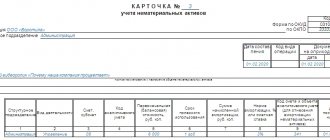

Inventory card (OS-6) in 1C 8.3

The organization must approve the form of the inventory card for further accounting of fixed assets. In 1C 8.3, a card of the OS-6 form is used. It reflects all operations carried out with the OS object from the moment it was accepted into the OS (clause 12, clause 13 of the Guidelines for accounting of OS, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

Where can I find the OS inventory card (OS-6) in 1C 8.3? The fixed asset card in 1C 8.3 is located in the section Directories - OS and intangible assets - Fixed assets.

An inventory card is created when a fixed asset is received by the organization. In general, the card is filled out automatically when documents are processed, but some data must be entered manually.

The data in the fields filled in automatically is relevant as of the current date. If you are analyzing (printing) past data, then in the Date of information , indicate the desired date.

If you don’t see such a field in the card, then add it using the More - Change form button.

Sequencing

How to fill out an inventory card for recording fixed assets? Let's look at some of the nuances of filling out each section:

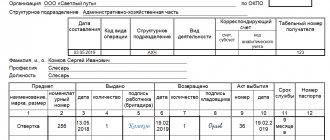

- The header of the document contains basic information about the legal entity (name of the organization, OKPO code, etc.), information about the object (series, model, brand, etc.).

- Section 1 provides information about the property that was already in use at the time the inventory card was compiled. If the OS is new, the section is left blank.

- In section 2 of the inventory card of a fixed asset object, information about the property at the time of its acceptance is entered. In the column “Initial cost” indicate the costs of purchasing the OS (excluding VAT). The useful life is calculated taking into account which depreciation group the property belongs to.

- Section 3 is completed after the asset has been revalued. Replacement cost is calculated as the difference between the original cost and the value of the asset after revaluation.

- Section 4 contains data on all movements of property within the enterprise, as well as on the disposal (write-off) of assets. The procedure for filling out an inventory card for accounting for fixed assets assumes that all entries in this section will be made on the basis of acts. It is mandatory to indicate the name of the document, its number and date of preparation.

- Section 5 contains information about the property after its reconstruction, completion, modernization and other operations, after which its initial value changes.

- Section 6 is intended to show the cost of repairing the asset. Here you must indicate the type of operation, the name of the document and the amount of costs incurred.

- Section 7 displays information about fixed assets containing precious or semi-precious materials. Also here is information about the structural elements that are a distinctive feature of the OS.

How to print an inventory card in 1C 8.3

Click the Inventory card (OS-6) or More - Inventory card (OS-6) button in the fixed asset card (section Directories - Fixed assets and intangible assets - Fixed assets). PDF

The OS Inventory Card form in the OS-6 form will be filled in with current data as of the Information Date .

The inventory card must be updated when:

- moving the OS,

- changing OS accounting parameters;

- during modernization, repair (reconstruction, etc.);

- upon departure.

In 1C you can also print out the inventory book for accounting of fixed assets (form OS-6b), which is used to account for fixed assets of a small enterprise.

The report Inventory book of fixed assets is located in the section OS and intangible assets - Reports - Inventory book of fixed assets (OS-6b). PDF

Test yourself! Take the test:

- Test. Purchase of a fixed asset with additional delivery costs

- Test. Purchase of fixed assets using loan funds

- Test. Sale of fixed assets at a loss

- Test. Acceptance of fixed assets with depreciation bonus for accounting

- Test. Purchase of a fixed asset: car

- Test. Document Acceptance for accounting of fixed assets

Is the OS-6 form mandatory?

Since since 2013, the forms of primary documentation approved by Goskomstat have ceased to be mandatory, organizations can develop their own forms of inventory cards. The main thing is that they are enshrined in the Accounting Policy. Also, the documentation must contain the mandatory details listed in paragraph 2 of Art.

In practice, in addition to the OS-6 form, the following forms are often used:

- Group accounting card OS-6a;

- Inventory accounting book OS-6b;

- form 0504031 for budgetary institutions.

Purchasing an OS that requires assembly and installation

But there is a different situation when the main tool requires assembly before commissioning, such as a computer. First, the organization acquires the components of the future fixed asset - a computer mouse, monitor, system unit, etc., after which it assembles all the components into a single whole - a finished computer and puts it into operation as a fixed asset.

This operation is carried out according to the following scheme. First, we create the document “Receipt of equipment” (section “OS and intangible assets” - “Receipt of equipment”) or the same document can be issued as “Receipt of goods and services” with the type of operation “Equipment”.

The tabular part “Equipment” indicates all components of the future fixed asset, quantity, price, VAT rate. It is necessary to set up an equipment accounting account 08.04.1 “Purchase of components of fixed assets” (the document “Acceptance for accounting of fixed assets” works with this account), a VAT accounting account. The remaining bookmarks are used if other types of inventory items or services are received simultaneously with the equipment.

Source:

Materials from the newspaper “Progressive Accountant”

Heading:

1C: Accounting 8 fixed assets

- Olga Tolokonnikova, senior accountant-consultant Consultation line

Sign up 7800

9750 ₽

–20%

Depreciation calculation

Depreciation is calculated using the document “Regular operation” with the type of operation “Depreciation and depreciation of fixed assets”. It is intended to reflect period-closing transactions. Period closing operations are carried out once a month. It is important to follow the sequence of performing routine operations. The Month End Assistant will perform all the necessary month end operations in the correct sequence. As a rule, it is not necessary to create documents manually.

At this point, the consideration of fixed assets can be considered complete. Proceed to the practical task.

Documents of the fixed assets accounting subsystem

For accounting and tax accounting purposes, the following main stages can be distinguished in the “life cycle” of fixed assets:

- formation of the initial cost of the object;

- acceptance of the object for accounting;

- operation of objects (accrual of depreciation, transfer from one division to another, transfer of an object for rent, change in the value of an object based on the results of revaluation, completion, modernization, partial disposal, etc.);

- disposal of an object from registration due to transfer, write-off or other reasons.

The listed events in “1C: Accounting 8” edition 3.0 are recorded (with a few exceptions) by standard documents of the OS subsystem, which are accessed from the OS and Intangible Materials section.

At the same time, using the same document, you can reflect different business transactions. For example, the document Receipt (act, invoice) with the type of operation Equipment allows you to account for the receipt of fixed assets in the following ways:

- from the supplier for a fee:

- from legal entities and individuals free of charge;

- from the founder (participant of the company) as a contribution to the authorized capital;

- from a company participant in order to replenish net assets.

The choice of the payment method is determined by the Account of settlements with the counterparty specified in the Settlements form, which can be accessed via the hyperlink of the same name (Fig. 3).

Rice. 3. Reflection of the gratuitous receipt of an OS object

Thus, as the account for accounting settlements with the counterparty, you should indicate the following account:

- 60.01 “Settlements with suppliers and contractors” (or, for example, 76.05 “Settlements with other suppliers and contractors”), if the fixed assets were received from the supplier for a fee;

- 98.02 “Gratuitous receipts”, if the OS was received free of charge from a third party;

- 75.01 “Calculations for contributions to the authorized (share) capital”, if the OS was received as a contribution to the authorized capital. You can now reflect the debt of participants on contributions to the authorized capital using a special document Formation of authorized capital (section Operations);

- 83.01.1 “Increase in the value of fixed assets”, if fixed assets were received from a company participant in order to replenish net assets.

After posting the receipt document in the accounting system, the corresponding accounting entry will be generated to debit the account for investments in non-current assets in correspondence with the accounting account specified in the Calculations form.

Depending on the applied taxation system, amounts are entered into the appropriate tax accounting registers.

In complex cases (for example, when the initial cost of an asset in accounting and in tax accounting for income tax does not match), to register the receipt of an asset, you should use the Transaction document (Operations - Operations entered manually) (Fig. 4).

Rice. 4. Registration of receipt of fixed assets using the document “Operation”

Individual events associated with changes in the state of an asset are not reflected in the accounting accounts.

Such events include, for example, the transfer of an object from one division to another (or from one materially responsible person (MRP) to another), a change in depreciation parameters, the termination of depreciation due to the conservation of the object, etc. A change in the state of an OS object is also recorded using standard fixed asset accounting documents (Moving fixed assets, Changing the state of fixed assets, Changing fixed assets depreciation parameters, etc.).

After carrying out the specified documents, accounting entries are not generated, but entries are entered into specialized information registers (for example, Location of OS (accounting), Initial information of OS (accounting), Initial information of OS (tax accounting), etc.).

Movements in the register can be viewed in the same way as accounting register entries, by clicking the DtKt button (Show transactions and other document movements) by going to the appropriate tab.

To generate a report on records of any register, you can use the Universal report (section Reports)*.

Note:

* For information on using a universal report in “1C: Accounting 8” (rev. 3.0) to display records in the information register, see the answer of 1C experts to the question “How to generate a report on fixed assets and financially responsible persons (the “MOL” attribute)?”

Practical task

Register the receipt of equipment:

- Supplier: KVADROKOM LLC

- Agreement: 1601 dated 01/16/2015

- Invoice 1601 dated 01/16/2015, Invoice: 1601 dated 01/16/2015

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E – 1 piece for 720,000 rubles.

TOTAL: 720,000.00 incl. VAT 109,830.51

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Production workshop

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E

- Main equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E OS accounting group: Machinery and equipment (except office)

- Depreciation group: Fourth group (over 5 years up to 7 years inclusive)

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Register the receipt of equipment:

- Supplier: LLC "COMMERCIAL VEHICLES - GAZ GROUP" INN/KPP: 5256051148/ 525601001

- OGRN: 1045207058687

- Address: 603004, Nizhny Novgorod region, Nizhny Novgorod, Ilyich Ave., building No. 5

TOTAL: 680,000.00 incl. VAT 103,728.81

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Administration

- Equipment: GAZelle NEXT

- Fixed asset: GAZelle NEXT Fixed asset accounting group: Vehicles

- Depreciation group: Third group (over 3 years up to 5 years inclusive)

- Motor transport: Yes

- Vehicle registration: Vehicle type code: 51004

- Identification number (VIN): 4564134

- Make: GAZelle NEXT

- Registration plate: а777кв77

- Engine power: 120.00 hp

- Tax rate: 45.00

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Calculate depreciation for the month of January.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Fixed Asset Accounting

| Closing a period in 1C Accounting |

| Sales of products, works and services. Settlements with customers |

| Cash accounting in 1C Accounting |

| Self-instruction manual 1C Accounting. Conclusion. |