that bank employees monitor ongoing transactions and if the description of the purpose of the payment is dubious, the transfer may be blocked.

Important! Blocking an operation is far from the worst sanction. Due to a serious violation, the company may be denied service and be blacklisted. Strict requirements and strict restrictions oblige the accounting preparer to responsibly enter information into column 24.

If problems arise with the bank, data about the company is also transferred to higher levels, namely to the Central Bank, which in turn adds to the black list of companies undesirable for cooperation. Being included in such a list may result in other financial and credit organizations refusing to open accounts and cooperate as counterparties.

Correctly entering information about your payment is important, since making mistakes when entering data in this column can subsequently result in many unpleasant moments for a company or individual.

Agreement to the loan agreement

Cash loan agreements, like any other agreements, can be changed by the parties themselves if there is an appropriate agreement between them. The loan agreement can be terminated by the parties by mutual consent on the terms established by them. To secure such actions of the parties, an agreement is provided for the loan agreement.

The agreement can set a new date for the return of funds, change the amount of interest for using the loan, and determine sanctions for violating the deadlines for repaying the debt. Once signed, the agreement forms part of the loan agreement, and the loan agreement must be interpreted only in light of this agreement of the parties. The additional agreement must be drawn up in the same form as the main agreement.

If the parties do not agree to amend or terminate the loan agreement, this can only be done in court.

What to use as collateral

A loan between an individual and a legal entity, by agreement of the parties, is secured by collateral in the form of property:

- movable;

- immovable.

A pledge, with the consent of an individual and a legal entity, is formalized both in a separate agreement (indicating its presence in the text) and in a section in the main document. Requirements for registration of a pledge (Article 334 of the Civil Code):

- written form;

- notarization;

- a detailed description of the item and its registration data (if available);

- an indication of the storage location for the duration of the fulfillment of obligations;

- consent to the implementation of the pledged property in the event of a violation of obligations.

Execution of the loan agreement

Repayment of debt under a loan agreement

Repayment of the debt must be determined by the parties and specified in the loan agreement. The parties have the right to provide for any procedure and terms for the repayment of borrowed funds. The money can be paid in one lump sum or paid in periodic installments. For interest under a loan agreement, the rule is that they are paid monthly, unless otherwise specified in the agreement.

If the parties have not specified the term and procedure for repaying the borrowed funds, the loan agreement is considered to be of unlimited duration. Under an open-ended agreement, the lender has the right to demand repayment of the debt at any time, and the borrower is obliged to repay them within 30 days from the date of receipt of such a demand.

If the loan agreement is for compensation, then early repayment of funds can only be made with the consent of the lender. An exception is the situation when the borrower took money for personal, home or family use, that is, not related to business activities.

Repayment of the debt must also be documented in writing. When transferring funds in cash, a receipt is drawn up. Cashless refunds are confirmed by bank documents.

If the borrower refuses to receive the money, it can be deposited or an account opened in the name of the lender at the bank. In this case, notification to the lender is required, which can then be confirmed in court.

Violation of the loan agreement

Violation of the terms of the loan agreement provides for civil liability. First of all, this is responsibility for the consequences of late repayment of the loan amount. For violation of the terms established by the contract for the return of funds, liability can be provided for in the contract itself in the form of interest on borrowed funds or in a specified amount of money.

If the amount of liability for violating the terms of repayment of the debt is not provided for in the contract, the borrower will have to pay interest for the use of someone else’s money, according to the rules established by Article 395 of the Civil Code of the Russian Federation. More details here: Calculation of interest.

Payment of these interests will be made without taking into account interest for the use of borrowed funds. Under agreements that provide for the repayment of debt in periodic payments, special consequences are established for violations of the terms of payment of the next payment. In this case, the lender may demand repayment of the entire loan amount with interest ahead of schedule. Such interest should be considered interest accrued for the entire period established by the agreement for the repayment of the loan amount, and not just interest accrued by the time of its early repayment.

To collect a debt under a loan agreement, use: Statement of Claim for debt collection under a loan agreement

Rules for filling out payment instructions

To avoid annoying mistakes and incorrect wording in the “payment purpose” column, follow these recommendations:

- Indicating the VAT mark is mandatory even if you do not pay it. If your financial transaction does not require taxation, then at the very end the description of the payment should be written “without VAT” or “VAT exempt”. If tax is included in the amount you transfer to another account, its amount should be indicated.

- If you are paying taxes, you must indicate which tax you are covering and for what period of time. Additionally, the details of the policyholder are indicated.

- If you, as an individual entrepreneur, want to transfer funds from one account to another, then in the purpose of the payment you must indicate “replenishment of your own account.” Such wording is not prohibited by law and will not cause any suspicion among bank or tax officials.

- Replenishing an account has its own characteristics, since individual entrepreneurs are allowed to deposit funds into their accounts without restrictions or justification for the transfer. For a company, replenishing an account will be a more complex operation, since in order to deposit money into the account it is necessary to have a basis that is described in detail. The funds contributed must have a clear purpose, for example, financial assistance, payment for services or any category of goods, or any other needs. Organizations must indicate the founder of the payment.

- When conducting a financial transaction marked as payment for a product or service, you should always remember that the transferred amount corresponds to the scale of the enterprise or organization. If a small company makes too large transfers, this may cause some suspicion on the part of the bank, which will subsequently monitor the transactions more carefully. Be prepared for the fact that the bank may make a request for acts on the performance of paid services and reports on them.

- Payment of funds for rent should also be described in more detail. Include the details of the rental agreement, as well as information about the period of time you are paying for. Also, do not forget to indicate what exactly you are renting, since it can be not only real estate, but also other types of property.

Challenging the loan agreement

Loan agreements, like other transactions, are subject to the rules for void and voidable transactions. In addition, the borrower has the right to challenge the loan agreement due to its lack of funds. Lack of money means that the borrower did not receive the money in debt or received it in a smaller amount than specified in the loan agreement.

If at a court hearing it is established that the loan agreement is non-monetary, the court will refuse to satisfy the claims on this basis or will reduce the amount of the amount recovered if the money was transferred in a smaller amount than specified in the agreement.

Drawing up a loan agreement in writing will exclude the possibility of challenging its lack of money with testimony, except in cases of deception, violence and threats.

It is necessary to distinguish a non-monetary loan agreement from the novation of a debt obligation into a borrowed one. By agreement of the parties to the agreement, it is possible to replace debts under agreements for the sale or lease of property, as well as other agreements providing for the payment of funds, with borrowed obligations.

New rules for borrowers and lenders have been in effect since June

Companies have the right to enter into a consensual loan agreement, refuse it unilaterally and charge interest at the key rate of the Central Bank. Lawyers can apply to the new relationship the practice that the courts formed before the changes. The article contains positions that will help avoid disputes between the parties. If a conflict arises, read how the borrower can challenge the agreement due to lack of money, and how the lender can resist it.

LOAN AGREEMENT

g. ________________ “___”__________ ____ g.

I, _______________________________________, hereinafter referred to as the “Lender”, on the one hand, and

I, _______________________________________, hereinafter referred to as the “Borrower”, on the other hand, have entered into an agreement on the following:

1. THE SUBJECT OF THE AGREEMENT

1.1. Under this agreement, the Lender transfers ownership to the Borrower of funds in the amount of _______ rubles, and the Borrower undertakes to return to the Lender the loan amount and interest accrued on it under the conditions provided for in the Agreement.

1.2. The amount of interest under the agreement is _______ of the loan amount.

2. PROCEDURE FOR PROVIDING AND RETURNING THE LOAN AMOUNT

2.1. The Lender transfers to the Borrower the loan amount “___”__________ ____. The fact of transfer of funds is confirmed by a receipt from the Borrower.

2.2. The Borrower returns to the Lender the borrowed funds and accrued interest “___”__________ ____.

2.3. The loan amount is repaid by the Borrower by _________.

2.4. Confirmation of the return of borrowed funds is a receipt issued by the lender.

3. INTEREST FOR USE OF THE LOAN AMOUNT

3.1. Interest on the loan begins to accrue from the day the funds are transferred to the Borrower.

3.2. Interest on the use of the loan amount is paid in monthly installments by the _____ day of each month until the loan amount is repaid.

4. RESPONSIBILITY OF THE PARTIES

4.1. For late repayment of the loan amount, the Borrower shall pay the Lender a penalty in the amount of _____% of the unpaid loan amount for each day of delay.

5. FINAL PROVISIONS

5.1. The Agreement is considered concluded from the moment the Lender actually transfers the loan amount to the Borrower in accordance with clause 2.1 of this Agreement.

5.2. The Agreement is valid until the Borrower fully fulfills its obligations to repay the loan amount and pay interest, which is confirmed by a receipt from the Lender.

5.3. The agreement is drawn up in two copies, one copy for each of the parties.

6. ADDRESSES AND SIGNATURES OF THE PARTIES

Lender: _________ (__________________________________________)

Borrower: _________ (__________________________________________)

Recommendations for drawing up a contract

- The contract must be drawn up in as much detail as possible; it must contain all agreements of the parties. It is necessary to avoid the possibility of double interpretation of the terms of the contract. The use of abbreviations in the text is not recommended.

- The contract must indicate the place where it was drawn up (city, town, village, etc.). The place of drawing up the loan agreement is the locality where the parties signed it.

- The loan agreement must indicate the date of its preparation. The date is indicated in local time at the time the contract is signed.

- The agreement shall indicate the full surnames, first names and patronymics of the parties (lender and borrower), and other data that will avoid confusion with full namesakes, for whom this data will completely coincide. You can indicate passport details or the date and place of birth of the parties to the contract.

- When filling out an agreement, it is better to use a citizen’s passport, since by ear you can incorrectly indicate the personal data of one of the parties, this will allow you to avoid fraudulent actions and see the borrower’s signature.

- The amount of money to be transferred under the loan agreement is indicated in numbers and in words.

- The agreement must provide for the procedure for transferring funds for the loan. The transfer can be confirmed in the contract itself or a separate receipt is issued upon transfer. You can indicate the transfer of money with a deferment.

- The amount of interest under the loan agreement can be specified per year, per month, for each day of use of borrowed funds. You can express the amount of interest in a specific monetary amount.

- The parties must provide for the procedure and terms for paying interest on the loan. Interest can be paid daily, monthly, annually. You can provide for the payment of all interest simultaneously with the payment of the principal debt or establish a different payment procedure.

- The parties must provide for a period for repayment of the debt under the loan agreement. This period may indicate a specific date or the occurrence of a specific event. If the repayment period is not specified, the loan agreement is considered to be of unlimited duration, the lender has the right to demand repayment of the debt at any time, and the borrower must repay it within 30 days after receiving such a demand.

- The contract must specify the procedure for returning money. Money can be returned in cash or non-cash.

- The loan agreement may provide for the borrower's liability for failure to repay the debt. The penalty can be determined as a percentage for each day (month, week, year) of delay or determined in a specific amount.

- Other conditions may be included in the loan agreement by agreement of the parties. If these additional terms are contrary to law, they will not apply.

- The loan agreement is drawn up in 2 copies, one for each party.

- At the end of the agreement, each party must put its signature and transcript (indicate the last name, first name and patronymic). If the agreement itself can be drawn up in printed form, then the signatures and their full transcript must be affixed to each person in his own hand, which will help in case the parties dispute the authenticity of their signature.