Bank commission - postings in 1C 8.3

In the accounting system, the bank’s commission is reflected in account 91.02 “Other expenses” (clause 11 of PBU 10/99).

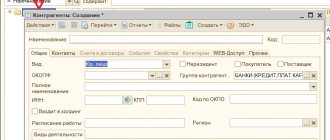

Reflect the debiting of the bank commission using the document Debiting from the current account in the Bank and cash desk - Bank statements section.

Specify the type of transaction - Bank commission .

the expense item Expenses for banking services if the item settings indicate:

- Use silently in transactions - Payment of bank commissions .

Familiarize yourself with other ways to reflect bank commissions in 1C 8.3 Accounting

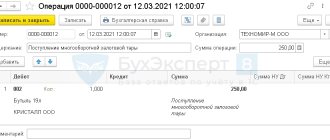

Postings

When you select the type of transaction Bank Commission, a transaction with 91 accounts is generated automatically.

Types of bank commissions

The most common types of bank rewards are:

- for cash settlement services (SSC);

- for making a payment;

- for the remote banking system (RBS or Bank-client);

- for cash withdrawal;

- acquiring commissions.

The commission for cash settlement services and remote banking services is set at a fixed amount and in some credit institutions it is charged as a subscription fee even in the absence of transactions on the account.

The remuneration for making payments is most often set at a fixed amount for each payment and only when transferring money to another bank.

For cash issuance and acquiring – it is set as a percentage of the amount of funds.

All of the above services of credit institutions are not subject to VAT. But, in addition to this, banks provide services subject to VAT: collection, maintenance of a credit line, provision of safe deposit boxes or SMS information.

It is advisable to account for accounting entries for bank commissions with and without VAT on different accounting accounts.

Refund of bank commission - postings in 1C 8.3

It happens that the bank returns the withheld commission for various reasons: incorrect tariff, excessive withholding, etc.

The reflection of this operation depends on the moment of return:

- immediately after holding;

- after the write-off of the commission is reflected in the reporting.

Refund of commission immediately after deduction

If the write-off and return are reflected in the same period, return to the commission write-off document and correct it to:

- Type of transaction - Other write-off ;

- Debit account - 76.02 “Calculations for claims.”

Select the expense item with the type of movement Other payments for current operations .

Postings

Reflect the return of the commission in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

Refund of commission after reporting

Since at the time of withholding it was not known that the commission was withheld unlawfully, its recognition as expenses is not considered an error, and in the return period, income is reflected in the accounting system (clause 2 of PBU 22/2010) and NU (Letter of the Ministry of Finance of the Russian Federation dated 08/13/2012 N 03-03-06/1/408, dated 01/30/2012 N 03-03-06/1/40).

If the commission has already been taken into account in expenses and the period is closed, reflect the return in the document Receipt to the current account (Bank and cash desk - Bank statements).

Postings

If the organization takes a cautious approach and believes that there is no basis for reporting in this case:

- expenses for deducting the commission (clause 1 of Article 252 of the Tax Code of the Russian Federation);

- income from the return of the commission (clause 1 of article 41 of the Tax Code of the Russian Federation),

That:

- reverse the expense to reflect the write-off of the commission in NU;

- do not reflect the income from the return of the commission in tax accounting (indicate the directory article Other income and expenses with the Reflect in tax accounting checkbox cleared);

- submit an updated declaration, because the tax is underestimated (clause 1 of article 81 of the Tax Code of the Russian Federation).

Learn more about ways to adjust your income tax return in 1C 8.3:

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: manual completion of an updated declaration

- Error: the amount of costs when purchasing services is overestimated. Corrections for income tax: automatic completion of an updated declaration

We looked at how to reflect operations on deduction and return of bank commissions in 1C 8.3 Accounting.

Test yourself! Take a test on this topic using the link >>

Setting up downloading statements from a client bank

Again, go to “Bank statements” through the “Bank and cash desk” tab.

Select “Download”, then the desired organization, bank account - “Settings”.

The system can offer exchange settings with the client-bank. This needs to be done, so select “Open Settings”.

Select the name of the client bank. Then specify the download file where information about the flow of funds in the account is located. To create it, you need to go to the client bank and find the unloading point in 1C.

When you upload a file, you will need to indicate its location. Then in 1C register the path to this folder. To do this, use the “Download File” field.

You will see another field “Upload File”. But if you make all payments in the client bank, you don’t have to change it. The “upload file” will be needed when outgoing payments are made in 1C and then uploaded to the client bank.

When all the settings have been completed, the data file has been downloaded from the client bank, you need to “Update from statement”. We check the list of payment orders, especially the “Type of transaction” column. If necessary, we make changes. Then click “Download”.

The uploaded documents will be reflected in the bank statement in 1C.

Learning to work with corporate cards (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Bank and cash desk

2018-02-06T11:33:48+00:00

| Is the article outdated and in need of revision? |

In this lesson we will look at the reflection in 1C: Accounting 8.3 (edition 3.0) of transactions with corporate cards.

A corporate card is a bank card linked to an organization’s card account.

Typically, an organization opens a special card account in a bank and links the required number of bank cards, which are called corporate, to this account.

The organization transfers funds from its main current account to this card account, and employees who are issued corporate cards withdraw money from these cards for their own account .

Then employees report on the expenditure of funds withdrawn from corporate cards using advance reports .

The advantages of corporate cards are obvious:

- costs and time for issuing funds for reporting are reduced

- the risk of losing cash is reduced

- it becomes possible to withdraw funds from the card in the desired currency (an irreplaceable thing when traveling abroad)

- control over the spending of funds appears online (for example, using a mobile application)

- it becomes possible to set limits both for the card account in general and for corporate cards in particular

- there is an opportunity to make purchases on the Internet

Requirements when working with corporate cards:

- funds withdrawn from the cards cannot be used for settlements with employees for wages and in general for any social payments

- An agreement is concluded with the bank on the issuance and servicing of corporate cards, to which is attached a list of employees who will use these cards

At the same time, as one of the readers corrected me, it is possible to withdraw cash using a corporate card and deposit it into the cash register for payment of wages.

Let me remind you that this is a lesson and you can safely repeat my steps in your database (preferably a copy or a training one), the main thing is that the version of the database is 1C: Accounting 8.3, edition 3.0.

To work with a card account in accounting, account 55 “Special accounts in banks” is used.

| Dt 55.04 Kt 51 Transferred money from the main current account to the card account. Dt 71 “Ivanov” Kt 55.04 Employee Ivanov withdrew money from a corporate card for reporting. Dt 91.02 Kt 55.04 Bank commission for cash withdrawal. Dt 20 Kt 71 “Ivanov” Employee Ivanov reported on the use of funds. |

Let's now look at these same operations in the “troika” (1C: Accounting 8.3, edition 3.0).

Cash (PKO, RKO, Collection, Cash Book)

Let's start looking at cash transactions. In the “Bank and Cash Office” section, open the “Cash Documents” journal. The journal is very similar to the journal of bank documents; it contains documents on receipts and debits of cash. You can also print a cash book from it.

Let's start with the operation of receiving money to the cash register from a current account. Let’s create a receipt document with the transaction type “Receiving cash at the bank” dated January 13 in the amount of 100 thousand rubles. Credit account - 51 accounts. Accepted from: the current account from which we will debit the money. Reason: Receiving cash from the bank. Let's go through this document.

We create the document Cash receipt order. Type of transaction: Issue to an accountable person. The date is January 13. We indicate the recipient - open the list of available individuals. We choose our director, to whom we will give 100 thousand rubles. You can indicate passport data, application, basis and comments to this document. Let's see it through.

Documents can be printed: outgoing cash order, incoming cash order, you can print the register of documents.

The cash book can be automatically generated based on the posted cash documents.

Now let’s go to the “Bank and Cash Office” section of the “Advance Reports” journal and try to create an advance report.

The document is intended to reflect in the accounting of expenses of an employee of an organization at the expense of funds received by the employee on account.

When entering a document, you must indicate the following details in the header:

- An accountable person is an employee of an organization who is accountable for the funds issued to him on account.

- Warehouse - a warehouse that stores goods, materials and other valuables purchased by an accountable person.

On the Advances , information about the amounts received by the accountable person is filled in. Fill in the details:

- Advance document is a document that reflected the employee’s receipt of funds for reporting (Cash issuance, Debit from a current account or Issuance of cash documents). When you select an Advance Document, the details of Advance Amount , Currency and Issued are filled in automatically.

- Spent - indicates the actual spent portion of the amount received for the report.

On the Products , fill in information about inventory items purchased by the accountable person:

- Nomenclature , Quantity , Price , Amount , % VAT , VAT are filled in with data on the purchased values.

- The name of the document (expense) , Document number and Document date must be filled in to correctly generate the printed form of the expense report.

- If an invoice for purchased assets is attached to the advance report, you must check the Invoice presented , indicate the Supplier the Invoice Date and Invoice Number fields . When conducting an advance report, in this case the document Invoice received will be automatically created.

- To generate transactions for the receipt of inventory items from an accountable person, you must fill in the Account Account and VAT Account . When you select an Item, the details are filled in automatically according to the Item Account register data.

On the Containers , information about returnable containers received by the accountable person from suppliers is filled in.

Payment tab contains information about the amounts paid to suppliers for previously purchased goods, works and services or paid as an advance payment. Fill in the details:

- Counterparty is the supplier to whom the payment was made.

- Agreement - an agreement with a counterparty. Must be in the form “With supplier”, “With principal (principal)” or “Other”.

- Debt repayment is a method of repaying debt to a supplier in the context of settlement documents. You must select one of the possible methods: Automatically, By document or Do not repay .

- Payment document - indicated only when choosing a method of debt repayment According to document . In this case, during the transaction, the debt will be repaid only according to the specified settlement document.

- Amount —the amount of payment to the supplier.

- The amount of mutual settlements is the amount of payment to the supplier in the settlement currency specified in the Agreement .

- Settlement account - an accounting account in which the balance of the debt will be repaid upon posting. Not indicated when choosing the debt repayment method Do not repay .

- Advances account is an accounting account to which the part of the payment that remains undistributed after the repayment of the counterparty's debt is allocated.

- Name input. document , Entry number. document and entry date. The document must be completed to correctly generate the printed form of the expense report.

On the Other , fill in information about other expenses incurred by the accountable person (travel expenses, travel expenses, gasoline expenses, etc.):

- The name of the document (expense) , Document number and Document date must be filled in to correctly generate the printed form of the expense report.

- If an invoice for purchased valuables is attached to the advance report, you must check the Invoice presented , indicate the Supplier and fill in the details Invoice date and Invoice number . When conducting an advance report, in this case the document Invoice received will be automatically created. Strict reporting form checkbox is selected if VAT on travel expenses is deducted on the basis of the received strict reporting form. The created invoice is not registered in the Logbook of received and issued invoices.

- Amount , % VAT , VAT are filled in with data on expenses incurred.

- To generate expense transactions, you must fill in the Cost Account (AC) , the analytics for this account, and the VAT Account . If the organization is a profit tax payer, the Cost Account (CO) and the analytics for this account are additionally filled in. When you select Items, accounting accounts are filled in automatically according to the information register of the Item Accounting Accounts.

For the document Advance report, a printed form AO-1 (Advance report) is provided.

On January 20, we create an Advance report. Accountable person: director.

On the “Advances” tab, add the cash order for which the advance was issued.

On the “Goods” tab we indicate the expense document: check No. 542 dated January 15. Nomenclature – create a new position “Printer paper” with the Nomenclature Type “Materials”. Quantity 10, price 200 rub. VAT 18% = 360 rub. Supplier – let’s create a new one:

- Name: LLC "TC KOMUS",

- INN/KPP: 7706202481/ 770601001

- OGRN: 1027700432650

- Address: 119017, Moscow, Staromonetny lane, building No. 9, building 1

Invoice: No. 8245112 dated January 15.

Accounting account 10.01, VAT account 19.03.

On the “Payment” tab we indicate the document (expense): check No. 58 dated January 14. Counterparty – let’s create a new one:

- Name: ZAO "RAIFFeisenBANK", in the amount of 1,500,000.00 rubles.

Register a receipt to the current account dated January 30, payment from the buyer, incoming number 56 dated January 30. Payer:- Name: ATAK LLC

- INN/KPP: 7743543232 / 774301001

- OGRN: 1047796854533

- Address: 125635, Moscow, Angarskaya street, building No. 13

- Agreement with the buyer 5426/65552 dated 01/14/2015

The amount is 349,000 rubles. Offset of advances is automatic, VAT 18%.

Register a receipt to the current account dated 02.02 payment from the buyer, incoming number 526 dated 02.02. Payer:

- Name: ATAK LLC

- INN/KPP: 7743543232 / 774301001

- OGRN: 1047796854533

- Address: 125635, Moscow, Angarskaya street, building No. 13

- Agreement with the buyer 5426/65552 dated 01/14/2015

The amount is 500,000 rubles. Offset of advances is automatic, VAT 18%.

Register a receipt to the current account dated 10.02 payment from the buyer, incoming number 352 dated 10.02. Payer:

- Name: BILLA LLC

- INN/KPP: 7721511903/ 774901001

- OGRN: 1047796466299

- Address: 109369, Moscow, Novocherkassky Boulevard, building No. 41, building 4

- Agreement with the buyer 7458/85/96 dated 01/15/2015

The amount is 2,500,000 rubles. Offset of advances is automatic, VAT 18%.

Complete a debit from the current account dated January 30. Other debits, incoming number 904258 dated January 30. Recipient:

- Name: OJSC SBERBANK OF RUSSIA

- INN/KPP: 7707083893/ 775003035

The amount is 490 rubles. Monthly fee for the provision of services using the Sberbank Business Online system for 'January 2015'. NDS is not appearing.

Complete a debit from the current account dated January 30. Other debits, incoming number 36666 dated January 30. Recipient:

- Name: OJSC SBERBANK OF RUSSIA

- INN/KPP: 7707083893/ 775003035

The amount is 600 rubles. Commission for maintaining the account '40702810638000067179' in rubles for the period from '01/01/2015' to '01/31/2015'. NDS is not appearing.

Register the receipt of cash from January 31 Payment from the buyer. Payer:

- Name: BILLA LLC

- INN/KPP: 7721511903/ 774901001

- OGRN: 1047796466299

- Address: 109369, Moscow, Novocherkassky Boulevard, building No. 41, building 4

- Agreement with the buyer 7458/85/96 dated 01/15/2015

The amount is 304,000 rubles. Offset of advances is automatic, VAT 18%.

Draw up an advance report dated January 26 Reporting to: director.

Purchased by receipt 555 dated January 16 “Printer paper” 1 pc. at a price of 200 rubles. + VAT 18%. Supplier TC Komus LLC. Invoice 84523659 from 16.01

Payment was made to the supplier ZAO "TMP No. 20" by check 60 dated January 16 under agreement 15/011 dated January 14 in the amount of 10,000 rubles.

Services were paid for by check 452 dated January 16 for photocopying documents in the amount of 500 rubles, excluding VAT. General running costs.

Generate invoices for advance payments for the 1st quarter.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

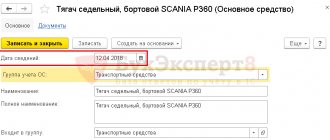

How to enter information about organizations in the 1C: Accounting 8 program

Interface Taxi 1C Accounting 8.3 How to switch to bookmarks, 1C Accounting 7.7 Accounting for production and production costs Setting up functionality in the 1C Accounting 8.3 program Fixed Asset Accounting