Features of bills of exchange as securities

Being an unconditional debt document, a bill of exchange can be:

- Simple, i.e. drawn up between two persons and having the nature of a promissory note of the direct debtor;

- Transferable – a document, the preparation of which takes place with the participation of a third party (used to formalize the transfer of receivables).

Both a simple and a bill of exchange can be:

- Someone else's or your own;

- Discount – interest rate, i.e. providing for an interest rate at which interest will be calculated on the amount of the bill, or interest-free.

Both types of bills of exchange can be commodity, i.e., confirm the debt under a contract for the supply of goods and materials, or financial. In this case, the subject of the transaction is the bill itself. The difference in the purpose of using bills of exchange affects the accounting accounts that will be used to account for bills of exchange.

Main components of bills

Bill documents differ, as mentioned above, in their details and attributes, which are precisely its main components. It is these moments that significantly distinguish promissory notes from any types of promissory notes.

Moreover, if the document does not contain even one of the required details, this will cause the document provided to be invalid. The legislation provides for such mandatory elements and components as:

- Label. If there is a mark on the bill of exchange, the bill itself will be officially recognized as a financial document. This very mark contains the necessary “bill of exchange” indicators, and in exactly the same transliteration as the text written in the document. In addition, the label may contain the words “transferable” or “simple” bill.

- Unconditional orders or promises to pay a specified amount. In general, the bill does not have any strict form. Bill law recommends that the document be drawn up in such a way that the text is as simple as possible, and also that it cannot be questioned or double-interpreted in any way. Communication on the bill must be such that it does not allow conditions and does not depend on external circumstances.

- Bill amounts. It is bill amounts that are one of the main attributes of a bill of exchange. The amount must be written in both alphabetic and numeric format. Moreover, it is written in such a way that there are no corrections. In the event that the written and numerical amounts differ in any way, the amount that was written and not the number written will be accepted as correct. Even if there are several prescribed amounts, the smallest amount among them is correct. It will be a reflection of the denomination of the financial document.

- Place of compilation. In this parameter, you can mark the city, country, as well as the region, a specific locality and, if necessary, the exact address.

- Date of preparation.

- Payment terms. If the bill does not have such an attribute, the bill simply becomes an ineffective document. That is why it is necessary to indicate the exact date, but without specifying the time. In some cases, you can specify not a specific date, but a period (the bill expires n days from the date of preparation).

- Place of payments. Here you can clarify where exactly the bill will be paid. Payment, for example, can be made at the place of residence of the bill holder or in some other place, which must also be specified and reflected in the bill. You can also note the name of the party that makes the payment (most often this party is a banking institution).

- Name of the acquiring party.

- Signature of the drawer.

- Availability of space for transfer signatures.

- Allonge (some additional sheets that can be added if necessary).

It is also worth considering that the bill, by its operating principle, does not allow any changes or amendments at such a moment as the details of the parties. Unless, of course, both sides agreed on these issues with each other.

In the event that the drawer party did not enter all the details, did not sign or did not transfer the bill to the bill holder party, then the bill holder party is able to independently write down all the necessary details in the bill, because the transfer of the document is interpreted in such a way that both parties agree to the terms of the document.

All data and details must be duplicated in one text, and in the process of compiling such a text, in no case should you create gaps or use expressions that could have a double meaning. If, as a result, the bill holder refuses to fully and timely fulfill its obligations, citing the lack of details or a legal document, the debt obligation may be considered within the framework of judicial proceedings.

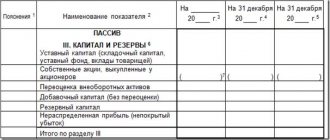

Accounting for bills of exchange: postings

Often, a promissory note in a buyer-seller relationship plays the role of a promissory note, since it arises in a situation where the buyer cannot pay for the goods with available funds, and the seller agrees to accept the bill. Such a commodity bill is not considered a security until it is transferred to a third party. To account for such bills, the buyer has an account. 60 open a subaccount 60/3 “Bills issued”, and the seller opens a subaccount 62/3 “Bills received”.

Transactions with it are recorded on both sides in the settlement accounts by postings:

| Operation | D/t | K/t |

| Accounting entries for bills issued | ||

| Reflected delivery debt | 60/1 | 60/3 |

| Security for future payment issued (behind balance) | 009 | |

| If the bill is interest-bearing, then the buyer’s debt will increase by the amount of accrued interest | 91 | 60/3 |

| Repayment of a debt | 60/3 | 51 |

| Writing off the bill after payment | 009 | |

| Accounting entries for bills received | ||

| The debt on the shipped goods is reflected | 62/ 3 | 62/1 |

| Payment security received | 008 | |

| Interest income from the bill | 62/3 | 91 |

| Received payment for goods secured by a bill of exchange | 51 | 62/3 |

| Writing off a bill after receiving payment | 008 | |

Example 1

Blitz LLC, to secure payment obligations under the supply agreement, Atrium LLC issued a promissory note in the amount of RUB 236,000. including VAT RUB 36,000. The accounting records of both organizations will reflect:

Operation D/t K/t Sum At Blitz LLC Debt to supplier for goods 41 60/1 200 000 VAT 19 60/1 36 000 A bill of exchange was issued 60/1 60/3 236 000 The bill is included in the balance sheet 009 236 000 Amortization 60/3 51 236 000 Writing off a bill 009 236 000 At Atrium LLC Revenue reflected 62/1 90/1 236 000 VAT charged 90/3 68 36 000 The cost of goods is written off 90/2 41 100 000 Bill received 62/3 62/1 236 000 The bill is included in the balance sheet 008 Payment for goods and materials received 51 62/3 236 000 Writing off a bill 008 236 000

Comparison of bills and bonds

Let's figure out how a bill of exchange differs from a bond.

Both types of debt securities have many similar elements:

- denomination;

- maturity date;

- the investor gains profit when the securities are redeemed or resold;

- can be sold or acquired;

- a bill or bond has the possibility of coupon income;

- sold in various currencies.

The difference between a bill and a bond is that the former are issued by small organizations that attract a small number of investors, while securities are issued by large companies and countries that need huge deposits. It is much easier to purchase or sell a liability than a Central Bank.

Article read: 211

Bills of exchange in accounting as financial investments

If an enterprise, having free money, invests it in the purchase of bills issued by banks and capable of generating income, then we are talking about financial investments. Such bills are the object of purchase and sale, they are recorded in subaccount 58/2 “Debt securities”. Let's figure out how bills of exchange are accounted for in accounting. Postings:

| Operation | D/t | K/t |

| Purchase of a bill of exchange | 76 (60) | 51 |

| Acceptance for registration | 58/2 | 76 (60) |

| The difference between the purchase price and the face value is reflected | 58/2 | 91/1 |

Example 2

On January 25, 2018, the company acquired a bank bill with a face value of RUB 2,000,000, issued on January 25, 2018, with a payment due date at sight, but not earlier than May 5, 2018. Interest accrual is 8% per annum. On 04/05/2018, the company executed a compensation agreement with the condition of transferring the bill of exchange to the counterparty who performed the work worth RUB 2,000,000. without VAT. It was accepted as payment for the work. The transaction was formalized by an agreement for the transfer of a promissory note.

Accounting entries:

Operation D/t K/t Sum 25.01.2018 Bill paid 76 51 2 000 000 The bill is included in financial investments 58/2 76 2 000 000 31.01.2018 Accrual of interest on the bill for January 2,000,000 x 8% / 365 x 6 days. 76 91/1 2630 28.02.2018 Interest accrued for February (2,000,000 x 8% / 365 x 28) 76 91/1 12 274 31.03.2018 Interest accrued for March (2,000,000 x 8% / 365 x 31) 76 91/1 13 589 05.04.2018 The work performed was accepted for accounting 20 60 2 000 000 Interest accrued for April (2,000,000 x 8% / 365 x 5) 76 91/1 2192 The contractor was given a bill of exchange to repay the mortgage 60 91/1 2 000 000 The nominal value of the bill has been written off 91/2 58/2 2 000 000

Promissory notes of Russian banks

Russian banks issue bills of exchange to both residents - citizens of the Russian Federation and foreign citizens. Russian banks offer them in rubles - the national currency, as well as in foreign currency.

There is a nuance: when we buy bank bills denominated in foreign currency, payment is made in rubles at the rate that applies at the bank.

Their validity periods range from 3 months to 3 years. The most popular ones are considered to be valid for one year; they are optimal in terms of interest rates and terms of circulation. Most often, banks carry out exchange and payment of bills of exchange for free.

OSNO and UTII

https://www.youtube.com/watch?v=ytdevru

Take into account purchased goods (works, services) secured by your own bill of exchange when calculating income tax, depending on the following factors:

- tax accounting rules that apply to the corresponding type of expenses;

This follows from articles 252, 272 and 273 of the Tax Code of the Russian Federation.

Input VAT on purchased goods (works, services) is deductible in the general manner - after the goods are accepted for registration, if there is an invoice and other necessary conditions are met (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation) . For more information about this, see How to pay VAT when paying by bill of exchange.

The object of taxation of UTII is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, transactions for the acquisition of goods (works, services), for which the bill of exchange was transferred as security, will not affect the calculation of the tax base.

The procedure for accounting for goods (work, services) for which the organization paid with its own bill of exchange when combining UTII with the general taxation system depends on the type of activity for which the goods (work, services) were purchased, for which the organization issued its own bill of exchange to the counterparty.

If goods (work, services) were purchased to conduct transactions subject to UTII, transactions with your own bill of exchange will not affect the calculation of the single tax (Article 346.29 of the Tax Code of the Russian Federation).

If goods (work, services) were purchased for the organization’s activities on the general taxation system, take into account the costs for them when calculating income tax.

If goods (work, services) are purchased for both types of activities, the amount of expenses for their purchase must be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation). For more details, see What taxes to pay with UTII.

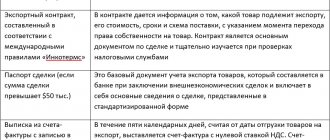

Methods for receiving a bill

The counterparty’s own bills of exchange may be received by the organization, in particular:

- for a fee (under a sales or loan agreement);

- to ensure payment for goods (works, services) sold;

- free of charge.

Depending on the method of receipt of the bill of exchange, the accounting and taxation of the transaction upon its receipt will be different.

Attention: payment of the authorized capital of the organization with the own bill of exchange of the founding organization (participant) is devoid of economic sense. If an organization carries out similar settlements with the founders (participants), then in some cases this may entail such consequences as: refusal of state registration of the organization, disputes between the founders (participants) of the company regarding the share paid in this way, etc. This follows from the provisions of the Laws of February 8, 1998 No. 14-FZ and of December 26, 1995 No. 208-FZ.

The promissory note issued by the founder (participant) only confirms his debt to pay the authorized capital. The founder (participant) cannot repay their debt to the organization. This is due to the fact that an organization that pays a counterparty with its own bill of exchange does not recognize the bill itself as property (goods). Being in the ownership of the drawer, he does not certify any rights and obligations, and upon transfer only secures the debt, guaranteeing payment on it with a deferred payment. This follows from Articles 815, 823 and paragraph 1 of Article 142 of the Civil Code of the Russian Federation, as well as Articles 1 and 75 of the Regulations approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.