According to Art. 313 of the Tax Code of the Russian Federation, the tax accounting system is organized by the taxpayer independently, based on the principle of consistency, that is, the same norms and rules apply from one tax period to another. If the rules and regulations reflected in this document change, changes must be made to the accounting policies. Let's consider what needs to be changed in the accounting policy for tax purposes for 2015 in connection with amendments to the law.

Let us recall that accounting policy for tax purposes means the set of acceptable methods (methods) chosen by the taxpayer for determining income and (or) expenses, their recognition, assessment and distribution, as well as taking into account other indicators of the taxpayer’s financial and economic activities necessary for tax purposes (clause 2 Article 11 of the Tax Code of the Russian Federation). The accounting policy must contain provisions regarding accounting methods that:

- the taxpayer has the right to choose based on legal provisions (for example, the method of determining the cost of goods or materials);

- are not clearly defined in the legislation and the taxpayer has the right to develop independently (for example, the procedure for separate accounting of expenses when combining the general regime and UTII or “input” VAT when conducting activities both taxable and not subject to this tax).

Let us note that it does not make sense to indicate in the accounting policy general information such as the applied taxation system, taxes paid, and also to reflect in it those methods and methods of accounting that, regardless of the desire of the organization, is obliged to apply in accordance with the law. There is also no need to include provisions “in reserve” in the accounting policy, that is, to record in it accounting methods that the organization does not use and does not plan to use (for example, the procedure for accounting for securities in the case when the organization does not carry out and does not intend to carry out transactions with securities papers). An approximate list of the main provisions of the accounting policy for tax purposes is given in the table on p. 78. A sample accounting policy is given in the appendix on p. 82. Next, we will consider what changes in the Tax Code of the Russian Federation will affect the accounting policy for 2015.

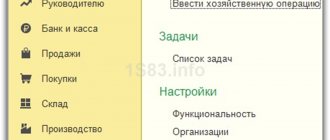

Accounting Policies Sections

The specialist must definitely pay attention to the structure of the accounting policy disclosed in the sixth paragraph of Instruction 157n. The accounting policy in an educational organization is established by the internal acts of this accounting entity, and the following are approved as such:

- an up-to-date working accounting plan, including, among other things, accounts used for maintaining analytical and synthetic accounting;

- methods used to comprehensively evaluate certain types of an institution's assets and liabilities;

- rules for document flow in the institution, as well as the existing procedure for submitting primary documentation that corresponds to the approved schedule;

- the introduced procedure for conducting inventory activities;

- technological methods for processing documentation to reflect this information in accounting;

- forms of primary and consolidated accounting documentation not unified by law and used in the institution, intended for the proper registration of business transactions. In this case, such forms must contain the details of the primary accounting document, which is provided for in paragraph No. 7 of Instruction 157n;

- the procedure for maintaining internal financial control by the organization;

- other acts and decisions, without which the organization and maintenance of financial records in an institution would be impossible.

Approved on August 29, 2014 by Order of the Ministry of Finance of the Russian Federation No. 89n, some changes were made to Instruction No. 157n. From now on, paragraph 6 stipulates not only the inclusion of the already listed sections in the accounting policy, but also the “Procedure for reflecting events noted after the reporting date in the organization’s accounting.” This concept, in accordance with existing international requirements, is used for accounting in commercial enterprises, but for government agencies this item is completely new. The accounting policy for 2015 should be formed taking into account all ongoing changes and innovations.

The corresponding PBU “Events after the reporting date” was approved in 1998, and by virtue of paragraph 3 of the regulation, such an event is recognized as an economic activity that has already had or may affect the financial condition, results of the operation of the institution or the existing cash flow. This fact must occur in the period of time between the reporting date and when the annual financial statements are signed.

The third paragraph of this PBU describes events that:

- confirm the economic and financial conditions as of the reporting date in which the organization operated;

- indicate the business conditions that arose after the reporting date and in which the organization is currently operating.

The appendix to the PBU contains an approximate list of relevant events and facts of economic activity. It is expected that, by analogy with the recommendations for commercial organizations, PBUs will be developed that apply to state as well as municipal institutions.

In accordance with the Order of the Ministry of Finance of the Russian Federation numbered 89n, the sixth paragraph also contains information that accounting forms developed and used by educational institutions that are not unified by the legislation of the Russian Federation must be included in the accounting policy. This is a significant difference from the previously existing practice, when the 2014 accounting policy was developed on the basis of only primary documentation.

If autonomous and budgetary institutions:

then when forming an accounting policy that takes into account all the nuances of the activity, the peculiarities of the functioning of such organizations and the maintenance of accounting or financial records are necessarily provided for, as prescribed by Instruction No. 157n.

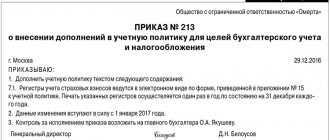

What should an order approving accounting policies include?

Formation of an order for approval of accounting policies (AP) is a process that is subject to internal requirements for the development and approval of general administrative documentation.

The accounting legislation and the Tax Code of the Russian Federation do not say anything about the content of the order approving the UE, therefore:

- the structure of the order is standard (generally accepted in a given company) for this type of document (title of the order, explanatory and administrative parts, signature of the manager);

- order form - it is drawn up in any form with the obligatory indication of the number of this document, its topic and date;

- content of the order - its text may reflect important aspects for the company (for example, from what date the CP is introduced, indication of the full name and position of the responsible employee who is entrusted with monitoring the execution of the CP).

Read about the types of general orders in the following materials:

- “Orders for core activities – what are these orders?”;

- “Orders for personnel - what are these orders (types)?”.

Adjustment of accounting policies

Based on existing sections of the accounting policy, it is possible to determine the lack of any information, or identify outdated or unreliable data. The procedure for making changes to existing accounting policies is strictly regulated. Clause No. 5 of Article No. 8 of the Accounting Law states that the current accounting policy for 2015 is based on data from previous years, maintained and applied consistently from year to year. That is, it is formed once when an organization is created. But according to paragraph No. 6 of the same law, its change is provided for and allowed in the following cases:

- in accordance with Russian legislation, exercise powers to fulfill their obligations in monetary form to an individual;

- on the basis of agreements, exercise the powers of a state customer concluding and executing government contracts on behalf of state bodies or local authorities,

- when existing standards and requirements established by law change;

- if a new method of accounting has been developed or chosen, which will improve the quality of information about the accounting object itself;

- if the conditions of the organization’s activities as an accounting entity have changed dramatically.

The last condition is especially important. The decision to change the accounting policy can be justified during the reorganization of an entity associated with a merger, division or accession, separation or transformation of a legal entity, carried out in accordance with Russian laws.

It is important to note that changes in the accounting policies of an educational institution are possible if Russian legislation in the field of accounting changes. And there are many such amendments at the moment.

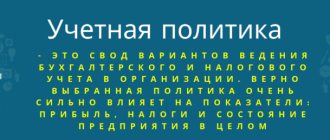

Why is UE needed?

Accounting regulations provide for certain rules for reflecting income and expenses, and the Tax Code of the Russian Federation provides its own rules. The methods chosen by the organization influence:

- on the cost of products, works and services;

- on its financial performance;

- on the amount of taxes.

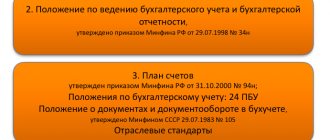

All this should be provided for in the UE for accounting and tax purposes. The requirement for its preparation is regulated by:

- for accounting purposes: clause 2 of PBU 1/2008 and part 1 of Art. 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”;

- for tax purposes: Article 11 of the Tax Code of the Russian Federation.

Changes in the application of accounts

As new accounts are introduced, the order of their use is added. It is also envisaged that changes will be made to the existing correspondence of the institution's accounts and taxation.

As noted, the account 401 60 is introduced, which helps to summarize information about the amounts reserved for the even distribution of expenses. If we consider it as a sample, then the educational institution, in accordance with the instructions, will have the right to create reserves necessary to pay for vacations or compensation, repair of fixed assets or scientific research.

This means that this account will accumulate deductions for items of an uneven nature. Within the framework of the approved accounting policy of the institution, the procedure for creating such reserves is established. That is, in this situation, the organization can independently determine whether the reservation principle will be used or not.

There is another important change in the text of Instruction 157n. An example of this is paragraph No. 25 of the new edition of the applicable instructions, which states that land plots used by organizations on the right of perpetual use are in this case taken into account in the “Non-produced assets” account of analytical accounting. Such registration is carried out on the basis of a document confirming the right to use and the cadastral value of the site.

Until now, based on paragraph 333 of the above instructions, these plots were accounted for in off-balance sheet account 01. Since the plots are transferred to the balance sheet, it is necessary to make changes to the established accounting policy of the educational institution accordingly, and the taxation procedure also changes.

Changes to Internal Controls

The procedure for implementing internal control is highlighted in a special section of the accounting policy. As stated in paragraph 3 of the new edition of Instruction 157n, it is assumed that before the adoption of primary accounting documents, internal control measures will necessarily be carried out in relation to them. That is, in the accounting department of an educational institution, it is important to establish a strict distribution of responsibilities to ensure the proper quality of such control.

In order to be able to correlate and compare financial statements for several years, adjustments to accounting policies are made at the beginning of the reporting year, unless there are compelling reasons for another option.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Order on Accounting Policy”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Additions to accounting policies

There are no specific references and indications of what causes additions to the accounting policy of an educational institution, since such organizations do not use PBU in their activities.

But all situations when a new type of activity, new operations or, for example, a new type of assets appear in the activities of an educational institution, additions to the accounting policy are required. Adjustments to accounting policies can be carried out by an organization several times during the year, and there are no restrictions on the number of such additions.

An addition to the accounting policy can be considered the addition of correspondence accounts for activities that have been carried out for a long time, or a comprehensive description of a situation that often occurs in the work of the organization.

An example of this can be situations where the employer does not issue accountable funds on account, while an employee of the organization, due to production needs, is forced to pay any expenses of the institution from his own funds. Instruction 157n does not describe the reflection of such transactions in the account intended for recording settlements with accountable persons, but the situation can be described as the fulfillment of undertaken obligations. Since the formation of the current accounting policy is based on the specific structure of the institution, the characteristics of the industry and taxation, the organization has the right to independently choose the account used in this case.

In Letter of the Ministry of Finance of Russia No. 02-06-05/4406 dated September 30, 2011. it is indicated that the use of account 302 00 in this case is not a violation of accounting in an educational organization. If the described operation to reimburse expenses incurred by an employee is not uncommon, then the institution reasonably supplements its own accounting policies with provisions deciphering the procedure for reimbursement of such expenses.

Related documents

- An example of an accounting policy for an organization with a simplified tax system

- Sample liquidation balance sheet

- Sample liquidation balance sheet of LLC

- Sample interim liquidation balance sheet

- Interim liquidation balance sheet of LLC

- Interim liquidation balance sheet

- Separation (liquidation) balance sheet of the main manager (manager), recipient of budget funds

- Separation (liquidation) balance sheet of a state (municipal) institution

- Letter of credit (form 0401063)

- Collection order (form 0401071)

- Announcement for cash contributions (Appendix No. 6 to Bank of Russia Regulations dated April 24, 2008 No. 318-P)

- Payment order (form 0401060)

- Payment request (form 0401061)

- Payment order (form 0401066)

- Advance report. Form No. 501

- An act of documentary verification of the correctness, completeness and timeliness of the transfer of insurance premiums (payments) to compulsory health insurance funds (FFOMS order No. 23 dated March 29, 1996)

- Act of purchase of inventory items

- Valuables inventory control report

- Act of control verification of the correctness of the inventory of valuables (order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49)

- Certificate of rejection and write-off of a car (car trailer) (in relation to standard form No. os-4a)

- Act on write-off of low-value and high-wear items. Form No. MB-8

- Certificate of write-off of technical equipment

- Certificate of write-off of technical equipment

- Act on liquidation of fixed assets (in relation to standard form No. os-4)

- Certificate of acceptance and transfer of fixed assets. Form No. os-1

- Cash audit report (instruction of the Central Bank of the Russian Federation dated 10/04/93 No. 18 (as amended on 02/26/96)

- Act of markdown of goods

- Act-receipt for the performance of warranty and paid work on the repair of telephone sets. Form No. tf-2-22 (letter of the Ministry of Finance of the Russian Federation dated February 22, 1994 No. 16-36)

- Act-request for replacement (additional supply) of materials. Form No. m-10

- Analytical data on accounting for the costs of procuring and purchasing materials for journal order No. 6

- Analytical data on accounting for deviations in the cost of materials for journal order No. 6

- Certificate of assessment of the value of buildings and structures approved. Ministry of Agriculture of the Russian Federation on January 22, 1992 (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm)

- Certificate of assessment of the cost of machinery, equipment and transport (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Certificate of assessment of the cost of unfinished capital construction (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)