It happens that a legal entity decides to purchase not a new car, but a used one. The reasons, within the framework of the question, are not so important.

This procedure of purchase and sale between individuals. and legal entities has many nuances associated with the acceptance of a vehicle on the balance sheet of a legal entity. We focus on the features of the procedure. We will tell you in this article how to avoid the risk of losing all the benefits from the transaction.

No problems needed

Why do accountants have such questions? Everything is obvious. Organizations and individual entrepreneurs are by default tax agents for personal income tax. What does this mean in practice?

The income that a company or individual entrepreneur pays to “physicists” must be calculated, withheld and transferred to the state budget for personal income tax. Is buying a car from an individual a basis for such actions? Let's figure it out.

For your information

Liability is provided for failure to fulfill the duties of a tax agent for personal income tax. Thus, for non-payment of tax, the inspectorate may collect a fine from the agent in the amount of 20% of the tax amount, provided that (clause 1 of Article 123 of the Tax Code of the Russian Federation):

- the tax agent did not timely withhold tax from funds paid to an individual;

- the tax agent did not transfer or did not completely transfer the amount of tax withheld from the “physicist” within the established period.

Paying a fine will not relieve the company from the need to transfer the withheld tax amount to the budget. Also, the tax inspectorate will be able to collect tax in an indisputable manner (clause 1 of article 46, clause of article 47, clause 5 of article 108 of the Tax Code of the Russian Federation).

Purchase of a car by a legal entity from an individual - transactions

There are certain accounting entries that need to be recorded.

- DEBIT 10 (41) CREDIT 60 - if the goods are accepted for accounting.

- DEBIT 08.4 CREDIT 60 - if there is a debt to the seller for transport.

- DEBIT 01 CREDIT 08.4 - if the means of production is registered.

- DEBIT 60 CREDIT 50 (51) - if the company paid for the purchase.

If the vehicle is purchased for resale:

- DEBIT 41 CREDIT 71 - if the goods are received;

- credit account - sale and resale of goods - 90;

If the company does not resell vehicles, then it is required to indicate the reason why the vehicle was sold.

- DEBIT account - 91 - other expenses of the enterprise with the sale of vehicles.

- DEBIT 91 CREDIT 41 - includes surpluses, unforeseen circumstances.

To prepare documents, it is advisable to have not only a notary, but also a competent accountant from the company itself.

No reason

If we are talking about buying a car from an individual, personal income tax does not need to be withheld. This is explained as follows. In accordance with the provisions of the Tax Code, an organization (legal entity) or individual entrepreneur that purchased property, including a vehicle, from an individual is not recognized as tax agents for personal income tax. This means that there is no need to withhold and transfer tax to the budget (clause 2 of Article 226 of the Tax Code of the Russian Federation).

Individuals selling property must themselves calculate the amount of tax payable to the budget, declare it and pay it within the period established by current legislation (Article 228 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated March 28, 2008 No. 03-04-05-01/89).

However, not every sale of a car generates income subject to personal income tax for its former owner. So, if a citizen sold a car that he owned for more than 3 years, then the cost of its sale is not subject to personal income tax (clause 17.1 of Article 217 of the Tax Code of the Russian Federation). And if an individual does not have taxable income, then there is no need to file a 3-NDFL declaration (Letter of the Ministry of Finance dated May 30, 2018 N 03-04-05/36698).

Let us note that when selling vehicles that are more than 3 years old, no income arises for citizens who (clause 17.1 of Article 217 of the Tax Code of the Russian Federation):

- are tax residents of the Russian Federation, i.e. they were actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation);

- did not use the sold car in business activities.

If a car that a citizen has owned for less than 3 years is sold, the individual will receive income. This means that you will need to report it to the Federal Tax Service.

SPI

Useful life is an indicator that makes it possible to understand how long the main means of production will generate income. SPI is necessary for making accounting entries .

The problem is that, in order to determine the useful life, documents are needed that make it possible to understand how long the machine “was in use” previously. Without this, it is impossible to establish SPI.

It would seem that nothing could be simpler: you need to open the PTS and look at the dates of registration of the vehicle with the traffic police . But the Ministry of Finance thinks differently. There are a number of letters on this matter. For example:

- 03-03-06/1/10056;

- 03-03-06/1/658.

The reason is simple: the fact of putting any dates on the title does not indicate that it was in these numbers that production depreciation of the car began.

Practice followed the following path: SPI for cars purchased in the name of organizations from individuals. persons are not determined . That is, the cars pass through the papers like new. This is not entirely correct, but no other way out was found.

Personal income tax on the sale of a car less than 3 years old

In order not to pay personal income tax on the entire sales price of the car, the seller can use the following deduction:

- or in the amount of expenses spent on the purchase of this vehicle, if there are documents confirming these expenses;

- or in the amount of 250 thousand rubles. (clauses 1, 2, clause 2, article 220 of the Tax Code of the Russian Federation).

For example, an individual sold a car for 750 thousand rubles. But he has documents confirming that you bought this very car 2 years ago for 1.2 million rubles. Then your personal income tax base will be negative (750 thousand rubles - 1.2 million rubles), and you will not have to pay personal income tax. But if the documents confirming your expenses from 2 years ago have not been preserved, then you will only be able to take advantage of a deduction in the amount of 250 thousand rubles. Accordingly, the personal income tax base will be 500 thousand rubles. (750 thousand rubles - 250 thousand rubles), and the tax amount is 65 thousand rubles. (500 thousand rubles x 13%). Since the income of tax residents of the Russian Federation is taxed at a rate of 13%. The tax must be paid no later than July 15 of the year following the year of sale of the car (Clause 4 of Article 228 of the Tax Code of the Russian Federation).

Read also

23.09.2016

VAT

Phys. persons do not pay VAT. This rule is contained in Art. 143 Tax Code of the Russian Federation. There will be no “input” VAT. But the tax will need to be charged if the company wants to resell the car (Article 146 of the Tax Code of the Russian Federation).

Exceptions (Article 154 of the Tax Code of the Russian Federation):

- Vehicles purchased for resale.

- Agricultural machinery contained in the list approved by the government (Decree No. 383 of May 16, 2001).

The VAT rate will be 10 or 18% (from 2021 - 20%).

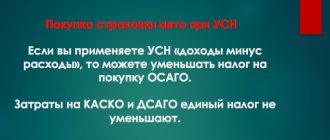

Preparation of documents for used car insurance

Buying a used car secondhand does not necessarily require maintaining a compulsory motor liability insurance policy.

According to the established procedure, if you buy a car without insurance, you must obtain it within 10 days after the purchase and sale transaction is concluded. At this time, you cannot be fined for its absence, but if you get into an accident and are found to be at fault for the accident, you will have to pay compensation out of your own pocket. Therefore, do not delay in applying for a policy! You can also negotiate with the seller to keep your current insurance. In this case, you will need to visit the insurance company together to re-issue the papers. For the unused insurance period, compensation is provided to the ex-owner.

Also read: How to apply for compulsory motor liability insurance when buying a used car

What to check before purchasing a car from an organization

Despite many “horror” stories from legal practice, it is possible to buy a good car from a legal entity. But before that, be sure to check:

- Powers of the person signing the contract. Availability of consent of the owners of the organization to the alienation of property.

- The reputation of the seller on the website of arbitration courts. If an organization has a history of litigation, there is a high probability of encountering an unscrupulous counterparty.

- Technical condition of the car. Organizations operate cars to the point of wear and tear. The technical condition of such machines is significantly worse than the market average.

- No lien on a specific vehicle.

- No debts to the Bailiff Service.

- No restrictions on registration.

And, as they say, be careful!

Author: Anastasia Kukhlevskaya

Putting the car on the balance sheet of the purchasing organization

After completing the purchase and sale transaction, the car must be accepted onto the balance sheet of the purchasing organization. A car is classified as a fixed asset (fixed asset) of production, since the period of use of the vehicle exceeds 12 months, and its cost, as a rule, is not less than 40,000 rubles.

The legal entity that purchased the car accepts it on its balance sheet on the basis of the transfer and acceptance certificate in the OS-1 form (Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). The act is drawn up by a special commission organized at the enterprise by order of the general director.

Next, the responsible person draws up an inventory card in the OS-6 form. It contains information from the vehicle report and passport. Documentation (form OS-1 and OS-6) can be developed by the organization independently on the basis of standardized forms.

It is worth noting that the acceptance certificate and the procurement act are different documents.

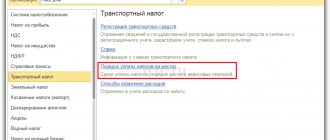

Registration of a car with the traffic police

The purchased vehicle must be registered with the traffic police. For this you will need an MTPL policy. To obtain it, you must obtain or use an existing diagnostic card, which is issued after the technical inspection. The document indicates that the machine is suitable for use.

So, a company representative must perform the following procedure:

- In the absence of a diagnostic card, ensure that the vehicle is inspected.

- Take out a compulsory motor liability insurance policy.

- Re-register the car with the traffic police as a legal entity.

- After inspecting the car at the traffic police department, obtain the necessary documents.

Only when the above actions are performed can it be stated that the organization purchased the vehicle legally.

Find out in more detail how a legal entity registers a car with the traffic police.

Algorithm for purchasing a car by a legal entity

Purchasing a car is a complex process. Conventionally, it is divided into several stages:

- Inspection of the car by the buyer. This is done by a representative of a legal entity. Usually at this stage a vehicle inspection is required.

- Setting the price.

- Drawing up a purchase and sale agreement (SPA).

- Transfer of money.

- Receipt by the buyer of the car and documents.

A legal entity has the right to require the preparation of additional documents.

The standard package of papers that accompanies the purchase of a car by an organization includes:

- PTS.

- Sales and purchase agreement (SPA).

- Purchasing act.

- Certificate of acceptance and transfer of the vehicle.

The documents are signed by the responsible person of the company. The agreement contains the necessary information about the seller:

- FULL NAME.,

- Date of Birth,

- passport details.

Moreover, if the owner of the car has a wife, he must present her written consent to conclude the transaction, certified by a notary. To purchase a vehicle, the signature of a representative of a legal entity and the seal of the organization are required.

Balancing is carried out on the basis of a procurement act. This further allows you to perform the necessary accounting operations.

Procedure for registration of PTS

When the procedure for registering a contract for the purchase of a car in person is completed, it is necessary to make a new entry in the vehicle passport. Be careful when filling it out and write legibly! You need to enter:

- date of purchase;

- number of the document confirming ownership and date of registration;

- signatures of the seller and buyer.

Please note that if one of the parties to the transaction has the status of a legal entity, the signature must be certified by a seal.

If there is no free space left in your passport (this happens infrequently, but it happens), you will have to go with the seller to the traffic police to get a new one. The inspection staff will replace the document (all data will be checked against the electronic database) and re-register the car.

This concludes the process of purchasing a used car. After making an entry in the PTS, the money is transferred. It is better to transfer funds by bank transfer (unless another method was initially agreed upon). In this case, the fact of the transfer will be additionally recorded, which will protect the buyer.

Results

For an organization, there are no fundamental differences in accounting for transactions involving the purchase of fixed assets from legal entities and individuals.

The accountant draws up the same primary documents and makes the usual postings. And most importantly, there is no obligation to pay additional taxes and prepare reports. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of payment: by bank transfer and in cash

Paying for the purchase of a car by bank transfer is the most acceptable option. A vehicle is an expensive product, so it is risky to carry large amounts of cash. But it is worth remembering some features:

- When paying for a purchase using your card, a fee may apply. Even a small percentage is not beneficial to the car seller, so he will insist on paying in cash.

- When transferring money through a current account, the bank charges a commission from the buyer.

You can buy transport by transferring money from the current account of an individual entrepreneur, but it is worth considering the purpose of the purchase: for personal use or for work, since any expenses and income are monitored by the tax organization.

With the first option, it is better to make payment through a personal account. Often, when paying in cash, a car dealership offers customers a good discount, and even with this payment method, the purchase occurs quickly and without delays.

An individual entrepreneur is allowed to use cash in the following situations:

- payment of salaries;

- under report;

- insurance premiums;

- personal needs;

- payment for contractor services;

- refund;

- payment of money to the paying agent.

The purchase of a vehicle can be included in the category of personal needs. To do this, you will need to issue a sales and cash receipt.