In this article, Professor of St. Petersburg State University V.V. Patrov, member of the Methodological Council on Accounting under the Ministry of Finance of Russia, examines some issues of calculating distribution costs for the balance of goods, reflecting them in accounting and reporting.

The accounting regulations “Accounting for inventories”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n (PBU 5/01), provides for two options for accounting for the costs of procurement and delivery of goods to central warehouses (bases), carried out until the moment of their transfer on sale *.

*Note:

The composition of these costs is listed in clause 6 of PBU 5/01. Since their largest share consists of the costs of delivering goods to the place of their use, if they are not included in the price of goods established by the contract (transport costs), in the future we will only talk about their accounting.

Clause 6 of PBU 5/01 proposes to include them in the cost of goods, and in clause 13 - as part of selling expenses. The choice of one of these options should be reflected in the order on accounting policies.

Let us consider the problem of this choice in more detail. Let's start with a simple situation.

The organization purchased goods of one name. The organization decided to include the amount paid for the transportation of goods in the cost of goods.

To calculate transport costs per unit of goods, you need to divide the total amount of transport costs by the quantity (weight) of the goods and add the resulting amount to the purchase price.

But in practice, in the vast majority of cases, suppliers’ accompanying documents indicate goods of several items (sometimes several dozen). Here the total amount of transportation costs must be distributed among all items. The question arises: in proportion to what basis should transport costs be distributed: cost, quantity (weight) or some other indicator? The distribution result (cost per unit) will vary depending on the distribution base.

The inclusion of transport costs in the cost of goods increases the complexity of accounting work and destroys the logic of accounting, because by choosing one or another base for the distribution of costs, the accountant receives in each case a different cost per unit of items of goods.

When considering this problem, we proceed from the fact that the amount of transportation costs for a particular batch of goods is indicated in the corresponding document. However, in practice this value is often difficult and sometimes impossible to calculate.

Many trade organizations enter into contracts for the transportation of valuables with motor transport organizations and pay for these services at an hourly rate.

In this case, a vehicle can make several trips during the day, transporting several consignments of goods, both from suppliers to the organization’s warehouse, and from the trading organization to buyers.

In addition, the car can be used for other purposes: transportation of materials, fixed assets, etc. Under these conditions, it is extremely difficult to determine the amount of costs for the delivery of goods from suppliers.

The same problems remain if the organization has its own transport.

Summarizing the above, we can conclude that in most cases, including transport costs in the cost of goods is inappropriate, and it is better to write them off to account 44 “Sales expenses”.

In organizations that take into account transportation costs as part of sales expenses, there are two options for their accounting:

1) with the preparation of calculations of distribution costs for the balance of goods; 2) without drawing up this calculation.

The need to calculate distribution costs for the balance of goods* is stated in clause 2.18 of the Methodological recommendations for accounting of costs included in distribution and production costs, and financial results at trade and public catering enterprises, approved by Roskomtorg letter dated April 20, 1995 No. 1-552 /32-2 (hereinafter referred to as Methodological Recommendations).

*Note:

Until 2000, it was prescribed to distribute not only transportation costs, but also the cost of paying interest on a bank loan between sold goods and the balance of goods.

Through this calculation, transport costs are distributed between goods sold for the current month and the balance of goods at the end of the month. The amount of distribution costs for the balance of goods remains in account 44 “Sales expenses” as its debit balance, and all other expenses are written off at the end of the month by posting:

Debit 90 “Sales” subaccount “Sales expenses” Credit 44 “Sales expenses”

At the same time, according to clause 9 of PBU 10/99 “Expenses of the organization”, all commercial expenses, which are understood as sales expenses, can be fully recognized in the cost of goods sold, i.e. at the end of the month, all expenses collected in account 44 can be debited to account 90, in which case account 44 will have no balance at the end of the month.

Consequently, based on the rules of regulatory documents on accounting, trade organizations have the right to independently decide on the issue of drawing up or not drawing up a calculation of distribution costs for the balance of goods, indicating this in the order on accounting policy.

Methodological guidelines for accounting for inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, recommend (clause 228) to draw up the above calculation if the amount of transportation and procurement costs associated with the purchase and delivery of goods is more than ten percent of the total volume of revenue from sales, as well as their uneven level throughout the year (crop products, fisheries, etc.).

However, from the content of Articles 318 and 320 of the Tax Code of the Russian Federation, it follows that trade organizations in tax accounting are obliged to distribute transport costs between sold goods and the balance of unsold goods.

The importance of distribution costs for trade organizations

Correct accounting of IOs is important, since their participation in the formation of financial results is almost decisive:

- ISO is one of the main indicators of the final functioning of the company;

- the amount of costs directly affects the amount of income received by the company from the sale of goods. Therefore, their optimization is a serious factor in increasing profitability and profitability.

- ISO level is the main guideline for determining the trade markup (its minimum value);

The extent to which a company can compete with companies operating in the same field depends on the ISO and its level.

Types of distribution costs in trade

Systematization of art involves organizing them according to common features:

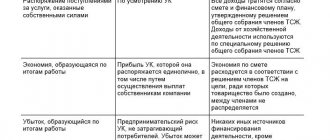

| Classification criterion | Kinds | Examples |

| ∑ turnover | – conditional variables | ISO related to the preservation of goods, their packaging, sorting |

| – conditionally constant | Shock absorption; Money spent on rent | |

| – mixed | Employee salaries, other expenses | |

| Compound | – complex | Packaging and packaging costs, compliance with storage conditions |

| – single-element | Advertising spending | |

| Place of appearance | – internal | Personnel training and professional development; salary |

| – external | Transportation losses | |

| How are costs treated? | – straight | Transportation cost; costs of packaging product units, proper storage |

| – indirect | Amounts for management personnel, advertising expenses | |

| Economic nature | – clean | Relates to cash flow; advertising |

| – additional | Expenses for unplanned repairs; additional packaging | |

| Accounting in the company | – obvious | Depreciation of fixed assets; salary |

| – implicit | Opportunities missed, for example, income that could have been received | |

| Frequency of occurrence | – current | Salary; main content funds, inventory |

| – one-time | Payment for one-time work | |

| – other | Shipping costs | |

| Controllability level | managed (discretionary) | The amount of costs is set freely, depending on the position of the company |

| Unmanaged (non-discretionary) | Taxes, fees |

What to do with the obtained values?

The manager's goal is not to completely reduce costs, but to optimize them. Reducing costs even by 10% may not be practical, since this operation is accompanied by high costs. Not every reduction in spending can be considered rational. Reducing indicators can lead to a decrease in the quality of treatment.

EXAMPLE 2. A manager decided to reduce distribution costs. To do this, it reduces costs on packaging and advertising of products. As a result, the level of demand for the product decreases. Due to the lack of packaging, the product becomes less attractive to customers and spoils. As a result, all the savings turn into even greater costs for the enterprise.

EXAMPLE 3. A manager reduces circulation costs in a company providing legal services. In particular, employees will no longer be able to undergo vocational training. As a result, their qualifications decrease, and therefore the company’s services become less and less popular.

Distribution costs are included in the main expenses of the enterprise. They are associated with the production, transportation and sale of the product. The IO includes payment for transportation services, rental costs of retail premises and warehouses. They must be reflected in accounting. They are fixed using special wiring. The obtained values for distribution costs make it possible to optimize costs.

Fundamentals of synthetic accounting of distribution costs

Active account 44 is intended for maintaining synthetic accounting. According to its debit, the accountant collects the amounts of expenses incurred in the course of the main activity, and the credit is calculated to write them off. The debit balance shows which ISOs for goods not yet sold are in stock at the end of the reporting period.

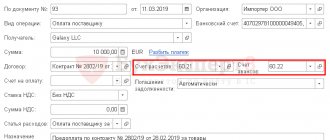

The following entries are made in the accounting of art:

| Debit | Credit | Explanation |

| 44 | 02 | For depreciation. OS amount |

| 05 | For the volume of depreciation. intangible assets | |

| 10 | Write-off of materials used for packaging product units and keeping them safe | |

| 60 | For the services provided for supply, security | |

| 68 | Calculation of taxes and other deductions related to art | |

| 70, 69 | Earnings and social contributions of employees | |

| 71 | Write-off of amounts spent on business trips and entertainment needs | |

| 94 | The amount of shortages and losses from damage to goods and materials (relevant for reducing taxes) |

The write-off of expenses is reflected as follows:

Dt 90.2 Kt 44

Important! On loan account 44, costs are written off to determine the final financial result - profit or loss.

Double entry system and chart of accounts

The fundamental method of accounting is the double entry method. It consists in the fact that to reflect the state and movement of each accounting object, a separate accounting account is opened:

- fact of economic life;

- property;

- obligations;

- income;

- expenses.

It consists of two parts: debit and credit. When reflecting a transaction as a debit to one account, it must simultaneously be reflected as a credit to another. It is such a record, reflecting a business transaction and containing an indication of the debited and credited accounts, that is called an accounting entry.

The use of this method should ensure at any time balance equality between the summarized turnover of debit and credit accounts.

Order of the Ministry of Finance No. 94n approved the chart of accounts. It is the basis for developing the chart of accounts used by the company in its work. It is on this basis that standard accounting entries are formed. Let's look at the most common wiring in a company's activities.

Maintaining analytical accounting of distribution costs

Analytical accounting of art products in trading companies is carried out for each of their types and for individual articles. The list is unified and includes all possible areas of art: from delivery costs to other costs.

Trading companies can supplement and change this list. But it is important to take into account the provisions of regulatory documents. Analytical accounting covers types of costs. For example, on the debit of the account. 94 collects information about the accounting value of goods that are missing. The amount is contained in account loans. 41 and 60.

Shortages arising during the sale of goods are indicated as follows:

Dt sch. 94 Kt. 44

Loss of goods due to emergencies, natural disasters, is written off from credit account 44 to Dt account. 99.

Accounting for distribution costs: features of accounting for transportation costs

Costs arising during the delivery of goods to the company's warehouses are included in the IO.

You can display them like this:

- Include in the actual s/s of the product.

- Take it into account 44 under the title “Sales expenses”.

Where to stop is determined by the trading company. But the choice must be indicated in the accounting policy. When the second method is chosen, the volume of transport costs is subject to distribution between the goods sold, and not yet. Costs incurred during the delivery of already sold units are written off to the account. 90.2.

Posting involving account 91: how expenses are written off in the absence of income

Commercial activities may not generate income when the business is in its infancy, during seasonal work, or under other circumstances. In such conditions, there may be no revenue, as well as other income and expenses, but it is not always possible to do without general business expenses. They accumulate on account 26 and require timely write-off.

In this case, what kind of posting is made when writing off general business expenses? Possible write-off methods for such a situation are presented in the figure:

The choice of method 1 involves the distribution of general business expenses among the objects of calculation (production continues, but there is no revenue from sales of products yet). In the absence of sales, general business expenses will be taken into account in the balance of work in progress.

When choosing method 2, general business expenses are written off monthly as other expenses. This method is used in the complete absence of activity, when it is impossible to recognize general business expenses as expenses for ordinary activities.

This material will introduce you to the types of other expenses.

Features of accounting for distribution costs in pharmacies

IO in pharmacies is their volume in monetary terms necessary for the delivery of medications to consumers, who are the population of the country and various types of medical institutions.

IO includes costs for:

- delivery of medicines and their safety;

- sale of medicines;

- employee salaries;

- others.

The total amount of pharmacy expenses exceeds the ISO. The latter, for example, do not include:

- entertainment and travel expenses, the amount of which exceeds the norm;

- amounts of financial assistance;

- bonuses from special funds;

- loan fees;

- fines and penalties due to inaccurate payment of taxes;

- additional vacation pay.

To reduce costs, you need to:

- To improve the organizational forms of providing the population with medicines, namely, to sell mainly ready-made medications and not spend money on their production.

- Use modern technologies that increase the productivity of pharmacists.

- Reduce delivery costs and the cost of medicines.

- Rationalize commodity distribution systems, eliminate duplicate links in the delivery of medications.

Pharmacies have a high level of ISO (20-25%) compared to other trading companies (6-9%). There is an explanation for this:

- significant amount of work;

- maintaining a staff of more highly qualified employees compared to a regular store;

- The sale of goods is carried out not in large quantities, but in fractional quantities.

All costs incurred by the pharmacy are reflected in accounting and reporting documents in the period in which they were actually incurred.

In operational accounting (analytical and synthetic accounting accounts), in the accumulative and turnover statements, IO should be recorded only in absolute amounts - in RUB.

The main reporting document for art is the report for the corresponding quarter. It reflects costs both in absolute terms and as a percentage of turnover.

Costs associated with the delivery of materials by our own transport, loading them by staff, as well as the costs of maintaining warehouses for their storage and production of materials are charged, depending on their purpose, to account No. 44 Distribution costs or No. 23 Auxiliary production. The actual consumption of materials is reflected in limit cards and recorded in Appendix No. 3 of accounting journal No. 10. [p.269] In accordance with the above, it is advisable to make the following adjustments to the working chart of accounts of the enterprise. We assign two additional characteristics to each cost item. The first feature I is variable costs. 2 fixed costs, 3 - semi-fixed costs. The second sign is 4 - regulated costs, 5 - unregulated costs. This will not significantly complicate the work of the accounting department, but will provide the accountant-analyst involved in segmental accounting with all the information he needs. Taking into account the proposals made, account 44 Distribution costs of CJSC Provizor could look as follows (see Table 30). [p.96]

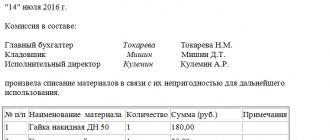

| Table 30. Features of analytical accounts for account 44 Distribution costs |

ANALYTICAL ACCOUNTS to account 44 Distribution costs [p.97]

In trade, public catering and other intermediary organizations (procurement) in the income statement (form No. 2 of the financial statements) under the article Cost is prescribed (Instruction of the Ministry of Finance of Russia on the procedure for filling out annual forms financial statements dated 12.11.96 as amended by orders of the Ministry of Finance of the Russian Federation dated 01.11.97 No. 81N, dated 20.10.98 No. 47N) show the purchase price of goods, the proceeds from the sale of which are reflected in the first line of this report. All other elements of cost are summarized in account 44 Distribution costs and in the amount attributable to goods sold are shown under the article Selling expenses. Administrative expenses may be included in distribution costs. [p.50]

The debit of the accounting account 44 Distribution costs includes (accrues) the following expenses [p.382]

At catering establishments, the cost of raw products used in food preparation is taken into account separately from all other expenses, namely on account 20 Main production. Food preparation costs (electricity, wages of kitchen workers, etc.), which are essentially production costs, are recorded as distribution costs in account 44 Distribution costs. [p.382]

Construction materials are assessed at actual cost or at purchase prices, with the allocation of costs for their delivery (including procurement and storage costs) as a separate object of accounting. Procurement and storage costs (for the maintenance of the supply apparatus, warehouses, storerooms, protection of materials, losses from shortages of materials) are taken into account in account 44 Distribution costs, and at the end of the month they are written off to the account Materials 10/8 - 44. Valuation of building materials in Analytical accounting is carried out at fixed prices and separately - deviations of actual costs from accounting prices. The release of materials for construction is written off to the debit of the Capital Investments account 08 - 10/8, and their shortage is written off to the account Shortages and losses from damage to valuables 84 - 08, followed by a debit to the account Settlements with Personnel for Other Operations. [p.152]

Account 44 Distribution costs (according to the new Chart of Accounts - account [p.17]

Account 44 Distribution costs [p.137]

Account 44 Distribution costs (according to the new Chart of Accounts - account 44 Selling expenses) [p.160]

Account 40 Finished products Account 41 Goods Account 42 Trade margin Account 43 Commercial expenses Account 44 Distribution costs Account 45 Goods shipped Account 46 Sales of products (works, services) Account 51 Current account Account 78 Settlements with subsidiaries (dependent) companies Account 79 On-farm settlements [ p.168]

Completing this line depends on the type of activity of the organization. For enterprises engaged in the production of products, performance of work and provision of services, these are sales costs reflected in the credit of account 43 Selling expenses and the debit of account 46 Revenue from the sale of products (works, services) (according to the new Chart of Accounts are taken into account as part of distribution costs account 44 Selling expenses). For organizations engaged in trade, supply, marketing and other intermediary activities, these are distribution costs reflected in the credit of account 44 Distribution costs and the debit of account 46 Revenue from the sale of products (works, services) (according to the new Chart of Accounts - in the credit of account 44 and debit account 90, subaccount Cost of sales). [p.210]

Completing this line depends on the type of activity of the organization. For organizations engaged in the production of products, performance of work and provision of services, these are sales costs reflected in the credit of account 43 Commercial expenses and the debit of account 46 Revenue from sales of products (works, services). For organizations engaged in trade, supply, distribution and other intermediary activities, these are distribution costs reflected in the credit of account 44 Distribution costs and the debit of account 46 Revenue from sales of products (works, services). [p.287]

It should be emphasized that before the approval of the Methodological Recommendations on the procedure for generating financial reporting indicators [26], the application of the norm of paragraph 9 of PBU 10/99 [13] in relation to costs collected in account 44 Distribution costs was quite controversial. [p.416]

Thus, based on the current accounting acts, commercial expenses are understood as costs collected on account 43 Commercial expenses, as well as costs collected on account 44 Distribution costs. [p.416]

Costs collected in account 44 Distribution costs. [p.417]

The amount of distribution costs attributable to the balance of goods unsold at the end of the reporting period at an enterprise carrying out its statutory activities in accordance with the constituent documents in trade, supply and other intermediary activities is taken into account in account 44 Distribution costs and is included in the item costs in work in progress (costs circulation) balance sheet. In this case, the amount of distribution costs related to the balance of goods at the end of the month is calculated according to the average percentage of distribution costs for the reporting month, taking into account the carryover balance at the beginning of the month in the following order [p.417]

Attributable to production and distribution costs (account 26 General business expenses, account 44 Distribution costs) [p.376]

Excess material assets identified during the inventory are debited to account 05 Raw materials and materials from the credit of account 99 Profit and loss. The amount of shortage of materials is reflected on the debit of account 84 Shortages and losses from damage to valuables from the credit of account 05 Raw materials and materials. Shortages due to the fault of materially responsible persons are included in the debit of account 75 Calculations for compensation of material damage from the credit of account 84 Shortages and losses from damage to valuables. Losses of materials (within the limits of natural loss) are debited to account 44 Distribution costs under the item of non-production losses within the limits of natural loss. [p.117]

Work clothes and safety shoes are given to the worker upon request or on a distribution sheet under the personal signature of the worker. The date of issue and the standard wearing period are indicated on the worker’s individual card. As low-value and quickly wearing items, work clothes and special footwear, as they wear out, transfer their value to distribution costs, the amount of this wear and tear is debited to account 44 Distribution costs. [p.119]

Containers manufactured at the oil depot using economic methods are supplied at list prices. The excess of the cost of packaging compared to the list price is debited to account 44 Distribution costs, and the excess of the list price over the cost of production is credited to account 99 Profit and loss. Packages received from suppliers arrive at the prices indicated on their invoices. [p.123]

Losses and broken containers within the limits of natural loss norms are written off to the debit of account 44 Distribution costs under the item of results for operations with containers. The cost of containers that have fallen into disrepair is written off according to the act, excluding the cost of scrap metal or rivets (at the price of possible use). [p.125]

Transportation costs for the delivery of petroleum products to the branches of the oil depot are written off to account 44 Distribution costs. [p.130]

Natural loss, shortages, losses from damage to quality and misgrading of petroleum products are taken into account in account 84. Shortages and losses from damage to valuables, regardless of whether they are subject to write-off to account 44 Distribution costs or attributed to the guilty financially responsible persons in account 75 Calculations for compensation of material damage . [p.155]

Shortages of petroleum products in excess of the norms of natural loss and losses from spoilage, if specific culprits are not identified, as well as debts for shortages and thefts, the collection of which was refused by the judicial authorities, are written off to the debit of account 44 Distribution costs in the manner specified in Art. 64 Regulations on accounting reports and balances. [p.155]

The cost of natural loss accrued within the norms is written off by the consignee to account 44 Distribution costs [p.158]

The consignee recovers excess freight charges due to redirection of oil cargo or due to other reasons from the shipping company and charges them to account 44 Distribution costs to reduce transportation costs. The consignee accepts the additional amount of carriage charge for his own expenses. [p.160]

The actual cost of producing and sending coupons is taken into account in account 31 Deferred expenses until they are issued to consumers. As coupons are issued to consumers, their actual procurement cost is written off to account 44 Distribution costs. Calico packaging bags in which coupons are sent are credited to account 05 Raw materials at the cost indicated in the sender's documents. [p.167]

An entry in the debit of account 63 can also be made in correspondence on a loan with accounts that record inventory and related costs, if overpricing or arithmetic errors in the invoices submitted by suppliers and contractors are discovered after the proper entries in the inventory accounts are made. material assets or costs (distribution costs) were incurred. Account 44 Distribution costs is credited for the amounts for excess tariffs (freight) when transporting goods (debit to account 63). [p.207]

The journal order 10-SN reflects both synthetic and analytical data on accounts 44 Distribution costs 31 Deferred expenses 86 Depreciation fund 03 Major repairs 89 Reserve for future expenses and payments. There are special columns for debit turnover according to other order journals (according to transcript sheets), as well as tables for calculating depreciation amounts of fixed assets (funds). wear and tear of low-value and fast-wearing items, administrative and management expenses, etc. [p.236]

| Table 29 Correspondence of account 44 Distribution costs |

In accordance with the current provisions, allocations of funds for the specified bonuses to organizations are reflected in the distribution costs account.

Such deductions are debited to account 44 Distribution costs (for oil depots, oil loading points and pipeline transport) and credited to account 78 Intradepartmental settlements for current operations. [p.267] Account 99 reflects gross income from the sale and intra-system supply of goods and packaging, works and services, written off at the end of the year. In accordance with the current regulations, until the end of the year, financial results are taken into account in the accounts 44 Distribution costs, 46 Sales, 47 Intra-system release of goods, works and services. [p.273]

At the end of the reporting year, the operational-resulting accounts are closed, i.e., the balances of all sub-accounts of accounts 46 Sales, 47 In-system release of goods, works and services are written off to account 99 Profits and losses of gross income (the difference between the amount of proceeds from the sale of goods, containers, works and services, and purchased - accounting value and turnover tax). At the end of the year, distribution costs and expenses for maintaining the management apparatus, taken into account (during the year) in the corresponding subaccounts of account 44 Distribution costs, are written off to account 99. [p.277]

In cases where ships (barges) are used to store petroleum products, the costs of their rental are written off to account 44 Distribution costs under the article Costs of storage, handling, sorting and packaging of goods. This item also includes costs associated with storing petroleum products in barges overwintered due to ice conditions. [p.289]

The bulk of materials are used for repair and maintenance needs, and their cost is written off as distribution costs. In this regard, account 44 Distribution costs is debited and account 05 Raw materials and supplies is credited. Part of the materials is sent for major repairs and capital construction, their cost is included in the debit of accounts 03 Major repairs and 33 Capital construction costs, respectively. [p.114]

If the container is subject to repair, the actual cost of repair is written off from account 23 Auxiliary production of the subaccount production and repair of containers and charged to account 44 Distribution costs. For untimely return of containers, the buyer will be charged a fine in the amount of twice its cost at the wholesale prices of the current price list. This operation is reflected in the following accounting entry [p.125]

Synthetic accounting groups and generates synthetic indicators based on distribution costs. Current costs of oil supply organizations are reflected in account 44 Distribution costs. This account is active. Expenses are recorded in account 44 throughout the year on an accrual basis. At the end of the year, account 44 is closed by transferring its balance to account 99 Profit and loss. [p.236]

Expenses for maintaining the management staff of oil supply organizations are taken into account in a separate subaccount of account 44 Distribution costs. [p.274]

Basics of cost analysis in pharmacies

For qualitative analysis, it is necessary to use the following initial data:

- planned calculations of turnover and inventories of current assets;

- amounts intended for payment of labor;

- wishes of management regarding minimizing the level of ISO based on the experience of more profitable pharmacies;

- results of analytical work on the study of art for the previous time period.

It is necessary to highlight factors that depend on the work of pharmacy organizations and those that cannot be influenced. The main factor that cannot be influenced is prices. Their dynamics affect the amount of trade turnover and the relative level of ISO. Initially, this concerns retail prices for medications.