December 15, 2021 Personal income tax

Personal income tax is an income tax.

A mandatory type of payment withheld from income received by an individual.

Personal income tax is transferred to the budget; payments are controlled by the tax authority (FTS).

To avoid violation of tax laws and subsequent penalties, it is necessary to strictly adhere to the established transfer deadlines and pay income tax on time.

Tax agents

The obligation to pay income tax is assigned to legal entities and individual entrepreneurs who have hired personnel. In this case, they act as tax agents, so they must:

- charge tax monthly (with an accrual total);

- withhold the required amount when paying staff;

- make timely payment of personal income tax to the budget.

All of the above requirements are regulated by paragraphs. 3 and 4 tbsp. 226 Tax Code. In this case, funds received by the payer from other organizations are not taken into account in the calculation.

Salary

According to Art. 136 of the Labor Code of the Russian Federation, the tax agent is obliged to issue wages every 15 days. But deductions to the personal income tax budget are made only once during this time - after the final calculation of the amount of the employee’s remuneration. And then almost immediately the tax is withheld and paid (see table).

| Payment method | When to pay personal income tax on salary in 2018 | |

| Cashless | Funds are credited to a bank card | On the day of transfer |

| Spot | 1. The cashier of the enterprise hands out the money personally | No later than the date following the day of issue |

| 2. Funds are received from the bank | On the day of receipt | |

These deadlines are established in paragraph 6 of Art. 226 Tax Code of the Russian Federation. However, there are special rules. If you have any difficulties, ask our experts on the forum.

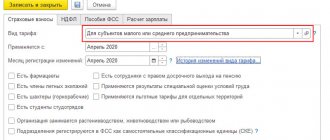

Unified agricultural tax

The deadline for paying the unified agricultural tax in 2021 (UST) is no later than March 31 of the year following the expired tax period. This follows from the provisions of paragraphs 3 and 5 of Article 346.9, paragraph 2 of Article 346.10 of the Tax Code of the Russian Federation.

The last day for tax payment (advance payment) may be a non-working day. In this case, transfer the amount of the unified agricultural tax (advance payment) to the budget on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

| Deadline for payment of Unified Agricultural Tax in 2021 | |

| For 2021 | No later than 04/02/2018 |

| For the first half of 2021 | No later than July 25, 2018 |

Payment for rest and illness

Since 2016, when accruing vacation pay and temporary disability benefits to an employee, the deadline for transferring personal income tax has become the last day of the month in which such funds were provided.

EXAMPLE accrued to K.V. Ivanov received vacation pay in the amount of 37,000 rubles, which were transferred to his account on February 8, 2018. The enterprise is obliged to pay income tax to the treasury no later than 02/28/2018.

Also see “Personal Income Tax Payment Deadline”.

Trade tax on the territory of Moscow

The trading fee must be determined and paid every quarter. There are no reporting periods for the trade fee. Transfer the calculated amount of the trading fee to the budget no later than the 25th day of the month following the taxable period (quarter).

Trade tax payment deadlines in 2021

| Deadlines for payment of trade tax in 2018 | |

| For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 |

| For the second quarter of 2021 | No later than July 25, 2018 |

| For the third quarter of 2021 | No later than October 25, 2018 |

When to pay personal income tax when dismissing an employee in 2021

The final payment is made on the day of dismissal. But sometimes an employee cannot come to collect his salary on time (for example, he gets sick). How long must the employer pay personal income tax in such a situation?

Based on clause 6 of Art. 226 of the Tax Code of the Russian Federation, tax is paid no later than the day of transfer to a bank account or delivery of wages in person (in the latter case - plus 1 day). Similar requirements apply when an employee is dismissed.

All possible deadlines for paying personal income tax on wages are presented in the table.

| Payment method | Budget settlement deadline |

| To a salary card | Day of transfer to account |

| Cash withdrawn from a bank account in advance | Date on which money was withdrawn from an account at a financial institution |

| Cash from daily earnings | No later than the next day after the employee is given the money |

Property tax

The deadline for paying the property tax of organizations in 2021 and the deadlines for paying advances on this tax are established by the laws of the constituent entities of the Russian Federation. Regional authorities also set deadlines for payment of transport tax/advance payments.

As for the deadlines for paying land tax and advance payments thereon, they are established by local regulations.

Accordingly, if there are objects of taxation for corporate property tax, transport tax and/or land tax, the payer needs to familiarize himself with the relevant law in order to avoid untimely transfer of tax/advance payment.

If you find an error, please select a piece of text and press Ctrl+Enter.

Dividends in 2021: income tax payment deadline

The management of business companies (LLC and JSC) has the right to pay their participants income from retained earnings. Frequency – once a quarter or based on the results of the reporting period.

Most income received by residents in the Russian Federation is subject to income tax. And dividends are no exception. The deadline for paying personal income tax in 2021 depends on the legal form of the enterprise.

The following table shows the limits on the timing of personal income tax payment in 2018 on dividends:

| Organizational and legal form of the company | Deadline for tax payment to the treasury |

| OOO | The day following the payment of dividends |

| JSC (CJSC, PJSC) | One month (from the date of transfer of money to shareholders) |

For more information about this, see “Personal Income Tax on Dividends”.

Concept and rates of income tax in 2020

Income tax (NDFL) is a tax paid on income received by all residents and non-residents of Russia.

The tax agent, i.e., calculates, withholds and transfers income tax from wages. person paying the income. Almost all income of a physicist is subject to taxation:

- wage;

- bonuses, allowances;

- remuneration received as part of the execution of civil contracts;

- winnings;

- income received in kind, etc.

Income tax rates depend on the status of an individual and the type of income:

| Tax rate | It applies to: |

| 13% | — income of residents of the Russian Federation; — income of refugees and citizens of the EAEU received while performing labor duties in the territory of the Russian Federation |

| 15% | dividends paid to non-residents |

| 30% | income from securities of Russian companies |

| 35% | — winnings in the amount of more than 4 thousand rubles; — interest on deposits in part of the excess of the amount of interest calculated on the basis of the Central Bank refinancing rate increased by 5%, etc. |

For more information about personal income tax rates, see the “Rate (personal income tax)” section.

When to transfer personal income tax when paying a monthly salary in two parts, find out in ConsultantPlus. If you don't have access to the system, get a free trial online.

For yourself: procedure and deadlines for paying personal income tax

When receiving funds from other sources (not through tax agents), the individual must independently pay the treasury. Such cases include, for example:

- winning the lottery;

- sale of real estate, the tenure of which does not exceed 3 years;

- cash prizes worth more than 4,000 rubles. and etc.

In 2021, the tax is paid no later than July 15 for the reporting period of 2017 (clause 6 of Article 227 of the Tax Code of the Russian Federation).

From January 1, 2021, winnings up to 4,000 rubles. are not subject to personal income tax. Tax on winnings from 4,000 to 15,000 rubles. the individual pays independently. Tax on winnings over 15,000 rubles. withheld by the tax agent.

Also see “Changes to personal income tax in 2021“.

UTII

Transfer the calculated UTII amount no later than the 25th day of the first month following the expired tax period (quarter). That is, no later than April 25, July 25, October 25 and January 25 of the year. This is stated in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation. Payment of advance contributions to the budget for UTII is not provided.

The deadline for paying UTII may fall on a non-working day. In this case, the tax must be transferred to the budget on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Deadline for payment of UTII in 2021

| For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 |

| For the second quarter of 2021 | No later than July 25, 2018 |

| For the third quarter of 2021 | No later than October 25, 2018 |

How do individual entrepreneurs pay income tax?

Merchants and individuals engaged in private practice make advance contributions to personal income tax upon receipt of a written notification from the tax office. The procedure and deadlines for paying personal income tax in 2021 in this case are regulated by clause 9 of Art. 227 Tax Code of the Russian Federation. The dates are presented in the table.

| Period | Payment deadline |

| January June | 07/15/2018 (postponed to 07/16/2018) |

| July – September | 10/15/2017 (postponed to 10/16/2017) |

| October December | 15.01.2019 |

Also see “Does an individual entrepreneur pay personal income tax for himself?”

Using up-to-date information about the deadlines for paying personal income tax in 2021 from our article, you can avoid conflicts with the tax office. Also use professional services and programs for accountants that include reminder functions. They will help you make all calculations and make payments in a timely manner.

Also see “Calculating Income Tax”.

Read also

18.08.2016

Value added tax (VAT)

Transfer the VAT amount calculated based on the quarterly results in 2018 evenly over the next three months. Payment deadlines are no later than the 25th of each of these months. For example, the amount of VAT payable to the budget for the first quarter of 2021 must be transferred in equal installments no later than April 25, May 25 and June 25.

If the 25th falls on a non-working day, then VAT must be paid no later than the first working day following the non-working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). For example, November 25, 2021 falls on a Sunday, so the last day to pay the first part (share) of VAT for the third quarter is November 26, 2021. This procedure follows from the provisions of Article 163 and paragraph 1 of Article 174 of the Tax Code of the Russian Federation. We present the deadlines for paying VAT in 2021 in the table (for legal entities).

VAT payment deadlines in 2021

| 1st payment for the fourth quarter of 2021 | No later than 01/25/2018 |

| 2nd payment for the fourth quarter of 2021 | No later than 02/26/2018 |

| 3rd payment for the fourth quarter of 2021 | No later than March 26, 2018 |

| 1st payment for the first quarter of 2021 | No later than 04/25/2018 |

| 2nd payment for the first quarter of 2021 | No later than 05/25/2018 |

| 3rd payment for the first quarter of 2021 | No later than June 25, 2018 |

| 1st payment for the second quarter of 2021 | No later than July 25, 2018 |

| 2nd payment for the second quarter of 2021 | No later than 08/27/2018 |

| 3rd payment for the second quarter of 2021 | No later than September 25, 2018 |

| 1st payment for the third quarter of 2021 | No later than October 25, 2018 |

| 2nd payment for the third quarter of 2021 | No later than November 26, 2018 |

| 3rd payment for the third quarter of 2021 | No later than December 25, 2018 |

Deadlines for payment of personal income tax by individuals

Personal income tax must be transferred no later than one day following the day of actual payment of income, including wages (including deposited and late paid). This rule came into force on January 1, 2021. Previously, personal income tax was paid on the very day when the organization withdrew cash from a bank branch for salaries or made a transfer to an employee’s account.

If cash balances from the company’s cash register were used, personal income tax was deducted no later than the next day. day. But a problem arose with deposited pay, since no actual payment occurred, and according to the law, tax is not calculated from invoices not posted to employees.

In the case of self-payment of personal income tax, he indicates the source of his income in the 3-NDFL declaration and submits it by April 30 of the calendar year following the reporting NP.

How can you reduce personal income tax 2021

Every taxpayer has the right to reduce the income tax payment paid through the use of tax deductions:

- standard;

- social;

- property;

- investment.

Now it is possible to obtain most of them directly from the employer. To do this, you need to write an application and collect documents confirming the right to deduction.

In addition, at the end of the year, you can submit a 3-NDFL declaration to the tax office to apply the deduction. It will be checked, after which a refund of the overpaid tax will be made.

Deadlines for personal income tax payment for individuals, entrepreneurs and tax agents

For each category of personal income tax taxpayers, there are special conditions for paying this tax and filing a declaration. For those categories of taxpayers who are required to make advance payments, the tax office itself sends out notifications. The amount of the advance payment is determined by the tax office based on the figures provided by the tax authority in the declaration for the past year (or the tax authorities calculate it based on the amount of expected income).

| Taxpayer | From what income | Personal income tax payment deadline | Advance payments | Deadline for filing a declaration |

| Individual (not engaged in business) | Based on profits recorded in the 3-NDFL declaration; For profits not subject to taxation, recorded by NA (valid until 2021) | Until July 15 of the next calendar year. for past NP | No | Until 30.04 of the year following the reporting year |

| For income not subject to taxation, recorded by NA (since 2016) | Until December 1 of the calendar year following the previous NP | No | Until April 30 of the year following the reporting year | |

| For income independently calculated and transferred by the taxpayer only for the purpose of obtaining tax deductions | Any day after the end of the calendar year | |||

| A foreign citizen who periodically travels to his homeland and is not engaged in business | For income recorded in 3-NDFL, sent ahead of schedule | Within 15 calendar days from the date of sending the early declaration | No | A month before the next departure home |

| IP | By business income | Until July 15 of the year following the reporting year | For January-June: until July 15 (1/2 of advance payments for the entire reporting year) For July-September: until October 15 (1/4 of advance payments for the entire reporting year) For October-December: until January 15 of the new year (1/4 of advance payments for the entire reporting year) | Until April 30 of the year following the reporting year |

| Representatives of private practice (including notaries and lawyers who have opened their own office) | By income from core activities | Until April 30 of the year following the reporting year | Until July 15 of the year following the reporting year. Note: when profits from private practice appear during the year, a 4-NDFL declaration is drawn up within 5 days after the expiration of a month from the date of the appearance of such income |

If the day of filing the declaration is a weekend, the deadline is postponed to the next working day.

Important! A 2-NDFL certificate is submitted for each employee. Read also the article: → “Why do you need a 2-NDFL certificate? How to fill out the form.” The employee must have worked during the reporting period for which the returns are submitted. The requirement is met even if the employee ultimately quits.

Penalties:

- 5% of the amount of personal income tax that was not transferred, for each partial/full month, starting from the date when it should have been paid. Limitation: the fine should not exceed 30% of this amount, but will not be less than a thousand rubles.

- a penalty equal to 1/300 of the refinancing rate in effect on the date of the late payment.

Tax returns

In some cases, the taxpayer must pay the tax themselves. For these situations, special declarations are provided; it is best to download them from the official website of the federal tax service. There are two main types of declarations.

Form 3-NDFL

This document is completed at the end of the calendar year. It must be completed and submitted by April 30 of the year following the reporting year:

- all individuals who pay tax on their own - individual entrepreneurs, lawyers, notaries;

- Russian citizens who received any financial funds abroad;

- citizens of Russia who received income from the sale of property (housing, cars, land).

The deadline for payment of 3-NDFL is July 15 of the following reporting year . For late filing of a declaration, a fine is imposed - 5% of the income tax. A declaration using the same form is submitted by citizens who wish to receive a tax deduction - they have the right to do this at any time during the year. The deduction is transferred to the bank account specified by the citizen within 3 months from filing the declaration.

Form 6-NDFL

6-NDFL is a more complex form of tax reporting. Its purpose is to explain the calculation of the amount of income tax determined by the tax agent. Completing this form is the responsibility of all employers paying personal income tax for their employees. Individual entrepreneurs who do not hire employees fill out this calculation for themselves.

The calculation consists of two parts, not counting the title page, which indicates information about the organization acting as a tax agent. The first section of the document contains general information about the tax rate, the amounts accrued in the reporting period and the total value of the tax withheld from them. In the second, the dates and volume of transfers of funds to the taxpayer are given line by line.

The document is submitted every quarter, strictly within a month after the end of the period. That is, the report for the first quarter is submitted no later than April 30 - a month after the end of the quarter (sometimes the deadline is postponed by several days due to the traditional May weekend).

Filling out this form requires some specific knowledge and skills, so it is advisable to entrust this work to a person with a professional education or at least someone who has experience interacting with tax authorities. There are a lot of recommendations on the Internet for filing 6-NDFL, but it would be more useful to consult with an accountant or tax officer.

6-NDFL is a more complex form of tax reporting.

Liability for non-payment

Penalties arising from non-payment of personal income tax have a wide range and depend on the form of the violation. By type, responsibility can be divided into:

- responsibility of organizations and individual entrepreneurs - tax agents;

- responsibility of individuals - tax payers.

The fine for late payment of personal income tax is up to 20% of the payment amount. At the same time, you should know that a penalty is charged only if the tax was withheld by the agent, but was not transferred to the budget.

If the non-payment is made intentionally and on a particularly large scale, the fine can be up to 500 thousand rubles.

Back to contents

Calculation of penalties for personal income tax

If there is a delay in paying personal income tax, the tax authorities charge a penalty, the daily interest on which is 1/360 of the refinancing rate of the Central Bank of the Russian Federation, which is valid on the day of accrual.

Back to contents

Date of receipt of other income

The date of receipt of income not related to wages depends on the form in which the income was received: monetary, in kind, in the form of material benefits, offset of similar counterclaims, debt write-off, per diem.

1. Cash income . When receiving income in cash, the date the income is received is the day the money is paid to the person. In this case, payment means:

- receiving cash;

- crediting money to the bank account of the income recipient (third parties on his behalf).

Such rules are established by subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

An example of determining the date of receipt of cash income not related to wages for calculating personal income tax

In March, Alpha LLC provided financial assistance. The accrued amount of financial assistance was paid to employees only on June 15.

Material assistance is income not related to wages. The income receipt date is June 15th.

2. Income in kind . When receiving income in kind, the date of receipt of income is the day of transfer of income in kind to a person (subclause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

An example of determining the date of receipt of income in kind, not related to wages, for calculating personal income tax

Alpha LLC builds housing by contract. The terms of the collective agreement stipulate that its employees standing in line for improved housing conditions pay 30 percent of the cost of the apartment. The organization carries out the rest of the work on the construction of apartments at its own expense.

This part is recognized as employee income received in kind. This is income not related to wages. The day of receipt of income in kind will be the date of signing the apartment acceptance certificate

3. Material benefit . A special procedure is provided for income in the form of material benefits. The dates for receiving such income vary depending on the type of material benefit:

- if a material benefit arises from the acquisition of goods (work, services, securities) at a price below market value, the date of receipt of income in the form of a material benefit is the day of acquisition. In some cases, a person can pay for securities after the transfer of ownership rights to him - then the date of receipt of income in the form of material benefits will be the day of payment for the securities;

- if a material benefit arises from receiving borrowed funds at low interest or without interest, the date of receipt of income in the form of a material benefit is the last day of each month for the entire period for which the loan (credit) was provided to the person.

Such rules are established by subparagraphs 3 and 7 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

4. Settlement of counterclaims of the same type . In this case, the date of actual receipt of income will be the day of the offset (subclause 4, clause 1, article 223 of the Tax Code of the Russian Federation).

5. Writing off debt from the organization’s balance sheet . If a person receives income as a result of writing off a bad debt from the organization’s balance sheet, the date of receipt of income will be considered the day the debt was written off (subclause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

6. Travel expenses . If an employee received income upon reimbursement of travel expenses, the date of receipt of such income is the last day of the month in which the advance report for the business trip was approved (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation).

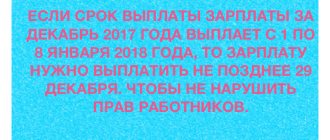

When to pay salary in December

Salaries must be paid at least every half month (Article 136 of the Labor Code of the Russian Federation).

The date of payment is fixed in the internal labor regulations, collective or employment agreement. It should not go beyond 15 calendar days from the end of the period for which earnings were accrued. This means that salaries for December cannot be issued later than January 15. Most employers issue salaries for the past month on the 5th or 10th of the coming month. In January, these days fall on holidays. In this case, you need to pay the money in advance (Article 136 of the Labor Code of the Russian Federation).

According to the Labor Code of the Russian Federation, organizations that issue salaries from January 1 to January 10 must pay them on Thursday, December 31, 2021. According to the law, this day is a working day, although it is shortened by an hour.

Calculate your salary and personal income tax with standard deductions in the web service

Should an individual entrepreneur pay personal income tax?

The answer to the question whether an individual entrepreneur must pay personal income tax depends on the form of taxation he chooses. On OSNO, individual entrepreneurs pay this tax after filling out the relevant declarations (3-NDFL). This is the only form of tax collection that requires the entrepreneur to pay income tax, so in practice it is extremely rare.

Other forms of taxation exempt entrepreneurs from personal income tax, although each option has a number of features. For example, an entrepreneur using a simplified system does not have to pay personal income tax on income received from business activities. This is considered the most profitable option, so most individual entrepreneurs work in a “simplified” manner.

When applying UTII for individual entrepreneurs, personal income tax is also cancelled, but only for the designated industry. When income arises from another type of activity, the entrepreneur will have to pay tax. The same applies to the patent taxation system - personal income tax is abolished only in the patent area.

Please also note that an individual entrepreneur who uses hired workers in his activities acts as a tax agent for them - that is, he fulfills the obligation to pay income tax for them along with filling out all reporting forms and declarations.

How can an entrepreneur pay income tax for an employee?

So, individual entrepreneurs are responsible for paying income tax for their employees. In accordance with the law, personal income tax on wages must be paid on the day the funds are transferred or issued to the employee for the month worked.

The amount of payment to the budget is calculated using a simple formula: total earnings x 0.13. Let's give an example. Let’s say the employee’s total earnings are 25 thousand rubles. What tax do I have to pay for it? It’s simple: 25,000 x 0.13 = 3250. That is, the entrepreneur must pay 3,250 rubles to the budget for this employee.

For foreign citizens there is an increased rate of 30%. Therefore, if a non-Russian citizen was involved in the work, the calculation will look like this: 25,000 x 0.3 = 7,500 rubles. That is, for the income of a foreign citizen you will have to pay almost 3 times more to the budget.

In some cases, the taxpayer must pay the tax themselves.

Which individuals independently calculate and transfer personal income tax to the budget?

Taxpayers are required to calculate and pay personal income tax themselves if:

- they received a certain type of income (Article 228 of the Tax Code of the Russian Federation);

- they fall into a separate category (Article 227, Article 227.1 of the Tax Code of the Russian Federation).

Certain categories of taxpayers include (in accordance with Article 227, Article 227.1 of the Tax Code of the Russian Federation):

- individuals engaged in entrepreneurial activities;

- individuals engaged in private practice (lawyers, notaries);

- foreign citizens working in the Russian Federation on the basis of a patent.

See also the material “Who are personal income tax taxpayers?”

Individual entrepreneurs need to keep in mind that starting from 2021, they themselves must calculate personal income tax advances throughout the year. The calculation procedure is described in detail in ConsultantPlus:

Get free full access to K+ and you will be able to see not only the formula, but other nuances of personal income tax payment by entrepreneurs.

The object of taxation is income received from the activities of these categories of taxpayers:

- business income;

- income from private practice or law office activities;

- income from employment or civil contracts.

Calculation and payment of personal income tax are carried out by tax residents of the Russian Federation, namely:

- taxpayers who received income from organizations and individuals who are not tax agents under employment contracts, employment and lease agreements, civil law contracts;

- taxpayers who received income from a tax agent who did not withhold personal income tax;

- taxpayers who received income from winnings in the lottery and gambling (the exception is winnings paid in a bookmaker's office or sweepstakes);

- taxpayers who received income from the sale of their own property or property rights;

- taxpayers who received income in the form of gifts from individual entrepreneurs or individuals, except for gifts that are not taxed (clause 18.1 of Article 217 of the Tax Code of the Russian Federation);

- taxpayers who received income in the form of remuneration to the legal successors of authors of works of art, literature, and industrial designs;

- taxpayers who received income as real estate, securities received to replenish the target capital of non-profit organizations.